I published this thread on Twitter this morning:

The government has just published new data on the cost of UK tax reliefs, which is the money given away by the government because some things are not taxable or because costs can be offset against income. Tax reliefs on savings are going to cost £59 billion this year. A thread...

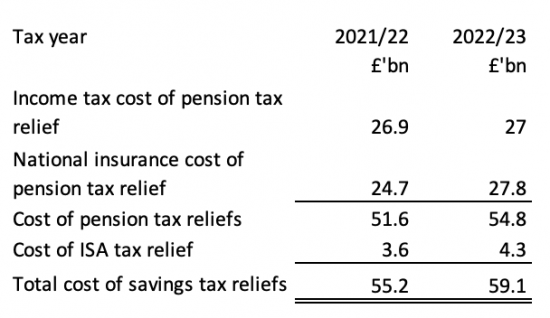

To summarise the data on the tax cost of subsidising UK savers last year and this year (2022/23) I have prepared this table:

For those looking for the source data on this issue, the data is available here.

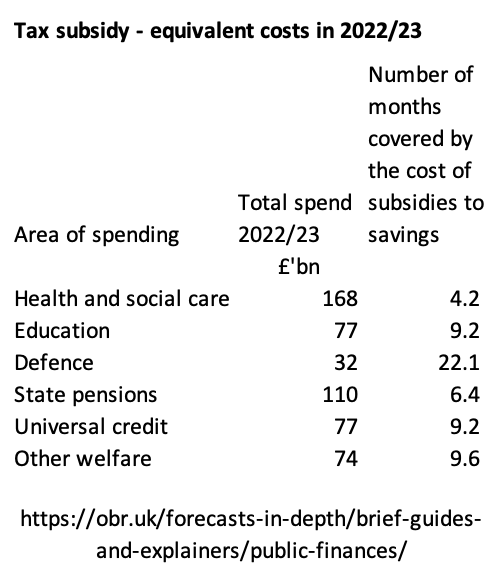

To put this in context I have prepared the following table showing the number of months spending on other essential services that could be covered by the spending made on subsidising the savings of the wealthy:

Now let's ask why we need to spend £59 billion a year subsidising savings, who gets the relief, and what we as a society get in exchange for that tax not collected, and what we should expect.

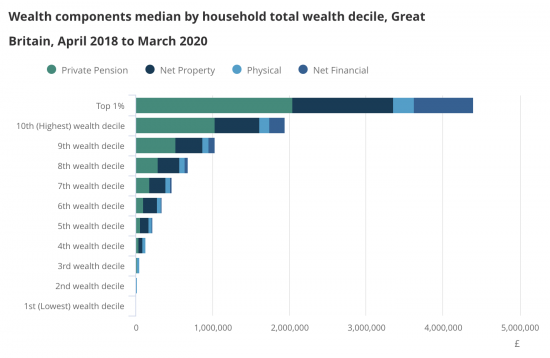

The first thing to note is who gets these tax reliefs. The best data on this comes from the Office for National Statistics and shows the distribution of wealth in the UK, including how much of it is made up by having pension savings. The data is from here.

The obvious evidence from this chart is that the vast majority of pension wealth is owned by those in the top 10% of the income strata, with most if the rest spread over the next couple of deciles. The evidence is unambiguous: most of this subsidy is going to the wealthy.

In fact, based on the ONS wealth data it is likely that 46% of all pension tax reliefs go to the top 10% income group.

Then allowing for the fact that this group are likely to get tax relief on their pension contributions at the 40% tax rate when most others get it at 20% the wealthiest people in the UK almost certainly enjoy a subsidy for their pension contributions exceeding £30 billion year.

Let's be clear what that means: the subsidy given to the savings of the wealthiest people in the UK is enough to pay for the NHS for more than 9 weeks each year or to pay for education for twenty weeks a year.

The obvious question to ask is why should a group already so privileged in wealth and income terms get such an enormous, and utterly disproportionate subsidy from the state, given at a rate denied to most of the UK population?

When we know that there is supposedly a desperate shortage of funding for public services why are we subsidising the wealthy to get ever more wealthy instead of supplying the health, education and other services that we need?

And let's be clear that society gets almost nothing in exchange for this subsidy. Firstly, that's because most of those who get the subsidy will save anyway: they have more than enough to live on so they will save anyway. The subsidy does not change their behaviour.

Of course there may be benefit to supporting the saving of those who might not otherwise save. But a subsidy on savings of no more than £5,000 a year at the 20% tax rate might be more than enough to achieve this.

Make this one simple change and almost all the wasted subsidy would be reclaimed. And, I stress, the subsidy is very largely washed because of the way in which pension funds are saved.

Pensions save in cash, shares, bonds (government and private company versions), in property and in little else. Cash just withdraws resources for use in society and delivers no net useful gain to an economy.

Saving in cash may be totally personally rational, but from a macroeconomic perspective, from which the government must view this activity, cash savings in banks do nothing to aid economic activity in the economy.

Investing in shares is much the same. Almost no company now issues shares to support its trading activity. Any new shares are issued in mergers and acquisitions. Most companies are actively buying share back to inflate their prices.

So, almost all shares in issue provide no new funds to promote real investment in the economy. Buying them is just gambling in financial markets by any other name.

Bonds make more sense, except governments do not need them to fund their activities, as quantitative easing proved. So they too are just savings mechanisms. And whilst corporate bonds can fund investment, most fund mergers.

So what is the social advantage of saving in pensions and ISAs? Next to nothing at all. No new economic activity is created in most cases, excepting in the ruinous and value extracting activities of the City of London. Its parasitical activity is dependent on these subsidies.

There is then at present no justification for these massive subsidies. They increase inequality. They divide society. The only business activity to gain is in the City, and that adds no value, and almost no real investment in the economy results from pension and ISA saving.

Despite this, my research with Prof Andrew Baker, also at the University of Sheffield, has shown that more than 80% of financial wealth is in accounts of this sort. That's disastrous for the UK because it means it harder to find funding for the real economic activity we need.

So what can be done? Three options. First, massively cut the reliefs in the way I have suggested. Cap relief to 20% on £5,000 or so of pension contribution a year: few lower paid people make more. I could be persuaded, maybe, to go to 10%.

I stress, I would let existing funds survive: I am not in favour of retrospective reforms for past contributions.

Then scrap ISAs unless they are reformed. ISA reliefs are now replicated in other tax law allowing £1,000 tax free investment income a year and generous CGT allowances so ISAs are simply money pots for the wealthiest now.

And if these changes are not acceptable change the rules on what funds must be used for. I suggest all ISA funds must be deposited with a government owned investment bank required to use the money in question for real social and green investment.

£70 billion a year goes into ISAs. There gave hardly ever been any net withdrawals. This money could be used to transform investment in sustainable social housing and the green economy.

And for pensions, require that at least 25% (and maybe more) of contributions go into similar types of employment creating investment with social and sustainable goals, very tightly defined to avoid abuse. The government investment bank could use these funds.

Do this and suddenly utterly useless subsidies to the wealthy are transformed into socially useful investment funds fir the benefit of society at large, and all by simply using tax reliefs fir better purpose without ever needing to raise a single penny of additional tax.

Of the options I prefer the investment bank route. But unless it happens I will continue to ask why it is that rather quietly and strangely unnoticed the biggest recipients of state welfare in the UK are the already wealthy? That makes no sense at all.

And for those objecting to what I am proposing please in that case justify why the wealthiest ten per cent of people in this country get more subsidy per person on average for their savings than those on universal credit get to afford the cost of living. I cannot, so how can you?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This is so clear and logical . Why on earth Labour don’t grab it? Low hanging fruit.

I wish I knew

Tax breaks are supposed to alter behaviour for the benefit of both the individual (otherwise they won’t get involved) AND broader society (why give away something for nothing in return?).

But what is the point of a tax break that does NOT alter behaviour and is a COST to broader society? The fact is that the wealthiest 10% will save anyway with or without tax breaks….. and are hardly the group that will endure poverty in old age.

I am not also sure that the obsession with saving for a pension is correct either.

First, “money can’t buy you love” was a famous lyric and to some extent captures the pension problem. At a micro level money might help but at a macro level it does not – the issue is whether there are enough resources (of things that you can’t accumulate and store now – ie. labour) to deliver care in the future…. and this can only be solved by sensible investment now (along the lines that you suggest, Green Deal etc..).

Second, does it make sense for me to pay 4% on my mortgage whilst my pension is invested at 3% in gilts? Possibly…. but possibly not. Individuals need to look at their balance sheet as a whole rather than compartmentalising pensions, mortgages, ISAs etc…. but this is a can or worms best reserved for another time.

Thanks

An interesting analysis.

I can’t see any problems in principle with governments using the tax system to incentivise behaviours they want to encourage. (And I think you have advocated exactly that for other things). It was perfectly reasonable for politicians to decide they wanted to incentivise people to have savings to protect themselves when there are future unexpected expenditures, or to incentivise people and their employers to maintain a pension fund to supplement the state scheme.

However politicians should also guard against perverse consequences of their decisions, and you have unearthed some here. The value of ISAs in incentivising saving, and income tax relief in incentivising occupational and personal pensions, would not be lost if there were a lifetime allowance for ISAs, and a lower annual allowance than at present for pension funds. (The latter would sensibly also restrict income tax relief to basic rate, and at the same time I would also suggest removing the lifetime allowance which has different impacts on defined benefit and defined contribution pensions – not that this is the subject of today’s blog).

(Disclosure: I am retired and my pension would no doubt be rather different if it were not for the tax status while I was working; I also have savings in the form of ISAs).

You can’t look at the tax benefits on the way in and ignore the tax paid on the way out. It’s nonsensical and misleading.

For comparison, what is the cost of the subsidy on public sector pensions and how much of the tax relief that you have highlighted refers to public sector workers?

Why can’t I look at it that way?

The tax is about one quarter of that so abolishing relief gives a massive net tax gee as in still – and the saving is now and the tax paid many years hence

And most public sector pensions are not funded

So what are you objecting to?

The top 10% of earners will be avoiding a marginal tax rate between 45% and 60% (depending on the NI position and counting employer contributions).

Most withdrawals are taxed at a marginal rate of 20%.

You can quibble over the details but the sums are large.

Precisely

The subsidy has a massive cost, even net

Take time into account and it us much bigger

Mr Davies,

One of my problems, increasingly in this ‘public’ versus ‘private’ is what counts as real “economic activity”, and what simply vanishes into the ethereal darkness. No, I am not thinking of the black economy (although it is tempting, and I hazard – mainly ‘private’, and very large, and very tax free).

No, I am thinking how a ‘private’ surgical operation counts as genuine economic activity, but an NHS public operation doesn’t count at all. Think of all that activity in our overwhelemd NHS; all of it effectively economic ‘junk’ from a ‘private’ perspective. Explain how that actually works effectively as a rational explanation of anything useful, in a world of real activity, and real human outcomes? Please, I could do with the revelation……..

“Saving in cash may be totally personally rational, but from a macroeconomic perspective, from which the government must view this activity, cash savings in banks do nothing to aid economic activity in the economy.”

On a recent thread you were boasting about how much of your pension has been in cash recently.

Do your own rules not apply to you?

I took short term loss avoidance

And cash savings can (I stress, can) be linked to green action

It’s not hard to find how

But you’re just trolling so I wouldn’t waste your time again

ISAs are to me at least a form of market making by the government on behalf of the private sector.

It’s a nice little savings pot that all the services you are losing can be used to pay for as the go private. Just to get the long big rip off started -get you on your way.

It’s the same with housing – housing is being used to give you an asset base from which you pay huge sums for dentistry, healthcare and whatever.

Too cynical?

Nope!

i agree with the analysis but isn’t it worse than that:

The subsidy is essentially money for the financial services industry to play with and is invested in tax avoidance, off shoring and investment overseas .

It thus represents an incentive for leakage of the tax base and for a maldistribution of investment resources. It may make sense from an individualistic point of view but undermines the national economy, overvalues the currency and is therefore a brake on exports and tourism , promotes inequality and erosion of funding sources for public services.

It is undoubtedly true that the financial services industry capture large parts of this for their gain