I posted this thread on Twitter this morning:

I had a long discussion with a radio producer yesterday on what I thought was wrong with the Autumn Statement. We discussed the numbers but what I said is most important is not what was said, but what was not. That's where the frightening bits are. A thread…..

[This is a long thread: if it appears to stop mid flow click the last post you can see and the rest should appear.]

It was a very long time ago that I realised that when looking at financial data - whether accounts or economics information - the key thing to look for is what is not made available.

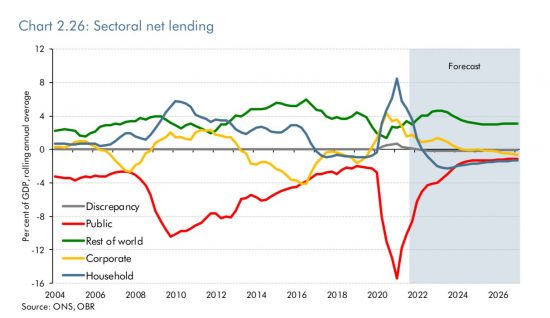

There was one critical chart missing from the Office for Budget Responsibility report, which was of the sectoral balances. This charts shows which parts of the economy are borrowing and which are saving. This was from March 2022:

You will note there are four sectors that cover all activity in the economy. They are households, business, the government and overseas holders of sterling. All sterling transactions fall into one of those groups.

Double entry requires that the sectoral balances add up to zero. For every borrower there must be a lender, as a matter of fact. The earlier chart shows this. So, the question is, why hasn't this been published and what might happen?

First, we know that the government is going to borrow. The forecast is for £170bn plus this year, and well over £400bn in all over this period. But we also know from the forecast that the OBR forecast no apparent net savings by the private sector over the next five years.

It's harder to predict what business will do, but I see it saving: that's the result of limited investment in a recession.

What we really do not know is what is forecast for the overseas sector. It's unacceptable that this is not forecast.

But let me explain what really worries me. As we know Hunt has focused all his attention on government debt and pacifying the financial markets. The whole focus was on meeting a fiscal rule he made up for the Autumn Statement solely so that he could say he met it.

The result of this has been obvious. As we know, households could (and the estimates vary) lose up to £4,000 a year - but this is an average, course. We know some households - the top 10% - will still do just fine, and will be saving. It's the rest that worry me.

If the top 10% of the wealth profile will be saving - and I have no doubt they will be - then over the next five years the rest of the UK is going to be borrowing very heavily in proportion to income. And for some this is going to be unsustainable.

Five years of mortgage rates at 5% or more is going to bring unimaginable financial stress. And since mortgage rates roll straight over into private rents those in that sector are also going to face intolerable stresses.

But that's not the end of this. Almost certainly, inflation is going to fade away by early 2024. But we know is that we have a government determined that wage settlements will not match the inflation that will have happened by then.

That means millions of households will not only have more cost. In real terms they will have less pay. It's OK to protect pensioners, those on benefits and minimum wage, but those from about the 30% mark in the income range to maybe 70% plus are getting no protection at all.

But it's worse than that: they are being sacrificed to the goal of the government meeting a meaningless fiscal rule. No wonder the sectoral balances were not published.

My fear is that these households will face financial burdens they simply will not be able to pay. Whatever the additional cost is - and for this group it is going to be well above the average - it's not possible to say ‘just tighten your belt'.

The reason for that is quite straightforward. The need to pay the mortgage, council tax, fuel bills, water and put food on the table will not go away. It's fixed, and it is much more expensive. And there will be less money. Lower real pay and higher taxes guarantee that.

No doubt the Treasury has assumed that this group will dip into their savings. The slight problem is most of them don't have any of any significance. Or the Treasury assume they will borrow. And it is true that for a while some will. For example, mortgages will be extended.

But, and I stress the point, this ignores the real issue. Over time, more and more in this group will run out of lines of credit. The straightforward impossibility of their situation will become more apparent. And the hardship being imposed will become very clear.

I am quite sure that some in the 10% will be contemptuous of that hardship. I already hear comments like ‘they should not have assumed cheap credit would last forever'. Or ‘don't they know we're in a recession: of course it will be tough'.

But the truth is that people in this group - those on average incomes - took cheap credit to buy houses at inflated prices because it was the only secure housing option available to them. And yes, they did and do expect some extras in life for them or their children.

No one in this group is at fault for thinking they should be able to afford their costs of living. And my fear is very large numbers of them will not be able to do so. And not just be a bit, but by quite a lot.

In real terms they may be missing over 10% of their household incomes and most households will simply not have that margin for error available to them. Many will also not be able to borrow that sum - because they could not repay it.

In other words, what the Treasury and the Office for Budget Responsibility failed to mention was that in their desperate desire to make it look like the government was managing its debt they have planned to pile totally unaffordable debt onto million of households.

There is, as I have long argued, a difference between governments having debt and households being in debt. Households have to repay their debt using money they earn. Governments don't have to repay their debts (and rarely have) and do so when it happens using money they create.

In other words, governments can always manage and afford their debts and households cannot. The difference is as simple and stark as that. But what the government has chosen is to pile the debt on those who cannot afford the debt when it could easily have afforded to accept it.

Of course, I could at this point just say this was a mistake. But it is much more than that. For the households involved this is a disaster. But again, that understates things. Because for the whole country this is a disaster.

There are always some households who cannot afford to pay their debt, and the financial system can survive that happening. But when millions cannot pay their rent, mortgages and bills, and when people cannot feed their children, the system cannot survive. It will break down.

What this Autumn Statement has set up is the biggest potential economic disaster since way before living memory where household debt default will be commonplace and those owed the money - from banks, to landlords, to energy companies and more, will not be able to handle that.

In other words, this will not just be a financial problem for the households involved in this disastrous situation: we face banking and corporate meltdowns too.

And that is all because the government refuses to believe that it can and must take on the job of creating the new debt - or money supply - that the country needs to survive this crisis.

And I stress, it is money supply that is needed to get through what is going to happen. Inflation creates a shortage of money. If money is worth less we need more of it to keep the economy going. It really should not be rocket science to work that out.

There are only two ways to make more money supply. Either the government creates the money by spending more into the economy than it taxes and borrows back from that economy, or the private sector banks have to create it by lending more to people who want to borrow.

There will be plenty of people wanting to borrow. There will be few banks wanting to lend, however, precisely because it will be obvious very soon that those wanting to borrow will not be able to afford to repay. So, that private sector solution is going to fail.

Alternatively, the government should be creating the new money that we need right now. That is, after all, its job as the creator of the state's currency. But what Hunt has said is that it is going to duck that responsibility.

Even worse, the Bank of England is going to try to sell the bonds it already owns as a result of QE to try to reduce the money supply still further over the coming years, all with the goal of keeping interest rates ruinously high.

That means the government is not just ducking its responsibility to create money, it is actively planning to make things worse via the Bank of England.

And what that means is that nothing about the Autumn Statement adds up. The numbers we have heard so far are bad. But what is really troubling is their implication, for household, then corporate, and then whole economy failure, and all because the government will not create money.

This Autumn Statement is not inevitable, as Tories and Labour alike seem to be saying. The austerity it imposes is not required, as they suggest. The pay clampdowns they both seem to desire are deeply undesirable. And high-interest rates are recklessly irresponsible.

We do not need to have an economic disaster in this country in the years to come. But as things stand we will. And it will have been manufactured here, firstly by the government and right now by Labour failing to spot what the government is doing wrong.

This can be avoided. Tax cuts, spending increases, more government borrowing and probably QE, and lower interest rates are all required. And there will be no inflation of consequence. And with the right explanation to the City, the package can be sold to them.

But that will take a very confident Chancellor sure of the power of the state to make lives better. Have we got one of them? I can't see one being available right now. But whatever happens we are going to need one soon.

That's because as night follows day we are heading for a disaster. We can avoid it. But only be accepting that it is the state that has to get us out of the situation we are in, and that piling more debt on households can only make things very, very much worse.

The Treasury and Office for Budget Responsibility have not told us the whole story on debt in the hope that they might get away with it. They won't. And the result will be very costly for us all.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Labour seem to be justifying their embrace of austerity by saying that they accept the “OBR figures”, rather than saying they accept the Tory figures. It’s as if “the figures” are now no longer a political choice, and accepting them is the “responsible” thing to do, of course. To what extent are “the figures” now the property of the OBR and not the Tories? Can the Tories now also absolve themselves of any reponsibility for austerity , and blame it all on the OBR , tne latter having given their seal of approval? Can you clarify exactly what the remit of the OBR is? Does it , as I suspect, merely check that the economic plan laid out by the government has some chance of meeting the arbitrary targets which the government wishes to achieve, whatever those targets are?

The OBR comments on Tory palms, nit some neutral world

It is ludicrous to suggest Labour accepts the OBR data

That means they accept the Tory plan

In case I wasn’t clear, I absolutely agree with you – Labour should reject the OBR figures because it’s the Tory plan.

Thanks

All I can do is back your post 100%.

We were hoping – with a mixture of savings and being mortgage free – to get both our children through university with tuition loans only and a minimum of other loans. Now we realise that what with higher costs for utilities, an impending increase in poll tax and personal tax that that is impossible, so we’ll have to load the support loan onto them as well.

It feels wrong you know; it really does in a household that saves for things to load your youngest with debt, a household that has been cutting expenditure and paid our mortgage off as quickly as possible and planned what we wanted to do. Anything we public sector workers get in November is essentially either going straight back to the government or to their funding lackeys in the private sector.

Having just finished Michael Hudson’s book ‘The Destiny of Civilisation’ I’m now on the introduction to Mattei’s ‘The Capital Order’ which is worth reading on its own as we witness the unravelling of 40+ years of Neo-liberal horse shit. Mattei is right – the austerity idea of saving is only possible when you have money to save, and increasingly people do not have savings but there is a government who can print money but won’t except for those who fund it.

And here I am, median middle class in pay moaning about all this and there are people even worse off than me!

Again, the word ‘loathing’ has to come into what I feel about the Tory party. I can save the word ‘despair’ for Labour, but the Tories are simply unconscionable – 12 years of it. I do not see any of them as human beings and that has all come about by their own hands – not mine. They’ve walked into a noose of their own making, damn them all to hell.

I agree with you

I started Hudson last night and Mattei is next….

Hi everyone

Before piling into the ‘tory scum’ scripts please do read Jess Phillips’ ‘Life of an MP’ in which she points out that many of all parties are decent individuals trying to do their best to transform the country through politics and the bad players are a minority. We should spare our bile for the factions that are pushing this ideology around and within government as well as certain gangs in the Tory party (ie No 10/Tufton et al/ERG) rather than focus on the tory party as if it were a monolith.

Regarding the missing graph: is it possible to obtain the figures from elsewhere?

But Jess Phillips plays the standard Labour line…

since mortgage rates roll straight over into private rents

That needs some kind of citation in my view because I don’t recall rents being particularly low during the period of 0.1% central bank rates. May be it’s more complicated than you implied.

It’s incredibly simple

Most private landlords have mortgages

They try to cover their costs by increasing rents

It is really not hard to see

And look at rent indices now

If the banks become or threaten to become insolvent due to debt non-payments the government will be forced to bail them out through QE as in the 2008 crisis. If the corporates like energy companies have mounting debt due to households and businesses being unable to pay, they will be forced to reduce their exorbitant profit margins and charge only the cost of production. However, this will probably not be sufficient to avoid the household expenditure meltdown that you foresee if the government does nothing or as usual too little too late. The critical factor is will Rachel Reeves and Keir Starmer consult their basic economics textbook and get their heads around sectoral balances?

The latter is vital

They just need to read this

If they read the standard econ textbook, they would get the mainstream neoliberal narrative — no MMT. That won’t help them. They would be better off reading this blog.

I do remember that, in the past, you have mentioned politicians who do ‘get it’ with regards to government spending. We need more of them to step forward, start talking about it and keep talking about it. The siren calls of ‘governments are like households’ must be drowned out.

It appears that more and more people are becoming aware of how governments can spend and create money to do so. But, it’s still not enough.

There is something very wrong when a government is deliberately taking action that will harm significant numbers of its citizens. And when the opposition is barely any better, it leaves you feeling demoralised because getting rid of the current bunch doesn’t feel like it will bring much improvement.

And, as an aside, is the story appearing today that Sunak is considering a ‘Swiss-style’ arrangement with the EU a deliberate distraction to steer attention away from the Autumn Statement?

Craig

That move towards the EU is denied, but I am certain someone said it

I have already heard a Conservative MP say ‘we can’t spend our way out of inflation.’

Hunt claimed we ‘should not hand on our debt to our grandchildren.’

‘We’ don’t seemed to have learnt much in the last 40 years. It is what I heard in the 1980 and 1990s.

I had a discussion yesterday, saying that with higher rents, mortgages, food and fuel prices plus an energy cap which is higher than Truss’, we have huge deflationary pressures which will put people out of business and create unemployment. (and deter investment and growth) Unemployment will increase state spending. Therefore we need an injection of money by QE.

My interlocutor insisted that it was more important to maintain ‘sound money’ as inflation would undo whatever good my suggestion might do. His argument that if we did not have sound money it would cost much more to borrow and even that the ‘market’ might not buy Govt. bonds. He dismissed QE as ‘just more debt to be paid back’.

What I call the ‘bankers view of the world’ is deeply entrenched. It says nothing we can do-except take the medicine.

Deeply depressing.

Agreed

I don’t necessarily agree with your conclusions, but the starting point for your analysis is exactly right — sectoral breakdown of borrowings / savings.

Over the medium term (say last 5 or 10 years), the dramatic increase in level of public sector debt appears to have been at least matched by household sector savings (valuation of private pension funds). Therefore, taking public + household sectors combined, ‘we’ haven’t been (overall) spending beyond our means. Its difficult to find sufficiently accurate and up-to-date measures of household sector financial wealth to know whether that continues to be the case over the last couple of years — i.e. since Covid. But intuitively, one suspects not.

Presumably the private pension funds are savings supposed to support people in retirement. If they either stop contributing to their pension and / or draw down some of their existing funds then they are creating another enormous problem down the road – unless you are assuming the with cataclysmic climate change they won’t be needing any pension as they will no longer be around.

Agreed

I am told by pension advisers that this is now happening and you are right as to the implications

As usual there are going to be big winners from this. For every home repossessed there is someone flush with cash waiting to mop up and rent out. Sale prices on these homes will be low so the lender still gets to collect the mortgage.

I read someone remarking that the neoliberal economic and pressure groups know that the Tories are finished. Their response will be to shift their pressure onto Labour in an effort to see continuity in policies and practice. Very broadly it is a bit like renting broadband, there might be various different front ends, different smiley faces and minutely different tariffs. Unfortunately when you look beyond the front end, or under the hood if you like, you realise that the broadband comes from the same place whomever you choose.

Agree that there was a lot of data missing but my understanding that this will be published on 24 September. Like you, I look at sectoral balances first and was surprised that they were missing last week. However, we can make a reasonable stab from their assumptions re HH savings and the current account deficit. So like March but worse and unsustainable. Possibly much worse?

Perfectly fair to scrutinise OBR forecasts but still important to remember that they are independent forecasts. Yes there always seem to be an element of reverse engineering in them, but not correct IMO to say they are the “governments plans”.

Sorry. But you are wrong

They are an audit of government plans

The audit is not independent of the data audited

It seems a grasp of basic macroeconomics is beyond the neoliberals both Tory and New New Labour. One person’s spending is another person’s income.

Like PSR I am fortunate to have a secure and relatively well paid professional job in local government (though even then I’ve had a real terms pay cut of 15% since 2010.) In August next year I expect my mortgage to increase by £300 a month when my fixed rate ends. With the withdrawal of the £400 energy subsidy plus the planned increase from April I expect to pay over £100 a month more there on top.

I’ve already stopped pretty much all discretionary spending and am saving as much as I can to pay off a lump sum when I remortgage. No more trips to the pub, no cafe stops when walking the dog, make do and mend for clothing.

How on earth those on average and below wages are going to cope is a mystery to me and the knock on effect on small businesses, leisure industry and trades people is going to be horrendous

You are exactly the sort of person who is now caught in a trap you never expected to be in

Completely agree that they are an audit of the governments plans. They base their audit on their own forecasts and data with the exception, as far as I can see, expectations of interest rates. Like the BoE they are using market expectations for interest rate inputs (which surprised me).

But FWIW, this is how they introduce their forecast

“The forecasts presented here represent our collective view as the three independent members of the OBR’s Budget Responsibility Committee (BRC). We take full responsibility for the judgements that underpin them and for the conclusions we have reached”

That said agree with conclusions and the sector balances when they are published will reveal how the assumptions are flawed.

I think we will have to agree to disagree

As usual everything you describe makes perfect sense and it is bewildering that so many politicians would rather sacrifice the health and wellbeing of the people over ideologies that are no longer practical, relevant and even morally reprehensible.

Of course the true cost to society is almost immeasurable and isn’t just about fictional black holes, increased interest rates and rising inflation.

Let’s think about how people feel and in times of desperation what people might do to survive and what this does to them as human beings.

If banks aren’t keen to lend then desperate people will turn to unregulated loan “sharks”… and we know how this invariably ends!

I guess shoplifting and petty theft will also increase… leading to additional cost pressures on retail businesses and workload pressures on an already depleted police and justice system.

I see a story this morning that retailers of wood burners are selling out, not only is this bad for the environment but more naked flames in confined spaces are likely to increase the workload of the fire service, and who knows what other things people might resort to for heating and getting power to there homes!

Of course many landlords who will be feeling the interest rate pressures will no doubt be making poor choices on maintaining their properties meaning that increasingly renters are likely to be living in poorly maintained accommodation.

Then there’s the increased pressure on an NHS that is already at breaking point and on an education system that is not only trying educate our children but acting as social workers for those

children and families that are struggling to cope.

And then there’s the cost to already stretched Mental health services as people try their hardest to make sense of it all.

I could go on as there are many other examples where standards of living and self esteem are being demeaned and it’s very likely to get worse in the next couple of years.

I would imagine that the poorest and most vulnerable in our society will be so exhausted using all their energy to survive that they won’t try to understand what’s happening; however the “squeezed middle” will now be looking for someone or something to blame and this opens the door for the blame narrative… who will it be this time, people on benefits? Migrants? Nurses? Teachers? Woke? or maybe just maybe it will be the Torys, the faceless think tanks and wealthy donors that perpetuate the lies!

I’m not sure where I’m going with this (apologies for rambling), but what I do know is this should not be happening in one of the richest countries in the world.

Finally, as we engage here in thoughts, analysis, ideas and education, we should never ever forget there are an increasing number of people in this country who are going to bed at night cold and hungry through no fault of their own!

So for now I’m minded of the words of Nelson Mandela…

“A nation should not be judged by how it treats its highest citizens, but its lowest ones”

‘In other words, governments can always manage and afford their debts and households cannot. The difference is as simple and stark as that. But what the government has chosen is to pile the debt on those who cannot afford the debt when it could easily have afforded to accept it’.

This is the crux of it all for me. And when you consider the size of the CBRA and the way that is being managed, someone please tell me what I/we are supposed to think? Are we supposed to be grateful?

These aren’t just words designed to wind people up – this is EXACTLY what is happening.

There is fiscal largess for those who don’t need it or are Tory supporters and nothing really for anyone else.

So, it’s socialism for the rich and markets for the poor and average person. The government and the BoE are nothing but guarantors for the rich and the Establishment.

It’s unacceptable, and Hunt, Sunak and Glen sitting there gurning during Autumn statement – how dare they even smile when doing what they are doing. They are just so out of touch – all of them.

In reality, this Government is like something that has gone off in your fridge and needs to be disposed of.

Your views and knowledge of MMT are scarcely heard.

Can you make a program for bbc or ch 4 to explain MMT?

( I do not understand how it relates to the international money markets.)

I have emailed asking for a tv program and ask everyone to do this.

Can you appear online on Not the Andrew Marr show, Sundays 10.30?

.

I have done the last show

TV shows are not made ion demand, unfortunately

Thanks for this; fascinating.

The Guardian today (21/11/22) has an article saying restaurants are going out of business at a higher rate that during COVID.

https://www.theguardian.com/business/2022/nov/21/uk-restaurants-bankrupt-faster-rate-covid-closures

The recession is hitting already. During COVID, when the economy went into a slump due to government policies, as Chancellor Rishi offered, amongst other things, the ridiculous Eat-Out-To-Help-Out scheme. Now, as PM, in the current largely government-policy-exacerbated downturn, we get the bill for his former largess, with a double dose of austerity on the side. True colours shown.

What I have forecast for some time is happening

[…] foundational OBR’s report is in error because it omits sectoral balances. Whenever a government has a debt, the non-government sectors of the domestic, the business and the […]

I didn’t have any education in economics. When someone explained about the views of Modern Monetary Theory enthusiasts, I believe my eyes were opened, in the sense of understanding that if you have a central bank your options are increased. For instance, Sunak’s furlough scheme and paying people with QE (quantitative easing, money the BoE has printed) money during the pandemic seemed appropriate to me because it was an artificial situation not related to the economy in its cause. If a business was viable before Covid 19, it was surely in the country’s interest for it to be viable again when covid had gone?

A mental picture that is helpful to me is that of the Great Depression in 1929 in USA. Everyone is sitting around, unable to earn because jobs are not available, and unable to spend because they have no money, and because they are not spending no businesses are prospering and therefore can’t employ the unemployed. Politicians must have been thinking, “If only someone could blow a whistle and say, “OK you have all got $10000 in your bank. Get going, be productive, resume normal economic life.”

For me, at least, money is an important but artificial construct designed to keep a record of the value of material things, and work, and to enable them to be exchanged. I have seen many chancellors struggle with the economy and it is clear to me that it is a delicate entity that needs careful adjustments. Also it needs a reasonably content society. I watched union leaders in the 70’s spot that inflation was high, another union had just got some of what it wanted, so to stay popular with their members they had better lodge a pay claim. That kept inflation going. I had a nice employer who just automatically raised my pay when inflation passed a certain point.

You say, “Either the government creates the money by spending more into the economy than it taxes and borrows back from that economy…” Could you go into slightly more detail as to how that would work. Do you mean spending (with public money) on projects, or say doctor or nurse training that would benefit the country as a whole?

I also think that serious economic troubles lie ahead. As a remain campaigner who believed in being well-informed, I was aware that there were so many negatives, many quite small but nevertheless they would add up to a big negative. Being, according to the OBR 4% poorer means that pay cuts are due. No one will like that so inflation will be kept going internally.

As a pro EU person, I am no friend of this government. Economics is your field; I am the layman. I am very interested to hear if my thoughts seem at least half reasonable to you!

I seemed to have missed this comment – apologies. I blame being ill

I hope I answer these questions in ‘Money fur nothing and my tweets for free’. It’s free. Can I suggest that first?