As part of the work I have been doing on GDP for the glossary a comment was made about the little-known element within GDP that is made up of imputed rents paid by owner-occupiers of housing in the UK for the entitlement that they are deemed to have of living in their own houses rent free.

I have done just a little data crunching on this as the subject is so little known about. This results:

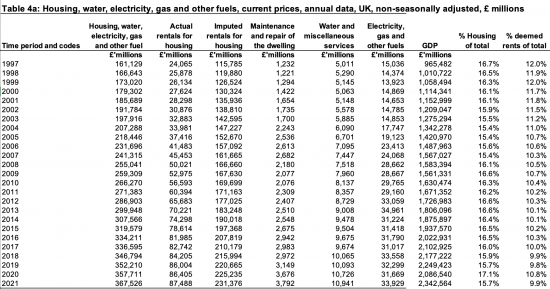

Click on the data to see a larger version of this.

The ley point is that in 2021 actual rents paid for housing in the UK were £87 billion. These were massively overshadowed by imputed rentals for housing, which were £231 billion. This is the sum that for GDP accounting purposes an owner occupier is deemed to pay themselves for the right to live in their own home. This sum has supposedly to be added to GDP to make sure UK GDP data is comparable with the GDP data of countries, like Germany, where renting is very much more common than it is in this country.

As is apparent from the table the net result is that over the last decade, just over 10% on average of GDP has literally been made up. There is no such income in this country. Nor is any tax paid on it.

It is also curious to note that whilst actual rents have grown from 2.5% of GDP to 4% of GDP these imputed rents have fallen from 12% to 10%. There has, of course, been a switch to rented property in the UK, but it is hard to see how imputed rents have fallen so heavily when the cost of houses has risen to significantly. I have not seen commentary on this issue, and it is not the primary focus of this post.

That focus is on the fact that we really should b aware that when looking at GDP data 10% of it simply does not exist. No wonder it is such a ridiculous measure.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Feel like my whole world has been a kafkesque fabrication. Its all just made up twaddle. Going to regard the madder green economic polices with more open mind.

Knock me over with a feather! The scale of this is revelatory. I immediately wondered about the “comment” that led you to do this? Not least because I immediately thought – how did I miss reading it?

Was it Mr Thomlinson’s thoughtful comment?

Perhaps another way of looking at the comparison with Germany is the comparative state of infrastructure between Britain and Germany, or the state of the armed forces equipment and readiness, or investment in the NHS; notably in the quality and modernity of the housing stock, where in the UK we have the oldest, most decayed, energy inefficient housing stock in Europe, and the capital, instead of invested in infrastructure, decent quality housing or productive resources has been privatised and tied up in this antiquated, mouldy anachronism, doing nothing at all but feeding asset bubbles and cyclical boom-busts …. endlessly.

I genuinely don’t recall now

Sorry to all involved

I know some of the arguments for counting rents in calculating GDP but in my mind, rents are not ‘new wealth’ but a transfer. It leaves the people paying rent with less money to spend on real goods and services. I suppose it also depends on what the rentiers do with the income.

Yep, all about juicing the numbers upwards so the governments can point to things getting better. “Look, the numbers are going up, your lives must be improving.”

Similar to unemployment falling whilst the percentage of people participating in the workforce falls. Just stop counting people as unemployed and another problem vanishes.

If this observation helps people to conclude that chasing GDP growth is nonsense then great. If we are going to chase something it might help if it were meaningful. Not sure what, exactly, but something like real median disposable income (with breakdowns that strip out housing, energy and food) might be something to look at.

But I will put in a “good word” for “making things up”!!

First, acknowledging that some things are “made up” steers us away from attaching too much import to data. (Your point).

Second, if the made up number is stable it still allows us to look at “changes” in the data which can be useful.

Third, if the “made up” number starts to look absurd it will challenge us to make up a better number and thinking about what we want our made up number to capture can be illuminating.

Fourth, it might allow us to “make up” some other parts of GDP that might be more helpful. (Measuring public service output by value rather than cost??)

The last is key

Hmmm! Not convinced by “making thins up”. It isn’t the only way of discovering something is a dud.

There is an old scholastic, philosophical principle that still has leverage: Occam’s Razor; never multiply entities beyond necessity. There is nothing necessary about any of this. I rest my case.

I guess it comes down to asking what calculations of GDP are for. If they are to get an approximation of total national income (i.e. money changing hands) for internal policy purposes then imputed income is a nonsense. If GDP figures are intended to allow comparisons between countries, then there need to be adjustments to keep data comparable.

But it does make one question whether there also ought to be imputed incomes for provision of informal care, etc.

I read somewhere that in Switzerland the calculation of income tax takes into account the “virtual” income to pay imputed rent for owned property. But I haven’t checked that it really is the case.

Your second point especially important

Until the 1960’s there was a tax on imputed rent for owner occupiers, this was one of the resins why you got tax relief on mortgage interest as it was a deductible expense

Schedule A, it was called

As I understand it, “imputed rent” is taxable in a few European countries, including the Netherlands, where it has a measurable impact on reducing inequality. https://sticerd.lse.ac.uk/case/_new/research/Inequalities_and_Poverty/policy-toolkit/housing-tax-imputed-rents.asp

Thanks

The polite way is to call GDP ‘ arbitrary’.

The impolite way is ‘total crap’. Or how about ‘pure fantasy’?

Shouldn’t GDP be based on some sort of double-entry book keeping?

Honestly……………….

It is not accounting

Economics always reserves the right to make stuff up

Well, I think that that was what I was suggesting – going back to how Mark Carney had described how we simply did not account for what we take from the environment until we have changed it or monetised it in some way – we don’t see the debit side.

How an earth can you measure output without measuring what you’ve taken and just declare it to be there?

In my own clumsy naive way I’m suggesting that GDP needs to be some sort of proper accounting exercise. The resource accounting work you’ve done I hoped would inject some sort of reality into wider areas like GDP.

You’re a busy man – please forgive my self indulgent treatises at this time of the morning.

No problem

Another eye-opener! Is this for all owner-occupiers – those with a mortgage as well as those owning outright? And presumably, as house prices increase, then so must the imputed rents, further pushing up GDP?

I might have to pursue those questions …..

Surely another entry under your ‘Creative Accounting’ section?

From the Glossary of ‘An A to Z definition of the main terms used within the national accounts.’…

Imputation

The process of inventing a transaction where, although no money has changed hands, there has been a flow of goods or services. It is confined to a very small number of cases where a reasonably satisfactory basis for the assumed valuation is available.

https://www.ons.gov.uk/economy/grossdomesticproductgdp/compendium/unitedkingdomnationalaccountsthebluebook/2022/glossary

Jeremy Smith comments…

Age UK found in 2017 that around 5 million (out of 14 million) grandparents have provided significant childcare – 30% of them for between 4 to 7 days a week, for a period of years. If (for example) we assume 2 million grandparents providing 10 hours a week on average for 50 weeks a year, and that the going rate would be £10 per hour, this would amount to an “imputed cost” of £10 billion, or a little under 0.5% of GDP… less than the imputed rent, of course, but far from negligible.

Taking ONS’s logic, childcare may be provided in Country A far more via the ‘market’, and in Country B far more via grandparents. Surely, the valuation of childcare services should either be “calculated on a consistent basis” with imputed charges where no market exists, or else we drop the whole charade of imputed rents and charges – whether for housing or for childcare.

https://www.ons.gov.uk/economy/grossdomesticproductgdp/compendium/unitedkingdomnationalaccountsthebluebook/2022/glossary

Thanks

What is the alternative though? If country A and country B have the same number of houses but different levels of renters vs owner occupiers (all other things being equal) then presumably they have the same economic output. If we’re going to include rents in GDP then we also need to include imputed rents, or else exclude them both altogether. Otherwise country comparisons make no sense.

Personally I would be supportive of a tax on imputed rents, would be interesting to see how much tax the monarchy should be paying on their unearned wealth.

But once you impute (make up) numbers, why not add some much more important numbers:

– The value of unpaid work

– The externalities caused by production inclduo9ing environmental degradation

– Added value from public services

Why just focus on a return to capital? Is that not hopelessly biased?

“The value of unpaid work”. This opens a huge new area. The NHS is an example. The cost of a surgical operation is in GDP, but not the benefit. A private surgical operation captures the income, so it recognises a benefit only because it is private sector.

In the case of an NHS surgical operation is the result of someone returned to health; hich may have enormous benefit; perhaps returning someone to the work force, or other spin-off economic benefits.

Selecting imputed rents seems a little odd; because the unpaid rent is effectively capital and in some, perhaps most cases the capital will be invested and is already earning rents, interest or dividends (and is taxed). Is there not a danger here of double counting?

Yes

But the ONS would say no

I would be fully supportive of trying to include the value of unpaid work etc. And of including the costs of externalities. But I wouldn’t call the numbers ‘made up’. Imputed numbers aren’t ‘made up’, they are estimations of real world services/products where no money is changing hands (and so there are no concrete figures to hand). If you want to argue for a more all encompassing version of GDP that’s fine, but it’s inconsistent to argue that some things should be included (eg unpaid work) and other things shouldn’t (eg imputed rents) without further justification.

Imputed rent comes as close to made up as you get

Out of left pocket and into right pocket is made up

The other issues discussed but not counted are real

Geoff,

May I ask you to explain in very precise detail what is real in your characterisation of “estimations of real world services/products where no money is changing hands”, about ‘imputed rents’.

There is no rent, that is a fact. What service or product is involved, and for whom? You seem certain, and I am interested.

Me too

Okay, take the example of unpaid work. My daughter’s grandma looks after her one day a week. If she wasn’t able to then we would have to put my daughter in nursery that day (or I or my wife could take a day off work but lets keep things simple for now and ignore that possibility). If she was in nursery then that day of service the nursery provides would be counted towards GDP figures. But has GDP actually increased? No, it’s just someone else doing the work, the fact that we are having to pay nursery and not my daughter’s grandma is irrelevant. I fully support the idea that unpaid work should be ‘imputed’ and added to GDP figures, would you accuse me of ‘making up’ numbers because no money is changing hands?

Likewise, when you live in the house you own, you are benefiting from that ownership. You have shelter, a place to live. It’s not unlike renting a house from someone else, except in this case that person is yourself.

I realise that conceptually it’s a bit of a rabbit hole, because there are all sorts of services we provide ourselves and goods we own and benefit from that you wouldn’t ordinarily consider part of GDP. But housing is such a large part of the economy that you can’t really ignore the benefit it provides, especially if you’re going to include rent in GDP figures and try to compare countries.

As I say, you either include both actual rent and imputed rent in GDP figures, or you exclude both, otherwise country comparisons and analysis of changes over time are meaningless. And as someone mentioned above, a tax on imputed rents is a good first step towards reducing inequality because the richest would be paying the highest imputed rents and therefore higher tax.

Thanks

I am about to make myself a cup of tea, and will later wash up the cup and put it away, but it would be ridiculous to count an imputed cost or value of this – or other domestic “services” that I might perform for myself or others – as contributing towards GDP.

This is very much “price of everything and value of nothing” territory.

Andrew,

I am not clear how you are defining “value”. NPISHs are included in GDP for goods and services, either “provided free or below the market price” (ONS). Are these goods and services imputed?

The donations are quantified, but the gap between donation and the market price expresses a value (I would say a real one) beween the donation and market price. The difference could even be a group of volunteers cleaning up litter on a beach, compared with the market cost of the work being undertaken by a waste management company. The price the waste company charges, compared with the volunteers does not transform the economic value of the activity (to say nothing of the social values of the volunteer activity). The production of an invoice is not a magic wand.

The bigger issue is this. Businesses have developed by using systems of accounting developed by the Venetians (all of it far more important economically than ‘economics’), which has been developed in a way that effectively allowed business (capital, commerce, private enterprise) to self-determine the boundaries of what is the individual business’s economic activity, and what is not. This began by establishing what counted as revenue, and especially, on this matter, what counted as cost. Thus, until relatively recently the pollution, detritus, even disease created by the activity of business was not accounted for, or cleaned up by business. Laissez faire for example, reached its limits of credibility only when the comfortable polluters in our Victorian cities were confronted by such threats to themselves of cholera epidemics cause by their own casual indifference to the effects of their own activities.

The litter that covers our streets, for example will be created by goods and services from certain sectors, more than others; fast food, for example. Do they pay the full cost of the litter their businesses create? Largely what seems to me their waste collection is paid for by local authorities; the publice sector, subsidising business. The wastelands of abandoned industrial sites throughout our country represent tombstones dedicated to the capacity of business not to absorb the full cost of their activity.

Even today our problem with Big Tech in social media is a function of ‘permissionless innovation’, which is just another form of cost to the business, companies have too long been allowed to ignore. Seeking permission costs money. The regulations always lag, and never quite recover the privacy of the individual, or ensure the business pays the full cost of protecting your privacy. The whole point of permissionless innovation is that it is the keystone to the philosophy of doing business. A business that radically innovates will determine the parameters of what counts as a cost in that new activity, in its own best interests.

Geoff,

You have completely misunderstood my question. I have already argued for including unpaid work, therefore that was not the point of my question. My question was referring exclusively to “renters vs owner occupiers” (you case in original comment). What is real about imputed rent for an owner occupier? The home is paid for, all the economic transactions are gone (the accounting would verify that). All that is left is the capital, which may be used to fund other investments. I have already raised the possibility of an imputed rent double counting.

Now, I wish to know what precisely is “real” about imputed rent for an owner occupied house?

John, I did say in my response, you are benefiting from the shelter etc. I’m making the parallel with unpaid work to prove my point.

If you move out of your house and rent it to someone else would that increase overall GDP in your view? There would be transactions and tax to pay so presumably you would say yes, but what has actually changed? Nothing really.

Andrew, yes in theory that should be included also though it’s obviously not practical and not really necessary to do so. Imagine though a theoretical example where there is one man on an island doing everything for himself, making goods, cooking food etc. Do you think this man has no GDP (however small) just because there are no monetary transactions? I would argue the opposite, he does have a GDP, we just have to estimate what that may be using ‘made up’, that is imputed numbers.

I don’t know why you guys have such a problem with imputed rent, it’s not a contentious issue. Dare I say it sounds like you just don’t like economists for some reason.

Imputed rent is made up

Even if international comparability of GDP requires it (and the standards on this are hopelessly outdated) it is utterly meaningless for domestic decision making purposes where others note there are many more important numbers we might impute that would have real decision making power

And do I dislike economists? Yes, by and large. They make up crap, pretend it is objective truth when it is solely there to advance the interests of financial capital and say that they are objective. That is total nonsense. Of course I call them out

Well, if you were so minded, you could rent out your house to another person, which sets a market rent that could be imputed. Or you could apply a tax based on the capital value if you were to sell (a little like local authority rates was based on a rateable value).

For example, in the Netherlands, I understand anyone who owns their own residence has to add imputed income from owning a home (“eigenwoningforfait”) and pay income tax on that amount each year, with deductions for mortgage and other costs.

It is calculated on a progressive scale based on the “WOZ” value of the house (“waardering onroerende zaken” – literally, valuation of real estate) determined each year by the local municipality. That number is also used for local property taxation (“onroerende zaakbelasting” – similar to council tax, but not based on values from three decades ago).

Perhaps a passing Dutch reader (if there is one) might like to comment on how this works.

Geoff,

“If you move out of your house and rent it to someone else”. If you move out of your house and rent it to someone else who moves in; that is real activity. There are real transactions, and a real rent charged and paid (if it isn’t paid, I doubt if the owner will be comforted by the fact that the unpaid rent will nevertheless be “imputed”).

I have no idea what you mean by comparing that with an owner occupier living in his own home, having some hypothetical rent calculated out of nothing, is exactly the same as moving home, and finding someone who will pay rent!

The point it seems to me you are missing is that for something to be real there has to be a ‘test’ of reality. There has to be ‘work’, actual transactions, observable activity. It cannot just be an abstraction. This is the weakness of neolcassical and neoliberal economics, as I keep saying: it is all theory, all abstraction. There is no rigorous method of testing theory in the real world. It is not science. It makes things up.

We are of one mind here John

If accounting did this it would be fraud

John W, are you saying that just because a bank transfer has been made, that is, a set of digital numbers have moved from one computer to another, that equals ‘real’ activity? I think most people would find that a strange idea.

Ignore the moving out of your house, let’s just say you buy a house and decide to rent it out rather than live in it. Does that house produce more GDP just because it’s rented than if you decided to live in it? No of course not.

Perhaps I can explain with another theoretical example. Suppose country A is purely made up of renters. People own houses but don’t live in their own houses, they’re all rented out to each other. Lots of rental transactions and lots of taxes to be collected and very high GDP (although the transactions are all digital so there really isn’t much ‘real’ activity taking place). Now suppose country B has the same number of houses and people but is made up purely of owner occupiers, no rents being paid, no taxes collected, no GDP (from housing anyway). Both countries have the same number of houses and same number of people. What you’re saying is that country A has a much higher GDP than country B simply because of all the transactions and ‘activity’ but does it really? No it does not, and because different countries have different levels of occupier ownership that is why the concept of imputed rent is needed to adequately compare countries.

Richard, merely repeating the same statement over and over again doesn’t make it true, that is an argumentative tactic straight out of the Trump playbook. And you seem to be prejudiced against economists, is that fair? I’m not sure why but maybe it’s something for you to reflect on.

Generally speaking I believe economists do a good job, calling out the futility of Brexit, calling out problems with austerity and the lack of productivity and investment under the Tories, calling out that the UK economy is still smaller than pre-covid unlike the rest of the G7. I’m not going to argue that economists always get things right, and clearly there are flaws in our measure of GDP, but imputed rent is not one of those flaws. Sorry to say as I think we probably agree on most things but I think you guys are barking up the wrong tree by trying to discredit the concept of imputed rent.

Geoff

Your argument is depressing

First, if you do not realise that transactions have consequences I wonder how far your economic thinking has got?

Second, you duck all questions asked of you.

Third, your dedication to the interests of capital is clear.

Fourth, that may make you a useful economist but shows you are way out of your depth in the real world.

Sorry, but you make no sense and display all the arrogance of the profession you defend.

Richard

Wow, okay clearly I’ve touched a nerve! I’m not going to try to counter your points apart from the last one about arrogance, I would suggest that you are more arrogant than you’d like to admit. Maybe you should go talk to some other academic economists and they can explain the concept of imputed rent to you, which is after all quite a simple and uncontentious concept. Good luck with that!

Sorry Geoff, but imputed rents is pure bullshit

Like most neoclassical / neoliberal constructs it has no relationship with the real world or any decision that need ever be taken in it

And it’s not arrogant to say so

It is truth telling

There you go again, stating something as fact without any justification. Trump would be proud.

I’m still laughing at the idea that, just because I’m defending the concept of imputed rent, that means I’m dedicated to the interests of capital. I would argue the opposite actually, that only by understanding the concept of imputed rent can you start to do something about inequality. Meanwhile you guys are inadvertently promoting the interests of landlords over owner occupiers. Incredible.

The concept of imputed rent has been around longer than neoliberal/neoclassical economics.

Truth-telling, ha! Love it. I think you should migrate to Trump’s Truth Social, lots of ‘truth’ to be had there.

I expected you to reveal yourself as a troll, and now you have

You have violated this blog’s comment policy and are now banned

Richard,

I unfortunately missed the opportunity to respond to Geoff, whom I felt had drunk too liberally from the poisoned chalice of economic conventional wisdom.

Neoliberal economists have a serious problem with two crucial issues:

Money. They believe economics is essentially a money-free activity; they believe barter is the fundamental activity. Adam Smith was completely wrong about this, and the discipline has never emerged from the hole it has dug for itself.

Accounting. Double-entry bookkeeping is not part of their standard education; and money functions in a system of double-entry. It is unavoidable, but the significance of double entry for the operation of money in an economy that relies on a complex hierarchy of money, is insufficiently understood.

Barter only works in a one-dimensional world; every barter transaction is unique. It does not transfer, it does not guarantee repetition. It can only exist at the extreme margin of economic activity, principally in the minds of economists, or in a war zone. A real, dynamic, continuous, functioning economy requires ‘money’, not as a convenience (the neoliberal fallacy), but as an existential necessity. What form the money takes is not important (sea shells, tally-sticks, coinage whatever), Money is fundamental and unavoidable to the real operation of ‘an economy’ (as distinct from an economist’s abstract idea of a single bargain).

It is the faith in economics being a non-money activity that I believe may lead Geoff to claim that money transactions are irrelevant, and we can simply invent activity (puff: just-like-that), out of nothing (and then stick a money quantum on it, simply to make spurious comparisons easy). It is money that makes economic activity possible in a real economy, not economic activity that ‘makes’ money possible.

Follow the money. That always works.

Agreed

Look at Geoff’s example of Country A and B to defend his case. Country A (taking in each others washing, eh, rent), and Country B (total inertia); bizarre abstraction heaped on abstraction. All to create a quite ludicrous comparison; no attempt to seek a an case from the real world.

All that to defend ‘imputed rent’, which creates economic activity where it literally doesn’t exist. I confess I feel slightly uncomfortable writing this when Geoff can’t reply, but I had developed this line of exploration deliberately over several comments to flush out the underlying issues, here is where it has led us, and I think this is important. Sorry, Geoff.

Hi Richard,

I’m surprised that you’ve only just found out about imputed rent! It is indeed a significant issue, and I think your reaction is an entirely understandable one from anyone encountering this for the first time. Wait, what?!?

That said, some other commentators have offered some defenses of why national accountants include this imputed transaction – due to the size and importance of the domestic housing sector, and the cross country variability in tenure, its been deemed necessary to apply this approach. This is not to say that this approach is easy to implement. But the rationale is clear. There are other wrinkles in the National Accounts, once you go digging, that might also raise eyebrows, and of course methodologies have changed over time (consider that weapons systems prior to the 2008 System of National Accounts were not capitalized, but instead recorded as immediate consumption).

For me, I’ve long been interested in a couple of wrinkles in relation to imputed rent. Firstly, the rationale, that tenure is different across countries and over time, isn’t limited to domestic dwellings – presumably different countries would also have different tenure mixes for property owned by companies and even governments – so why isn’t imputed rental applied across the economy to all fixed assets? (Answer, it just isn’t, by convention).

Second, the manuals have a really interesting comment about how rental payments (whether actual cash rents paid by tenants to landlords or imputed rents paid by owner occupiers to themselves) really has two parts (albeit its rare that these can be observed. One part of the payment is a payment for the use of the fixed asset itself – the house – which is what national accounts call rental (and which forms part of GDP). However the second part is a payment to be in the specific location – a payment for the land that the dwelling sits upon. National Accountants call this part rent (not rental), and treat it as a form of property income, not output, and its not included in GDP. The manual (European System of Accounts 2010) says that you should try and split these payments and “If there is no objective basis on which to split the payment between rent on land and rental on the buildings situated on it, the whole amount is treated as rent when the value of the land is estimated to exceed the value of the buildings on it and as rental otherwise.”

So ask yourself this, how would you record rent payments in property hotspots like London, or Edinburgh – maybe all as rent (and thus not entering GDP at all) – but certainly not all as rental.

Anyway, I’d note that measuring the modern mixed economy is an insanely complex task. How do you measure the government’s contribution to GDP? What about banks, who make their money from both interest rate margins and fees? How should we record extraction of non-renewable resources? And 101 other areas where things are trickier than simply recording the (accrued) cash flows.

Its true to say that these are all contestable areas – but I think its excessive to state GDP is a ridiculous measure, merely something that is very hard to measure, and where certain assumptions, methodological approaches and conventions have been adopted, and refined, down the years.

Phil

Thanks for the comment and I know your expertise in this area

And yes, I have known about this for decades, but I had not written about it fir a long time, if at all here

But, regrettably all you prove is that the process is utterly absurd and GDP is hopelessly past its use by date for any decision making purpose

Might you address the curiosity that a notional return to capital is apparently thought much more important than valuing unpaid Labour?

Hi Richard,

While I really appreciate the blog, and enjoy much of your commentary, I really do wish you’d dial back the language a bit! GDP are an honest attempt to do something that is conceptually and technically very difficult – and there are honest debates about what to include and what not to include.

People have debated unpaid labour (Samuelsen’s old joke about marrying your housekeeper/ butler etc and GDP falling) for literally decades and all this is highly contested.

Yet we still use GDP – we use it as a denominator for key economic aggregates, we talk about GDP growth and measure whether the overall economy has grown or not. I think it is useful, especially when we remember that there are three different measures of GDP (measure by output, income and expenditure) and that they usefully measure different things, especially in an advanced economy like the UK with a competent statistics office publishing detailed estimates and granular data.

As for the argument that GDP is “hopelessly past its use by date for any decision making purpose”, I’d at least question whether it is being used for decision making purposes – I don’t really think it is, its more like a useful yardstick, but as part of a suite of data points that we use to answer contested questions like, how healthy is our economy?

My personal view is that the underlying assumptions behind imputed rent are questionable – but rather than not including it at all, I’d rather prefer to see the concept applied more widely (across all sectors of the economy), but also more narrowly – with a better attempt to strip out the payments of rent on land from imputed rent and actual rental.

From a fiscal data perspective, I’d also welcome a change in approach to things like debt and deficit measured in % of GDP, or at least where this is the headline measure. GDP as a proxy for national income is fine, for some purposes – but government debt would likely make more sense in relation, not to GDP, but to government revenue.

Anyway, I continue to enjoy the dialogue. Keep up the good work!

Phil

I have provided one reply already on the blog

Another on the substance will follow asap

Richard

Mr Stokoe,

“That said, some other commentators have offered some defenses of why national accountants include this imputed transaction – due to the size and importance of the domestic housing sector, and the cross country variability in tenure, its been deemed necessary to apply this approach.”.

It is a curious fact that we are dwelling on imputed transactions because of the importance of the domestic housing sector, when Britain’s deep long term economic problems are around investment and productivity in the economy. I remember Thatcher and Tebbit being in a frightful muddle because they couldn’t seem to fix the productivity problem, or even understand how to tackle it; and we still can’t. I suggest to you that the two problems may be symbiotically related.

I am reminded of the dying days of medieval scholasticism; nobody doubted it provided for its scholars, internally coherent accounts, but it encountered real difficulties, only when obliged to engage with a changing world beyond the text.

True