The FT has this to say this morning:

The research is by Carbon Tracker and I cannot, as yet, find it on their site, but I have previously discussed it with them.

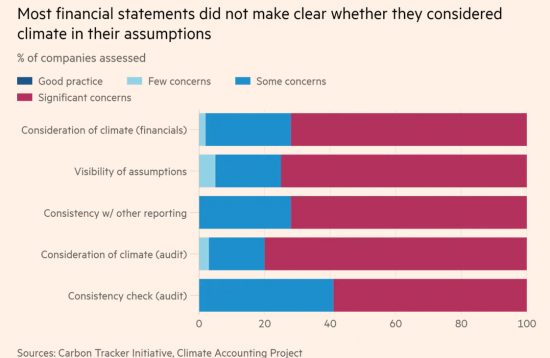

The message is clear and is summarised in a chart by Carbon Tracker:

Companies are issuing misleading accounts when it comes to climate change.

An announcement a few days ago from the International Federation of Accountants (IFAC) makes it clear that there is absolutely no intention to address this as yet by making it clear it is leaving all decision making to companies and their auditors for the time being.

The result is that on this biggest issue of our time the accounting profession is ducking out of responsibility despite having demanded the right to set accosting standards for the world. The similarity with its approach to tax and country-by-country reporting, where alternatives approaches have had to be taken to get the standard that is needed, cannot be avoided.

My resolve to work to deliver sustainable cost accounting increases.

IFAC said it in its statement:

Professional accountants have a critical role in

-

Aligning and integrating climate-related information and disclosures with company climate commitments, targets, and strategic decisions.

-

Quantifying, wherever appropriate, financial impacts of climate issues.

-

Ensuring climate-related reporting complies with reporting requirements without material omissions or misstatements, based on a company-specific materiality determination.

-

Supporting global initiatives to enhance climate and broader sustainability-related reporting through standards set by a new International Sustainability Standards Board (ISSB) that will address material impacts on a company's enterprise value.

I agree with the first three.

I am quite sure that the ISSB is not going to deliver the required standards, precisely because it is being set up in a fashion that ensures that its reporting does not overlap with that required in the numbers in financial statements.

The evidence shows that IFAC and the accounting profession are failing. There is a lot to do to address that failing. It's time accountants joined in.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] Read here […]

Of the 30% of companies that do include climate risk reporting in their accounts, which is the best in your view.

The reason I ask is that if Sustainable Cost Accounting is to progress it needs to show that it is better than the most obvious alternatives, which include putting CO2 in prices, and the best climate risk reporting already out there.

The best climate reporting says how many emissions there are

Carbon pricing attaches an entirely articulated price to that

How does that measure the impact on the entity?

What investors need to know are:

A) How does this impact your finances?

B) Can you make the change?

C) Can you access the required capital to make the change?

D) If not, what are you forgoing to do?

SCA does that

Existing reporting does not

Now you tell me, which is more useful?

TCFD is aimed at informing investors about climate related issues, in a qualitative way (as you listed above) via climate related scenario and risk analysis. So, are you saying that there needs to be an entirely new reporting standard (perhaps with TCFD as a basis) that is embedded within accounting framework? And what body/board will prepare this?

TCFD dials too deliver because a) almost no one is using it b) it does not require that the reporting entity disclose the impact within its financial statements

Who should prepare a proper standard? Ideally the IFRS, but it is showing no enthusiasm

Who else can? Anyone to start debate. I am working on it

This is important stuff, because unless the data is out in the open it can’t be discussed. Stakeholders need to be able to compare companies with respect to climate impact – not just shareholders, consumers and others too – all on the same basis. It seems to me (as a non-accountant) that it becoming part of an annual report is the way to go, and that a requirement is tight accounting standards that ensure figures are comparable.

In practice it seems to me there are two needs. The first is simply a record of current performance, comparable to financial reporting, measuring the carbon implications of all activities. It needs to include lifetime carbon use via some amortisation process, recognising that for example wind turbines aren’t zero carbon, there is carbon consumption in their manufacture and servicing. Accounting standards ought to be able to define exactly how the calculations are done, and we will be able to make comparisons immediately.

Second there needs to be an indication of the plans, and risk to the company, of moving to a low-carbon economy. While it would be nice to put a number on that in terms of cost, that is something open to gaming. One element of it has to be narrative. For example, we don’t know what the mix of electricity generation will be in 10 years time with the risk a number will be picked from a hat, or whether carbon capture will be cheap (or even practicable). As you remark in a different blog, off-setting is another whole area beset by uncertainties. I know it is something you think about deeply, but I have my reservations about costed plans producing anything remotely meaningful. At the same time though, we do need a form of reporting which incentivises the changes necessary.

My reservation about offset is in part that it cannot be costed

I have wondered how many investors are duped by stuff like this, thinking that they are doing something responsible, but with little real accounting proof that they are.

Many

Hopefully not off topic. The Ardennes in Belgium had a pasting from floods in July. Same weather front that did for Germany/Ahr valley. I buy sawn timber in the Ardennes to make furniture. My supplier was complaining about the amount of timber the Chinese were buying & the impact it was having on forest cover (& by extension the ability of the area to absorb heavy rain). Driving back today with some planks of Yew (table project), I passed a large Maersk container (I knew it was maersk – cos that is what it said on the side) next to a saw mill being loaded with tree trunks. I have seen the same in other places in Belgium. Doubtless the same happens in France (note containers are only used if the timber is being exported).

Begs the question: what is Maersk doing about “sustainable cost accounting”? Or perhaps helping de-forestation in the Ardennes (and in other locations) to keep the Chinese market for European timber fed does not matter? A container is a container a shipped container regardless of content is… a profit?

We will be looking at Maersk as part of the project I am doing at Copenhagen Business School