There was a fascinating discussion between commentators Andrew and Clive Parry on this post yesterday relating to the calculation of interest costs on index-linked gilts.

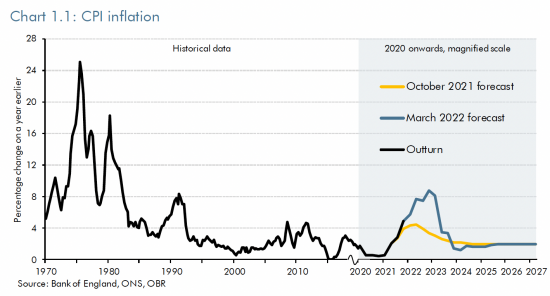

To summarise, the reason why supposed costs of interest in the government's forecasts are rising so much is because current inflation estimates are high. However, they are also forecasting that these will fall, as this Office for Budget Responsibility chart shows:

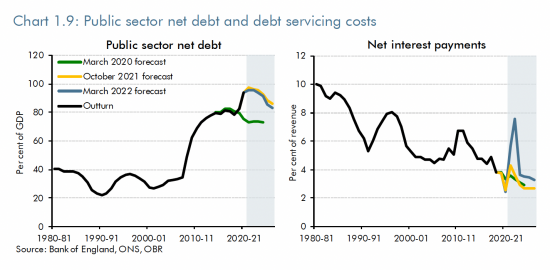

By 2024 the Office for Budget Responsibility says inflation will be back on target. I admit that I have no confidence in that forecast, but it is used as the basis for the right hand of these two charts as well:

The hike in interest costs this year disappears in 2023 and a downward trend is in place from 2024. Why? Because the accounting accrual for the cost of paying back index-linked bonds is removed from the national accounts when inflation falls again, with no real cost of significance having ever been incurred.

Right now Sunak is using this cost as the reason why he cannot relieve poverty. What will he use his bonus due by 2024 for? I think you can be quite sure it will be for tax cuts.

How terribly convenient this accounting will have proved to be if it works out that way.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

It is important, because right wing commentators can spout nonsense such as the government’s interest payments this year are £83 billion which is much more than the UK’s defence budget. Without saying that a large chunk is paid straight back to the government, another chunk is voluntary, much is just an accounting accrual for a redemption payment to be made in decades to come (possibly matched to some extent by a deflating premium on issue), and some comes back in tax.

So how much cash interest is actually paid to and retained by third parties? And is that affordable in comparison to say GDP and tax revenues?

Agreed

I tried to make those points to Edwina Currie on air yesterday

She asked me out to dinner in response and was offended when I declined her invitation

Beyond cynicism.

Government is meant to govern – not play with us like the Gods of Olympus.

Surely more like the gods in King Lear, PSR,

“As flies to little boys are we to the gods – they kill us for their sport”

If I’ve remembered wrongly, I’ve remembered substantially correctly, I believe.

Certainly the sentiment resonates, because it rings true of our current bunch of criminals asset-strippers masquerading as a government.

Charts 1.9 illustrate the absurdity of the ONS methodology. In a world where interest rates are still very low is it reasonable that interest rate costs spike so much and then decline? NO!

In fact, the last gilt to mature (March 7th this year) carried a coupon of 4%… and on the 8th March a new gilt 30 year gilt was sold with a coupon of 1.25% – interest costs are declining not rising.

The problem comes with Inflation linked bonds. Here the principal (or amount owing) rises with inflation. That is why the Left Hand chart takes a spurt up – the amount owed on inflation linked bonds has gone up much more than forecast because inflation has been higher than forecast. That is correct.

What is wrong is the Right Hand chart. It is wrong to include that increase in “amount owed” as an interest expense. It is double counting and delivers a spiky chart that tells us nothing about how interest payments are developing over time. Go and ask an investor “has the interest you received doubled this year?” – trust me, you will be greeted with incredulity. They will acknowledge that their interest income is 6% higher than last year – but this would barely be visible on the chart.

The ONS must revisit their methodology.

Agreed

The Scott report into the Thatcher government’s lies about selling arms to Iraq in the 1980s concluded that her government was an ethical void and marked by a determination to avoid accountability.

They went on to say that government policy appeared to consist only of the pursuit of electoral advantage for the Tory party and the pursuit of greater wealth for the already rich.

The only thing that has changed is that the Tories now feel so secure in their control of this country that they no longer feel they even have to keep up the pretence of being honest.

Agreed.

And I’m sure that it is the lack of regulation and consequences meted out by Governments after the 2008 melt down that has so emboldened the rich to behave so….well….monstrously.

I think the 2024 income tax cut was announced for one reason alone. 2024 is potentially an election year. It’s a bribe that works in two ways. 1) They go into the election (any time between now and 2024) and the Tories and their friends in the press will make a big issue out of whether Labour will honour the tax cut if elected. 2) If the Tories win they can easily back out of the tax cut by saying circumstances have changed and income tax cuts will have to wait. In the Tories case that will be the next election year of their choosing, 2027 to 2029.

We can now see why the Tories got rid of fixed Parliaments and went back to the old way of the Government having the right to choose the date of the Election. They did it so they could con people with election bribes. Last time it was “get Brexit done”, when they have done no such thing. Next time it will be income tax cut bribes. It’s the usual cynical Tory playbook for winning an election.

The acute points made by Andrew and Mr Parry make clear the redemption inflation element of ‘interest’ is not cash. It is interest deferred. It looks, walkds and talks more like capital than interest. More generally this case made by Richard, Andrew and Mr Parry would be better re-packacked into a one-two page A4 briefing document and circulated around the political world by every means avaialble. This needs to change; not just to effect the specific change by expose the wider issue of debt, interest and repayment to wider scrutiny and public understanding. It is a such a good case study.

re-packaged. Every comment fluffed!

That is an idea for the weekend…….