If UK government ministers were to be believed the cost of servicing UK government debt creates such a burden on its finances that austerity is required, including with regard to public servants' pay.

As a result comments like this arise on the blog:

Hi Richard,

Long-time reader, first time commenter. In a pub debate, a friend of mine insisted that growth in this country was being held back by the cost of servicing government debts, and that only austerity in government spending could undo it.

Whilst I understand that a lot of government “debts” (i.e. money) are held by useful things like pension funds and foreign governments and the government debt has never, and will never, be paid off, it still appeared to be logical that servicing those debts could drag on the capacity for the government to grow the economy.

What is the MMT response to servicing government debts, and the role of the current UK's debt obligations in limiting/facilitating spending? Thanks.

So, I used the OBR's latest forecast of debt servicing costs (which will be out of date by Wednesday lunchtime, but will do for now) plus standard GDP deflator data from the ONS monthly statistics pack to look at this issue.

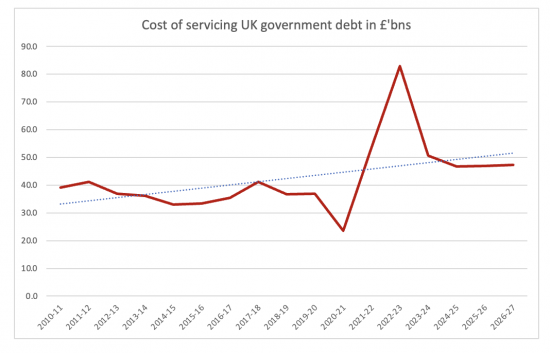

This is the actual cost of debt servicing data in original prices, plus the Office for Budget Responsibility forecast to 2027:

I added the trend line. It is upward.

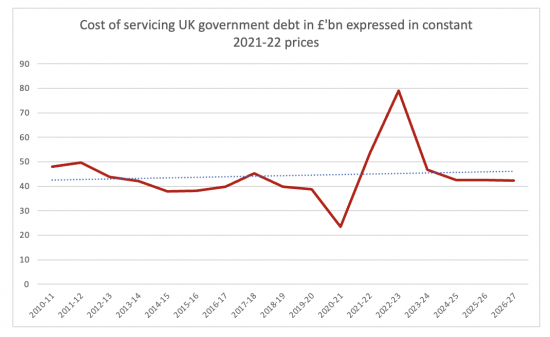

Then I restated in 2021-22 prices:

The pattern is broadly similar, but now the trend line is rising only very slightly.

What is actually quite surprising is how stable this is, 2020 - 2023 excluded.

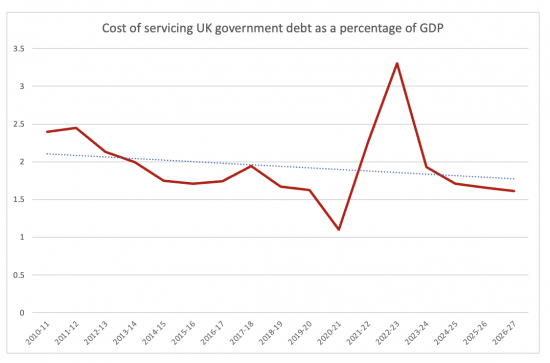

After that I stated the data as a percentage of GDP to indicate the capacity to pay:

The trendline is now downward. 2020 - 23 are still aberrational.

First, some observations before drawing conclusions:

- Debt servicing costs in 2020-21 were very low because inflation virtually disappeared in that year and that meant the cost of servicing index-linked bonds almost disappeared as well.

- Debt servicing costs are high in 2022-23. That is because as 2021 closed inflation rose and it will not drop significantly until later this year. As a result, the claimed cost of servicing index-linked bonds rose dramatically.

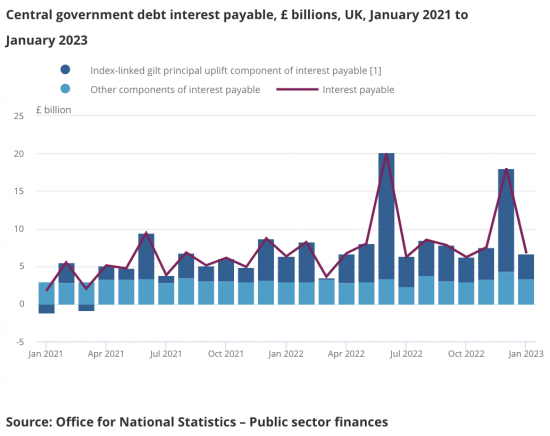

- I stress the claimed cost is high. That this is due to index-linked bonds is made clear in this chart from the Office for National Statistics January public finances release:

- Pale blue represents recurring standard gilt interest costs and dark blue the exceptional costs of index-linked binds, showing the shift from negative costs in January 2021 to exceptional costs in January 2023.

- However, it is important to note that these costs are estimates: the actual cash due on these bonds will not, on average, be paid for 18 years: we have that long to save up for the payment. If the payments were spread over that 18-year period, as would be reasonable, there would be no exceptional cost in 2022-23.

- Note that forecast costs fall heavily from 2023-24 onwards and as a declining trend to GDP. That is because inflation is expected to fall to close to zero from 2024 onwards, largely eliminating the cost of index-linked bonds again. There is no reason to think this forecast of low inflation is wrong.

So, is there any reason to think that debt servicing costs require austerity now? The simple answer is there is none at all. The cost of servicing government debt is a small part of total spending: the exceptional cost in 2022-23 is due to exceptionally poor accounting which the government will not explain in public, and that cost will not recur. There is then no reason to take it into account when planning future public spending.

As for the modern monetary theory approach to this: MMT suggests that the government need not borrow from external sources. It also suggests that interest rates be kept as low as possible to prevent upward shifts of wealth within society and to encourage investment.

MMT also acknowledges that interest rates on government debt are set by government choice, even though they deny it.

MMT does, therefore suggest that this chosen debt servicing cost is no constraint on spending. And if the decision is made to pay it, MMT suggests that it is wholly affordable and is no constraint on other actions.

So, in summary, if the Chancellor talks about this during the budget today and says it requires austerity he is talking total nonsense. I could be less polite, but that will do.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

To what extent must UK interest rates follow global (or US) trends? How much sovereignty do we have in this respect?

I think as much as we like

The ECB follows its own path

Several Central Bank authorities create something called a “Monetary Conditions Index” and set their interest rates according to this index. This is called an operational target. World interest rates are an important factor to such regimes. In this policy regime, policy makers have to follow what other policy makers are doing. Policy makers have decided not to be first or do too much thinking and just follow the work of others. Which can be a useful strategy if your state doesn’t have reliable data or the resources to manage a more complex approach.

From my out of date knowledge I can only recall Canada, Norway, Sweden and New Zealand using this rate setting instrument. UK has chosen not to. And that is what MMT says. That such type of policy instruments are optional. Central banks who are independent can choose not to follow them and can create their own set of instruments which they think are best.

“….. the exceptional cost in 2022-23 is due to exceptionally poor accounting which the government will not explain in public”.

I think you have covered this before Richard, but since you are answering a commenter looking for answers, it may be useful to expand on your explanation above.

I thought I had in sufficient detail

Getting rhe balance right is really hard

“….. the exceptional cost in 2022-23 is due to exceptionally poor accounting which the government will not explain in public”.

I love that line! Beats me rambling on.

At the risk of “banging on”…..

The “interest” on I/L gilts is the stated coupon which is very small. The “uplift” is NOT interest…. and will decline next year anyway. The “uplift is not ignored… any data on the “size of the National Debt” will include it.

Do UK rates have to follow other countries? No – but there may be consequences for the Exchange rate… which in turn, could influence inflation. That is the theory but the practice is much more messy – just ask any FX trader! One thing that is sure is that Brexit makes our currency more volatile; if we were still in the single market, free movement of goods, services and people would have a stabilizing effect.

Agreed

But there are always trade offs in how far to go in any one post

It was the knock-on effect on FX rates I had in mind. I understand that our dependence on imported food means that any drop in value of sterling has a big effect on lower incomes.

Yes, but as Clive has said it is much more complicated than the suggestion of a direct relationship implies

The increase in volatility of the currency due to Brexit is a really interesting point. Do we have a substantive illustration of it?

Can’t pull down the data these days (no easy access to Bloomberg) but last time a looked at this we saw implied volatility on GBP option being higher than EUR. In particular, we saw a much bigger skew in options pricing due to a perceived higher risk of a GBP meltdown. All this was not such a feature prior to 2016.

You could say this is due to many things….. but Brexit and political stupidity go hand in hand

Thanks Clive; it seems Brexit and stupidity go hand-in-hand.

From what I read here, and follow up with the references, it feels like Conservative and Labour governments alike operate on an entirely delusional view of the money system and government’s place within it. An academic told me that the purpose of ideology is to distort understanding and perception of reality. To me this sounds like a description of neoclassical economics, and government, to the extent that they promulgate and perhaps believe these false depictions of money. The tragedy is that this distorted view of money, such as the myth of government as household and consequent “need” for austerity, leads people who are being harmed, and in some cases killed by government policy, to believe that austerity is necessary, that the government has no choice, and it is acting responsibly, literally that reality is forcing the government’s hand, rather than seeing that austerity for the wilful act of deliberate and unnecessary cruelty (to paraphrase Noam Chomsky) that it is. The MSM also seem to promote the view that government spending is something separate to the economy, a drain on it, as though, when governments spend money, no one in the economy is paid it and/or spends it in turn in the economy. Where do they think government spending goes?

You understand what is happening

They do not, and lie

If government is like a household then to turn it around using logic. A household must therefor be like the government. So I demand that I can print cash like the government does.

Try it

Just don’t make them look like a fiver

I think you’ll find no one wants them