According to The Guardian this morning:

Britain's economy is at growing risk of falling into a summer recession amid the biggest squeeze on household incomes since the mid 1950s, as soaring inflation curtails consumer spending power, forecasters have said.

They add:

Economists said the double blow from slowing post-lockdown growth and rising living costs after Russia's invasion of Ukraine could result in a fall in gross domestic product (GDP) for two consecutive quarters, which is the definition of a recession.

All those they spoke to were working for commercial organisations. Without exception, their comments appear optimistic. Take this for example:

Thomas Pugh, an economist at the accountancy firm RSM UK, said he expected households would probably need to dip into savings or take on debt to protect themselves from rising inflation.

This he explained as follows:

“This is a key reason why we think the UK will avoid a recession this year. However, our forecasts suggest GDP growth will average just 0.1% in each of the remaining three quarters of this year – so it would not take much of a rise in oil prices or a disruption in supply chains to push the UK into recession,” he said.

Politely, this is nonsense. He wholly misses the point as to what will actually cause the recession, which is that people will stop spending because they will be aware that they cannot afford to do so.

As Danny Blanchflower has noted in Prospect:

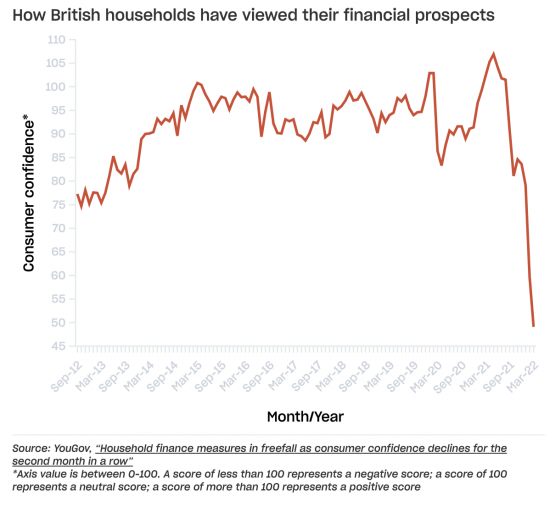

There is a massive collapse in consumer confidence in the UK. Of course price hikes help create that, but the recession creating mechanism is consumer reaction.

And it is true that those fortunate enough to have them will spend their savings. Others might borrow. But to presume that this will keep the economy going - which is what the forecasts imply - is absurd when millions will have no access to borrowing and have no savings to fall back on as their costs become unmanageable. They will stop spending, because they have no choice.

These economists seem to think this a marginal issue. They really do need to get out a bit more. In the real world the crisis is already happening. And the recession is already coming. The question is how we deal with it?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

There are lies, damn lies and (GDP) statistics.

Whether we slip into recession or not is largely irrelevant. It will certainly feel like a sharp recession for most people even if the bean counters tell us otherwise.

If we spend more on gas and less on restaurant meals GDP does not change but we will feel hungrier and colder. Indeed, if people go into debt in order to pay their bills and maintain some luxuries in life it would actually boost GDP.

Danny’s chart of household financial prospects tells us what life is going to be like, not GDP.

Fair point

But I think GDP will follow

This is the sort of story that would have set my late father off with his rant that summarised the situation better than any academic ‘…these people haven’t got any money!’

So what exactly can these expensively educated people see that I (Board of Trade Boatmans Licence, MCA Basic Sea Survival Certificate) cant?

Incomes are declining in both real terms and as a percentage of GDP while the cost of essentials – food and fuel are going up – a lot. What was that depressing statement made by the Iceland Management that they didnt lose their customers to cheaper shops but to food banks.

So with a larger percentage of household budgets going on food and fuel something has to give, and thats discretionary spending. That means fewer meals out, clothes, visits, travel, new cars, etc etc.

The impact of which is??

Well, in my book recession.

Agreed

From The Guardian today (19.4.22)

https://www.theguardian.com/business/live/2022/apr/19/imf-global-growth-gdp-forecast-russia-ukraine-invasion-inflation-elon-musk-twitter-uk-gdp-ftse-100-business-live

Energy bosses warn of expected increase in UK fuel poverty

Energy bosses have warned of significant increases in the number of British houses falling into fuel poverty in the coming months, amid rising energy bills.

Speaking to MPs on the business, energy and industrial strategy select committeein parliament, the chief executives of several energy suppliers said that there were signs of more customers concerned about payments.

Michael Lewis, chief executive of E.ON, said:

We are expecting a severe impact on customers’ ability to pay.

That will see a “significantly larger number of people moving into fuel poverty […] and a consequent significant increase in bad debt,” he said.

Government action “isn’t nearly enought to mitigate the full impact of the price increase”, Lewis said.

E.ON expects the debts of customers to increase by 50%, or 800m, up from £1.6bn now.

EDF has seen a 40% increase in calls from customers worried about their debt.

Simone Rossi, EDF chief executive, said:

We are concerned about what is in front of us.

Unfortunately pre-payment customers are being hit first.

We now see bills being higher for longer, so I would expect government to reassess in short order to see what is possible.

Will “Demand Destruction” appear on the table later in the year? Particularly where fuel is concerned? In note that the CEO of the Rotterdam-based Vitol, the world’s largest independent energy trading company, warned on 27 March that rationing of diesel fuel in the coming months globally was increasingly likely. He noted, “Europe imports about half its diesel from Russia and about half of its diesel from the Middle East. That systemic shortfall of diesel is there.” In 2020, Russia shipped more than 1 million barrels of diesel daily. Most of it, some 70%, went to the EU and Turkey. France was the largest importer, followed by Germany and the UK. In France some 76% of all road vehicles – cars, lorries – use diesel. Most of the ‘essential’ items we all buy are harvested and transported by diesel.

Maybe rationing of diesel is just around the corner?

It may well be…

People are already making choices.

The number of people subscribing to at least one video streaming service in Great Britain has fallen, with more than 1.5 million people cancelling memberships, a new report has found.

https://news.sky.com/story/netflix-amazon-and-disney-subscriptions-cancelled-due-to-shrinking-budgets-research-finds-12593362

Discretionary spending is one of the first things to go as people have to find the money for things like rent, mortgage, food, energy, etc. All the stuff that’s a non-need is now under threat. Things you need and have no choice but to pay for will be the priority. Unless you are on pre-payment for gas and electricity the increase has yet to hit. I can speak from personal experience that when it comes to electricity what I use to get for 6 days is now lasting 4. Yes, I’m making all the savings I can. Some people will get a real shock when the bills turn up even if they are trying to save now.

Then we get hit again in October. I expect Boris to make a statement soon along the lines of “let them eat cake”. Accept cake is now getting quite expensive too.

The downturn is already here