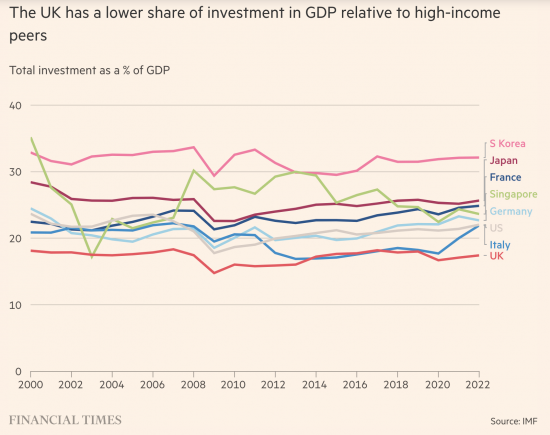

Martin Wolf has been obsessing in the FT about the low rates of savings and investment in the UK, making the rather basic error of equating the two issues.

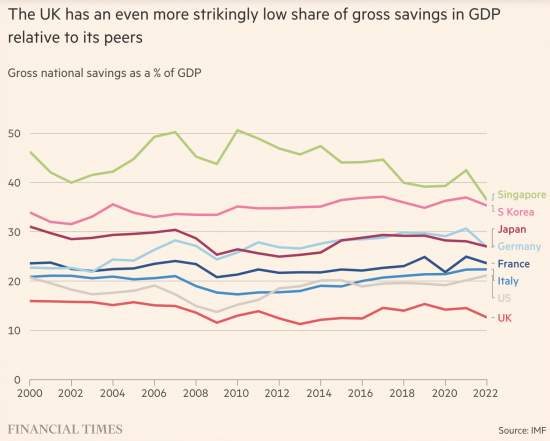

He has published two charts:

I note what he has to say but think he misses the point at so many levels.

First, he remains obsessed with growth. He has not yet noticed that w live on a finite planet. For an intelligent man who writes about climate change that is very odd.

Second, he has not noticed that the quantum of investment is not what matters: it is what it is used for that matters. When the need is for social and sustainable infrastructure rather than more productive capacity to make products that can only bring the impact of climate change ever closer that is, again, very strange.

Third, Wolf does not ask the very obvious question, which is why do we save so little? The answer is, of course, that people in the UK are so poorly paid on average that they do not have the capacity to do so whilst businesses are so obsessed with shareholder returns that they will not do so.

And Wolf also fails to ask the glaringly obvious question, which is why when the City of London hosts the second largest financial market in the world is it that we save and invest so little?

Could it just be that it is precisely because we host the second-largest financial market that we do not save because we do not think we need to save since we can always attract savings from others?

Or is it that this financial market is not about saving and investment at all and is simply about speculation?

Might, alternatively, it be the case that the focus on financial returns that the City has created has destroyed the awareness of the need to make real returns in the UK?

Or is it just that the inequality that the City seemingly deliberately creates with active government connivance prevents saving and investment?

Might it, in fact, be all those things, coupled with a total lack of awareness of the need for investment that we have, which has to be led by the state sector?

I suspect that the last of these explanations is true.

But what I also know is that this is damning evidence that the City of London not only does nothing for this country but actively fails it. For all the billions poured into it every day, with over £60 billion of tax relief attached a year, we got a truly appalling return.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Indeed – I do wonder sometimes if the City could correctly be characterized as the UK’s real enemy within.

By far the largest money-guzzler for most people is putting/keeping a roof over their heads. If you can get on the property ladder many people believe(d) it to be both savings and investment; if not, the question of “why save?” is probably moot.

The City of London may not do much for the UK, but it’s an international bourse and facilitates a lot of trade for other countries and peoples. We use it because it’s generally competitive, honest and better than the alternatives.

If you think that as a foreigner, we are a bit dim and should go elsewhere for the City’s services, please suggest where you think we should go.

So what does the City do for us, speculation, market rigging, tax abuse and ransoming government part, that is? Please tell. I am all ears. Other countries seem to do better without such an institution. Justify in that context, please.

The City of London is the second largest financial market, largely for historic reasons that are little to do with what it does now. It seems to me it continues because it provides the service (analogically) of a major trade waterway, in money flows round a global financial world. It is the scale and continuity of the money flow that matters.

It isn’t money coming to London (there is very little here) that is critical; the real money is circulating through London, but always going somewhere else. Is speculation the reason it comes here? Maybe in part, but perhaps that is less important than the fact that the world knows that in Britain we pretend to the highest international standards, but actually have very low standards; the best of both worlds, and we write the manual. Hence books are written endlessly about ‘Putin’s People’, ‘Moneyland’, ‘Kleptopia’, or on money laundering; and we are always at a loss to know how it all could have happened since this is Britain, the best of all possible worlds.

A great deal of money is still to be made by providing the goods and often specialised services simply, at every level, to facilitate the continuous global money flow; a very small margin taken out of the vast volume of the money flow for services rendered, provides a very, very profitable economic opportunity for a country; even if its time has come, and gone.

You hit the nail on the head

Yes… he has. Criticism of the City is well-founded but needs to be split in two.

First, it’s failure to deliver capital for productive use in the UK. Second, it facilitates a huge volume of business that has nothing to do with the UK or the real economy in the UK… which may or may not be “a good thing”. (an FX transaction that allows a Japanese exporter to the US to hedge their USDJPY exposure is a “good thing”; money laundering is not).

Each of these failures is a long comment in itself but on the second point I would observe a few things.

(1) The City is “Wimbledonised”. We can run a jolly good tournament but none of the serious players are English. Whilst foreign banks do contribute to the UK as employers and users of ancillary services, don’t for a moment thing that UK banks are serious global players in finance.

(2) London holds its privileged position due to its time zone, languauge and history of Empire. Time zone won’t change but business is ebbing away to Paris, Amsterdam, Frankfurt etc.. This will be a slow multi-decade process but it is happening.

(3) London is a large “laundromat” because it is a large financial centre. I am not sure that on a “per transaction basis” London is worse than any others….. and a lot better than (say) Cyprus or Dubai.

I read Martin Wolf’s book(The Shifts and the Shocks) a few years back and to be fair to him he did describe UK banks as “glorified civil servants” who in effect are implementing govt monetary policy. He adds that they should as such be rewarded as civil servants and not masters of the Capitalist Universe as they tend to be in the upper echelons.

He also cautions aganst massive transfers if “hot capital” across national boundaries which he says seldom does much good for the general populations of the nations involved. He says that we need to address what type of society we need and that may well mean more rigourous capital controls.

I don’t think you and he are that far apart on the major issues.

He thinks we are

I tend to your view on that

The City’s role now is primarily about wealth extraction, with very little on genuine wealth creation of the kind that generates jobs and ‘value’ for the wider population. And yes, I use the terms ‘wealth’ and ‘value’ advisedly. It is overwhelmingly focused on property, trading and speculation. Rana Faroohar’s book Makers and Takers, whilst US focused, is a good summary.

Which prompts a thought for the glossary – perhaps a section on what we mean by ‘investment’ would be useful. Most of what the City describes as investment is merely trading, speculation, buying and selling revenue streams, betting on and pumping asset prices. What one might call real investment, where capital is spent in ways that create future value be it in public infrastructure, people and skills, genuine innovation et al is of little interest to the City. Short vs long term is a factor. Self vs wider public interest. Their narrow and selfish interpretation of ‘value’ and ‘wealth’.

Ive long thought that ‘investment banks’ should be had up under the trade descriptions action as they do next to no real investment.

This is both a glossary item and a myth

Again, reading Clara Mattei’s ‘The Capital Order’ is like having some rather filthy dirty glasses taken off, cleaned and put back on again. The book is epiphany in its own right.

All I see is austerity everywhere – historically and now – even New Labour did it by keeping to Tory spending plans and changing public sector pensions. The PSBR in the 90’s was merely another form or austerity – the OBR is the latest iteration of such a retarding mechanism on state investment.

The ‘inward investment’ that is so often spoken of is as John and Clive point out is just money passing through – it is not being put to any positive use at all really for the country – we are just a ‘conduit country’ for money. Inward investment is just a lie.

From the way we have dealt with our rubbish, to social housing, to the NHS to everything, we have actually been living under periods of austerity to varying degrees.

We have never truly invested in the right things at the right amount.

Private gain at the expense of public squalor and environmental degradation. I think it’s all coming to a head now.

I must get back to it

I have been reading novels af5ter days of writing the glossary

Two of your blogs this morning come down to the same question: what is the business economy FOR? The shareholder/stakeholder blog points out that it is just a smokescreen to justify business decisions in terms of shareholders, that is an alibi to allow people at the top to run the business in their own interest. This blog underlines the way the shareholder fiction means the way businesses assess “success” is whether they can continue making short term profits the way they did in the past and not whether they are planning (and investing) for the future.

Somehow businesses need to be shaken out of status quo thinking, and the stakeholder viewpoint might help significantly there. They need to be planning for the world as it will be, not as it is – most likely for something which isn’t about being bigger but being the same size better. A world which is more sustainable, less destructive of the environment and preferably restorative. A world with a different population age profile and all that implies. A world which is more about quality of life than quantity of production. A world where businesses are not assessed on the basis of growth, though investment in their future will still be important.

The question is how to change the culture in that direction. The main levers governments have are taxation and regulation. It needs a lot of skill (and probably luck) for tax incentives to do what is intended – the world seems full of examples of well-intentioned incentives that have turned into mere tax avoidance schemes. The regulatory approach might work better overall, and a requirement to justify business decisions in terms of all stakeholders rather than just shareholders would be a productive start. But the bigger debate is rarely addressed seriously.

Thanks

I will reflect on that

I agree re regualti0on though – this is the way to go

“whilst businesses are so obsessed with shareholder returns that they will not do so.”

Was in London last week, had lunch with my stockbroker (I’m a traditional sort of person). The discussion focused on markets/returns etc. I’m unusual since I focus on capital growth i.e. an increase in the share price due to increases in company activity. The focus is 100% on renewables and energy efficiency etc. The stockbroker noted that most of their clients (they offer the usual range of asset management services – which I don’t use – I can manage my own portfolio) were focused on dividends & it was a waste of time to try to get them to consider, for example, capital growth. This has implications on – where to put money. Most Uk companies offer limited growth prospects (I can count on one hand the good ones) – there is a much bigger pool of interesting companies in mainland Europe.

Two classic dividend-focused companies were mentioned in the conversation: BP & Shell. We had a very interesting discussion on their prospects, the position of UK pension funds and what the future holds (nothing good). In a previous post I mentioned a bio-tech investment (UK company – very good prospects, cutting edge tech, global lead) that ended in the company being unable to raise funds from a regional development bank – & was taken over by the yanks. Pathetic is not the half of it.

Other Uk companies, good tech, dependent on Uk energy policy being fit for purpose – it ain’t & they languish. On & on it goes, the Uk gradually failing – due to a focus on “finance” – whatever that means.

You are absolutely right

Most companies in the UK are being hollowed out to pay unearned or excessive shareholder returns and real growth is but a memory

There is much debate about the poor levels of productivity in the UK. For me it’s not difficult to understand, that if you fail to invest in your people and their skills, equipment and digital, R&D, infrastructure, it’s not surprising that productivity is poor. Investment that does not happen because returns to shareholders in dividends and share buy-backs are all that matter. Driven by a City and the creed of financialisation. Meanwhile the Right just think that productivity means employing fewer people working longer hours and paying them less.

Spot on

Seeing that billions and probably trillions pass through the City each year, a relatively modest tax on every transaction could produce a huge income for the UK that could be used for climate, infrastructure and the welfare of Uk citizens.

A totally unreasonable proposal 🙂

I used to be a pensions trustee and after attending many “beauty parades” of investment managers and listening to their slick presentations…..the results to me just demonstrated that we were dealing with one big casino.