The US-incorporated Silicon Valley Bank (SVB) failed last Friday. It is not clear what the extent of the failure might be as yet: suggestions are that it is insolvent to the tune of many tens of billions of dollars, but this might exaggerate the issue. What seems certain is that it cannot meet the banker's promise of payment on demand when sums are due and that means it is bust.

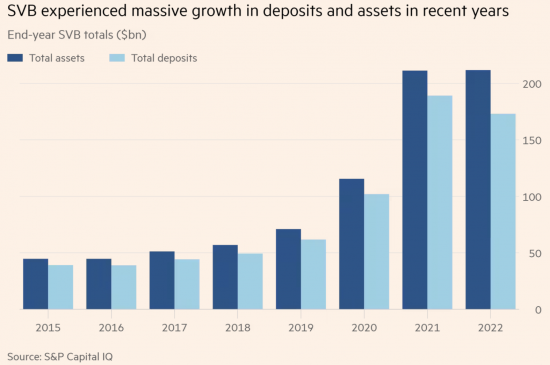

The bank failed for a straightforward reason. Although it claimed to be a tech bank it actually was little more than a cash deposit taker in reality. During the Covid era the size of the bank grew massively, largely by taking more deposits, as this chart from the FT showed:

The trouble for this bank (and some others, as it is not the only US bank failure this weekend) is that no one wanted the money being deposited with it. The loans they made in comparison to deposits were small. Instead they had to find another use for the money in order to pay interest to depositors.

To do that they bought what seemed like valuable bonds (mainly but nit entirely US government ones), which paid interest that appeared above average at the time in proportion to value. By doing so they increased the apparent rate of return they made by about 0.4% compared to the return they could have made by placing funds on deposit with other banks.

However, interest rates then rose, and it seems that SVB had never planned for that possibility. As a result they had not considered the consequences for them of this eventuality.

If the Silicon Valley Bank had placed money on deposit it wotld not be bust now. It would still have that money. It would even be making good money on its funds. But it had bought bonds and when interest rates rise the value of bonds fall because the actual interest paid on them is fixed and therefore the only way in which the effective interest rate on them can be increased is by their price falling.

It is not clear by how much the bond portfolio of the Silicon Valley Bank has fallen in value, but it may be, as already noted, by tens of billings of dollars. This was no problem if depositors appreciated that this was only a paper loss that would only give rise to a real cash cost if the bonds had to be sold. Last week that hope fell apart. Depositors asked for $42bn of money from SVB last week. The Silicon Valley Bank could not find it. An attempt to raise new share capital was unsuccessful. Insufficient bonds could be sold. Those that could be were loss making. The bank was bust.

Rumour has it that HSBC will take over the UK operation of SVB this morning.

In the US the government has guarantee all depositor's money using the fund it has created to underpin its deposit guarantee scheme even though many of the deposits in question far exceed the $250,000 that scheme guarantees.

It seems likely that the UK government is trying to guarantee something similar here.

So, what are the lessons?

The first, and most obvious is that these bankers clearly had no clue as to what they were doing. Yet again the so-called ‘masters of the universe' have got things wrong.

Second, regulation failed. The risks in this bank were obviously incorrectly appraised by them, and it was allowed to continue trading when there was obviously too much risk implicit in an apparently well funded balance sheet.

Thrd,the bank had insufficient capital for the risks it took. If there had bern sufficient capital it would not now be bust.

Fourth, as ever, this bank presumed the state would cover its risk. As ever that has proved to be correct. The mockery of privately owned banks continues when what they actually do is extract value for private gain safe in the knowledge that governments will not let them fail.

Fifth, the fallout from the over-inflation of interest rates by the Fed is clear. These are being artificially manipulated upward when there is no need for that, most especially when there is no US wages spiral. Artificial risk is being created instead by over deflating asset prices too quickly for markets to handle. This crisis was created by the Fed.

Sixth, this bank was used by the well off and the companies they own. There is always an excuse for bailing them out. None is found for anyone else. Wealth flows upwards, as ever.

Seventh, cash deposits served no economic purpose here: most of what this bank did added no economic value. Despite that it will secure an expensive bail out. At some time we will realise that savings do not equate to investment, and the models we have for saving make no economic sense, as this failure proves. But we are not there yet.

Eighth, this is market failure because this bank could not even manage cash, the most basic task asked of it. It was said to be reality good at tech. Based on this are we really expected to believe that? Surely we can do better than this?

In summary, it seems this bank failed because it did not even understand cash management. I hope no state funds are involved in its bail out.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I have read that it was a good old fashioned bank run of the sort that no bank is entirely able to withstand, arising from a loss of confidence, and that it may have been sparked deliberately by a well known billionaire intending to profit from the wreckage. This isn’t to dispute any of your critique. Have also seen assertions from a disinterested party in the area whom I know that the bank could have been saved at the same cost with the same but earlier action. Not convinced but it’s not inconceivable.

I blame neoliberalism. We should have a State Investment Bank and a State Retail Bank and keep it simple. All the so called “entrepreneurs” typical Investment Banks foster only increases inequality and does not benefit Society. It is time for the State and Society to take centre stage at the expense of individual aspiration and greed.

Is it true that the CEO of SVB was the CEO of Lehmans?

I have no idea

Wikipedia says the CEO of SVB since 2011 is : https://en.wikipedia.org/wiki/Gregory_W._Becker

The first CEO when SVB was founded in 1983 was Roger V. Smith, formerly of Wells Fargo; then from 1993 it was John C. Dean; and from 2000 to 2011 it was Ken Wilcox.

When it collapsed in 2008, the CEO of Lehman Brothers was: https://en.wikipedia.org/wiki/Richard_S._Fuld_Jr.

So I think that is “no”. The nature of the banking industry that one or more of these people may have worked together (perhaps at a third bank) at some time.

Who said they were the same?

Borrowing short and lending long may seem smart, but it is always a recipe for cash flow disaster if conditions change. See Northern Rock.

Why did depositors ask for over $40 billion back last week? About a quarter of the bank’s total assets? That sounds like a bank run. Was there a catastrophic loss of confidence?

SVB served a small community of tech companies who all knew each other.

They talked.

There was a run on the bank.

Brilliant summary. Again amazing to the outsider that a ‘tech investment bank’ is doing little more than the usual money market manipulations.

Apparently HSBC has bought the UK subsidiary for £1

Re the £1 sale of SVB.

Reminds me of the HBOS purchase by Lloyds after 2008 , though obviously not as big. Probably not enough time to do the usual “due diligence” and uncover all the actual debts. But with the backing of the BoE the establishment represented by Mr J Hunt can today safely claim in the press that “no taxpayers money” was used in the rescue.

This is indeed true but we all need to understand that the BoE is using its exraordinary powers to create reserves to do this. It is as such not a “free lunch” just because so called tax monies are not used(aka govt spending). In effect what it is going on is that this is still all been done that on the back of the entire nation’s economic efforts. It is a bail out carried out on our behalf and backed by all of us.

But generally most of us do not “see” this. What the eye doesn’t see the heart does not grieve.

One person’s view, that may be of interest…

https://michael-hudson.com/2023/03/why-the-banking-system-is-breaking-up/

C

Fabulous insight it is remarkable how you grab complex situations so quickly and present them with such ease. Its a pity you are not running the economy, if you were this kind of thing wouldn’t happen.

Richard

I read this on a website:

‘I checked their SEC filing page. Jesus. KPMG issued an unqualified opinion on financials and internal controls on the annual report TWO WEEKS AGO.’

It’s true (Part II, Item 8 “Report of Independent Registered Public Accounting Firm”). KPMG has served as SVB auditor since 1994.

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000719739/000071973923000021/sivb-20221231.htm

https://www.goingconcern.com/friday-footnotes-kpmg-clients-spectacular-failure-pwc-gets-defensive-kids-doing-taxes-3-10-23/

Staggering…

As per usual

Weren’t you telling us all last year that buying bonds at a gold of 1% was a great investment just last year?

It was, at the time

But locking into it was not a good idea if you had an immediate repayment obligation

It seems you do not understand that

A wonderful take down of the incompetence and criminality of the ‘masters of the universe’.

All I can add is what Frederic Bastiat said:

‘When plunder becomes a way of life, men create for themselves a legal system that authorizes it and a moral code that glorifies it.’

So whilst the rest of us get told that we are lazy good for nothings, those at the top of the capital order get away with stunts like this!

I remember when Equitable Life collapsed in the 1990s one of the directors explained that the problem was that the company had become dominated by a “whizz kid” who came up with all these great money management ideas that none of the other directors understood. At the time nobody said anything because they did not want to appear stupid.

I wonder how common this is?

In a world where liars and morons like Trump and Johnson can rise to the top we can only assume that anything is possible.

I read with great amusement elsewhere on twitter that two of senior executives of SVB, including the chief risk officer, had been employed at AIG and Lehman Brothers respectively in similar positions in 2007/2008.

Thank you for the great explanation here Richard.

I read that SVB bought $100 billion of long dated bonds.

This seems staggeringly incompetent.

But someone else benefitted from SVB’s loss when the interest rate rose.

I wonder who that was?

Could it be someone connected to SVB’s reckless investment decision?

Or have I “lost it” and this is a conspiracy theory too far?

Owning such bonds was fine

The problem was the lack of awareness of the impact of chang8ngninterrst rates on the value of them and the inability to sell them without a loss

Who gained? No one has much gained from this destruction of value

There will likely be political gains from this fiasco, but I wouldn’t bet on those gaining being too terribly concerned with the well-being of the electorate they expect to manipulate in the process.

Paul, re your “whizz-kid” question, another obvious one was the role played by Fred Goodwin aka Fred-the-Shred in the spectacular collapse and multiple law-breaking of Royal Bank of Scotland. I’m reading Ian Fraser’s very detailed book, ‘Shredded’, just now about the RBS debacle and what staggers me is that nobody in RBS’s higher echelons of management went to jail for their misdemeanours, which cost shareholders, staff, customers, the Treasury and taxpayers dearly and, along with HBOS, wrecked Scotland’s international reputation for prudent financial management.