This is one for the geeks, I must admit.

As those who understand sectoral balance accounting know, these balances must by definition add up to zero. That is because in accounting terms every debit must have a credit, which is a reality matched exactly in the real world by the fact that for every lender there must be an equal and opposite borrower.

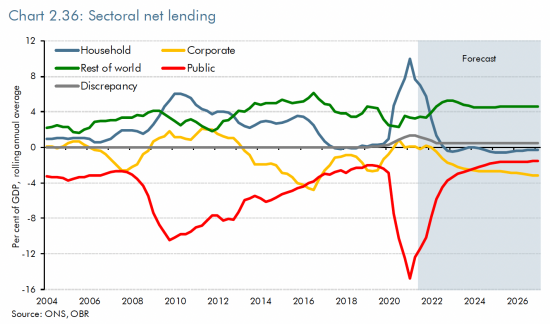

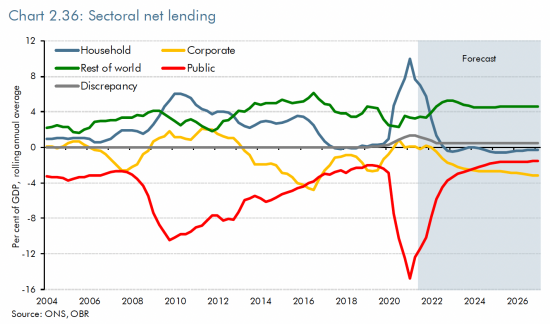

This is the chart for the sectoral balances for the UK from the most recent budget:

The importance of this chart is that it shows who is borrowing, and who is

saving within the UK economy, split between the four major subgroups that exist within it i.e. the government, households, businesses and the overseas sector.

I normally recommended that any forecasts produced by the government with regard to where the sectoral balances are going be ignored. There is good reason for doing so: these forecasts are usually works of fantasy designed to suggest that the government will eliminate its deficit, which is a goal that it rarely succeeds in achieving. That is what this chart, predictably shows.

However, there is something more important to look at in this case, and that is the green line, which is the contribution made by the overseas sector. These funds are those provided by individuals, companies and governments from outside the UK who save in this country. Part of that saving is reflected in investment in bank

accounts. Some might be in

shares, but the largest part may well be the reserves of foreign governments held in the form of UK government bonds, which do of course represent loans to the government, in effect (and yes, I know all the

modern monetary theory arguments).

The very obvious question to ask at present is what might the impact of the conflict with Russia have on these balances? It is thought that Russia had the fourth largest overseas reserves balances in the world prior to this conflict beginning. It is, of course, now known that many of these balances have been frozen, including those in the UK. Assuming, however, that at some time this conflict will come to an end and that those reserves will be released, which would reflect some sort of return to welcome order, then how is Russia likely to react?

My suggestion is that they are not going to be too keen to hold these reserves in any country that froze their assets, including the UK. It is much more likely that they will either move them to China or, alternatively, they will hold gold. Whatever their choice, I think that the relatively stable flat green line shown on the chart until 2026 for overseas balances might, in this case, be decidedly optimistic.

If that is the case then the UK government might find it harder to balance its books. Readers of this blog will know that I consider that to be a matter of some indifference: there is absolutely no necessary virtue, and often some degree of peril, in pursuing this goal. However, that does not prevent the Treasury thinking otherwise, and if they think that Russian reaction might make this goal harder to achieve then the pressure for

austerity coming from that source will only increase.

If that happens we will suffer, yet again, for their stupidity.

I agree, the forecasts are a nonsense…. along the same lines as the BoE inflation forecast is nonsense. Ie. the forecast always matches the policy goal – why? Because if it did not it would mean we have either the wrong goal or the wrong policy and they could never admit that.

The correct way to use this analysis is to target/manage/forecast all the lines EXCEPT the red… and allow the red to be whatever it takes to make the balance zero. Unfortunately, HMT targets the red line.

In reality we know…..

(1) The red line should and will stay lower for longer (govt. deficits will persist)

(2) The blue will not drop so sharply (individuals are not going to splurge in such an uncertain world…. although it will fall as people pay more for energy).

(3) The yellow line will not go down as companies won’t invest in the current climate

(4) The Green line? Here, the risk is that it falls as foreigners take their money elsewhere.

Russia FX (excluding gold) are about USD450bn….. which might imply about GBP 40bn of GBP reserves. Whatever the outcome of the war/sanctions etc. this will leave the country. Will other CBs follow suit? No…. with the possible exception of China. FX reserves are there to provide instant cash in case of emergency…. it has to be held in tradeable currencies (which MUST mean in Foreign countries) and Gold is typically held in vaults of stable countries. Only if you, as a country, are planning something very naughty would this be a problem…. which brings us to China. Will they reduce currency holdings in favour of gold? Quite possibly.

However, the green line could fall for other reasons.

(a) If London really does clean up its act then the money launders will go elsewhere.

(b) In a risky world people like to keep their money close to home

So, my bet is that the outcome for the green line will be a modest decline.

That’s enough to make an impact in a twitchy Treasury

The blue and red spikes are presumably the covid lockdown and unwinding working through, and not much else save the passive resumption of ‘normality’?

Nerd or not – I agree with you conclusion.

The net foreign acquisition of UK financial assets has actually been falling since Brexit, along with the pound’s value against the dollar. Britain’s response to the Ukraine crisis can only make things worse.

In 2007, the pound bought $2.00. After Brexit, the pound’s value dropped below $1.50. So far this year, following the events in Ukraine and Britain’s response, the pound’s value has fallen to just over $1.30.

Foreign investors/speculators have been fleeing the UK. Others have taken advantage of the cheap pound to acquire real UK assets. Meanwhile, we’re having to pay more and more for the food, fuel and manufactured goods we need and no longer produce ourselves.

As the accounting dictates, there are only two ways of paying the bill – either the government or the private sector must bear the lion’s share. The private sector can’t do it without running up an unsustainable debt. So the government will have to make the funds available. But the current government will balk at doing so and the opposition doesn’t understand the problem.

The likely result: further economic mismanagement and national decline, amid much flag-waving.

A fun exercise would be to post the charts from previous economic outlooks and chortle as every one of them sees the governments net borrowing taper to almost nothing in defiance of reality and history!

It has been done….

Once upon a time the OBR did it

Then it got embarrassing

It would just take a lot of time and I don’t have that spare

There’s a book to write and right now data on the impact of inflation on household well being to consider before next week’s budget

There will be a thread coming

A couple of questions: Why the discrepancy from 2019 until now? My understanding was that UK as a whole ran a current account deficit, which I understood to be the net flow to foreign account holders, which is what I thought the green line shows. Is that not the case?

This is the sectoral balances rather than the current account, but the two are related

I am not sure what you mean by the discrepancy since 2019

There is a lump in the grey line after 2020.

Statistical flaws are growing…..

We need to invest more

Out of interest how would holding gold help? Presumably most gold reserves aren’t physically moved to the country that owns them as it’s a risky expensive and unnecessary operation to perform when they can pay someone to look after them where they already reside? Of course that makes them just as easy to be frozen as foreign currency reserves. if they did go through the process of physically moving them to Russia, how do they spend them on the international market from which they would have presumably been expelled and any country that did trade with them would be sanctioned in return.

I don’t think gold relevant any way

There are those who do

I worry about Sectoral Balances if they still assume that the money created by governments out of thin air can only be cancelled as tax. Another implication of that dogma is that spending and tax cannot be allowed to continually diverge, because eventually more government £ IOUs will be presented than the government can honour. I have argued elsewhere that this is wrong. A lot of government-created £ IOUs are either destroyed or locked away so that they will never be presented. (https://sussexbylines.co.uk/the-mysterious-case-of-the-burnt-banknote/).

If so, what happens to a sectoral balance if the money on one side of the balance goes up in smoke?

A few years ago, my brother and I visited the battlefields of Flanders, and our grandfather’s grave in Pond Farm Cemetery. Later, our guide took us to Ypres, which was reduced to rubble and rebuilt, exactly as it had been, using post-war reparations. As I looked at the faux-medieval architecture, I thought to myself that I was looking at the seeds of WW2.

Later, the lesson of WW1 reparations was learnt, and after WW2 we had the Marshall Plan. I fear that all this has long been forgotten.

Ukraine is being reduced to rubble, but with the destruction, the money it represents is also being destroyed. Replacing money that no longer exists should not be inflationary.

But if we look on countries as sectors, what happens to sectoral balances if the money on one side of the balance is destroyed?

My fear is that if Ukraine survives and retains its ties to The West, it will be destroyed by conventional economics even more thoroughly than by Putin.

You still think money is something more than a promise to pay

It isn’t