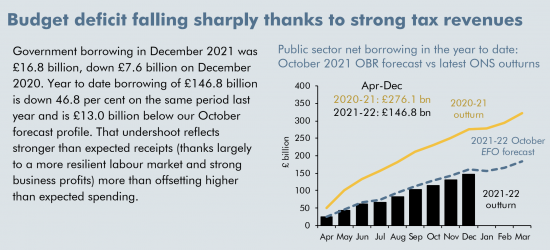

The Office for Budget Responsibility published this commentary this week:

This needs to be out in the context of its borrowing forecasts made last October:

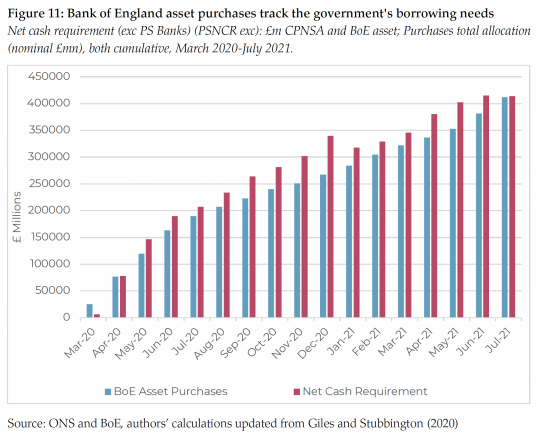

That also needs to be set in the context of a recent report from the New Economics Foundation that showed that quantitative easing has been funding government deficits whatever the Bank of England would like to claim:

Now let's extrapolate a little.

Now let's extrapolate a little.

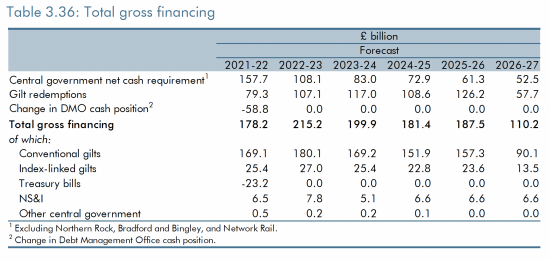

The QE programme has come to an end. The total government cash requirement is to be funded by financial markets. And, in addition, QE may begin to be unwound. This means that the Bank of England will not repurchase gilts when those it owns are redeemed. It owns 33% of all gilts right now.

What this means is, broadly speaking (and all the figures are estimates, so broadly speaking is good enough) that in 2022/23 the financial markets will have to fund £100 billion of gilt purchases and at the same time the Bank of England will withdraw over £35 million from that market. That means there will be a cash call on U.K. financial markets of around £140 billion when over the last two years there has been none, in effect.

This is a seismic change to funding. More than 6% of UK GDP is going to be required by government to be withdrawn from effective money supply. What are the consequences?

Candidly, who knows?

We can be sure that the policy is deliberately designed to push down government bond prices by increasing the number of gilts available to the market. The result will be increasing interest rates. That much is predictable.

It is also predictable that without a change in policy more than £100 billion is going to be withdrawn from financial markets over the following few years.

Apart from increasing interest rates no one can be sure what the consequence of this is. But, given that QE was always intended to push investor funds into riskier assets, and this has clearly happened, what we can reasonably expect is a reversal of this trend. There will be sales of riskier assets. In fact, those sales could be significant. The £140 billion required in the coming year has to come from somewhere within the financial system, and they do not create the money to fund this.

What this might mean is three things. First, there will be net selling markets in riskier assets.

Second, net selling markets reduce prices at the margin.

Third, markets are valued at marginal prices, meaning that the overall sense of well-being amongst those with assets will fall.

Which assets are likely to fall in value? Gilts will, of course. But so too will shares. Corporate bonds will also fall as interest rates rose. And most likely house prices will too as the stimulus has also ended there.

Summarise this, and the massive reversal of economic policy that the end of QE, rising interest rates, and QE reversal simultaneously represent look likely to create a significant fall in assets values, across the board in the UK, with the US looking likely to do much the same.

Corporate profits will fall as a result as pension deficits rise. Real investment will fall in the economy.

But what else happens? In effect, liquidity dries up. Because prices in markets are expected to fall no one wants to buy. So prices fall again. Or, alternatively, markets freeze. Both create chaotic situations. And given the intense financialisation of the UK economy, the result could be chaotic.

There could be banking crises, e.g. because of property price falls, or a stock exchange crash, or a loss of confidence simply leading to an economic downturn.

QE was done in the UK with the aim of inflating asset prices. That was always the wrong thing to do. There was always the better alternative of Green or People's QE. But QE was done. And now the intention is to reverse it, rapidly. My point is a simple one. Bad as QE was, unwinding it rapidly could be worse and this government and the Bank of England seem unaware of that, which is really quite worrying.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I am not sure that QE itself was bad. In fact, given the dereliction of duty by government on the fiscal front it was the only tool in the box available to monetary authorities. If there was a failure it was that too much faith was placed in its ability to percolate through to the real economy. This was true in many countries.

First, you cut policy (overnight) rates to zero, then you buy gilts further out along the curve to push term rates lower, this pushes investors into riskier assets which finally prompts real investment in the real economy…. but this last stage has been conspicuously absent.

Despite this “transmission failure”, it has still allowed governments to finally get the message and spend (furlough etc.) without having to issue gilts in the open market and push rates higher. But what it has not done is persuade governments to make the investment we need so badly and where “markets” have failed to deliver.

But, we are where we are and what should we do?

I think the BoE should stop thinking about the right size of its gilt portfolio and think about the right level of gilt yields. Just as Central Banks have been engaged in repo (and buying or selling short term instruments) to guide market rates towards its policy rates, so it should buy or sell long term gilts in order to deliver long term gilt yields at the “right” level. What is the “right” level? Well, that is a question for another blog!

How much the BoE buys or sells in the gilt market will be an “output” number rather than a “policy” number.

I think the first issue is to use QE for the right purposes i.e. direct economic intervention. This would make it clear that it is actually a fiscal intervention.

And what is the right interest rate? Try zero…

The “right” interest rate? First, I am looking for a policy framework that can deliver in all weathers/ While it’s hard to see the case for much higher rates at the moment that might not be the case for ever.

Today, I would be aiming for 0.25% for the o/n (ie where we are now) and a 1.00% to 2.00% range for 30 year gilts (currently 1.4%).

At some distant point in the future? 2% for o/n (ie. zero real rate versus inflation target) and 2.00% to 3.00% for 30 year yields.

Whilst we agree a lot of things, I think we do differ on rates. I am in favour higher rates but compensated by bigger deficits – ie direct spending by government on the stuff we need to do… that is drained through gilt sales at a reasonable rate to prevent asset price bubbles. But, as I think I said once before, I am in favour of higher rates but I am not in favour of increasing rates! Rate hikes any time soon could be seriously destabilising as we might be about to see in the US.

I recognise that in the real world it is a battle lines against the monetary headbangers / fiscal austerions and my musings about higher rates may not be helpful…. but I really do believe that we need a policy making framework that balances the use of fiscal and monetary policy rather than the current system that is failing.

Disagreement is good

“I am in favour higher rates but compensated by bigger deficits – ie direct spending by government on the stuff we need to do… that is drained through gilt sales at a reasonable rate to prevent asset price bubbles.”

This seems to me to be right, although I see no adequate executive arm of government, professionally capable of delivering the spend where it is needed, and through shrewdly constructed local avenues of delivery (the Government is, as we speak, attempting through ‘reserved’ legilsation and prerogative attempting to dismantle Devolution to Scotland, quietly and out of public sight or notice – inadequately reviewed by a compliant media).

The Crash and its aftermath (including QE) demonstrated that ‘enterprise’ cannot be relied on to be enterprising. Capital copes badly with adversity (the failure of 3% War Loan proved that in 1914; Capital was not sufficently prepared to back Britain to win the war). Capital follows the easiest path to profit; and hates taking risks. Capital likes the reputation of “entrepreneurship” (and thinks it owns the term), but it always prefers monopoly to competition, and relies more on the security of ‘safe assets’ that only Government can offer to protect its Capital.

Bubbles tend to follow new ideas when Capital does suddenly throw money at something new; but only because the bubble feeds on Capital’s fear of being left out, and invests in things it does not understand; capital always fears being left behind by technology and innovation, much more than it likes taking risks. We have managed to create in the 21st century an instinctively reactionary, rentier form of capitalism; a parasitic host that is destroying that on which it feeds: the British people. Rentierism spends far more on politics and PR, and managing government through political party (entryism is a rightwing as much as a leftwing problem – and the resaon for that is the nature of a politcs dependent wholly on ‘Party’); than rentierism will ever spend on business innovation and risk – except in desperation to save its skin.

Big risks on issues like energy (developing carbon capture and storage, tidal and so on will always require to begin with Government resource). Remember oil? The Middle East oil industry began with the Anglo-Persion Oil Company (1908); Admiralty driven, Government financed, along with Burmah Oil (who supplied the management, engineering and pipeline construction expertise). Where is Anglo-Persion now? It is BP. Think about it.

This is a self-induced credit crunch then. I’d imagine the aim is to instil in the masses the fixed idea that money can’t be created from nowhere to finance govt spending (as it routinely is and very publicly was to pay for Covid) without there being a terrible price to pay. Destitution is our inescapable fate, therefore. A TINA for our times, then. More Osbornesque mumbo-jumbo, more economic voodoo from the high priests of finance, shaking their juju sticks, rolling their heads and speaking in tongues, all of it simple theatre to convince we lowly ignorati the gods of finance are against us and our fate cannot be escaped.

To which the answer, of course, is Japan, something we’ll have to be reminding everyone about at every opportunity.

I thought you said QE would never be unwound?

I did

And for precisely the reasons I note I very much doubt it will be for long

In other words, I will be proved right

UK has big ambitions for renewables. Scotland will build a load – needing circa £50bn of investment. One wonders where the money will come from, given…. & this is the kicker – renewables are a low margin business – regardless of what elec prices are doing at the moment. So if interest rates go up – what happens to large-scale investments that have lowish returns? I guess the “FID” (final investment decision) will be to delay. Dounbtless mental titans such as Sunak have worked all this out……..or…..perhaps not.

So, they’re talking about doing the wrong thing ‘righter’ yet again.

‘Unwinding’ is a typically technical word that does little to describe the consequences it creates.

Why not call it ‘undoing’ and be done with it because it sounds more accurate.

They would surely be better of doing PQE or GQE?

Former member of the MPC Kristin Forbes tried to justify quantitative tightening recently:

https://www.ft.com/content/c5d408e5-d52c-4b85-b82f-c88b764247de

Part of the justification for QT is ideological: according to Forbes it’s important for central banks show that QE is not financing government deficits, and part of the reason for this is that it’s important for central banks to be independent of government and that means they need to show they are not financing them.

Other than that, according to Forbes the reasoning for QT is that high inflation and growth and a low output gap mean monetary policy needs to be tightened, and it’s better to combine QT with interest rate rises rather than interest rises alone, with QT allowing more gradual increases of interest rates.

The article doesn’t really address how it could be possible to unwind QE without the negative effects on the economy of both the market response and the reduction of money in the economy. All it says is do it slowly so we can assess the damage as we go.

In summary, we need QT to satisfy central banker egos

You have just answered the question I was about to ask, namely “cui bono?” But I have always thought that the independence of central banks was something of an illusion. Could the BoE actually do anything momentous, especially anything as consequential as unwinding a significant amount of QE, without tacit government approval?

No, in a word

Although they will claim otherwise

But then they said they weren’t funding the government either when they glaringly obviously were

Blame it on Brexit. Blame it on COVID. Perfect time to hide contrary news.

Do I understand this right? Whenever a Qe Bond held by the BoE matures, the Treasury pays the capital sum to the BoE, cancelling the Bond. The Treasury is obliged get the money to do so by issuing a another Bond of the same value to the private sector. So unless the BoE simultaneously repurchases from the private sector the same value of Bonds, the debt that was effectively cancelled by QE is now reissued. Yes?

Re the first bit, yes

Re the second bit, yes

Re the third bit, yes

10/10? Phew!

Gold star!

Sorry but you are wrong and don’t understand how QE has been deployed here. In the UK, QE has not funded the deficit. The government has created new money by spending, it didn’t need “funding” . The BoE has matched gilt purchases from the private sector with gilt sales from the government – why? Who knows, I don’t think they do. IE no net money has been provided in any way from the private sector to government .

That claim is not true

It is your fantasy as to what could have happened

And I agree it could have done

But it did not

QE was used

I deal in realities

Should we not focus on one rotten part of the system but the whole system? Our current system leads us to over consume (if we have the money) and to pay little attention to the impacts our existence has on other species. I think Capitalism needs to go – it is not compatible with our continued survival on this planet. We are running out of time and this government is dancing to the tune of the highest bidder whether that is a Russian Oligarchs in London, media tycoons and public opinion that makes it back to Boris. These feel like very dark times. I will be out on the streets making my opinion known.

[…] By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK […]

While I don’t want to be an apologist for the government, QE had a practical benefit. With an unanticipated need to close down the economy due to a pandemic – as with the previous need to deal with the banking crisis – QE could be applied very quickly. Directing money towards infrastructure investment (ideally green), which I agree would be a much better way of stimulating the economy, has a long lead time.

Nevertheless, I would like to think QE isn’t a permanent approach that can’t be unwound: there really needs to be a way of transferring the money created to something more productive. The question is, would it be possible to unwind QE while balancing that with investment in the productive economy? That wouldn’t change the amount of money in the system, but it would stop it unproductively supporting high property prices – and by supporting economic activity might not crash the stock market which like it or not is needed for national prosperity.

(Not that I think that strategy would find favour with the current Conservative government, for whom stimulation of house prices seems their only idea for growing the economy).

Better taxation of wealth is now what is needed to unwind QE

………………..but instead they come up with NI increases under the lie that that is fairer when the rich can already absorb that cost better than those who have suffered austerity, lost income from Covid/BREXIT or on lower wages.

They should be clawing QE back from the rich alone as the rich benefitted most from it – and the Tories know this – as the BBC documentary made clear that was shared on here recently.

Richard, you have explained in a previous post why you think issuing Bonds remains a necessity. But do Bonds have to be tradeable? What are the pros and cons? Wouldn’t term deposits at the BoE do just as well?

Yes, they have to be traceable or they cannot meet the need of the financial markets and w3 need those markets

Hi it feels unlikely to me that you are censoring or blocking me as you have posted comments from others which are borderline abusive whereas mine has only been (I hope) constructive and questioning. I find your blog quite unique in its addressing of the issues around MMT/QE etc – I think you have said recently you are also on a bit of a journey to really understand QE/asset swap arguments etc. Me too. So I would welcome further debate on it and am rather disappointed that my reply to your post calling my post a “fantasy” was not put up. I don’t have a copy of it but in summary:

There have been (for all practical purposes) no NET new holdings of gilts in the UK by the private sector since the pandemic. This is a fact and I challenge you to disprove it. Therefore from a NET position, the government has not taken any cash out of the private sector and replaced it with gilts. Private sector holdings may have changed in maturity or being index linked etc but the NET position is unchanged.

The BoE purchases private sector gilts in QE from the private sector. The Treasury sells gilts to the private sector. The numbers are identical (see your original chart). As you often point out, the BoE and the Treasury are the same entity and would be consolidated under UK GOV PLC if it were a private company.

So if the private sector has not provided any NET new money to the government it is clear that the only place any new money has come from is by UK Government expenditure (from the BoE) to the private sector (as always).

Therefore QED has not funded anything. It’s an asset swap. QED.

If I’m wrong i would really, genuinely, like to know where the flaw in my logic is. Calling it a fantasy isn’t a logical argument really is it?

I wonder if you will post this in order for others to weigh in and point out where I am wrong if you can’t!

Your aggression makes you look like a troll. I am still not sure you are not.

Your point holds broadly true since 2020

It did not from 2009 to 2016, at all

And since all transactions are asset swaps what does your claim mean? Fundamentally, it is meaningless

Richard, I’m sorry if my post(s) came across as aggressive – it was/is not intentional. You offer quite robust and terse responses to posters yourself, but you cover a lot of ground, so fair enough. I don’t really know what a troll is so I cannot answer that accusation. I am genuinely here to understand more – there are few forums which offer your level of analysis and discussion and whilst I do not agree with many of the things you say, that’s fine because that’s how we can all learn, through robust but respectful and constructive debate.

I was quite specific in saying that my comments only applied re the pandemic QE whereas, as you say, the GFC QE was different.

You ask what my claim means. You said : “QE was always intended to push investor funds into riskier assets, and this has clearly happened,”. This was true pre-pandemic but hasn’t been true of the additional QE since the pandemic (there was roughly £450bn of it before the pandemic and about £900m now I believe I am right in saying). So the c.£450bn of money created by government spending is in people’s and company’s bank accounts rather than in pension funds, insurance companies. Public sector deficit = private sector surplus. You point out that all transactions are asset swaps but if you follow MMT’s reasoning, government spending creates money and only taxation destroys it (as I think you have highlighted, taxation doesn’t “pay” for anything in MMT’s framework so it’s not a swap of any kind, it just gives value to the currency). If the BoE were to ever sell a gilt it holds in the APF back to the private sector it is as you say, an asset swap and no “money” has been removed from the system (plus the gilt will revert to reserves/money when the Treasury redeems it).

Put another way, if QE did not exist, would you need to have invented it in the past 2 years (at least in the UK)? The private sector and QE did not “fund” government deficit spending during the pandemic – we are agreed on that. The BoE could have just credited all of the pandemic expenditure into the private sector’s bank accounts in exactly the same way as it did. We would have records of £450bn of new money going into the private sector, created by the government/BoE. It isn’t “owed” to the government (“the government neither has nor does not have money”) – the government decided it was useful to pay people to do something (eg stay at home, be a nurse, etc). However, you might want to take some of that money out of the private sector for various reasons (inflation eg) at some point. But with a fiat sovereign currency it has nothing to do with repaying debts or financing further expenditure when that “debt” is just owed to yourself (as a government). The one thing that perhaps QE gives you is a £900bn tally (in its gilt holdings) in the APF of how much new money the government has created in excess of how much it has destroyed in tax receipts. Given that no-one believes this will ever be unwound (see the House of Lords report which says there are no examples worldwide where it ever has been) what is the point of it? As you point out, if the government carries on in its belief that it needs to fund its activities through gilt issuance as well as taxation then you don’t really want the BoE competing with itself in gilt sales…

Which brings me to your point on funding :

The NEF website you referenced also has in Nov 21: https://neweconomics.org/2021/11/public-debt-and-debt-servicing-costs-the-nightmare-that-never-was, the following : “…in its recent £6 billion sale of green gilts due to mature in 2053, the UK Debt Management Office (DMO) received £74 billion in subscriptions. That is the DMO got 12 times the amount of bids received in the Treasury’s auction versus the amount it was selling – no shortage of demand there”. So whilst sharing your concern about whether the appetite is there once the BoE indirectly stops funding the gilt purchases by the private sector, nevertheless it seems that the private sector has lots of cash (around £450bn of it perhaps?) (You said: ” The £140 billion required in the coming year has to come from somewhere within the financial system”).

So let’s summarise

Money was created

The money used to create it was called QE

And the government does owe it – because all money is debt based – MMT says so – and this is debt based money in commercial bank deposit accounts with the BoE

I am really not sure what you are arguing about

Might we de3al with facts, not Nill Mitchell driven pedantry, please?

So QE created money

And

Government created money

And…

Saw it was good?

OK, perhaps the IMF can explain what I am trying to say rather better than me in this paper (Jan 13th 2022) : https://www.imf.org/-/media/Files/Publications/DP/2022/English/MFDNTHCEA.ashx

It’s not a bad read. A fair summary of part of that paper is that QE – if never unwound (which I believe it will not be) – is the same as Monetary Financing (MF) which is perhaps what I’ve been trying, rather badly, to say : “To better understand the properties of MF, it is helpful to compare it against QE. Monetary finance and QE share several common features. For example, they both aim to provide macroeconomic stimulus in a liquidity trap and they both involve an increase in the monetary base. The key distinction pertains to whether the initial monetary expansion is expected to be unwound in the future or if it is perceived as permanent.”

If you say QE creates money (by the state buying gilts and crediting reserves) then you must agree that gilt issuance destroys money (by the state selling gilts and decreasing reserves). I’m not sure that’s right.

I didn’t know that MMT says all money is debt-based – can you point me to this please? Warren Mosler describes money as “tax credits”.

Without descending into pedantry my point is that whatever you want to call it (QE, MF, Government creating money by spending, whatever), if you take a step back and look at what has happened, the state has expanded the monetary base by around £450bn over the last 2 years, following an expansion of £450bn after the GFC. Whether that is a bad or good thing or what if anything to do about it is best addressed by looking at what is going on in the economy and targeting inflation and full employment by social and fiscal policy, not by worrying about numbers on the BoE balance sheet and politicians from both sides recycling tired and clearly wrong arguments about how the money system works in an evolved, not designed, fiat system of money and not trotting out stuff about austerity and how we can “pay for things”.

I am bemused

I say money is created

You say it is

I say let’s deal with substance

It seems you do

What are you wasting my time for?

What are you arguing about?

I genuinely apologise if I have wasted your time, I guess I’m just trying to understand it all.

Thanks for engaging.

Trying is fine

But you started telling me I got things wrong and I have no idea now what they were

You said QE funded the deficit.

I said you had that wrong as the government didn’t need any funding because it created the money : “quantitative easing has been funding government deficits” is what you said.

Whether you call it MF or QE is irrelevant and a sideshow. The government creates the money. It could have done exactly what it did without the QE mechanism. The QE mechanism is a distraction.

Shall we go round again? 🙂

No

The process of money creation used was called QE

I am bored by this

You are a troll