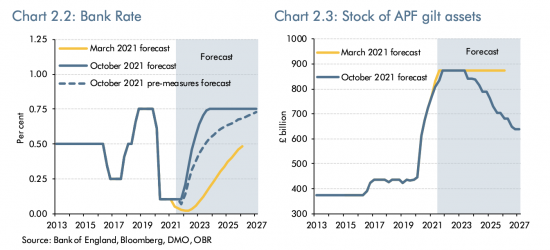

These charts are in the Office for Budget Responsibility forecasts that support the budget:

Interesting that bank rate is going up by much less than the sum Sunak referred to in the speech, and maybe later.

But the really interesting figure is on unwinding quantitative easing. Apparently, the economy is going to grow so much that it will be able to absorb more than £200 billion of quantitative easing reversal, which we know will take money out of the economy, reduce share prices, reduce confidence, force up interest rates and reduce real demand in the economy. none of which is reflected anywhere else in the forecasts made.

If you can believe that you will believe anything. I do not. This is yet more magical thinking.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I don’t see that as reversing quantitative easing. Maybe you do, but you would need to explain why.

I see it as not rolling QE over. In other words, when the bonds bought by the BoE expire then new bond purchases are not made.

This is not the same as the BoE selling bonds back.

That is described as reversing QE

Sorry,I used the term for a reason

If the matured QE bonds are not rolled over, how does the Treasury “fund” the repayment?

Presumably a significant reason for unwinding QE is the stinging criticism from the the House of Lords Economic Committee report in July,

entitled “QE is a REALLY BAD thing and we hate it”

https://publications.parliament.uk/pa/ld5802/ldselect/ldeconaf/42/4208.htm#_idTextAnchor069

which stated amongst other things, that-

“many market participants said that they believed the Bank of England had used quantitative easing primarily to finance the Government’s deficit spending. If such sentiments continue to spread, the effectiveness of the Bank’s policies will be threatened severely.”

“We are concerned that the scale of quantitative easing exposes the Bank of England to political pressure not to raise interest rates if rising inflation does not prove to be short-term as is forecast by the Bank. The design of the quantitative easing programme and the size of the Bank’s balance sheet…..has increased the sensitivity of the public finances to a substantial rise in debt servicing costs if the Bank needed to raise interest rates to control inflation. This will test the Bank’s independence. If it does not respond to the inflation threat early enough, it may be substantially more difficult for the Bank to curb it later. Failure to pass this test would damage hard won trust in the Bank of England’s ability to achieve its mandate.”

The chair of the Committee, Lord Forsyth, said “QE is a serious danger to the long-term health of the public finances. A clear plan on how QE will be unwound is necessary, and this plan must be made public.”

They make it sound as though if QE is not unwound, Armageddon will surely follow. And if QE IS unwound, Armageddon will still probably follow , so we’re f****d anyway.

The one thing that nearly all of the committee’s witnesses agreed on was that QE provides liquidity to stabilise the financial markets, and it has kept interest rates low . But on the downside, it has created increased wealth inequality. Any other effects it has had seem to be hard to discern. No doubt most of what this committee has to say is gold-standard nonsense, but a detailed understanding/critique is beyond my pay grade. As I try to be a lay proselytiser for MMT , any responses/explanations that counter the dire warnings from this Committee about QE from you good people would be much appreciated.

Sorry, but I have not got the time to respond

Anyone else?