Just when you thought the economic issues that we face are down to war, the aftermath of Covid and the incompetence response of our government to both, let me add something else into the mix. That something else is China.

Ignore for a moment (although not forever) the fact that China is likely offering some sort of support to Putin, although it is not clear what. There is, after all, no surprise in the fact that China is not a great fan of western democracy and which side it was going to take in this dispute was never really going to be in much doubt.

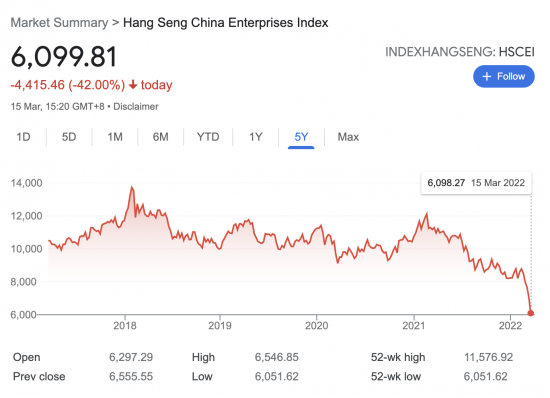

Instead, look at what is happening in China. This is the Hen Seng China Enterprises stock index:

As graphic impressions of falling off a cliff go, that's impressive.

Why? Partly the crushing burden of debt within the Chinese property sector, which has massively over-expanded.

Partly the fear of fallout from war in Ukraine, and maybe beyond.

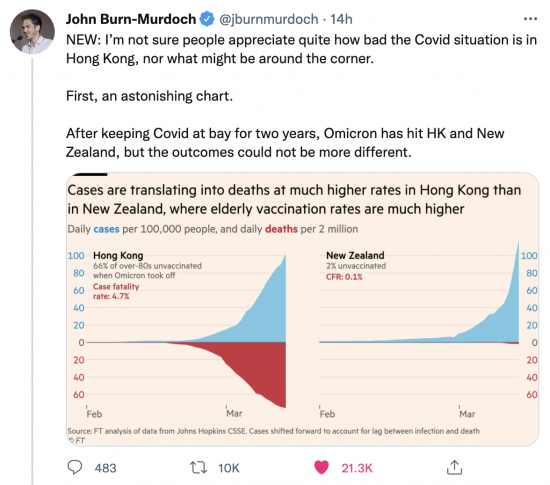

But at least as much it's Covid. John Burn-Murdoch at the FT illuminates this, first noting the aberrational growth of Covid in Hong Kong:

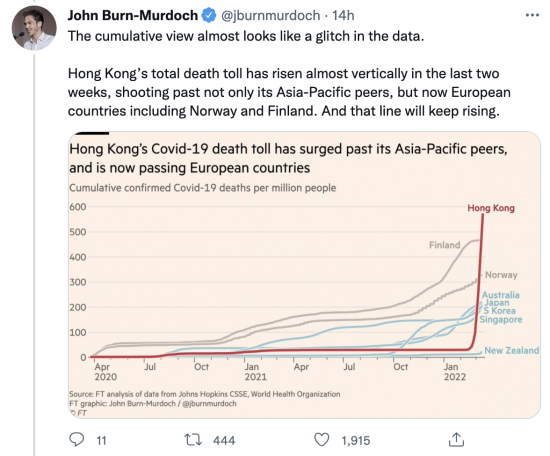

It's not just that the growth is exceptional, the impact is too because of low vaccination rates. But to illustrate just how odd this is, look at this chart:

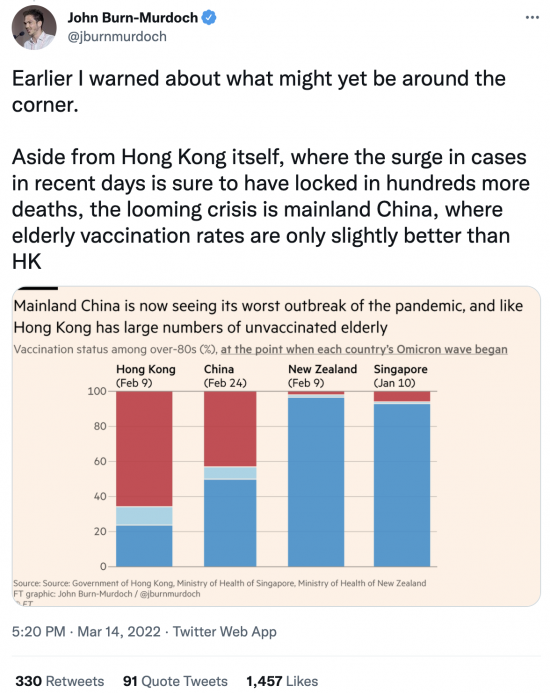

And the situation in Hong Kong is flipping over into China:

The Hang Seng is down for a reason. The expectation is business disruption. But the biggest disruption of all might come from a massive spread of Covid in China.

What's the obvious consequence of that? Apart from misery in China, more supply chain disruption for us here in the UK is, of course, the logical outcome of this. The assumption that we were going back to normal (war apart) looks to be wrong in that case. Even without war 2022 looks as though it might still be very difficult. And that's before government economic policy mistakes add to our woes.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

First, I can’t ignore China’s possible supply of arms to Russia. You may not be so surprised but I certainly am… and so is the market with a large drop today. My assumption was that China would try to stay out of things and let the West/Russia slug it out and then exploit both their weakened positions.

Second, you are right on COVID. Vaccination rates are poor, particularly among older Chinese where there is quite strong resistance. In Singapore the same cultural issues were at play but there the government used (a little bit of) carrot and (big) stick to force the vaccination rate higher. For example, cash payment to be vaccinated, no entry to restaurants etc without a vaccination, un-vaccinated COVID patients having to pay their own hospital bills if they get ill etc. Tough stuff…… but it worked.

NZ (without such a big stick) has also worked hard to push vaccination.

I guess link between the two stories is that China’s leadership have as little regard for their own people as any other. With Xi having manoeuvred to a position of such personal power (unseen since Mao) the risks are great.

They are…..

You very much create the impression that you “wallow” in bad news. Why’s is that? Why does bad news perk you up and make you happy? You seem a very odd individual..

I don’t wallow in bad news

I want to plan for the consequences of events and think we can

I accept the belief that we can improve the lot of ordinary people is not commonplace

But does it make me an odd individual?

Or is your desire that people suffer the oddity?

You are odd. So am I….. but that is not a bad thing.

What really pleases me is that you are getting such traction in the boxing community, Marvin Hagler today, Tommy Hearns yesterday. I am keen to know what Ray Leonard thinks….. will he be commenting tomorrow?

🙂

I have often thought the same Clive, he seems to illicit responses from wide ranging sporting luminaries, Richard’s posts also seem to sometimes reach beyond the grave… Marvin Hagler died in March 2021

🙂

Odd that, isn’t?

I cant think of anywhere better to put this point (Feel Free to move it) BUT………..

Back in the days of The Falklands War most nations that might otherwise have sided with Argentina in its dispute with the UK drew back from supporting it when it invaded for one simple reason.

Almost all nations have land borders, many with either diplomatic or actual ‘Hot’ disputes on them – Kashmir, the Russian/Chinese border etc and the last thing they wanted to encourage was the use of force to resolve them.

So why does China want to support, publicly or otherwise Putin? Yes there is the Taiwan issue bit they have never looked like invading and the potential disruption could be massive.

What do they think they might get from this other than perhaps Putins gratitude?

Hard to tell

And they may well not be pleased for having been out in this situation

Perhaps we should heed both the Russia and China problems with quite ironically a quote from Jospeh Stalin:

“Death is the solution to all problems. No man – no problem.”