There is an article in the FT this morning Ruchir Sharma, who is the chair of Rockefeller International, in which he claims that in the current world of rising interest rates:

Markets will reward discipline. … Only now, discipline has a stricter meaning. Whether it is the US running up trillions in liabilities for Medicare and social security or Europe shovelling out energy subsidies, even superpowers are ill advised to borrow as if money were still free. In the new tight money era, markets can turn swiftly against free spenders, no matter how rich.

In the article Sharma suggests three things. The first is that the era of cheap money has gone.

The second is that bond vigilantes are not back.

However, third, market discipline on overspending governments is here to stay.

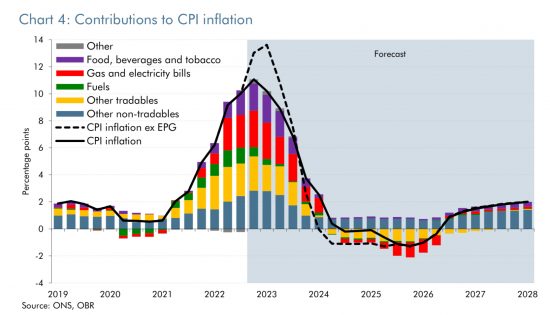

Politely, this is deluded thinking, which I know from just one chart. This is the Office for Budget Responsibility inflation forecast issued with the November Autumn Statement:

Of course this is a forecast and so of course it is wrong. But it also reflects three things. One is that inflation always returns to the mean after a peak, and usually remarkably quickly. That is especially true when, as on this occasion, the inflation is due in large part to a single exogenous shock.

Of course this is a forecast and so of course it is wrong. But it also reflects three things. One is that inflation always returns to the mean after a peak, and usually remarkably quickly. That is especially true when, as on this occasion, the inflation is due in large part to a single exogenous shock.

Second, we are already seeing declining inflation in the USA and real indicators of decline in things like gas prices and shipping costs. That fall in inflation is going to happen.

Third, this chart happens to agree with Bank of England thinking, which coincidentally makes their policy of raising interest rates so very obviously wrong since it is apparent that these rate rises are not needed.

But, most tellingly, if inflation goes negative, as forecast, how is any government, anywhere , going to let its central bank persist with very high real interest rates whose only consequence by then will be to crush the lifeblood out of any economy? That is simply not going to happen. Instead, interest rates are going to tumble as politicians demand monetary policy support for government efforts to promote economic recovery in the wake of wholly unnecessary recessions created by central bankers who have no idea how inflation works or what causes it.

The likes of Ruchir Sharma might wish the era of cheap money to be over. After all, their organisations exist to assist the ever upward flow of wealth in society, and high real interest rates greatly aid this process. The reality us, however, that falling interest rates are going to happen in 2023 and with inflation disappearing rates are likely to tumble in 2024. I doubt they will go below 1% again, but with deflation likely rates of well below 2% are very likely, and even essential.

Markets should enjoy their moment of thinking they have power. It is not going to last.

The real challenge is in creating the thinking that will ensure it never happens again. Modern monetary theory makes clear that these rates are not necessary. No wonder markets hate that thinking. The bigger issue is, why don't supposedly progressive politicians like it? What is it that they are frightened of?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

All I can say is that I hope that you are right. But there could be a lot of damage throughout 2023 if high interest rates are maintained. You of course talk a lot of sense. I don’t see that replicated elsewhere, particularly in the markets who benefit from high rates and have friends in the BoE – as you point out.

If cheap money returns then all assets boom .. bonds, property, infrastructure, equities the lot.. and the wealthy get more wealthy. You are wrong to assume the rich want a period of tight money. So much of their returns depends upon leverage that they will be praying for low interest rates and a flat yield curve.

They are frightened of being proven wrong. There is nothing more dangerous in this world than the fragile ego of a politician. Or an economist.

“have no idea how inflation works or what causes it.”

This could be you Richard.. 10 months ago you were saying inflation wouldn’t be a problem!!!!!

I did not anticipate war in Ukraine

Stop being stupid, politely

Mr Marriott,

We expect Government to use its resources (intelligence, FO, Defence Ministry, NATO for example, and its own experience of office), to establish the risks of war. Government is the only focal point with the resources to do this on a world scale. Government failed.

Putin’s modus operandi was established in 1999; the destruction of Grozny, Chechnya (the Russians used exactly the same methods in Mariupol, 23 years later). This was accompanied by Putin flooding the world, and especially Britain with Russian oligarchs, who transformed the London property market. The oligarchs easily worked their way into the Conservative Party, took over newspapers, and the Conservative Party was only too ready to take their money; and even appoint selected oligarchs to the House of Lords. Nobody noticed, or cared.

Then, 2006 Alexander Litvinenko was assassinated in a Mayfair Hotel, taking tea in a public lounge; laced with radioactive polonium. Britain did nothing. The Government followed the princples of the policeman Renault (Claude Rains) in the film ‘Casablanca’, who faced every crime executed by the Nazis by the declaration ‘arrest the usual supects!’. Britain sent a few Russian diplomats home. Nobody noticed, nobody cared.

Over these years Putin was able to form his opinion of Britain and the world as weak, greedy and money-grubbing. It provided him with the confidence that Russia could act with impunity; the West would do nothing. He was able to turn the European energy market, including Britain. In 2013 in Ukraine, the pro-Russian President Yanukovych fled to Russia following popular protests in Kyiv. Nobody in the West noticed, nobody cared.

The Russian reaction to its failure to undermine Ukraine politically followed. In 2014 Russian ‘Spetsnaz’ special forces took over Crimea. At the same time Russian backed forces took power of parts of the Donbas. Nobody noticed, nobody cared.

In 2015 Russia took a leading role in the war in Syria, using the same tactics it had used in Grozny, or later in Mariupol, or Kherson. Nobody noticed, nobody cared.

In 2016 Brexit provided to Putin telling confirmation of the weakness of Europe and the stupidity of Britain. Over the very same long period, through oil and gas supplies (BP was a big player in Russia), Nordstream and so on, Europe and Britain delivered their domestic energy supply and pricing (the most critical element in their economic security), effectively into the hands of Russia and Putin. Nobody noticed, nobody cared.

It should come as no surprise that by 2022 Putin jusged that he could do anything at all, with complete impunity. He invaded Ukraine. …. Finally it was noticed by Britain and the West.

Who would you blame Mr Marriott? Those not in office? Or is everyone blameless in this catastrophe, whatever their responsibility for Britain’s security? I will be interested to read your explanation of how this utter disaster for Britain came about.

Inflation is not all down to the war, even energy prices were marching upwards well before the war as were all commodities.

It was a shocking call on inflation.

There was short term price fluctuation due to Covid reopening far too quickly

There was nothing shocking about the call

There was to the politics

This sounds like a good summary – greed, indifference, inaction and repeat – plus the mainstream media never framing an agenda to to promote public concern about Putin’s actions because it wouldn’t have suited their backers.

After PMQs today (7th December) there was a more important debate, following an urgent question from Margaret Hodge MP to the Treasury Minister (James Cartlidge MP, a completely unknown cipher nobody has ever heard of, probably even in the Conservative Party). Hodge challenged the UK Russian sanctions regime, when BP (which I mentioned above), owned almost 20% of the Russian oil giant Rozneft. On the invasion of Ukraine BP promised to divest the shareholding. It hasn’t; and now it appears it is due to receive a £580m dividend from the Rozneft profits, during the war. I suggest readers follow the debate on Parliamentlive (from around 12.35pm to 1.14pm).

We discover that not just BP; a significant number of British companies are still operating, and presumably profiting from doing business in Russia. Cartlidge wrung his hands, but offered MPs precisely nothing. He followed what he insisted was established Treasury precedent, which he preached; discussing individual companies and their commercial profit interests is never discussed by the Treasury. It was all very complex.

Chris Bryant described the Government as “complacent”. We discover also that Zelensky’s government has written to BP, telling them the dividend is “blood money”. Even the very few Conservative MPs who remained for this car crash were baffled, uncomfortable and uneasy (most were too smart to stay); but pathetically joined in the empty hand-wringing.

It is quite clear that the Conservative Party is so far down the sewer of neoliberal ideology that private profit and the privacy of sensitive commercial issues – even over Ukraine sanctions – remain sacrosanct if not sacred issues. It trumps the most basic morality, even in a war backed by sanctions. This is utterly appalling.

We really are lost. Scotland, please – get me out of here.

Chris Bryant is too kind to them

Good question by Margaret

Remamber, BP was created in 1908 by the British Government (the Admiralty wanted to switch from coal to oil), equity funded by Burmah Oil. Historically the Government always had a discreet hand buried mysteriously within the company, and its direction. When (or if) that changed? I have no idea.

When the golden share was given up after privatisation

Richard,

Yes of course, but hmm … still not sure. They say there is more than one way to skin a cat (not that I have ever taken the skin off anything, even the proverbial rice pudding) ……

Good post John

It may be that the intelligence services did warn but the politicians thought that ‘imperial’ expansion was a thing of the past. Some did notice but most decided, as far as I can see, that confrontation would be counter-productive. Those still alive in 30 years time -may- see the records when they are released under the 30 year rule.

The Royal United Services Institute issued a report on the lessons of the war up to July. The first chapter describes the Russian plan of invasion based on captured documents.

I am now fairly sure that Russia wanted to take back all of Ukraine, not just ‘come to the aid of oppressed ethnic Russians’ as they claimed.

I have just done an Amazon book review on ‘Ukraine Revolt, Russia’s Revenge’. It was written by an American embassy employee in Kyiv at the time of the Maidan protests. The author writes as one convinced that Russia engaged in hybrid warfare but much of what he says seems to check out. He provides a lot of detail about events, attitudes and people.

Mr Stevenson,

Thank you, especially for your clearly well informed guidance toward Christopher M Smith’s book. I have ordered it.

Richard provides such an invaluable public resource for those trying to understand important issues; there is always a contributor able to offer scholarly insight.

The economy certainly did briefly overheat after reopening, with services PMIs in the US and UK well into the 60s, in the US hitting an all time high of 69.1 back in November 2021. Emergency support was left too long but now we have the typical central bank overreaction effect. They pat themselves on the back but it is precisely the inflation that has brought down demand coupled with the war. The market pivoted before the Fed last week because they know this fact.