The Banque de France has issued a working paper on modern monetary theory (MMT). In the introduction to it they say:

In the last few years in the U.S. and especially since the publication of Stephanie Kelton's book, The Deficit Myth (Kelton, 2020) in Europe, the so-called Modern Monetary Theory (MMT) has been gaining prominence in the media and the public. This paper exposes the main proposals of MMT in the light of their doctrinal sources, also confronting them with economic facts and with other currents of economic thought.

Their conclusion is:

Overall, it appears that MMT is based on an outdated approach to economics and that the meaning of MMT is a more that of a political manifesto than of a genuine economic theory.

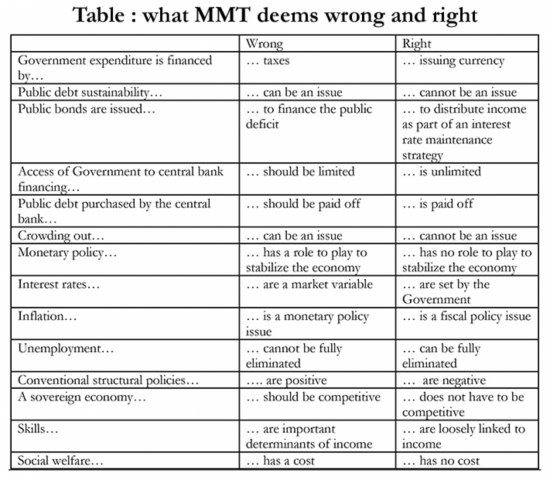

They then produce this table, which they say summarises the differences between MMT and what they consider to be mainstream economics:

I have read the paper. The table is a good summary of the naive arguments within it. In a world where the authors believe (incorrectly) that argument can be summarised by polar opposites they create caricatures that are false, not only about MMT but also about the system they claim to support.

For example, as a matter of fact taxes very clearly do not pay for all government spending, despite their claim that it does in their world view. Borrowing and QE clearly do as well, and neither shows any sign of being unwound.

There is also not a shred of evidence that crowding out is an issue in a world where there is a glut of savings.

Nor can anyone suggest how public debt purchased by a central bank might be ‘paid off' when the credit balance on the central bank balance sheets after that debt repurchase does not relate to public debt anymore, but does instead represent bank deposit accounts from clearing banks, the redemption of which requires the cancellation of the money created that these balances represent.

And, as is apparent from the most basic knowledge of the economics of inflation, supply side inflation cannot be addressed using monetary policy, although latest announcements from the Bank of England show that they do not know that.

Similar critiques of the other claims made for neoclassical thinking could be offered. At best these claims are glib. They are all caricatures. Most are obviously wrong.

So if they could not get their own side of the argument right did they come close to the truth with MMT? They did not., of course. That is very largely because they treat issues as if they exist within a silo. So the role of tax is completely misportated because not only is the wrong silo selection criteria used, the relationships between silos is ignored.

To expand in this, that tax is used to cancel money creation (which, as a matter of fact takes place) to limit inflation as part of an overall policy of fiscal management to determine optimal levels of economic activity to achieve desired social outcomes such as sustainability within the constraints of the actual resources available within the economy is ignored. That type of integrated thinking cannot be fitted into their silos.

That is deeply telling. Using reductionist, rather than systems thinking, the authors reveal a profoundly Cartesian view of economics, using a faux-scientific approach which denies the integrated reality that the observable economy actually is coupled with a denial of the political reality of all economic decision making, including their own.

The authors use this useful blindness within their own methodological toolbox to justify their claim that MMT is a political construct. They do not see their own support for supposed central bank independence as another such construct that just happens to be intensely anti-democratic. Numerous other such comparisons could be made, so blind are the authors to their own biases.

What should be made of this paper in that case? It is best seen as little more than a puff-piece presented as if an economic argument that is intended to support the status quo against a truth so apparent that those seeking to maintain their grip on power must quite literally make up arguments to support their case that are so shallow they do in the process reveal the hollowness of their own ideas.

The opponents of MMT really have got to do better than the Banque de France do if they are to counter its arguments. This was a lazy, ill informed and so blatantly biased piece of work that the Banque should be deeply embarrassed by the work of its chosen authors.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I agree that the MMT rejectionists are deeply flawed in their approach.

That unfortunately will not stop their lies from being spread and adopted elsewhere. They’re also lying in that they say that MMT is gaining popularity. Is it? I don’t think so, despite the best efforts of Richard M and Co.

MMT is only outdated if you believe that money is an entirely market led, private matter. MMT goes against that sort of thinking – the thinking of the times we are in. That is the only way in which MMT is out of date.

MMT is out of date /out of step with the BELIEFS (false consciousness) that dominate economics – not the facts which remain the same.

That does not make the Banque de France right – not at all.

Thanks

The Banque de France is desperate to mask its role in propping up a right-wing government. They want to make out how important they are when in reality their role in economic management/policy is marginal at best.

It very much appears to be a strawman building and knocking down device based on Keltons explanation.

(Which seemed a bit light on tax in her Ted talk)

Macron is a banker and represents their interests and he is being prepped to move the EU away from its course and of course be re-elected to deliver the privatisations in France that have worked so well in the U.K. – Not.

Let’s see what her direct response will be.

I am reminded of the book The Structure of Scientific Revolutions which popularised the term paradigm shift. The author, Thomas Kuhn, concluded they tend to happen when the ‘Old Guard’ retire or die.

My understanding of it is when people have taken years to reach their status of expert, someone who says ‘that`s not right’, is going to be an emotional challenge as much as an intellectual one. Humans defend their ideas like territory. The truly open minded who are willing to change their mind because of the evidence, are probably rarer than we imagine.

I so agree with that

Planck’s principle is the view that scientific change does not occur because individual scientists change their mind, but rather that successive generations of scientists have different views.

Informally, this is often paraphrased as “Science progresses one funeral at a time”.

It is quite difficult to progress one bank funeral at a time …..

In 2008 they tried to do all the bank funerals simultaneously …. and we still ended back where we started…. with state-backed Neoliberalism this time.

I so agree too.

In my line of work – housing development – we have been under pressure to complete properties before the end of this quarter.

One scheme will not finish in this quarter and because of that the recriminations have already started from top management.

It is simply self-defeating because the reaction demands that we ignore reality (supply chains failing for example and staff shortages due to Covid). And if they ignore reality they think it gives them the right to condemn and harangue people just for the sake of it.

So what happens next time is that when SMT ask about progress, the people delivering – scared of not being able to speak of reality – tell lies instead, and things get worse as a result, for which they will be further condemned. It’s Kafkaesque!!

What is being encouraged is lying, disinformation because of the fear of telling the truth.

I think that something similar exists in most economic discourse these days.

I think something like this works in academia

Pilgrim: I would like to reiterate what you say; in my experience with a large multi national company; I could write pages about what the board would say to its workers and when targets were never met the workforce paid by losing their jobs, although the company still made profits.

But in this one instance which is typical of their attitude, the board decided the workforce should work a 12 hour shift system, and after the workers rejecting it twice before they made an ultimatum of disinvestment if it wasn’t finally accepted. This system was to make the workforce more flexible and increase output etc, whilst workers told them when you make ice cream, people buy when the sun comes out and stop when it goes back in, during high demand periods. so to be flexible you need workers to be available at weekends for overtime etc., in a 12 hour shift system they work rigidly to scheduled work patterns, whether the sun is shining or not. You will no doubt guess how it all turned out.

Needless to say they did not listen to people with decades of experience in the industry, but rather listened to consultants who hadn’t got a days experience in Ice Cream production. When modern management fails, lying becomes endemic, almost expected.

The real problem is whilst workers themselves know what is happening around them, they are too frightened to put their heads above the parapet for fear of being victimised and sometimes even deny what they see with their own eyes.

in Mrs. Keltons book she writes ” MMT does not come with a prepackaged set of policies to be rolled out across the global landscape. It is first & foremost-a description of how a modern fiat currency works ”

the banque seems to have deliberately misread her book .Rather than produce the clumsy table, a serious critic would have taken each one of her myths in turn & explained to its readers WHY she is wrong

Agreed

I’ve not read the whole thing but the table seems very odd. They create a straw man to know knock it down, but don’t recognise that both “right” and “wrong” columns are straw men (simplifications at best). And they contrast “should be” with “is” in a couple of places, rather than “should/should not” or “is/isn’t”. You can have “should be” and “is”. at the same time.

Who do they think sets the base rates? The market, or the government (or its agent, the central bank)? Sure, the market adds a margin, but it starts with something outside the market, which to be fair responds to market information but also political pressures.

Compare Germany to China. Does a currency have to be strong or weak for economic success?

The authors seem to be reasonably experienced economists. Perhaps the Banque should be encouraged to commission another “working paper” (or someone else – hint – should publish an academic paper) as a rebuttal.

Time…..time….

Working on about 9 papers right now, which is a bit crazy, and more are beginning

Not all for journals by any means, I admit – but in early project stages that’s what happens

You see it is obvious. When the central banks meet up to set interest rates they are only copying the market rates. That is why central bank rates are 0, mortgage rates are 3% and credit card rates are 15%.

Only why this makes sense is that credit card and mortgages are not markets according to the BdF. So where can I find these 0% market rates? Banks who copy rates from the central bank!

Respectfully, you have it entirely wrong

You think that a credit card deal – where the rate reflects risk of default not the time value of money – define actual interest rates

No, they are defined by a central bank that can tell banks what it will pay on more than £900 billion of funds

Sorry – but if you think a credit card trumos that you have not worked out the political economy of this

It puts me in mind of John Kenneth Galbraith

‘Faced with the choice between changing one’s mind and proving that there is no need to do so, almost everyone gets busy on the proof.’

Very good

I started reading about MMT around 2010. The fact that banks feel obliged to publish anti-MMT ‘working papers’ is real progress. MMT is an idea that will not go away. We all know that reality will prevail, history tells us that.

Agree a full rebuttal would be very useful, but time consuming.

So in the meantime perhaps just an additional column called, oh, I don’t know…maybe “Bollocks”?

Would fit nicely with the title of the Table

“So in the meantime perhaps just an additional column…”

1) Taxes give value to issued currency.

2) Public debt can be an issue if the debt is in a foreign currency. Inflation can be an issue if there is too much total spending ,ie not just by govrnment, relative to the level of taxation.

3) MMT says the central bank is part of government. It can issue currency without limit but this does not mean it should.

4) Public debt purchase by the central bank is simply an asset swap of one type of IOU for another.

5) Crowding out cannot be an issue if Government controls interest rates sensibly.

6) Monetary policy has a small role to play. The Govt needs to regulate bank lending for example.

7) Govts have the power to override the markets on interest rates.

8) Inflation can be caused by either too lax monetary or fiscal policies.

9) Unemployment can be eliminated only with the introduction of a Job Gurantee.

10) Conventional structural policies …are positive ….are negative ?? Not sure.

11) Co-operation with trading partners is better than outright competition.

12) MMT recognises that, in a market economy, highly skilled individuals, for example Lionel Messi at football, will always earn more than those with lesser skills.

13) MMT does not suggest there is no cost for welfare. This is measured in terms of the real resources diverted to support those who need them..

Thanks

Appreciated

The Banque de France doesn’t run the French currency any longer. I’m not sure why it even exists. If there is only one currency in the Eurozone shouldn’t there only be one central bank with perhaps a few regional offices? Why does each country still have their own?

This a genuine question BTW. I don’t know the answer.

So maybe they have forgotten most of what they would have known at one time?

They probably haven’t forgotten everything such as that the central government, but only if it is currency issuing, does set interest rates. Anyone can see that this is what has happened as a result of the QE program.

I’m not sure why they think MMT suggests social welfare has no cost. It obviously involves a government redirection of available resources so it must have a cost.

Mark Blyth highlights why governments choose austerity as a means of paying down debt, rather than taxing the rich.

Whilst these sets of videos may be slightly off topic, they do highlight the thinking behind the 1% and why the Bank of England is trapped into accepting their orthodoxy, please follow on from the first short video on the topics around Brexit: https://www.bing.com/videos/search?q=Mark+Blyth+Live+in+Athens+youtube&&view=detail&mid=59FCF0BE8483BC9C439B59FCF0BE8483BC9C439B&rvsmid=8E1E5DED2413FF0F2AA38E1E5DED2413FF0F2AA3&FORM=VDQVAP

Mark Blyth highlights why governments choose austerity as a means of paying down debt, rather than taxing the rich.

Whilst these sets of videos may be slightly off topic, they do highlight the thinking behind the 1% and why the Bank of England is trapped into accepting their orthodoxy, please follow on from the first short video on the topics around Brexit: https://www.bing.com/videos/search?q=Mark+Blyth+Live+in+Athens+youtube&view=detail&mid=8E1E5DED2413FF0F2AA38E1E5DED2413FF0F2AA3&FORM=VIRE

https://www.bing.com/videos/search?q=Mark+Blyth+Live+in+Athens+youtube&&view=detail&mid=59FCF0BE8483BC9C439B59FCF0BE8483BC9C439B&rvsmid=8E1E5DED2413FF0F2AA38E1E5DED2413FF0F2AA3&FORM=VDQVAP