The Bank of England Monetary Policy Committee report issued yesterday makes grim reading. These charts are all from the first chapter on the economic outlook:

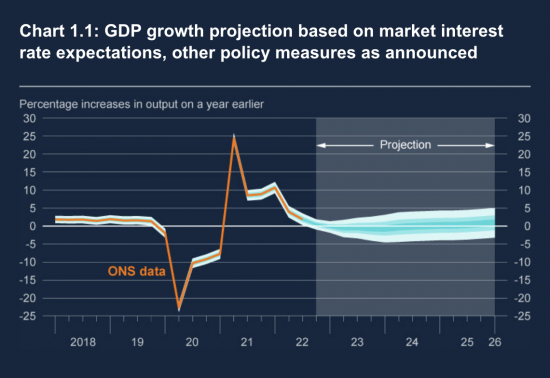

The Bank is not expecting growth until 2026. You might call that its own mark on its own mismanagement of the economy.

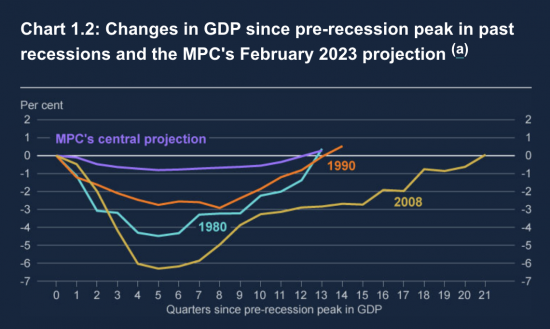

As a result we, singularly in the G7, will take until 2026 to recover from Covid, assuming nothing else happens in the meantime to knock us off course (which is a mighty big assumption):

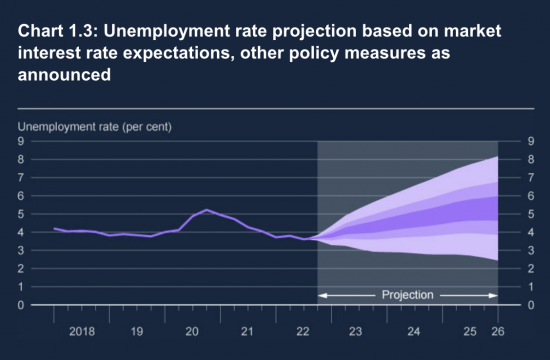

The price of this incompetence is to be borne by people who will be unemployed:

You would think they did not care, given the casualness with which they make such forecasts.

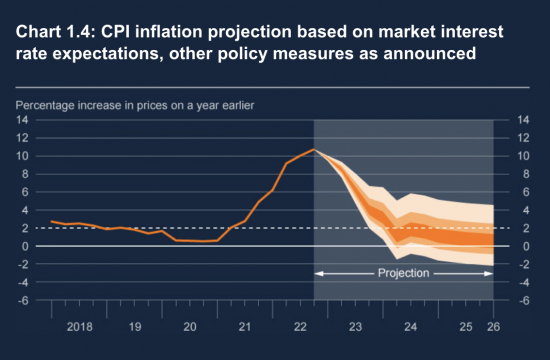

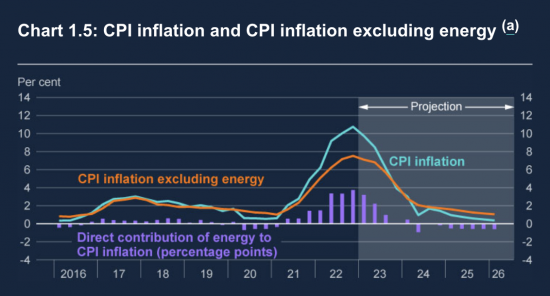

And what is staggering is that they increased interest rates even though they admitted that a) there is no way that the rate rises that they have already delivered have impacted inflation to any significant degree and b) there is no scenario in which they can imagine inflation rising again, as this chart shows:

As they in fact show, energy costs are actually going to pull inflation down now:

But even though they know the underlying cause of inflation is going, they are still wanting to impose recession on the UK.

Why? The great unspoken reason is that outside the EU the UK economy is basically unable to grow because it has not got the people to do so.

This could, of course, be celebrated. We would be the first post-growth economy. The trouble is there is no plan for that. All the old objectives are still in place, with a shrugged-off recognition that there is no chance of delivering against them.

This is economic failure on a grand scale, and the Bank of England is just compounding it.

But so too are the entire political class that refuses to talk about Brexit. Rarely has politics been so utterly irresponsible.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

What was most astonishing of all, was listening to the Governor talking about the economy, forecasts, interst rates and policy and thinking; what is it in this conversation that isn’t political.

The greatest triumph of neoliberalism in Britain isn’t that Conservatism swallowed it whole, but that Neoliberalism presents itself, through the Bank of England, as not being politics at all.

But it is. The Bank of England is making political decisions. The Emperor has no clothes; all you have to do – is look.

Totally agree

You are both on the right track – the depoliticisation of economics by so called ‘experts’ is one of the major thrusts of Clara Mattei’s ‘ The Political Order: How Economists Invented Austerity and Paved the Way to Fascism’ (2022).

I have been distracted from it

I do not think this is a meeter of “experts”; it is a specific problem with the “experts” who call themselves “economists”. I have always thought it was the central purpose of the discipline of economics; indeed critical to its self-esteem as a “science”; that economists work relentlessly to de-politicise it. Yhis can be very simply put:

How can you have a claim to be a science, if it is political? The economists, not being the subtlest of thinkers have decided that you can’t; so by magic economics isn’t political.; but it is.

Philosophically, the question is much more complex and nuanced; but there is no point in looking for philosophy oe unance in economics. Adam Smith is long dead.

Another triumph for neoliberalism, is the way the media do not question the narrative, that “Neoliberalism presents itself, through the Bank of England, as not being politics at all”.

The second point I wish to make is a question. Is the BoE policy being driven by a an unstated priority; to follow the $ and the US Fed even more closlely, because after Truss (and because our energy policy and structure is such a wholesale catastrophe) they fear for £ sterling (and energy costs, or anything critical we import where the price closely follows the US$)? Is this now an unstated central plank of BoE (and government) plicy?

I think so

That being so (and I’ve thought it to be the case for some time), when do interest levels come down again? Do we have to wait for a signal from the Americans?

Probably

I would be cutting now

In passing it is worth noting that De Gaulle’s major reason for keeping Britain out of the Common Market was that he regarded Britain as a Trojan Horse for an American domination of Europe which he thought needed to be resisted.

He was right on the US

He’d be more right now with the GOP being the way it is. When PSR mentions fascism, just think of the current GOP. Some of them are worse than virtually any Tory we have now. They are really scary. What is going on in the minds of a not small number of Americans that they vote for the politicians we are thinking of?

Sorry, the link from Mastodon is screwed up again.

BTW I fully support your campaigning, so it’s helpful to make sure people can find your articles!

Annoying because I always put spaces in. I will now include a para break

Grim reading indeed. The acknowledgment that our potential growth rate is now less than 3/4% means that it is almost inevitable that living standards over the medium term will flatline…….

….but only under the current assumptions about policy!

There IS an alternative….. and if you don’t know what it is you have not been paying attention! Pick a few random bits from this blog and you will get the picture.

The whole point of neoliberal capitalism is to reward the rich top 10% or more particularly the top 0.1% of the population and to ignore the well-being of the vast majority of the rest of the population. In this regard, Sunak is being very strong in their defence and promoting their interests as long as profits (preferably excessive) and asset prices increase or hold up.,

Therefore rising interest rates are good, holding down workers’ pay is good and ignoring the investment needed to counter climate disaster is good in all the ruling classes’ eyes. There is no alternative if Labour continues on its timid trajectory in countering this. Greens are good but too weak at the moment but hopefully will improve in the meantime, we are facing an increasingly revolutionary situation where there will be increasing cruelty and a massive clampdown on civil liberties through strike bans and wiping out any form of meaningful protest.

The government appears to be following what we in the RAF in the wireless fitting trade, in the 1950s, called the unofficial policy of The Royal Electrical and Mechanical Engineers (REME). This appeared to be ‘fix it or f— it so nobody else can fix it’.

Oldrafman

Here we go, the ‘exploitation econom’ again, this time the hoo-ha over pre-payment meters (from the Guardian):

“But this morning Dermot Nolan, a former Ofgem chief executive, said banning the use of prepayment meters could lead to higher bills for other customers.

Asked why energy could not be treated like water, where supplies are not allowed to disconnect households, he said:

If you did that for energy, I think, frankly … bad debts would rise.

Now it is up to companies to control bad debts but if you look at the water sector, maybe 2-3% of your bill is actually bad debt, so you’re probably spending £15-20 a year to cover bad debts.

That’s definitely higher than energy, but not hugely higher.

If you did that and you still make companies manage debt as much as you can, I think you would get slightly higher energy prices as a result – that happens in water.

Is that a trade-off you should make? I’m not sure, but I think you could argue it is the more civilised thing to do. But you would, I think, have slightly higher energy prices as a result.”

So, we have a system of socialising losses – whilst insulating investors from those losses, and the companies by getting other customers to pay.

Just like we were expected to pay for the bank bail out in 2008, by having to have austerity imposed on us as a result.

This adding risk onto utility bills and what have you could be stopped by a decent regulator as it helps to reinforce unreasonable price hikes.

And the language being used is pure silver tongued divisive fascism – your bills are higher because of those who cannot pay – THEY are the problem.

This is not a market in my view, this is a monopoly pretending to be a market and has it all sown up. Pure exploitation to me.

It is a monopoly that should be in public ownership precisely because it cannot be trusted in any other ownership

It is still a public monopoly in Scotland, and even the apologists for private sector excess like the Scottish Conservatives are too craven to make much of a fist of promoting its privatisation; it would probably finish them with the public. Scottish Water is far short of perfect, but much to be preferred to the profit gobbling, leaky, wasteful, expensive, turn-the-rivers-into-sewers business model they have in England.

PSR says “This adding risk onto utility bills and what have you could be stopped by a decent regulator…” Precisely so PSR, but isn’t it a feature of neo-liberal economic thinking that the regulators should be largely ineffective? Neo-liberals regularly cite Adam Smith’s views on the power and fairness of free markets, but NEVER mention his strongly-worded caveats about the dangers of monopolistic exploitation. This one is particularly apposite to the situation we find ourselves in today: The rate of profit, he said, was “always highest in the countries which are going fastest to ruin.”

In every case I can think of, regulators have been shrunk by Tory governments so that they do not have anywhere near the resource or the remit to do what is needed.

A cynic might suggest that just as Tories are starving the NHS so that they can say that it has failed and must be privatised, by strangling regulators, they can claim that regulation does not work.

Good point

And true in my experience

Yes Ken, the source of much of this is a Neo-liberal POV about markets and libertarian public choice theory that is for sure, but how many people out there know it?

In addition, not many of the ‘most sophisticated electorate in the world’ (Ha!) understand that privatisation just creates a cuckoo in the nest – another mouth to feed – and a big one – so that money for reinvestment, wages, pensions etc., is diverted to them.

I have to be honest though and say that even when setting rents in council housing, a provision is made for bad debt on rent for others, but it is no where near the £15-£20 per year add on it is utility bills and most councils are non-profit and reinvest their surpluses back into the service and just not line the pockets of the mega rich with even more money.

Richard wrote: “And what is staggering is that they increased interest rates even though they admitted that a) there is no way that the rate rises that they have already delivered have impacted inflation to any significant degree and b) there is no scenario in which they can imagine inflation rising again.”

I saw Bailey deliver this on Ch4 News last night and that was the point where my blood pressure could take no more. In the week where an independent report was critical of BBC staff’s lack of understanding of economics, it seems ridiculous, but essential that we have a similar independent review of the economic competence of the Treasury and the Bank of England. Sounds like a job for the Mile End Economists!

Calm, calm, calm…….

As the saying goes, when the only tool you have is a hammer…

Interest rates are the Bank’s hammer.

The Chief Economist at the BofE, Huw Pill now has on-line Q&A sessions with the public.

https://www.bankofengland.co.uk/events/2023/february/virtual-q-and-a-with-chief-economist-huw-pill-feb-2023

They are heavily policed and filtered I suspect. Ive been on one and he seemed very complacent and smug.

However, if you’ve nothing better to do, you might get a question answered. More likely it will confirm opinions

I have an invitation, but will it change anything?

I doubt it – but as above, will probably confirm your assumptions!

I was deeply unimpressed. Very different to Andy Haldane who I suspect left because his views did not fit well within the conservatism of the Bank. He has much more freedom at the RSA.

I am not much of a fan of Haldane either…

These days far from the person he once claimed to be

I see that elsewhere you are again suggesting that tax should be paid by companies where the customer is.

I work for a UK company that exports to 19 different countries around the world. At the moment, our profits are taxed entirely in the UK. So you think we should be employing 19 additional firms of accountants to deal with 19 different tax regimes, file 19 tax returns and pay tax in those 19 countries rather than in the UK?

I am not sure what I have been quoted as saying

I suggested unitary apportionment formula taxation

And yes, that might require additional declarations if you had establishments in those places

I think there is a huge difference between exporting to other countries and having a large orgaqnisation there running that country’s part of your organisation. If you have a presence in a country, benefitting from that country’s infrastructure, you should be a tax payer there.

I saw a few people suggesting economics isn’t a science and really is a philosophy. 300 years ago science didn’t exist, it was all philosophy. What the philosophy of sciences, both human and natural, tried to do was understand our environment so that we could make better decisions. ‘Science’ isn’t meant to tell us what to do, but to borrow a phrase from a well known philosopher of the time, science is the invisible hand. Unfortunately the majority of economics is utilitarianism. And as Bernard Williams remarked, there are 2 branches of utilitarianism. A public spirit and a heavy handed paternalism that tells everyone they know best for society even though it is clear to everyone else they dont. The bank of England independence might have begun with good intentions but has ended up too paternalist for its own good.

Can economics be subject to the scientific method or are there too many uncontrollable variables?

Economics is pseudo science when reduced to mathematics

Part of the problem is the ‘wrong kind of maths’ – at the risk of being mocked!

Neo-classical economics, along with its many other failings, is stuck in the maths of the 19th Century. Dealing with the many variables and their non-linear interactions and feedbacks needs the 20th C mathematics of complexity. Meteorologists and environmentalists understood this decades ago. People like Steve Keen and Eric Beinhocker (his Origins of Wealth is well worth reading) get it. Plus the work of the Santa Fe Institute on economics and complexity – Doyne Farmer and Brian Arthur. Their podcasts are a good intro.

The right kind of maths and models can be helpful but they are still only part of the story. As the saying goes, all models are wrong but sometimes are useful.

May I put it this way?

The purpose of science is to make predictions. Physics, which has been the gold standard (not least for economics) for over 300 years established its authority by its capacity to make predictions that were totally consistent, reliable, and reproducible with certainty. Physics has two critical elements that require different methods; theory, and experiment. Without both functioning together with a high degree of precision, there is no ‘Physics’.

In the case of economics it does prediction badly; very badly. We know that. The 2007-8 financial crash demonstrated the failure; and not for the first time, but the failure is demonstrated over and over again. You cannot rely on the predictions of economics with the certainty required to provide economists with the authority they crave.. The reason for that is that the theories are developed mathematically, but they have no absolutely secure method of testing the theory; because there is no experimental method in economics securely to test reality with any authority or reliability at all. The experimental method has never been adequately developed in economics.

Economics has made the fundamental error of trying to copy physics by pursuing theory and mathematics, but without the expermintal method. It only has theory and theorists. Economists describe an abstract world of their own mking.

I should have added – that is why neoliberal economists are obsessed with microeconomics; because they can study it without worrying about reality. They remain safely in their abstract world

This is a good introduction to complexity economics. It fundamentally challenges how neoclassical economics operates, its assumptions about society and behaviours, and methods. In particular the assumption of equilibrium. The Santa Fe folk are an eclectic mix but include serious mathematicians and physicists. Physics and maths has changed fundamentally in the last 150-200 years. Newton to Einstein. The ‘maths’ of neoclassical economists has not changed which is just one of their multiple failings.

They do not claim the false certainty of the neoclassicals who are just jumped up statisticians really.

https://sites.santafe.edu/~wbarthur/Papers/SFI%20Symposium%20Intro.pdf

Interestingly their work on economics was prompted by John Reed, then CEO of Citibank who recognised the failure of economists and their predictions back in the 80s.

https://www.sourcewatch.org/index.php?title=Santa_Fe_Institute

No need to worry. We can rely on the “Market” to perform its wonders, all on its own as it comes to our rescue to fix our economic woes: the sturdy, self-reliant, independent, equity driven market is all we have, and all we need.

Oops! Not quite. We do have a small problem with the fact that the transformation from the internal combustion engine to electric cars seems to have stalled; badly. The “Market” is going to fix it, however, don’t you worry.

That will be why the media is reporting that BMW is negotiating a £75m funding package with the Government to produce the electric Mini in Oxford. So not wholly with its own capital, or our wonderful capital markets.

The “Market”, eh? Never known to use its own capital when it can use the public sector: except when it is called Government “borrowing” by neoliberals, and criticised when it is used for nurses or doctors pay (having a healthy, stress free, well paid labour force doesn’t seem to matter, because we have a surfeit of spare labour keen to work for buttons so our monopolies can make more money than they know what to do with, and use it to buy their own shares); or bailing out failed banks when private equity has run for its life in a crisis, and spends years in hiding – whenever the going is tough.

I subscribe to ‘The Lens’ by Stephanie Kelton and this little bit of interesting conversation came through on one of her posts from it seems an interview with the U.S. Fed.

‘Question: When you say that the Fed needs to see “substantially more evidence” that inflation is retreating, how many months are we talking about? Or are you really just focused on the labor market?

Fed Chair Jerome Powell Powell: We want to see a lot of things but especially wages coming down.’

It could very well be that most recent interest hike here in the UK is following the same logic: to destroy the value of wages.

I mean, what do the U.S. and British governments want for their workforces?

Here its been about well paid, good jobs according to Boris at least. Really?

My view is that the U.S and UK governments want wages low enough to encourage debt so that their rentier mates who fund them are happy.

But then these very same politicians moan about the benefit ‘bill’ being too high in their respective countries.

As I said, what do these people want?

It does not add up as a policy at all. Low wages will require more additional spending on benefits that is likely not to happen or meet the needs required. So personal borrowing will go up and we know that credit is a destabilizing factor in economies as is poverty.

None of it makes sense except that we are placed in a perpetual merry go round of stupidity it seems on purpose if only to avoid doing the right thing!

He may have meant wage rate increases coming down, but either way your comment stacks

The Lens is well worth people’s time. Also Steve Keen’s Debunking Economics podcast

And then we get Truss spouting off in the paper’s today. There is no evidence that will convince these people. Its a pure cult of beliefs reflecting the self-interests of a small group of the very wealthy.

Agree on both those