According to the FCA - the UK's Financial Conduct Authority - mortgage stress in the UK is growing. New data that they have issued today shows that:

- 356,000 more people with mortgages could face payment problems by the end of June 2024. This is down from early estimates, but remains significant.

- Those moving from a fixed rate could pay £340 a month more on average.

- Londoners and those in the South East are most likely to be stretched.

Stockbrokers Hargreaves Lansdown estimate as a result that:

- By the end of the year, 26% of mortgage payers will be at risk of default - over 2 million.

- 650,000 are at ‘high risk' because they are not only face a dangerous hike in their mortgage payments, but they don't have emergency savings to protect them.

- 347,000 are at ‘critical risk', because on top of the extra costs and savings shortfalls, they're already spending more cash each month than they have coming in.

- Singletons, older people and Londoners are particularly at risk.

- Remortgaging in 2023 will swallow an extra 3.1% of your income after tax - £2,120 a year.

As the Guardian notes this morning:

The [FCA] has told banks to consider slashing mortgage payments for borrowers struggling with rising bills, as it revealed that 356,000 homeowners could be at risk of missing their monthly instalments by summer 2024.

The guidance from the Financial Conduct Authority confirms how lenders can support customers who have missed payments or are worried they may fall behind, including by extending the term of their mortgage to lower the monthly amount due, or temporarily slashing payments.

This was entirely predictable, of course. I did predict it. And it is also wholly unnecessary. That is because the current rates of interest being promoted by the Bank of England are not needed to tackle inflation.

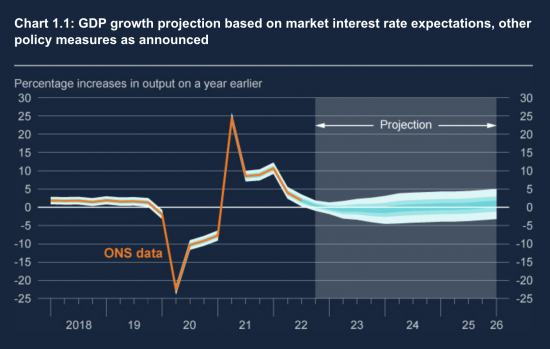

The latest Monetary Policy Committee report from the Bank of England includes this chart:

The message of that chart is unambiguous, as Prof Danny Blanchflower and I will be arguing in a report we will submit to the House of Commons Treasury Committee on quantitative easing and quantitative tightening next week. It is that if current expected rates create a significant risk of an economic downturn - as they obviously do - then those rates are clearly too high.

What is required now is not just support for those on incredibly high interest rates but an immediate cut in interest rates. We will be suggesting 1% straightaway with the expectation of more to follow.

Like so many other crises that this country faces, this one has been made by the government getting almost all aspects of its policy wrong. The Chancellor could overrule the Bank of England on rate policy. He is not. All those facing considerable stress as a result know who to blame. They could start with the Governor of the Bank of England. But the real person to blame is in 11 Downing Street.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Is this right? Potential house purchasers requested mortgages. If they appeared to have enough income for the necessary monthly payments – at the then rate of interest – the banks invented the money by typing numbers.

When the BoE announced a higher interest rate, the retail banks announced higher monthly payments because … they could! … and all the others do the same.

Quaker businesses long ago, were successful in part because they quoted a price which they subsequently honoured no matter what. Barclays … Lloyds … What’s happened? Or am I mistaken in some way?

Those banks have forgotten their Quaker routes

Suppose though that QE had been used to provide 25 year fixed rate mortgages. It could have been

Whether it be the Fed, ECB or BoE, central bankers seem to take some sort of perverse pleasure in playing the “hard man”.

With energy and food prices higher (and largely beyond central bankers control) the only way to keep aggregate inflation close to target is to engineer falls in other prices…. and that means failing businesses, hardship and poverty. They and their masters feel this pain is a price worth paying…. largely because they are not the ones paying it!

Turning specifically to mortgages I am torn. On one hand, anyone that took on debt when rates were close to zero without budgeting for the day when rates rose was foolish. On the other, where are people expected to live? The private rented sector might be OK for 20-somethings but for 40 year olds trying to raise a family with some stability/security it is tough and the pressure to overstretch in order to buy is intense.

In the end, it all comes back to a theme you have written on quite a bit – Security. Whether that be health, job or shelter we all crave it…. our current government chooses to deny it.

Clive, you say that you are torn on the mortgage issue. I totally agree with you.

We had years of low IR’s, the knock on effect of that being rampant house price inflation. Government, mainly Tory, basked in the glory of asset price inflation, it bought them votes, while doing nothing on the question of affordability. This was especially hard on renters and I believe deliberately so to encourage them to “get on the ladder”. What is happening now is the inevitable result of seeing IR’s as the main weapon to supposedly control inflation. Even though that inflation index is in itself flawed as we can see today in that everything we need just to live is still victim to massive price increases, mortgage, rent, energy, water and that basic need, food .

The traditional affordable housing sector prior to 1979, was council housing. The Tories sold it off without providing an affordable alternative. That was deliberate policy. Tenants also had more security before 1979. The Tories took it away to leave it to the free market to sort it out. In housing that means the landlord has the advantage. The tenant has the insecurity.

Labour under Blair and Brown were no better.

I know that when Richard talks about the need for lower IR’s he has also said that there needs to be a commitment alongside that to building more affordable housing. While I think that the politicians, both Tory and Lab, would ultimately like to see lower IR’s again, I don’t see any commitment from them to address the affordability side or genuinely build more housing. We have had over 40 years of failure on that front.

So, if and when IR’s do come down again, don’t be surprised if house prices start going up 10-15% a year again. The Tories will respond with a scheme or two. Part buy, part rent, 50 year, 100 year, 1000 year Reich mortgages where your descendants pay it off for evermore and a day.

And you are right. Security – that basic need of a roof over your head – and happiness is destroyed on the alter of ever increasing asset price inflation and politicians who promise a lot and never deliver. Where does it end?

QE could have been sued to supply 25 year low cost guaranteed rate mortgages

It could also have been sued to build, council housing

It did not have to be sued to buy bonds

The alternative existed

It still could

I came across this post in Linkedin -https://www.linkedin.com/feed/update/urn:li:activity:7039920042230050816/

The key sentence in the post is:

‘If UK PLC was a business, with a debt to income ratio of 101.9% and still rising, the reaction would be to put the brakes on borrowing and spending and come up with a strategy to solve this’.

If you can be bothered you could reply

UK Government debt stood at £2.4 Trillion in June 2022

I was recently having a conversation with a Director who expressed concern over Government borrowing and debt and the downstream impact that it would have on taxes, the economy and ultimately us.

During that conversation, this Director said that he believed that government debt was at around 86% of GDP.

Data from the Office of National Statistics Jan 2023

UK general government gross debt was £2,436.7 billion at the end of Quarter 2 (Apr to June) 2022, equivalent to 101.9% of gross domestic product (GDP).

It also transpires that the UK is one of seven EU countries with a debt to GDP ratio that is higher than 100%, Belgium, France, Spain, Portugal, Italy and Greece have also exceeded the debt to GDP ratio of 100%.

If UK PLC was a business, with a debt to income ratio of 101.9% and still rising, the reaction would be to put the brakes on borrowing and spending and come up with a strategy to solve this.

For all the talk we have heard from politicians of late, both the government and opposition, I don’t seem to recall any of them mentioning the figure 101.9% or the word government debt!

What do you think?

That ratio is meaningless

The only relevant ratio (assuming debt is stated correctly, and in this case it is not as the government owns 1/3 of that debt meaning it is actually £1.7bn at most) is the ratio os servicing cost to incme, which is insignificant

So the comment is, to be polite, pure twaddle

I don’t agree that what Eric C is saying is “twaddle” as you put it.

Your argument seems to be that the part of national debt that is owned by the BoE APF through QE is somehow cancelled.

Clearly this is not the case. The government is having to make good on the losses suffered by the APF on the gilts it holds as they have lost value with rising interest rates. If these bonds were cancelled this would not be necessary.

In addition, the cash/reserves created through QE also attract a rate of interest when deposited at the BoE. Which is a cost to government and is of a similar magnitude to that which would have been paid on bonds given where rates are.

At best you can argue there has been a debt swap from longer maturities to borrowing cash in the overnight market (cash), but by no means can you claim that the debt has been cancelled.

The debt servicing costs, which you place weight on, take into account the full 2.5 turn (approx) debt regardless of the structure of how that debt is held, which makes your argument not only wrong, but essentially moot.

More crass twaddle from someone who is clearly clueless about microeconomics and thinks a little accounting knowledge (which has never got as far as consolidated accounts) is a substitute for some knowledge of the macroeconomy

Patiently (although why I am wasting my time I do not know):

a) The BoE is owned by the Treasury.

b) The BoE is indemnified by the Ttreasury for its losses on owning bonds

c) As a result the gilts oiwned by the BoE are not consolidated into the BoE accounts because it ahs no beneficial control of them

d) They are instead controlled by HJM Treasury

e) The consolidated Whole of Government Accounts show these debts as cancelled, correctly

f) The government cannot have an interest charge for paying itself

g) The payment of interest it makes to the APF comes straight back to it as income

h) The Treasury is not making good the losses on APF owned bonds because these are only paper losses due to mark to market accounting – there is no cash movement. Just because the ONBS got this wrong there is no reason for you to do so

i) The payment of interest on central bank reserve accounts is vol;untray and not needed for moenayry po;licy to work – at least on all the balance so it cannot be claimed to be a cost

j) There was a debt swap in QE, but the central bank reserve accounts were not created by QE: they were created by spending, so your claim is wrong

k) You have the debt servicing cost wrong so everything else is also wrong

Now, go and learn some economics

But – and it’s a big but – UK PLC does not exist and the government is not a business, any more than it’s a household. All the rest is therefore nonsense.

You are right

The idea of UK plc is outrageous in itself

My brother is a mortage broker. Last September after the Truss/Kwarteng circus, there was a mass recall of all mortgage offers by the major bank lenders, many that he been working on for weeks prior. They then hiked fixed mortgage rates by 2% overnight even before the BoE acted, though to be noted the building societies did not. Many of his clients either had to pull out or swallow huge increases in monthly costs. My brother lost a lot of business that week much to his dismay and views the major bank lenders as “greedy, gouging f***ers”.

Those now coming to the end of 1.5 % fixed rates are now looking at circa 5.5 % or more fixed rate mortage deals and those are now for 5 years contracts only. 2 years rates are nigh on impossible to achieve on “affordablity criterea” as they want borrowers locked in. This actually increases average payments £800 a month. So it is going to a lot worse than the above reports are suggesting since my brother says about 70% of mortgages are currently of the fixed type. Though that may have to change as folk face eye watering leaps in monthly payments. Something has to give.

I would add base rates dont seem to affect the mortgage rates all that closely. But reducing them sure will help in forcing lenders to drop rates , which they sorely need to do.

Thanks

Very low interest rates since 2010 has caused a housing crisis by causing rampant house price inflation and making property unaffordable for the vast majority of people. No doubt you are a house owner and want it to

continue..

No, I do not want it to continue

I want my children to have hope

Why would I want them to be denied what I had?

What a stupid middle-class dinner party comment you have made

“No, I do not want it to continue”

But if interest rates are at near zero as you want then house prices will continue to run away.. exceptionally low interest rates have fuelled house price inflation since 2010..

That need not be the case

The price hikes were fuelled by deliberate government policy providing funding to support them

One issue surely is that we have as a nation built up unsustainable amounts of consumer and mortgage debt compared with other nations.

Partly as a result of low pay in the case of consumer debt and in the case of housing because of the removal of controls on lending and allowing housing to be purchased for things other than owner occupation

If Price to Earnings ratio’s were what they were at when I bought my first house in 1986, while the interest rate hikes would be unwelcome they would not be a disaster

Thank god I’ve done with all of that. Those of us who have just need to find the money to maintain what we now own – the stupid Tories don’t even consider that in their austerity policies.

As the saying goes, when banks tell you that you cannot afford a mortgage to buy a house,

it is implied that you can afford to rent and buy someone else their house.

https://www.theguardian.com/politics/2023/mar/12/rishi-sunak-has-electricity-grid-upgraded-to-heat-his-private-pool

What timing. Hope they don’t increase the energy prices next month. If you’re a rich tory bastard you can afford to ask anything you want and it will be given to you.

Sorry. I don’t normally swear.