My long-term critic, Tim Worstall, had a go at me on the Adam Smith Institute blog yesterday for comments I made that were published in the Sunday Times on Sunday (unsurprisingly) concerning the tax disclosures made by Apple's UK retail arm in accounts that they published recently. As ever, Tim gets everything he has to say wrong, so it's worth setting the record straight.

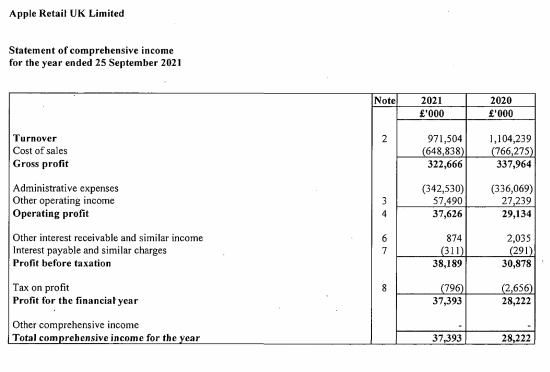

The Sunday Times rang me about these accounts. They had noticed the very low tax charge, here:

That is a tax charge of 2.1% when the headline rate is 19%.

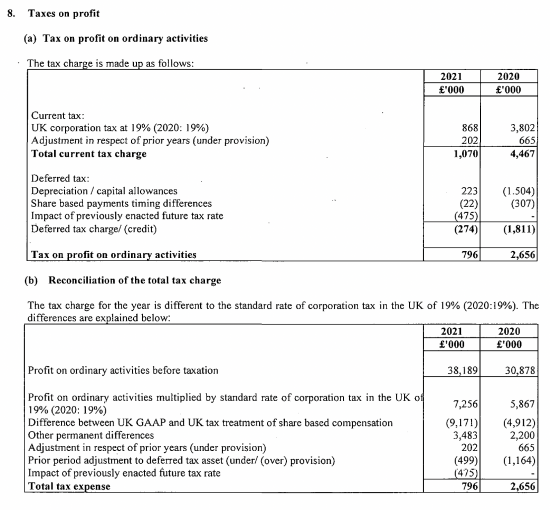

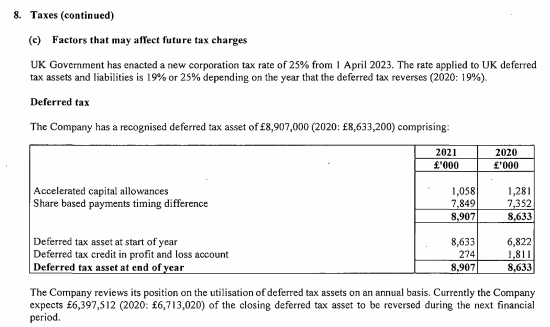

So I directed them to the tax note:

The key number is that which refers to the difference between UK GAAP and UK tax treatment of share-based compensation, totalling £9,171,000 of tax saving in note 8(b).

What this suggests is that when grossed up £48 million of payments have been made in shares to Apple Retail managers in the UK on which tax relief has been claimed without the costs in question going through these accounts but with tax relief being claimed.

We know they could not have gone through these accounts as note 5 says shared-based payments were only £30 million and there is no noted timing difference on these. The deferred tax note also provides no hint of a movement of anything like this size, and there is no indication of any accounting for a sum of this size in movements in equity either. So, the number in question is effectively missing from the accounts as far as I can see.

So, what happened was that this company claimed a deduction for a cost that has not gone through its income statement. That's what I told the Sunday Times. They checked the story and printed it.

No one has said Apple has done anything wrong. Nothing has been claimed for tax that was wrong. No one has suggested otherwise. But, the question I raised is a simple one, and is how can a set of accounts be true and fair if they reveal a profit of £38 million by excluding a cost of £48 million which was, nonetheless, claimed for tax purposes? In my opinion that is not a true and fair set of accounts and the company and auditors should have used the powers available to them to offer a true and fair over-ride of GAAP and make a disclosure that revealed the proper performance of the company. They decided otherwise, which is their right. I disagree with them.

Unsurprisingly, Worstall and the Adam Smith Institute failed to spot any of this, but then Worstall has long proved himself to be little good at anything but writing a blog laden with abuse. But there is a real issue here, which is why we have accounting rules that allow this to happen. And that was worthwhile drawing attention to.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Thanks to lockdown, I did finally manage to read ‘The Wealth of Nations’

Not a small book and the product of a particular time and place, BUT it seems to me that Adam Smith was a fairly acute and humane observer.

I fear that his name is being taken in vain by his so called ‘supporters’ who are in fact no such thing

I wonder how many of Adam Smith’s so-called supporters have read his Wealth of Nations themselves, cover to cover. Few, I would guess. And fewer will have also read his Theory of Moral Sentiments, which came first and was the basis for his later work.

I have read both

They are behind me, now

May I return to my base tax belief. The taxes on which Government actually wholly depends requires that they are simply applied, not easily challenged or delayed; and are paid at source or at the point of transaction. Note that this means that PAYE, VAT, NI, fuel taxes etc.,; typically paid day and daily by ordinary people, and not taxes that are less immediate or direct; taxes stoutly resisted by people or corporations with large resources, and sheathed in expensive lawyers and accountants who can delay, challenge on esoteric points raised by the complexity of tax law, codified in pursuit of taxing the untaxable.

Notice that politics itself has become nothing more than an unedifying circus run by unedifying, self-serving people; simply because the real, ordinary tax payer is the permanent, exploited prisoner of people who make the law, but exclusively represent the vested interests of the professional tax avoiders.

But it would be wrong not to tax bases that cannot be taxed in this way – most to do with wealth

Richard,

You have just forensically deconstructed a set of accounts that, at face value reveals the process as producing something little better than an oxymoron; an oxymoron that very few had even noticed, or want to acknowledge even now.

That doesn’t work as a way of handling tax. What is the value of the process? I take the robust, realistic way of confronting such a problem. Scrap the theory that you can make the process work. do something more effective. Do not attempt to make the theory work; that will not work, it will merely expend useless effort. Take a line of approach that will actually work and the avoiders witll struggle to avoid. Keep it brutally simple, and so difficult to suvert, it isn’t worth the expenditure of resource to do it..

I am not sure I follow you on this one as yet

“subvert”.

Making accounts work on an abstract measure of something like ‘profit’ just becomes a ritual dance; a sly accommodation that compromises the expense of resource by both sides to push it to the bitter end. That is a really bad way to execute policy, in my opinion.

Tim ‘Worst-of-All’ should be his name.

His attitude seems value-free to me – he’s conflating two different things, pretending that they both end up being the same thing and calling that an argument. But someone who probably seems to think that tax is theft would, wouldn’t he? (Does he? Highly likely.).

As for John Warren, I’m no expert on tax but I’m thinking that what John is saying is that dealing with taxation has become so difficult as to be too easy to pull the wool over people’s eyes. Too many caveats, too many exceptions, too many tilts toward what exactly? Too many rules that are temptations and invites to play rather than rules as they should be.

Maybe John is saying tax should be exactly like it says on the tin and nothing else.

If that is that’s the case – he’s right.

So, how do you tax profits, rents, gains and wealth then?

How?

As simply as possible Richard – that’s how.

One thing I was always struck by when I became aware of Jolyon was why do you need a barrister specialising in tax?

I’m not against tax – as you know – and I’m not saying it should not be collected. But it’s really telling when lawyers and barristers have to get involved in something which as I understand is a sovereign right?

Is it the drafting of the law that is the problem?

Is tax law in line with its actual role in the modern cash/credit rich economy?

We all know it needs an overhaul as well as more people to administer it (and I’m not talking about tax barristers/lawyers making specious arguments on behalf of those who don’t want to pay).

I promise you, simplicity in taxing profit, gains, wealth, rents and the like is simply impossible

And I would oppose the injustice from. trying to make it simple

Accounting and tax will always have different approaches e.g. to what is an expense and what is a tax expense and law is always inherently uncertain

So this goal is simply not worth pursuing

Tax those things you can tax as close to source as you can. If a tax requires industrial scale expertise, and one-to-one forensic accounting just to figure out how to measure it because there is no fixed measuring stick; I suspect it is not worth the expenditure of effort on both sides.

I do not believe all “rents” are impossible to identify, but I believe the capacity to move profits, to use tax havens and so on are only done because it is worth doing (when we know it shouldn’t be worth doing); and the authorities do not have the resources to cope with the problems it all creates, on a global, industrial scale. It doesn’t work.

I suspect a sound tax system, based on taxing primarily the easy-to-tax affairs and avoiding the difficult; would put half the most expensive lawyers and accountants out of business. It would, I suggest widen the scope of small entrepreneurs and investors within Britain, rather than relying on complex tax vehicles and elaborate accounting. I remember being informed many years ago, that Germany’s economic success was based on possessing far more engineers, and far, far fewer accountants, than in Britain.

I am going to have to disagree John

Taxes on profits exist to stop leakage from taxes in wages

We literally cannot do without them

“Taxes on profits exist to stop leakage from taxes in wages”.

A fair point Richard, but I am not sure the real consequences of this approach work out well, either from the perspective of profits tax raised, or the impact on people relying on wages. Intentions do not interest me, only outcomes. I do not see much of an upside in the performance and outcomes of profits taxes. The devil has all the best paid tax accountants, working 24/7, always ahead of Government (which is quietly relieved it doesn’t work out better).

You will never persuade me on this one

Your approach is a tax avoiders dream, I am afraid to say

Richard,

The dialogue with Andrew has been most illuminating. Andrew, whose comments so often have precision focus, wrote: “This is just an example of where tax and accounts are not necessarily aligned”, and it seems to me the main reflection from that is that the Global Corporate perspective (a relativist one) has clearly come, triumphantly to dominate the world. Mere national sovereignty was slowly bent to the will of the commercial society Adam Smith first critiqued, and now has finally been defeated by a Global commercial society (this should remind and warn us of the catastrophe that is Brexit) that has taken over the world in the guise of neoliberalism, and is answerable to nobody.

In this sense, the Global Corporate may (almost certainly will) consider the UK accounts ‘meaningfulness’ secondary to the convenience and advantage of its tax affairs. The point of published accounts is to provide the minimum information allowed (with lots of PR puff), and minimise the tax paid. Your discussion with Andrew over GAAP, for me illustrated the degree to which the triumph of Globalism, and Corporate advantage has driven accounting into increasingly recondite, opaque, failed attempts to ‘square the circle’. I struggle to see the value in all this complexity, when it is obviously shorn of substance.

*

Do you really think the corporate world simple?

Do you actually think accounting is just adding up?

Do you really think that is all the government needs to do to produce useful accounting data?

Really?

Why?

Because I promise you, if you do then you have totally misunderstood the world, and accounting.

This is not some giant conspiracy. It is all about us being complex people who do less then straightforward things.

I would be more persuaded if you could show any signs that the tax-avoiders are not winning, ‘hands down’ already.

What I wish to pursue is a regime in which the tax raisers actually have some chance of not being overwhelmed by the tax avoiders. I am not convinced that you are not ‘flogging a dead horse’, and we would be better looking elsewhere. Or set tax rates at a level where there is no great advantage in spending large resources on tax avoidance; which consumes too much scarce resource already, for all or good.

I find this mildly depressing

Having spent years explaining on this blog that tax is nit just about revenue now, apparently, the idea that is is is promoted here

And having spent years suggesting the decline in revenue is due to falling HMRC resources the idea is being promoted that this is a good thing

And having suggested tax is about taxing harms this idea is being contradicted

Whilst the idea that we might want a progressive tax system is being rejected

I think you have been on the wrong blog John

It looks like you should have been supporting the Institure if Economic Affairs after all, as that is clearly where your views belong

Sorry but it has to be said. You are making a complete fool of yourself John. Think hard before posting again on this theme. Anyone else would have been blocked for repetitively trolling far-right crap by now. You are arguing for a tax system that will only ever tax wages and consumption, in effect. Capital should go untaxed in your view. Frankly, shame on you.

Taxing profits started with taxing income. If you are a self-employed person, your taxable income is your profit (that is, gross income minus expenses). Unless you are going to tax all sales but disallow relief for purchases. If I buy stock for 4 and sell for 10, am I taxed on 6 or 10?

The difficult comes when you move away from a simple business with cash in and out. Which year do you tax the expected revenues from a three year contract? What if it starts small and gets bigger? Which year do you recognise the substantial up-front costs? Do you get tax relief for those costs at once, or spread over time, or at all? Even the simple things, such as income recognition, or income versus capital, end up being complicated.

The last two are amongst the most complicated – as some of my academic work suggests

Thank you Andrew – all very interesting.

So, I suppose this why we need to change people’s attitudes to tax and educate them about it.

Understood.

Richard,

I think that is a rather harsh and impetuous judgement of my opinion. Do you really think, from everything I have written here, that I believe the corporate world is simple? That I have misunderstood everything? That I believe HMRC resources should be cut? Or that I do not believe in progressive taxation. That I am a neoliberal, or a neolibaral stooge? Really?

What I am trying to explore is just how far the system, in terms of the taxation of profit is failing; and how intractbly difficult it is turn this round. I am trying to be realistic about the scale of the task – how successful it is likely to be in the world in which we live; and I do not see either promising results, or geen shoots. I am trying to explore where resources are best spent, where returns are likely to be most productive, perhaps in terms of looking for new ways of taxing the element of profit that current ideas signally fail to achieve.

I considered this Blog a way of rethinking the possible. It was possible to explore the undiscussed, and even unthinkable.

I do not subscribe to the idea of a simple world, but I simply do not see where or how you are going to solve this profit-tax problem, with current prescriptions. I have no problem with your intention, but I do not see how you can make it work. That is the sum of my position. We live in a Global, corporatised world and we are ill equipped to cope with the effects (as demonstrated by Brexit, when the EU gave us the best chance of achieving some consensus); because Global neoliberalism has successfully defined the defeat of sovereignty by corporate power. Sovereign corporate tax has become a casualty of that defeat and framing the problem in current terms has its own difficulties. I can only say I consider that a fair basis for exploration, and I do not see my efforts in the hostile frame you have provided of me.

It is, however your Blog, and your peroragive. You have my best wishes.

John

Frankly, based on your comments offered here trenchantly and without in any way suggesting them to a thought experiment, with robust and firm rebuttal of my opinion included, I think I was fair to conclude as I did: that you are a proponent of taxes on labour and consumption alone, leaving capital alone, whilst treating revenue raised as the sole purpose of tax. After you made a number of comments reiterating that opinion I frankly wondered if you were unwell, or whether this was the longest preamble to the revelation of a troll in the history of the blog. I am offering little apology: your tone was aggressive and I concluded what I did from it, give the manner in which it was presented.

You are usually rigorous but in this case your assumptions failed you. Maybe you really do not appreciate the complexity of something as apparently simple as accounting for a contract that spreads over a number of years, and what judgement is required to make any fair representation of revenues, costs and profits in such cases. To claim this is a conspiracy or that if an accountant is required to be involved in determining how profit should be allocated is in that case naive, at best. And to say accountants should not be involved is well, let’s just call it naive as well.

We live in a complex world – even when we look at very simple levels of transactions. But should that mean they are untaxed? I think not, and the premise of your arguments was therefore in my opinion wholly false. It’s up to you whether you like me pointing that out or not – but I will, as I do not offer favour here, but I for one will not give up claim on taxing capital for fear that some complexity might be involved.

Richard

Richard,

“Maybe you really do not appreciate the complexity of something as apparently simple as accounting for a contract that spreads over a number of years, and what judgement is required to make any fair representation of revenues, costs and profits in such cases.”

I have spent my life in business, one way or another; most of my adult life in corporate business, from large to small, IPOs to full listing included. Thus, I think I can fairly say that I understand the “complexity” sufficiently well.

I am not against any form of doable taxation. My concern is what is “doable” and how, precisely can it be done. It isn’t going well just now for the taxation of profit in a Global World (which is perhaps, ironically more penal in tax terms for small local companies), and I do not see what is, realistically “doable” in the context of Global Corporatism. That is all. This has been evident to me for a long time; therefore I am trying to encourage thinking ‘outside the box’. It wasn’t a thought experiment, because I do not have the ‘thought’; I am looking for it, I haven’t found it. The complexity is not the problem, it is the sense that the complexity is not yielding the fruit. New thinking is needed; we have been thinking this one way, with little variation, for a long, long time; perhaps for too long.

If I was brusque, I apologise, but I am not an ideaolgue; results, outcomes are what matters to me. I am a pragmatist. The real test is “does it work”? Frankly, I don’t see it, and while I don’t argue with “complexity” I would point out that it apparently isn’t delivering either. Therefore, where can Sovereign Government exert leverage over Global Corporatism? Currently, I cannot answer my own question; but it remains a legitimate question, and at least I can ask the question, whatever anyone thinks. I have never been bothered by being in a minority of one. I couldn’t write the way I do, if I did.

You don’t agree. Your prerogative, I neither expect or request special privileges, I am not in the least offended by your responses, but given the strength of your opposition to my opinion, I will leave it there as my final word. It isn’t appropriate, especially for readers and commenters on the Blog. Best wishes.

If that was a signing off that is a shame

But let’s also get real: we need yo tax ina world of global corporatism because there is as yet no other and i don’t have time to play in scenarios that don’t exist and are not likely to do so

I don’t know anything specific about Apple’s tax affairs, but I suspect the UK staff are granted “Restricted Stock Units” by Apple Inc, the ultimate US parent. This is a type of employee share incentive often provided by US employers due to its US tax treatment.

UK tax law allows a UK company to claim a corporation tax deduction for the “cost” of the shares issued to UK employees in these circumstances, based on the market value of the shares. See Part 12 CTA 2009, and in particular the conditions in s.1008 and the calculation in s.1010. https://www.legislation.gov.uk/ukpga/2009/4/part/12

If these are RSUs, that is likely to be the market value of Apple Inc shares when the units “vest” and the employees actually get the benefit of owning the shares (somewhat like the exercise of share options).

The quid pro quo is that these share awards will not benefit from a special tax treatment for employees, so the full value of the shares will be subject to income tax at up to 45%, and employee and employer NICs (and the apprenticeship levy, and health and social care levy).

I expect the full amount of tax and NICs etc. paid will greatly exceed the corporation tax deduction that the company claims.

You’d have to ask an accountant why these share based payments do not affect the UK company’s cost of sales for accounting purposes. Perhaps because the UK company does not pay or compensate the US parent for providing the shares to its employees, and it is not required to recognise a transfer pricing adjustment for that cost, so the UK company does not bear the cost in any meaningful sense?

Who does bear the cost? Apple Inc shareholders whose holding is diluted?

You are right about the share scheme

My argument is that if the company gets the tax relief it should account for the cost

It’s really straightforward and not exactly contentious ,I would have thought

I was just explaining the tax, but you are the accountant! Would it be right to recognise a substantial expense in the company’s accounts, when there was no actual outlay by the company itself? How much?

This is just an example of where tax and accounts are not necessarily aligned, Should a company recognise accounting depreciation when it claims capital allowances at a different rate? Should it recognise accounting depreciation on items for which no tax deductions are available?

Generally I can live with their being differences – and accept that note 8(c) of the Apple accounts is meant to cover these issues

But it’s very rare to find a reconciling item for a cost that would fundamentally change the view of the accounts (a loss of £10 million rather than a profit of £38 million) entirely missed from the accounts

My point is that there is a ‘true and fair over-ride’ in GAAP which lets it be ignored (with explanation given) iof that is necessary to present the right result. In my opinion that should have been done here. EY and Apple decided otherwise. That’s where the difference of opinion is.

‘I promise you, simplicity in taxing profit, gains, wealth, rents and the like is simply impossible.’

OK – well, I’ve no reason to not trust your judgement on that at all given your involvement and expertise in the field.

But it sounds like a sort of ‘market making’ to me – creating a market out of a contention which creates excuses to do many of the things we know are wrong – like offshoring and deliberately (it seems to me) obscuring other things in the accounts etc for the purposes of tax. and also – well – it legitimises the undermining of tax at the other extreme end of the tax argument.

I mean – there’s so much more that needs doing than arguing and fighting over tax because accounting and tax have different ‘approaches’.

Anyhow – I’m happy to leave my ‘complaint’ at that – you’ve enough on as usual.