To continue my pre-Budget thinking, I have been considering the impact of inflation on government revenues.

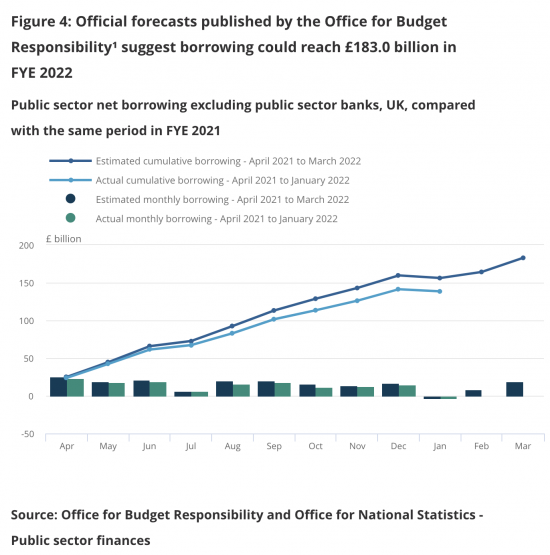

Government revenues have been better than anticipated this year, so far:

Extrapolating this trend and assuming that savings per month are the average for the year to date then the deficit for 2021/22 will be about £20 billion less than anticipated last October, and will come in at about £163 billion.

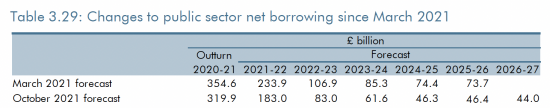

Forecasts for deficits last October were:

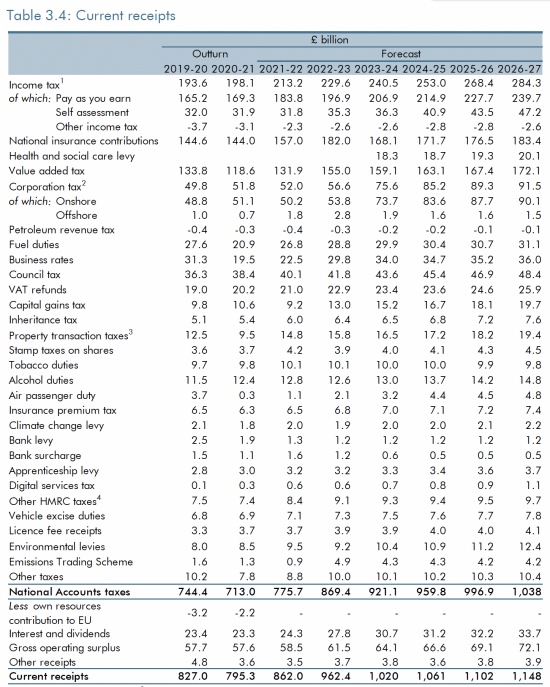

Revenue forecasts were as follows:

There were already some pretty wild numbers in there: VAT was, for example, forecast to grow by 17.5% in the coming year - which is pretty exceptional by any measure. But income tax was also forecast to rise by 7.7% (it's hard to equate the two by the way, expecting some VAT rates being normalised in the coming year e.g. on hospitality, without apparent impact on demand), whilst overall revenues were supposed to rise by 8.4%.

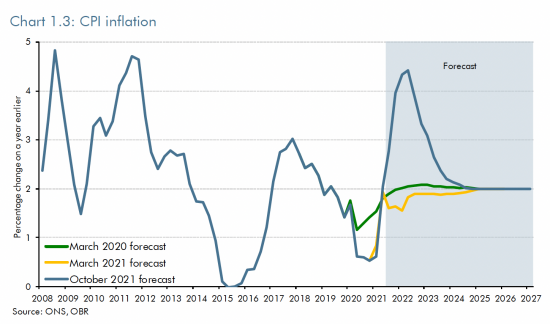

This forecast assumed inflation of just over 4%. This was the chart of expectations:

This is very obviously wrong now, due to profit-taking exploitation within energy and food markets. As a result it's likely that rates could rise to 8% or more without government intervention and settle at a figure exceeding 4%, again, assuming the government is happy for inflation to continue.

I am going to assume - as the government will - that this has no impact on underlying economic activity (I stress, I know this is not true: I am doing what the government will do) and assume that costs are not allowed to rise by more than 4% but that revenues will rise by 8% because of RPI increases across much of the year.

Do this and revenues will rise by more than £35 billion. Costs will not rise as much. And any increase in the cost of the national debt will absorb nothing like this sum.

In other words, Sunak is heading for a revenue bonanza, having already enjoyed one in 2021/22 of more than £20 billion.

The deficit forecasts have already been noted above. With 2021/22 running better than forecast and inflation giving Sunak a considerable boost at cost to the rest of the economy that deficit is going to be falling to maybe no more than £40 billion in the coming year, which would represent a current account surplus (when investment is ignored), which is the government's target.

Do this though at the time that a massive recession is looming, as I predict, and you are not setting up the massive tax cuts Sunak is planning for 2023 in a pre-budget bonanza, but you are instead setting up a real risk of recession, massive food and fuel poverty, and half of households in the country being unable to pay their bills, in no small part because the government has taken far too much in tax from them.

Economic mismanagement on this scale is very hard to imagine, but it looks like it may be planned.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The Tories know us well.

They’ve got salivating over tax cuts like Pavlov’s dogs.

We’re being bribed as usual.

Assuming your main focus was on balancing the books, what does inflation do to forecast government expenditure? Wage inflation for example. The cost of servicing index-linked gilts. The amount paid in central bank deposits. Etc.

It’s dire. What I propose might ace £25 billion in debt servicing costs, or more.