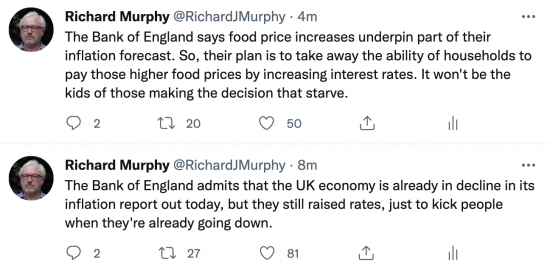

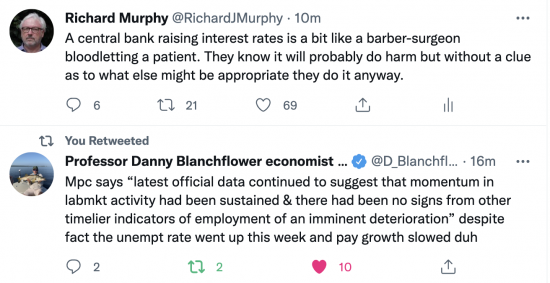

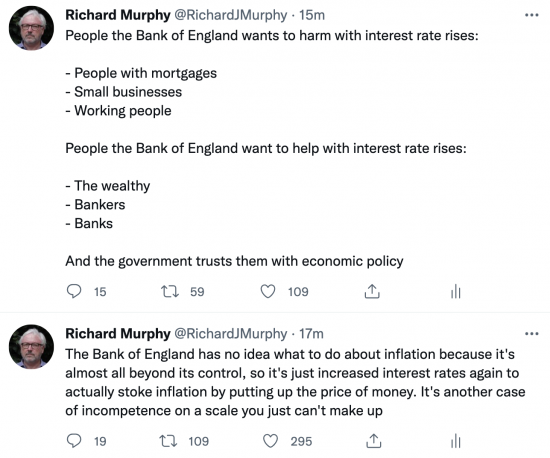

Some thoughts on the Bank of England interest rate increase:

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Armstrong and Wu in the FT summarise things well regarding the Fed hike

https://www.ft.com/content/26f3910c-043d-481b-90b1-d461be15fa6c

“Monetary policy tightening slows inflation by pulling demand down so that it no longer exceeds supply. How it does this is not subtle. It makes credit more expensive, so companies invest less and consumers spend less. It makes asset prices fall and asset markets less liquid, so companies and households become poorer and less inclined to spend. It makes people not get hired and it makes people get fired. It does this quite indiscriminately. It is not a scalpel, it is a sledgehammer. It smashes things.

For a while, the Fed had been suggesting that it could swing the hammer and get scalpel-like results. As of yesterday it is being more realistic.”

The BoE is following.

Smashing those already least able to survive, in other words

By taking money away from people who might spend it – indeed, need to spend it to survive – and giving it to people who don’t and won’t?

Precisely

Forgive my naivity – just tired of getting hammered and wondering if we can actually protest in any a practical way? Can we do anything to make the Chancellor and BoE think twice? Eg stop using cards and revert back to cash temporarily? If we withdraw and sit on OUR cash will this affect them? Each time we spend money on a card a charge is generated and that is ultimately passed onto consumers somewhere and profit made somewhere.

Should we do a short term cash only project to pause fees and ultimately gain power of when we get our money. Cash is instant – cards though isn’t – Eg customer pays today but money might not land in small business account for a week or more.

Interesting idea – but the cost of cash handling for small businesses is also very high

Indeed it is but for a short term option it may help prove a point we’re not happy and force a rethink. It’s also only expensive if it’s banked going back to my point of not putting cash into their accounts. Cash could be used to pay contractors, bills (via post office eg utilities etc). Yes it’s an inconvenience but short term might be an option. Also – we’re constantly told small business is the back bone of the economy whilst simultaneously two footing us into the stands and it could serve as a reminder we can kick back and perhaps could fo with a break? Naive again.

Anyway – thanks for the reply and all your other work.

What about checks?

When did you last see one?

Or use one?

Who accepts them now?

I paid for work being done one only a few months ago.

“.Should we do a short term cash only project to pause fees and ultimately gain power of when we get our money. Cash is instant – cards though isn’t – Eg customer pays today but money might not land in small business account for a week or more.”

This reflects the hierarchy of money. The difference is between cash and credit. Banks turn cash into credit; a kind of reverse alchemy where they turn free circulating cash into (profitable) rent.

I think if I’ve understood you correctly this is kind of my point in wondering if we have leverage on the banks. “Please stop penalising us / kickingvus while we’re down or we won’t facilitate the free loans on our cash” scenario. Sorry if I’ve misunderstood.

A surprisingly large number of our customers (we’re a mail order business) pay by cheque. Most of these are of a certain age and are happiest paying in this manner. Also a number who are a bit younger but probably on the autistic spectrum. You can actually pay cheques into banks by sending in photos via a banking app these days.

Anyway, that’s by the by.

Ann’s suggestion wouldn’t have any sort of an impact, unfortunately, because the vast majority of people have embraced the cashless society (for good or ill) and wouldn’t consider changing at this point. Barely even tinkering around the edges.

Without doubt this won’t work for many businesses as they’re all different but I’m thinking small businesses such as the local barber, grocer, butcher, hairdressers, beauty etc. Our local chippy only accepts cash for walk ins so I take cash (they take card for online orders). My local dog groomer won’t entertain cards so I take cash. If the businesses say we’re not using card facilities this month because we want instant payment and the Government to hear our concerns at rising cost and we DON’T want to put YOUR prices up then maybe people will get onboard. Ultimately more rises will lead to our customers paying more or job losses and nobody wants that. Granted – it’s a long shot but right now we need solutions and our Govt don’t appear interested in listening. I’m all ears for solutions.

As a tax justice campaigner I admit to not being a fan of cash

Why not? You may have answered this already but, if so, I missed it. I don’t mind it myself.

I get that totally coming from an angle of tax dodging. My business is totally traceable so not an issue for me but those others I mentioned perhaps open to abuse.

Electronic payments (when prompt and when online banking etc is working) is a much better system not least nobody wants their cash till robbed overnight!

My angle is short term and about being noticed / heard. I guess I’ve been mulling over how we get a Govt to listen when protests, petitions, hashtags etc fall on deaf ears. Cash appears to be the language they hear.

Tax revenue next year will be interesting when small businesses aren’t paying tax on grants they received in lockdown and profits are lower due to higher overheads. An aside to the original point.

Looks like we don’t have much option after all.

I think the tax dodging issue is overplayed, except for the big players. The people I know who use cash run from tax dodging; they don’t want the embarrassment or inconvenience of being caught.

Having worked for the tax authority I think you are a bit naive – cash businesses were always high risk for suppression of sales and given that HMRC has retreated from its local office network the risk of being caught is very low now, and of course those traders don’t pay the cash into the banks as that gives an audit trail

I agree – it’s not the done thing to ask for cash or ask for a discount for cash so to speak. I think most people do see it as morally wrong.

Electronic payment delivers everyone into the hands of the banks. That is just a fact. The convenience is undeniable, and compulsive; but beware, the siren voices to which the public listens do not signal the rocks ahead. Digital technology has destroyed the direct link between the sovereign issuer of currency with the final user (ordinary people; it delivers them wholesale and blind into the hands of rent-seeking intermediaries). It also hurries us all into the hands of Big Tech (when Big Tech conflates itself with Big Banking – as it will – a revolution will have been completed that is not understood, and will be impossible to change; Government itself is sidelining itself).

The public knows not what it is allowing to happen – to them. Sovereign Government is selling off the people (they are mere carriers of profit opportunities in data). The Economic efficiency of digital technology is focused on turning ‘profit opportunities’ (that used to require reputation, presence, direct contact with buyers), into rents that are self-liquidating, cheap to operate and require almost no direct contact with consumers. In a Global world the rent-seeker increasingly can hide, disappear; even when they continue to operate in plain sight. The law still lives on in the age of the quill pen, and is paid very well to stay where it is. By the time the law moves, global digitital business has moved on to a different world.

Besides, Ann… I’m not convinced there’s actually enough notes and coins in circulation to make the point you are looking to make.

Good idea on paper though!

I’m sure you’re right! I’m also sure they’d just swallow cards at ATMs anyway if this caught hold.

I’ve been listening to the media recently over the stupid interest rate hike.

Doesn’t anyone find the way that is done is rather………….Fascistic?

The Enemy: Inflation.

The Enemy’s Co-conspirators: wages, war, decent social security (add your own).

Divide & Conquer: Debtors versus Savers, Remainers versus Leavers (BREXIT), The Brutalised Natural Society Fascists versus Woke.

It must be so much fun running a country like this for evil swine who do this to us.

I’m not a fan of trying to regulate the economy solely by monetary means which usually translates into interest rate adjustments.

On the other hand, I don’t agree with the MMT call for interest rates to be permanently set at 0%. This ignores the effects of inflation on both borrowed and lent money.

What is your opinion on the correct approach to monetary policy?

I am with MMT

NeilW

All you have to do to allay your fears about MMT is understand the impact of tax on the money supply.

Tax withdraws money. As money is pumped in, it is used (spent) to be spent elsewhere and is taxed as it goes through those other transactions (hopefully unless the money ends up offshore).

As long as the taxation is in effect, that helps to control inflation. An active taxation policy stops money from building up and causing inflation.

I think your problem is that you may be wedded to low tax or anti tax sentiments – tax is bad thing?

Taxes were raised in the past to create revenue – this is true. But this does not apply in our modern age where money is more abundant than it ever was and central banking was created (a sovereign issuer of a country’s currency) who print money to cover the financial operations of the economy as the payer of last resort.

So the role of taxation has changed from being a revenue source to (amongst other things you can read about in Richard’s book ‘The Joy of Tax’) to actually a cooling mechanism in an an economy awash with money by making sure that money is not left to build up which can be a cause for inflation, amongst other factors. We know for example that house price inflation is driven by credit money – bubbles.

Counter intuitively, Tax can also help control inflation by not being there: in the case of the cost of living crises, the Government could lower taxes or remove them from things like fuel to ease the pain at times like this as well. But the Government could increase taxes on the speculation that is taking place in the fuel markets to curb profiteering.

The worst thing to do (which is happening) is for the Government to think that there are only a few tried and tested things that they could do to control inflation.

Highly developed advocates of MMT like Richard and others know that MMT is not for ever – at some stage it would have to stop having reached certain beneficial goals. Unfortunately, those idiots peddling austerity, hiking interest rates etc., do not think like that. They’ll keep looking vainly for the results from their policies that will never come.

What modern economies need is skilled and heterodox (varied) management of this abundant money. We simply don’t have it because the people who run it are mixture of stupid and corrupt. For me, they are using techniques from when money had its value tied to gold. Their tools are rusty and out of date and dangerous to boot and should be put in the bin.

How can you use inflation (of credit in this case via interest rates) to control inflation? Would you use petrol to put out a fire? Because that is what the incompetent financial psychopaths at the BoE are doing.

This will force us into a recession which is going to hurt a lot of ordinary people. People will lose jobs; companies will go to the wall. Poverty will increase.

Is recession NeilW a desirable goal? Really? Do you have any other ideas?

We need new ideas NeilW; we need new tools; we need MORE tools than simple blunt instruments like interest rates. We need to be creative. We need the BoE to care instead of crocodile tears like ‘Sorry, but…………’. And the Government needs to TRY new things and change and adapt and vary approaches for our (your) benefit! We need new markets like Green.

Do you think that you are going to get such a proactive, dynamic economy policy from a fat lazy bastard like Boris, who is just looking after the people who funded him and keep him there?

Don’t be like Boris: managing the economy is an art, because you are dealing with things which seem to oppose each other and (yes) it is very complicated and it constantly changes.

As Scott F Fitzgerald said: “An artist is someone who can hold two opposing viewpoints and still remain fully functional.”

Artists are people who make things work – they bring together different influences and synthesize them into something new.

It’s been too long since we’ve had any artists in the BoE , Treasury and Government.

Open your mind NeilW! Open it, and let heterodoxy in!

Thanks

But MMT does not say rates should be at zero.

Hence my comment

Well, some might be OK at zero, and others not if we are going to be truly heterodox.

@ Clive Parry,

“But MMT does not say rates should be at zero.”

It is my understanding that it does; or, at least as close to zero as makes no difference.

https://www.usnews.com/debate-club/should-the-federal-reserve-keep-interest-rates-low/federal-reserve-interest-rates-should-be-at-zero-forever

@ Pilgrim Slight Return,

I don’t have any fears per se about MMT. The zero interest rate policy is fine when inflation is low but if it isn’t then no-one will want to save their money. As Stephanie Kelton says: the Government’s deficit is everyone else’s surplus or savings. This works both ways. If the Government doesn’t run a deficit, everyone else won’t be able to run a surplus. But if everyone else doesn’t run a surplus, or want to save…….

@ All,

The MMT favoured method of inflation control is to tighten up fiscally. ie Raise taxes and/or cut back on government spending. This also can be described as ‘bloodletting’. So the choices are ‘bloodletting’ or do nothing and let inflation happen. It doesn’t look like there are any good choices at the moment.

The best option at present is to spend

We are in recession

The inflation is transitory. Only Japan has this right

And MMT need not say 0%, but dies because there are almost invariably better policies to follow

I am fascinated with MMT. No one, other than BoE and the commercial banks (though their product is only temporary) can “make” money, unless they wish to be locked-up. All we can do is take money from someone who has some. At any one moment there is a fixed amount of money in existence. Any that is locked up in savings is useless to the rest of us.

All animals need air, water, shelter and food; for humans, we also need energy to help with 3 of those.

No one has yet found a way to make us pay for air, though the B******s have managed it for water. For shelter I expect we can knock up a few sheds, but that leaves food and energy. Sadly Britain does not seem cabable of feeding itself or (yet) collecting enough energy, and we are forced to buy from abroad wheat and oil – and a few other things!

The Boe is charged with keeping inflation within limits and therby (?) keeping the value of the pound abroad. Evidently it is of paramount importance to keep the value of the pound high enough or we shall all freeze and starve. How is BoE to manage that?

We actually are by GDP the sixth richest country in the world. That creates the value of our currency

And the BoE is tasked with controlling inflation and not with managing the exchange rate

Statista says 72.8% of GDP comes from the services sector, and seems to imply this is mainly travel and tourism – and that did not appear to be incoming! A mere 17.04 comes from manufacturing and a negligble 0.58 from agriculture. No mention of finance sector!

Seems bizarre to me; evidently I know little.

I do not recognise that data

Where should I look for better figures? Preferably simplified.

Looking across the country, IF it is apparent that the country is rich. it certainly does not appear anywhere near level! Surely an acceptable ratio between the richest and poorest would be a useful measure of the quality of the country?

Office for National Statistics

[…] comments posted here yesterday regarding the Bank of England’s interest rate rises that it claims will help tackle inflation […]