Danny Blanchflower had a longish discussion yesterday in which we agreed that the inflation that is dominating economic discussion about our economy at present is a passing phase. That does not mean it is not important. Far from it, in fact. But what it does mean is that when discussing inflation we have to remember that this is a temporary phenomenon, and what is just as important is to discuss what happens after it.

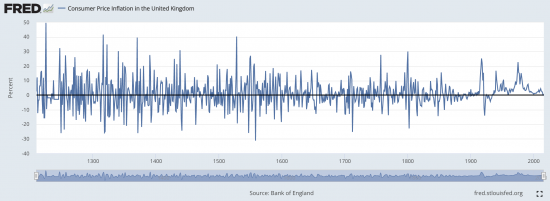

There is a lot of evidence to support this opinion. First, take this St Louis Fed chart which summarises data from the Bank of England on inflation trends in first England and then the Uk over a period of more than 800 years:

After a period of inflation there has, historically, been deflation, and even if the latter has been rare of late, there is always a return to more normal rates. Inflation does not persist.

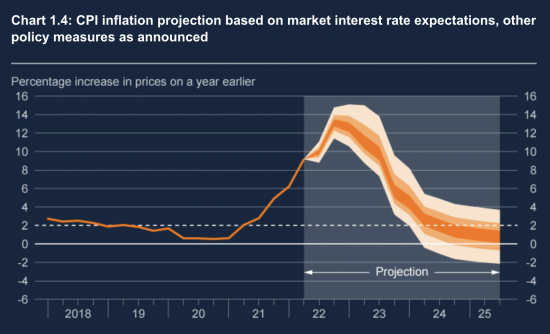

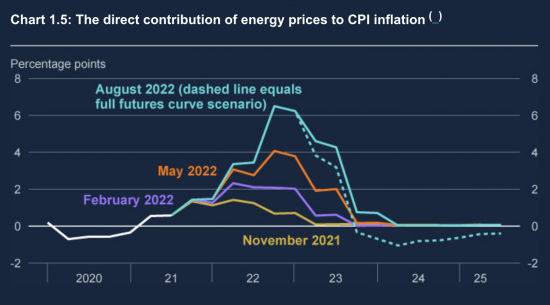

The Bank of England agrees right now. The data is from the August Monetary Policy Committee forecasts. They say we might have zero inflation and even have a risk of deflation by 2024:

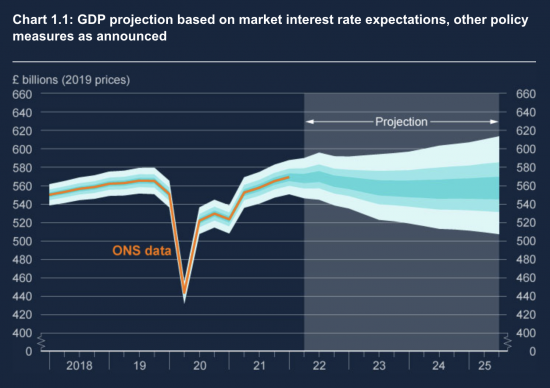

Why is that? Because they think their plan to crash the economy will work:

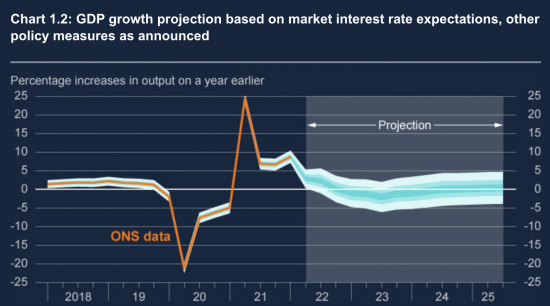

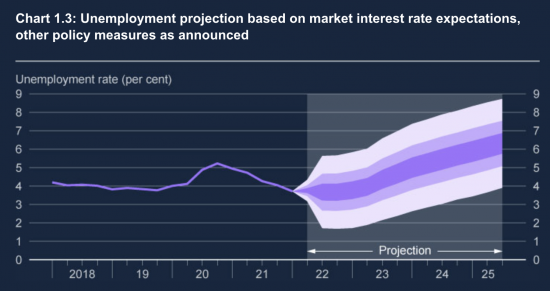

They think they will achieve that by pushing unemployment significantly higher. There are victims, in other words:

But let's be clear that their forecast of falling inflation is not based on their either crushing the economy or employment: it is based on falling fuel costs:

This is the determining factor.

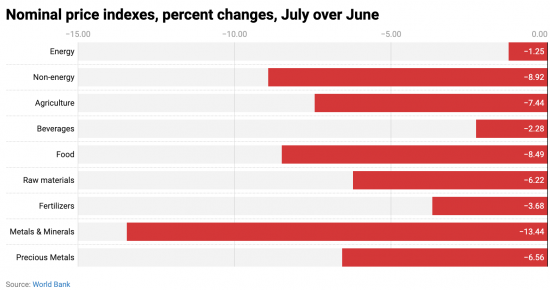

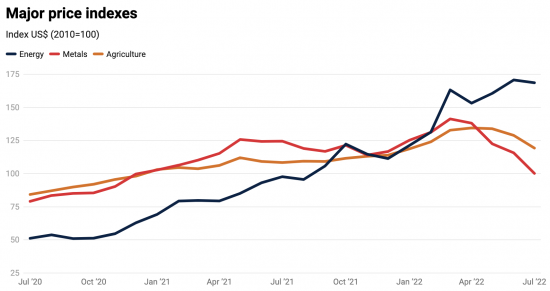

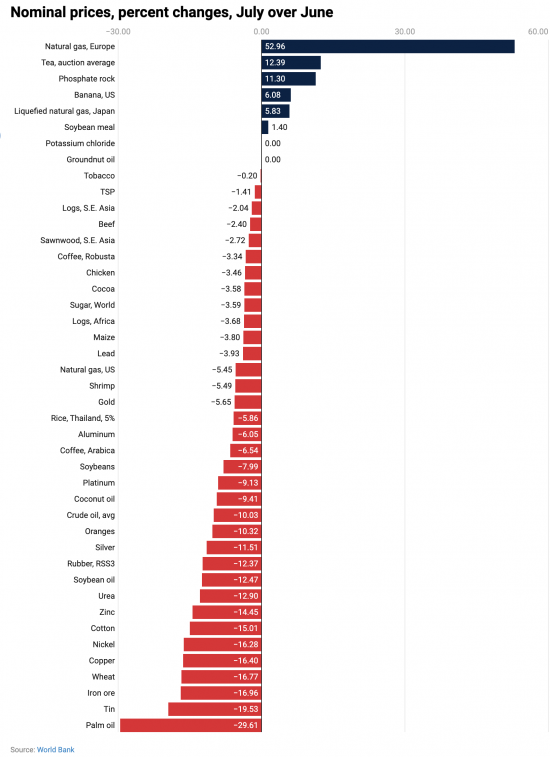

There is real-world evidence to suggest that prices, excluding gas in Europe are now actually falling, and fast. This data comes from the World Bank, earlier this month:

Energy in Europe remains aberrational and the UK is an outlier in its dependence upon gas, 50% of which we have to import now. The price of tea is not good either. But, thereafter commodity prices are falling, and whilst the impact of that is not being seen in shop prices as yet, because the impact of energy cost increases is overwhelming them in Europe right now, this is bound to work through the system and prices will, like night does day, begin to stop rising, and in some cases will fall.

The significance of this is threefold because what it says is that we have a crisis that is going to have different stages requiring different responses, but all of them must be anticipated now or the situation will get very much worse.

The stage we are in, which is going to get worse in the short term, is the inflationary stage because of the impact of gas prices. It will be temporary. This is the vital thing to appreciate. It is very likely that, as the Bank of England forecasts, energy prices will fall and cease to contribute to inflation, and maybe quite quickly. Even the behaviour of the energy companies that are seeking price caps lower than those that Ofgem suggests that they are aware that this is not only the case, but that increasing prices now will be deeply detrimental to well-being and are seeking to avoid those price increases happening as a result.

The policy response in this stage is survival. At this stage, the shock to people, businesses, public services, charities and others is so big, and the capital available to most of them is so small that they lack the resilience to survive this shock without one of three things happening. One is that they need an increase in income. The second is that they need financial support, and probably of a non-repayable nature because it will be spent on consumption and not investment. Or third, the price rise has to be avoided by state intervention. Any or all of those are possible: I think all three will be required as I reflect in Surviving 2023. And I stress, all need help, and not just households.

But, and it is vital to stress this: this is but a stage, and it will self-correct. The hype in markets caused will diminish: order will be restored and that will be true whether or not war continues, or not. Supply chains will work around this. They are just not there yet.

The second stage of this is recovery. This could happen in late 2023, but is more likely in 2024. The chance of this relatively short-term recovery depends entirely on the actions taken by the government now. If the plan by the government is to support people with all the help that they need with the aim of keeping people and families well, fit, fed, together and in both their homes and jobs then the recovery stage will be relatively quick. All the foundations for a return to normal will be in place if this is the policy.

Unfortunately, this is not the policy. Tory leadership candidates are saying that they cannot help because there is no money (which we all know to be a lie, because they can create it) whilst the Bank of England is seeking to destroy the chance of people affording heat and food and the prospect of staying in their homes by increasing interest rates. Their intention is to crush spending power when it is already shattered. As a consequence, they want to force business closures and unemployment. They also want to create credit, rent and mortgage crises, all based on making debt unaffordable. In other words, their plan is to leave us in the worst possible place for recovery once prices stabilise, which they will despite, but most definitely not because of, the Bank of England's policies.

Then there is the longer term. This is where we face the structural problems. We are too dependent on gas. We need a Green New Deal to transform energy usage and deliver climate goals. We need to create high-paying work. This requires investment. After the shocks it has faced business will not do this. Only the government can. But as far as the Bank of England is concerned its job at this time will be to suck funds out of the economy through quantitative tightening (QT), which reverses QE, when what it is highly likely that we will need is QE or other forms of Bank of England support to fund transformation.

In other words, big thinking is required. And we are not getting it. Instead, we heard demands all yesterday for higher interest rates and for the imposition of pain that commentators claim is necessary to deliver the austerity that they think is needed to rid us of inflation. They're wrong: inflation is already going, but not at the consumer level, as yet. What is required is not pain, but help to get through this. A great deal depends on politicians understanding that this is the case, and it seems that very few do as yet.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Could we have a reference for the Blanchflower discussion? Thanks.

It was a phone call

Very much agree with all your comments here.

The BoE are risking a massive deflationary period with their actions.

The pendulum swings both ways and pushing it harder in what they think is controlling inflation they will then be fighting deflation down the road and claiming how that couldn’t have been for foreseen.

Should the government support energy prices, I realise that the way they do this will effect the outcome, what would that / could that do to the inflation figure?

If they chose the right way could they significantly reduce inflation?

Another incisive post which I whole heartedly agree with and then some.

I think your analysis is excellent. However, one point you haven’t discussed here, or elsewhere as far as I know, is that some commentators say the BoE has no choice to raise interest rates because otherwise the pound would crash, and this would stimulate inflation. Could you write a blog on this?

I will try

Mr Blanchflower was also interviewed on BBC radio 4 at about 1:15pm (World at One) – which was interesting; and wholly agreed with the post here. Perhaps unsurprisingly?

We had been speaking until 10 minutes before he went in air

Why is the BOE trying to push everyone into a bad state of recovery – who is benefitting from this? It makes no sense I agree but there has to be a reason for it for which I can never find an answer.

Another issue I’ve heard mentioned is the belief that the pound must be kept at a reasonable rate against the dollar because so many of the UK’s transactions are in that currency. Raising interest rates will help achieve this. I can see the logic here must I have not heard the same argument applied to the Euro.

So, if the US is stupid we must be too. It’s really not a very good argument, is it?

Not a good reply either. The issue is not what the US does or does not, but whether or not there is any economic sense in the UK using interest rates to reduce the impact of a widening exchange rate. Personally I have some doubt.

There is no evidence they work

My concern is that the things we don’t need to buy form the bulk of what makes up the inflation index. The things we have no choice to buy or pay for – a roof over your head, council tax, gas, electricity, water are all going up, some by horrendous amounts.

Then there is the knock on effect to other essentials like food and clothes which we also need to a greater or lesser degree (i.e. re clothes most of us can probably get by with what we have for a couple of years, although this reduced spending will destroy those businesses depending on sales.)

Lets be blunt about it, the real inflation in these “need” areas of life are horrendous right now and it may continue for the next year or so at least.

Can anyone answer me this question. The average energy bill before the crisis was around £1200 a year. Predictions are now saying that by next summer they will be between £4,000 and £5,000 a year (although the Tories will probably wake up and do something eventually to keep them more or less where we are now). Anyone here see these bills returning to say £1200 to £1400 a year in a couple of years, assuming by then some normality has returned to the market and the price trend has returned to where it would be had this crisis not occurred? I don’t see it myself, not short of nationalization anyway.

I hope it does happen, that prices in the things we have no choice to pay for will fall back, but historically the tendency is for them to stay high. When was the last time house prices were remotely affordable for instance? This has a knock on with rent. If private landlords are putting up rents right now because of this runaway inflation do you honestly think they will reduce their rents in 2-3 years time if we get back to a sort of normality? They don’t usually. Just as house prices don’t usually fall back for long either.

I just think that this crisis will hit people hard who spend most of their money on need items that are woefully under represented in the inflation indices.

I think we may well see a lot of deflation in things we don’t need to buy, but not so much in the things we need and have no choice to buy or pay for. I hope I’m wrong, but a crisis like this represents a challenge which we haven’t really faced before. The disconnect between official inflation, mostly made up of non-need items and real inflation in the things we need and have no choice to pay for has been exposed.

I hope the deflation in all the need items in our lives is fully passed on. I fear it won’t be.

Many prices never fall

Energy is an odd exception. It does as petrol prices are right now

They may not go back to £1,200, but it is quite likely the peaks will not be sustained

Hiwever, other prices will not go down as much

BoE are advising caution in terms of pay settlements in order to prevent inflation getting out of control. This is on the back of many workers having had long term squeeze on pay which has reduced their real terms income. Would a non cumulative pay deal be appropriate to help people? If this was 4-5% cumulative and say 6% non cumulative this would help in terms of not escalating inflation

It is better than nothing, but as I doubt we will get overall deflation it just defers addressing the issue and removes none of the stress.