A comment on the blog yesterday referred to a valuable paper from the Hosue of Commons Library on how so many activities were nationalised by labour after 1945. That paper is here.

Like a great deal that comes from this source, the paper is very helpful.

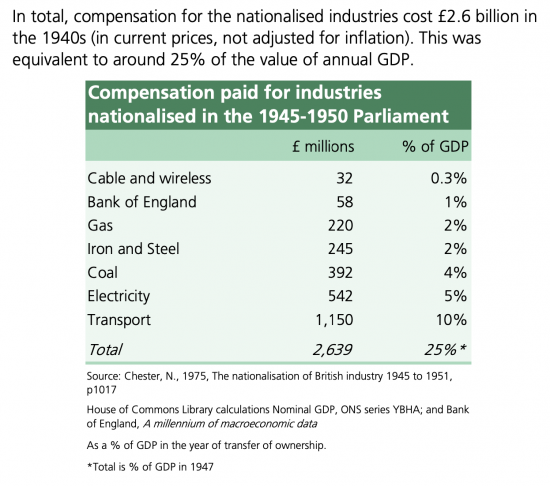

Amongst the data made available is this table:

The payments were not made in cash: bonds were used as the means of payment with the national debt increasing as a result.

Would it be worth increasing the national debt by 25% of GDP now to achieve the same result? I think so.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Agreed.

When you privatise, you create another mouth to feed: the shareholder. And he/she comes first under law. Before the customer, before the worker. Before the strategic needs of the country.

The people of this country need to get their thick heads around this as it is the source of a lot of problems.

Actually, they don’t come first in law

For once, I have to disagree

But they may come first in practice

OK noted and thanks – but would it be fair to say, ‘in practice’?

That’s how it seems to me in terms of asset stripping and whatnot. And also, the service user/employment side seems powerless against it all or is it that they’re just not as effectively organised?

In practice profit stripping do0es seem to be the priority of many large companies

See https://productivityinsightsnetwork.co.uk/app/uploads/2021/06/PIN-Report-29-6-21-FINAL.pdf

Ofgem has recently told the electricity network operators to spend £22bn on making their networks fit for renewables. Under the “regulated asset base” model favoured by Tory & Liebore this delivers a return of around … extract from Bloomberg article on the subject:

“The rate of equity return was set at 5.23%, up from 4.75% in an earlier proposal, but still some way off the 6% in the previous price control period. The price control runs from April 1 next year to March 31, 2028.”

We are talking monopolies, supplying a “good”, electricity that most people cannot do without. It is worth noting that these rates of return applied, even when inflation and interest rates were running @ close to 0%.

Nationalise them – yes. But first, a bit of softening up such as a reduction in return to reflect risk – perhaps 2% return on assets which in any case are mostly 100% depreciated in any case. Without exception, network operators are profit maximising entities, this fits badly with the need to have networks engineered for a renewable future & in a way that is not forever focused on max CAPEX to get max return. The aim being to erode share values.

On a fairly regular basis I speak to people on the receiveing end of ridiculous & costly proposals from DNOs to reinfocre their networks to accomodate renewables. In 100% of the cases, what is proposed is uneccessary and is, quite simply a way for the DNO to extract money with menaces (a la the mafia). The cherry on the cake for the DNOs is that after having got some poor devil to pay for network reinforcement – they (the DNO) can then put the asset on their “regulated asset base” – at which point UK serfs have the pleasure of paying for the asset. Heads, DNOs win, tails DNOs win. Most of the DNOs I speak to are pleasant enough – but I have no doubts that the Mafia are very personable provided you pay up. And for those that might say: but Ofgem will stop them… oh please, the DNOs regard Ofgem with total contempt – I know cos they told me so & they know far more than Ofgem could ever know about their networks, their assets etc etc.

It is interesting to note that there is dead silence on this subject (nationalisation) from Liebore – but there would be given the present party line on balancing the United-Corner-Shop-Serfdoms books.

What am I doing? Working with companies that want to expand renewables behind the meter, telling them to not tell the DNO, because the DNO won’t know (and lacks the capacity to ever know), generally taking an approach to the DNOs which ignores their synthetic rules and regulations (all designed to extract money) whilst at the same time making sure that any RES that a company installs functions in a way that is consistent with stable network operation.

I agree: softening up by applying tighter regulation is the precursor to nationalisation

It is quite extraordinary how much public money is being thown at windfall profit-rich energy producers/providers (not the UK “suppliers”, who produce only invoices), drowning in surfeits of surplus profit; and not a single word about serious reform of the ‘bust’ UK domestic energy market: by Government or Opposition. They have offered precisely no genuine solution; which demonstrates how far we have fallen into the nonsense about “markets” and their magical powers; when it is transparently obvious we are being royally ripped-off by a monopoly industry, operated it seems as a government sponsored cartel (the legislation seems designed somehow to have evaded the standard protocols of the law of contract; was that wrinkle passed by Parliament, or was it an Order in Council?).

I’ve never really understood how adding another financial pressure, profit and extraction, can make a entity more productive and effecient. I get that incentives can make an entity work better but so often the profit is not shared locally. From listening to assessments of M&S over the decades a profit was not enough. The profit had to increase year on year. And yet this is not enough either as the profit, increasing year on year has to increase by large amounts and on and on. Surely, in many cases, chasing ever increasing profits is going to result in cost cutting (labelled as efficiences) and that cost cutting might well hamper efficiency.

Aiming to make more profit is meaningless, I can say as an accountant

You aim to do more of what people want, and preferably better, so they will buy more

If you succeed you will probably make more profit if you have fair cost control

But profit is an epiphenomenon – the consequence of doing something well

Those who aim for it are simply rentiers (back to that, again)

It is true that debt is increased if you borrow to buy an asset. But that asset generates revenues, and has an inherent capital value that shows +ve on your balance sheet if you are a business. If that is taken in to account, was the total national balance sheet still in debt? Has that ever been analysed? Only considering the money required to repay National Debt is IMO false accounting. Many business borrow to invest in capital equipment and assets, that are then used to generate revenues. When preparing the cost benefit analysis you need to take account of the total business case, including new income streams. Politicians like to think only of the the ‘debt’ for electoral gain, thus we had ‘austerity’ that actually cost the nation more than the revenue costs saved, as the UK failed to grow its economy in that period.

See the Steve Keen post