There remains much discussion of inflation in the media, fuelled by central bankers and others. Yesterday Andrew Bailey from the Bank of England was before parliament intent on fuelling speculation that interest rates are coming, and soon.

But why? He has already admitted that the phenomenon we now face is temporary. Around the world the impact is very largely created by increased prices of durable goods, from cars onwards, and that is due to supply chain issues. More routine goods are overall seeing more balanced increases (and yes, I know there are exceptions). And even Bailey has accepted that there is nothing that an increase in interest rates can do to solve a supply chain blockage.

Instead, two other phenomena are being seen. One is that people are deferring buying consumer durable goods - hence the greater than expected slow down in the economy when it was forecast to be growing rapidly. And second, the supply chain is sorting itself out.

The latter is undoubtedly true. Two indices show this. The Baltic Exchange Dry Index, which tracks iron ore, coal and grain cargos, is falling:

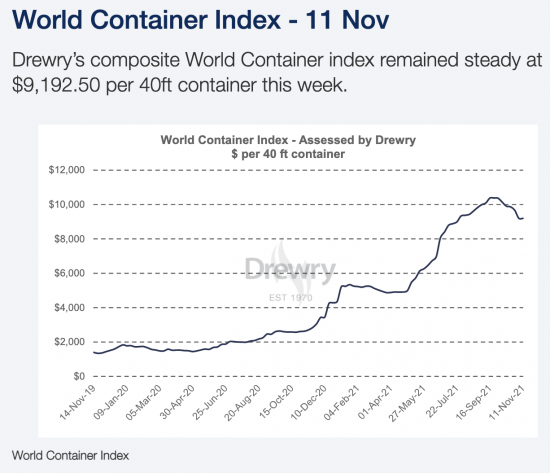

So too is the World Container Index:

There must be a reason for this. The obvious one is that the demand for shipping is falling as the logjams that were created by the world economy reopening are resolving themselves, already.

So, people have smooth their purchasing to counter inflation, and shipping prices are falling as the problems there resolve.

Now, what is the case for an interest rate increase Andrew Bailey, apart from, that is, the perennial banker desire to profit at the expense of others by charging for a product that cost nothing to create?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Andrew Bailey is a puppet it seems to me, sent in once again by his unseen backers to worry Parliament – and lets face it – they’re such a weak bunch and not particularly bright either so he’s in with a good chance.

Still, we know from reading about the MPS just how persistent and persuasive these Neo-libs are don’t we?

Bailey’s statement yesterday suggests a medical problem with brain function! I am worried about inflation so I almost voted for a rate rise, which I will do next time!!! There was no need, of course, to explain how this particular cash gift to the banks might affect inflation. When you have a wand, all you need to do is wave it.

What happened to the food shortages which you promised us would get worse?

The government let in EU workers

When the facts change I change my mind

What do you do?

Those food shortages may yet well be on their way. When the import controls agreed to in Johnson’s Magic TCA kick in, and they’re due to start being phased in from January 1st, how long will it be before EU companies, frustrated by the expensive overcomplexities of selling to Britain, remember they have 26 other EU countries they can sell to easily and cheaply, and give up bothering with Britain at all?

‘Not Hungry; (or should we call you ‘Not Informed’?)

Where have you been?

I’ve seen shortages in the supermarkets and elsewhere since BREXIT.

This week in the East Midlands at least, fixtures that should be full of crisps and snacks have been empty; prior to that it was flour and its derivatives, prior to that it was yeast – the list goes on.

All this stuff is ordered as it goes through the till.

Thins are NOT back to normal. No way.

Beautifully succinct Richard!

This is the right data to look at. The jury is still out but the interpretation that you give is by far the most likely.

Having worked in logistics for several decades I know from experience modern supply chains are built for financial efficiency rather than resilience. I say ‘financial efficiency’ somewhat ironically as it’s short term financial efficiency as there’s always more to pay in the longer term. I used to build contingency plans for just such disruption eventualities and was constantly criticised for ‘pessimism’ and ‘unnecessary increases in marginal costs’. But of course when the inevitable happened and the plans were activated, almost everyone had amnesia and said what a good idea it had been – until the next time.

There is a need to delve more deeply into supply chain risk management, resilience and local sourcing wherever possible, but that need a great deal more systems thinking in supply chain management which, although it is happening, seems to be a glacially slow process.

🙂

The wise are rarely thanked

In my industry, we are still facing big shipping delays at a local and international level.

Airfreight back to the UK from Shanghai, as an example, is currently taking 14 to 17 days. It normally takes 3 or 4. A week or so of that is getting it processed through Stansted due to a chronic shortage of staff. Another 4 to 6 days is actually getting it on a plane in China.

Some areas of global transport may be returning to normal, but others are getting worse by the day, currently.

I am sure you are

But the rates are falling – that is all I am saying

That will then feed through