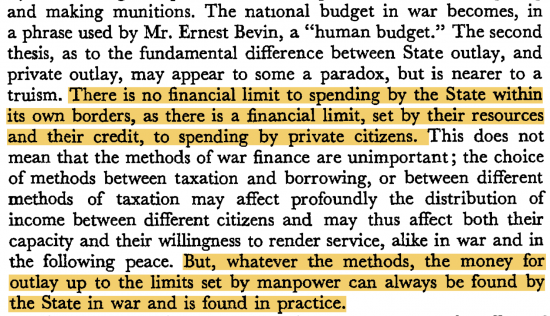

This paragraph is in William Beveridge's 1944 report on full employment, admittedly from the 1960 edition:

I have highlighted key sentences, but those in between are fairly key too. This is modern monetary theory, written in 1944.

The references to the financing of the war clearly references Keynes' work on that issue, without saying so - and it is right.

However, the fact that the other paragraphs so clearly put forward the straightforward view that government is not a household and that the money for full employment can always be found by any government that has an economy not enjoying it is vital.

I suggest that Labour should take note.

The SNP should too.

Great work by Malcolm Reavell in Modern Money Scotland to find this.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Richard,

Yes, very revealing that this was in 1944.

It was a Tweet by by Thomas Fazi that led me to it: https://twitter.com/battleforeurope/status/1454096110771916801?s=20, so credit to him!

cheers

Malcolm

Thanks!

I too am indebted.

But the implications are that it is only worth having such Government spending is when there is war.

So what about during the peace?

It’s just a stupid isn’t it to ignore the fact that, that which can be spent on war to ‘protect our way of life’ cannot be spent on the means to improve ‘our way of life’?!

I mean come on…………………………….! This is how we are ruled whether they be Tory, Labour, Lid Dem, SNP or Green it seems to me.

Politicians will only ever get my respect when they accept things like this. Instead of considering this essential question, what we get instead is Neo-liberal mythology (laissez-faire static society basically, dominated by the perma-rich) or what I can only be described as upper class Catholicism – that being poor and suffering is the only way to redeem yourself in the eyes of God and its good for you and your soul.

I really have become indifferent to many modern politicians or their prospects and they must consider me – and a growing number of people of all backgrounds – as a mortal enemy.

As far as I am concerned too many politicians are actually killers.

They want to kill me (by not providing me and mine with decent healthcare, or decently regulated goods and services).

They want to kill my hope with their heartless and stupid policies as well as their domination of the bent media.

They want to kill my income, by cutting my pension and the wages I signed a contract for in the public sector (but behave like CEO’s and award themselves pension and wage increases).

They want to kill my children’s prospects by reducing my ability to provide for them as well as making it harder for them to study.

They want to kill the planet we live on because they do not want to take responsibility for saving it.

So now my thoughts turn to self defence?

Tell me oh wise blog: How should a society protect itself from this political class of mass murderers?

Can I just mention that he says the condition applies in peace too…..

Modern politicians cannot take heed of this because (and I hate to say it) von Hayek’s ‘Road to Serfdom’ has won the day.

And thus the State is gelded, so that vested interests can have the world THEY want.

It’s as simple as that.

But in saying that – this at least tells us where the battle is.

If we had the money, we could have loads of this section reprinted and sent as greeting cards to all politicians in the UK every month until they learnt the truth of the matter. Lions Led by Donkeys could get in on the act too.

Do Labour, or anyone else, have the courage to revisit Beveridge, interpret his postulates for today, including of course the implications of the above highlights? Or are they satisfied that the “5 giant evils” have been defeated? They act as if they have been.

And they are wrong to do so

Beveridge’s understanding was illuminated by the crisis of war; an understanding that should remind us that understanding of money need not be modern. May I observe here that the most important critical exposure of the failings of modern macroeconomics, and the development of a far more relevant (i.e., ‘real’) alternative to either Keynes or Monetarism, that I know of; was devised by the American economist Morris Copeland (1895-1989); so broadly a contemporary of Beveridge. Copeland challenged both neo-Classical and Monetarist theories for the inadequacy of their empirical scrutiny of the data, and for their reliance on abstract, over-simplified dogma. He developed a Funds Flow or Money Flow model of total economic activity in 1949, that more accurately represented real macro-economic activity, but although not complete, revealed, even in the unaccounted summed discrepancies it produced, the broad areas; where the extremely large elements of economic activity fell that were simply not accounted at all for by Keynes or Monetarism’s weak, over theoretical macroeconomic formulae that did not adequately acknowledge the nature of money flows. Minsky was, I think a disciple. Fortunately there are some modern disciples of this school, especially in the US.

I should add that his followers have increasingly emphasised a critical aspect of money, completely overlooked by neo-classical and neoliberal economics; the recognition that an essential element of money is that it is a form of IOU; there is a debtor and creditor. The element that is overlooked by mainstream economics is double-entry book-keeping. The modern followers of Copeland and Allyn discuss monetary economics within a framework of the principles of accountin.g

This is an emphasis of MMT as well

Very interesting John.

I will dig Copeland out – any obvious resources on line you could through my way on here?

Minsky wrote ‘Papers Concerning Some Reinterpretations of Keynes’ which extensively discusses Copeland, but it is not his most accessible text.

I think the best way to approach this (unless you are a historian), may be to explore the modern economists who are following the legacy of Copeland, Allyn and Minsky, and are developing its application in modern money and banking; they have much to offer. Here I would advise, above all reading Perry Mehrling, a brilliant economist at Columbia University, who writes with a simple, pellucid clarity of thought I can only admire. Mehrling is also a natural communicator. Just do a search.

Enjoy.

Thank you John. I will check out Mehrling.

Steve Keen of course has drawn heavily on Minsky in his work and his approach to agent based modelling.

It’s a slight tangent but I’d also recommend the work going on at the Santa Fe Institute and people like W Brian Arthur and Eric Beinhocker, applying systems thinking and complexity to economics. Both integral to Steve Keens work.

The more widely one reads around economics, the more one concludes that the prevailing neoliberal economics are about as flawed as pre-Galilean beliefs that the sun revolves around the Earth. They are only sustained by the political power and money that benefits from what is just a collection of ill founded beliefs.

I struggle to see how the major challenges we face such as climate change and inequality can be properly tackled, until that belief system is over-turned.

PS Noting that Beveridge was a Liberal, the LibDems really ought to be paying attention – not just Labour and SNP.

Indeed

And I admit I adapted one of your paragraphs to be a tweet

You can send your bill…

One of the problems that MMT faces (or a modern Beveridge) is that there are no billionaires ready to give it support and found (or fund) an “MMT Mont Pelerin Society” and capture the intellectual and political zeitgeist and inaugurate a paradigm shift. It just isn’t in the interests of the money/power brokers to do so, because it would make them redundant. So they just fund and promote neoliberalism and neoliberal politics because doing so rewards them handsomely.

Warren Mosler had helped….

I’ve been listening to the radio today about COP26 and it’s already struck me about the use of language.

It seems that the language over money to pay for change is couched in terms of debt and ‘reparations’ and even tax.

I find this very worrying.

Tackling global warming should be seen as an investment in our future. Invest to save – literally in this case.

Instead, the language is negative and even punitive.

We need to monitor this because as a PR exercise it’s a disaster. There’s no way people will be won over if is depicted like ‘pay back time’.

Agreed….

Very useful stuff .

Am trying a one page draft economic manifesto for local Labour and maybe more – under the ‘Anything we can do, we can afford’ heading. Labour have to at least look at this. They are making so little impression at present.

Yes the system looks completely bought and sold – but there are internal contradictions – hence these tax cutting ideologues having to raise taxes to try to keep the show on the road – and safe for more exploitation. Ten years wrecking the economy – and now planning ten more to dig themselves and ourselves out.

But it is difficult to have much hope – when the climate change crisis and pandemic are run as PR programmes – with almost nothing of the well understood practical programmes which would have a chance of working , being done.

Thank you John Warren.

I looked at Wikipedia last night – not very scholarly I know – but I think they summed up Copeland very well in that he had a observational approach to economics (based on science of observing cause and effect rather like Newton’s first thoughts on gravity) rather than doing what the Neo-libs did (as accounted in detail in the book ‘The Road to Mont Pelerin’ which I am still digesting) where they simply created laws or rules based on (from what I can see) – no evidence whatsoever.

Copeland also had what I would call ‘depth of field’ (photographic term from one of my hobbies which is about ensuring that your pictures are rendered sharp and in focus where it matters) in his subject – he was able to join up micro with macro and see how one related to the other in reality (his money flow concept for example). To say he was grounded is an under statement. I look forward to getting to know him better.

I’ve been reading von Horn’s chapter about how the Neo-libs dealt with the concept of monopolies in ‘The Road to Mont Pelerin’ and this chapter (Chapter 6) to me shows us just how beholden the MPS was to its funders like the Volker Fund, and why we should not be taking them seriously. And I’m not guided by von Horn’s critical analysis either- you only have to read what people like Aaron Director and Freidman say in their own words to realise that something really dodgy was being created here.

In point of fact for example, the ‘argument’ that Government regulation of monopolies could not be relied upon because Government allows itself to be influenced by monopolising corporations is just a circular argument for actually doing nothing – and it’s all the Government’s fault by the way. Those poor corporations just can’t help themselves apparently.

It’s confections like this that you can link to people like Timothy Snyder and his concept of the ‘politics of inevitability’ – that nothing indeed can be done. And when you are deliberately giving contradicting advice and information (agnotology) from the pulpit of a learned institution like a university, it’s no wonder nothing gets done.

And to think that our politicians are influenced not by Copeland but people like Friedman. It’s all predicated on lies as far as I am concerned.

I used to think that to be Government Minister or just an MP you had to be really clever because running the country was a serious job for seriously clever people so I discounted myself.

I was wrong. I made a big mistake. Too many politicians are involved because of what they believe and not what they know.

No wonder we are in a mess.

And unlike others who blame immigrants, Europe, Muslims or the Jews or their neighbours I’m not falling for it. My eye remains fixed on the cause. It’s those who simply do not read or study the art of managing a country for the benefit of everyone.

We are not ruled by the best of us anymore; more likely we are ruled by those with the biggest mouths, deepest pockets, best suntans, photogenic presentation, thirst for power and the smallest brains to name a few. They all might as well be living on Mars for the good they are doing us at the moment.

Never believe those in charge are more clever than you

Some may be

Most are not

BS is their major skill

‘Never believe those in charge are more clever than you’

Well I did.

And boy am I pissed off about it.

🙂

https://ieor.columbia.edu/files/seasdepts/industrial-engineering-operations-research/pdf-files/Mehrling_P_FESeminar_Sp12-02.pdf

The opening to Chapter 21 of “The Financiers and The Nation” by Labour MP Thomas Johnston, published 1934:

“IN the summer of 1931 a Labour Government

suddenly sagged at its knees and fell dead. High

Finance had killed it as High Finance will kill the next

Labour Government, and the next again, unless be-

times the creation and withdrawal of money credit

comes to be generally regarded as a State Service,

even as the Navy is regarded as a State Service, and

one which the Nation would no more dream of

farming out as a job line to a company promoter, than

it would dream of farming out the Navy.”

The Labour Party has known this stuff for a very long time but has dropped it or forgotten it or lost the will to fight.

Definitely distracted.

LOL!!! In the US it’s a matter of public record that the FED funds all government deficits but this seems to go completely forgotten.

https://fraser.stlouisfed.org/files/docs/historical/house/1947hr_directpurchgov.pdf

While the whole section is worth a read, on page 8 former FED Chair Mariner Eccles flat out says… “If Congress appropriates more money than Congress levies taxes to pay, then, there is naturally a deficit, and the Treasury is obligated to borrow. The fact that they cannot go directly to the Federal Reserve bank to borrow does not mean that they cannot go indirectly to the Federal Reserve bank, for the very reason that there is no limit to the amount that the Federal Reserve System can buy in the market. That is the way the war was financed. Therefore, if the Treasury has to finance a heavy deficit, the Reserve System creates the condition in the money market to enable the borrowing to be done, so that, in effect, the Reserve System indirectly finances the Treasury through the money market, and that is how the interest rates were stabilized as they were during the war, and as they will have to continue to be in the future. So it is an illusion to think that to eliminate or to restrict the direct borrowing privilege reduces the amount of deficit financing. Or that the market controls the interest rate. Neither is true”

Note, the FED is obligated to maintain stability in the interbank payment system so the FED must ensure there are sufficient reserves at all times and therefore is always adding reserves (absent QE, which is just pre added reserves) when the Treasury auctions new bonds. If the FED does not add the funds to the market it loses control of its target rate and eventually risks instability in the interbank payment system. The end result is that the FED funds all deficits indirectly. It’s just an illusion that they are borrowing funds.