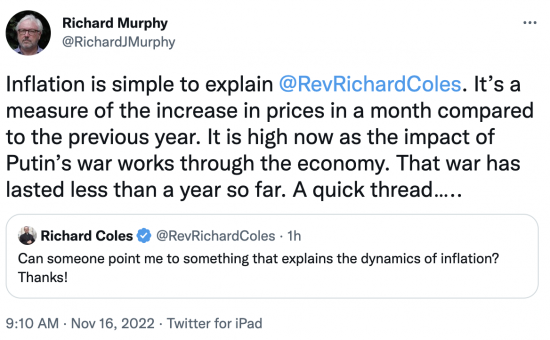

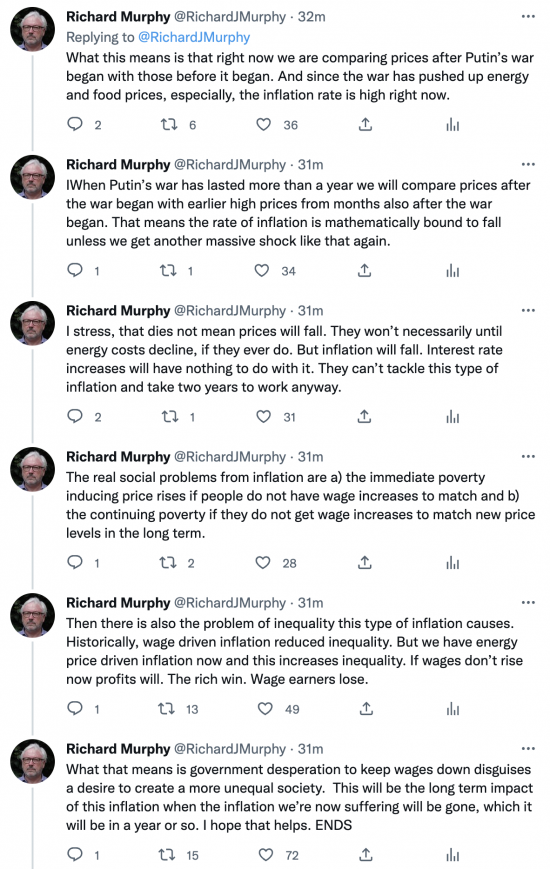

A quick thread on inflation this morning, in reply to a tweet from the Rev Richard Coles:

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I kind of understood there was a difference between wage driven inflation and inflation driven by other sources, but this short thread helped to clarify that quite better in my mind. It seems kind of obvious once its pointed out. Inflation isn’t really a “thing” in and of itself, its just a measurement of some other cause. If the cause of the price increases are external, then you can’t employ any economic policy change within your system to affect that. In what way does increasing interest rates (or decreasing public spending, even) help to resolve an external political conflict.

I also found this interesting: “that does not mean prices will fall. They won’t necessarily until energy costs decline, if they ever do.”. Prices go down if there is an abundance of supply in something (assuming good market competition etc). Until we can put a solar panel on every roof there’s probably not going to be an abundance of energy. That mean we’re stuck with high energy prices for the medium term.

Without wage increases to match, people won’t have enough to live on. That results in businesses making less money (except in key markets), which means less wages. And that creates a depressive cycle. This seems obvious to me, and I know very little about economics beyond what I read in the news and posts like these. Why is it not obvious to the people in charge of making these decisions. Is there some information they’re privy to that I am not, are they bound within an irrational system, or is it plain malice?

Thank you

You get it

I think I get it too, which is why I’ll be contesting the higher internal interest rate my council is imposing on affordable housing development loans from the HRA which is already making some of our housing schemes unviable.

So, that means that they will be:

1. Contributing to the government induced recession in their city, (congratulations – nice job!).

2. Likely not to spend the thousands of Right to Buy Receipts that they are on the verge of losing to the same government who is underfunding them. Imagine explaining that your councilors?

3. Face growing housing lists.

4. Higher rates of Houses of Multiple Occupation (HMOs) where there is a known problem with over-crowding in the city.

To me, it does not make sense, yet the accountants seem to think it does. We’ve already underspent the budget by £4 million this year – at this rate we’ll be like Kensington & Chelsea – spending bugger all on services but keeping a nice ‘financial reserve’

going and that used as evidence of how ‘prudent’ we are, whilst people go without homes, B&B bills keep going up (we’re breaking DHLUC guidelines now but no one seems to care at Westminster) and people are hungry and cold.

Bugger the accountants – the city where I work requires leadership and vision – just like the rest of this God-forsaken country.

We’ve underspending in my LA for getting on 12 years and our surpluses are just sitting there underused. It’s criminal.

And once again, not having listened to the UN Rapporteur last time he was here, the UN is once again warning the austerity addicted reprobate Tory party once again about what it is up to:

https://www.theguardian.com/politics/2022/nov/15/uk-must-act-over-its-housing-food-security-and-equal-rights-says-un-body

Rogue state? I think so – don’t any of you?

And we point the finger at China?!

‘Bollocks’ is all I can say.

Good luck

I would vote first for stupidity, followed by plain malice.

Richard,

Whilst I agree that fuel and especially gas prices have played an important part in the current global inflation situation, I think you cannot simply blame the Ukraine war for it in isolation.

Russia invaded Ukraine at the end of Feb 2022. However UK CPI was already 5.5% by this point, pre-war, having risen from sub 2%.

This means that the war simply cannot be the cause of all the current inflation problem.

Moreover, to highlight the point, gas and oil prices have fallen significantly since their mid summer highs so if it was only energy prices then we would see inflation falling at least on a month on month basis, where in reality the opposite is true

Likewise, core inflation excluding food and energy is currently 6.5% in the UK, again pointing to the fact that inflation more broad based and is not solely caused by the effect of the Ukraine war.

So my point is, if inflation is solely because of the war, why where we already seeing high and rapidly rising inflation well before the war?

No one disputes that Covid played a role by a) allowing an artificial savings accumulation by some and b) because of a chaotic and too quick reopening. But that impact has now worked through

And you ignore that energy impacts on all prices

Your claim does not stack

Again I don’t disagree that lockdown and it’s end had an effect.

That said, I don’t know why you are calling the savings accumulation artificial. It is perfectly normal given people were limited in what they could do. Are you suggesting those extra savings should have been taken away from people by some manner?

But if savings accumulation was too great (and unleashed an inflationary wave as people were able to spend again) then essentially you are arguing that the money supply and velocity of money drive inflation. At which point you could also argue that huge government spending was also a massive driver of inflation by the same method.

I also don’t think lockdown reopening was chaotic, given it was phased over months and in four stages. Or are you suggesting that lockdown should not have ended, much as in China?

Either way you cannot simply blame inflation on the war when there was already high and rising inflation well before the war, which seems to have been driven by increased demand and increased money supply.

You think Covid was not artificial?

You think the rush to reopen was planned?

You think disruption to normal savings patterns might not be capable of having an inflationary impact without the reasons you ascribe?

And you think I should take you seriously? Sorry – bit I smell trolling 0- because these comments – like should we have been like China? – are obviously a wind up

You are now banned

Thank you Richard. Presumably Hunt and Sunak very well know the inflation rate will fall next year, whatever they do or don’t do.

So from that perspective, is this all just theatre to try to give support for their regressive policies? Whatever they choose to do, they can then claim it worked.

The media seem to ask very few questions, and just take their agenda of interest rate rises and public spending cuts as inevitable.

I suspect you are right

The fact that their cuts will be forecast for 2024/25 inwards also suggests that

1. It suits their agenda and will further drive privatisation of health and education

2. They will take the credit when as Richard says inflation will fall automatically

3. They will make Local Authorities raise Council Tax and due to the way they fund LA’s Labour Councils will almost certainly make bigger increases and that enables the Tories pre election to point the finger and say that under Labour taxes would rise

4. They will have accumulated a little war chest to spend as a pre election sweetener

All in all, if you are a bastard Tory, what’s not to like in shafting the ordinary member of the population for the next year or 3

For me, for most people there are two types of inflation. The first is “need” inflation. So there are certain things that we need, some of which we have no choice but to pay for, a roof over your head, gas, electricity, water, perhaps running a car, council services/tax, etc. There is also food and clothing. They are needs, but we do have more choice. We have to eat. With clothing it is possible to get by without the latest fashion, but we still need it. What we have seen in the last 12 months is massive price increases in more or less everything we need.

Then there is non-need, the stuff we don’t really need and we have more choice over whether we buy or not. The trinkets of life. The things that may give us some momentary pleasure, but if you didn’t buy it you wouldn’t necessarily miss it or need it.

The trouble is, the “official” inflation indices are largely made up of non-need tat. They do not reflect real inflation for most people. For example, house price inflation is not included in any inflation index, yet a roof over your head, whether you buy or rent, is a basic need of life. The real cost of this is totally unrepresented in the inflation indices.

Right now we have rampant inflation in what we need, which will massively reduce the ability for people to spend on the non-need stuff. It’s not difficult to see what the outcome here will be. The discretionary spending non-need side of the economy is basically up the proverbial creek without a paddle.

I would like to see a need inflation index. It would be an absolute shocker right now for most people and that is why it will never happen.

Tye need index suggests a rate of around 15% at present

15%? Basic food essentials, housing costs and energy, which those on the lowest incomes must spend on, is surely at about 40%?

There is no evidence for that

According to the Guardian:

“Lower-income families spend a larger share of their budgets on energy and food, exposing them most to the 130% annual jump in gas prices, a 66% jump in electricity, as well as food and drink inflation of 16.4%”

https://www.theguardian.com/business/2022/nov/16/highest-inflation-for-41-years-leaves-jeremy-hunt-with-difficult-budget-choices

Lowest income families spend on very little else (receiving housing benefit and council tax benefit). How can their inflation be only 15%?

The ONS say it is

I do not always believe them, as is well known

Good that Richard Coles is showing an interest, as a Minister he must carry some ‘clout’ with viewers

Perhaps a brief tutorial for him on things like MMT might be worthwhile?

General understanding of data are poor… and CPI data are no different.

First, looking at Year on Year change every month is fraught with danger from a statistical perspective. Inflation rose to 11.1% in October from 10.1% in September because the monthly rise in Oct 2022 CPI was 2% versus a rise of 1.1% in Oct 2021 (the 0.1% discrepancy due to rounding issues, I presume). I think it would be better “headline” with “Prices rose by 2% in October”…. but I accept that the current way of looking at things is deeply intrenched. I think it is important to understand three things. CPI is a measure of price LEVELS, Inflation is a measure how fast prices are CHANGING. The YoY inflation number for October 2022 depends just as much on price changes in October 2021 as it does on price changes in October 2022… so can mislead.

Falling inflation does not mean falling prices. In a flood, the tall people will breath a sigh of relief as the water stops rising but for the short people it doesn’t help – they are still drowning. Inflation will fall due to base effects (with virtual certainty) and the government will (with absolute certainty) claim credit for this mathematical fact. My fear is that the tall people will be relieved and the fact that our nation is full of “drowning” people will be conveniently forgotten.

Agree with all that

I try to patiently explain this in air – several times in the last day

It always shocks presenters