I am often asked to define what I mean by full employment. It was a theme that Danny Blanchflower and I discussed recently when talking about Mile End Road Economics. He drew my attention to the 1955 work of Lord Beveridge, as updated in 1960 to comment on this phenomenon in the post-war era.

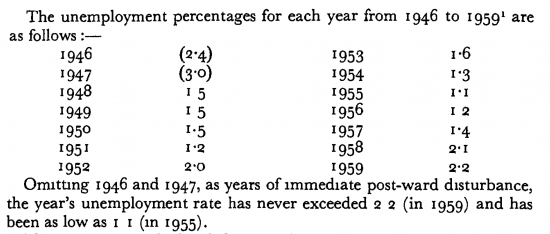

As Beveridge noted in that year:

A few paragraphs later Beveridge said:

I think that definition of full employment can be updated now. It has, very obviously to allow for people to have the hours of work that they want and to be rewarded for doing so at what we now think is a living wage. But take those into account and Beveridge is the start point for an appropriate theme.

As interesting is his observation on what full employment might mean in practice. The much more recent idea of the non-accelerating inflation rate of unemployment (NAIRU) is both toxic, and very obviously wrong in the context of what Beveridge had to say. Beveridge saw that the job of society was to deliver full employment for the benefit of the people of the country. Now we have a system of economics that treats unemployment as the residual in the equation used to ensure inflation does not happen so that the wealthy do not see the value of their cash deposits fall. As modern monetary theory shows that is entirely unnecessary: without full employment there cannot be the type of inflation that requires monetary policy adjustment, as I discussed recently.

But as significant is the fact that without political and fiscal policies designed to deliver the training and skills to deliver the staff to fill jobs that exist in the economy then we cannot have optimal economic outcomes because skill shortages can exist at what seems to be full employment using Beveridge's definition with market disruption resulting as a consequence. We are clearly heading in that direction as an economy now.

In other words, full employment is a measure that is not wholly captured by Beveridge's suggestion because what is also required is that not only are the jobs offered at fair pay and with the hours and security that people want, but that there be the people to do that work or the economy is not itself at full capacity. And the only answer to that issue is to be found in political and fiscal policy, but never in monetary policy.

What Beveridge was right to do was point out that the choice between these options is political. We can choose the stagnation of the last four decades when real wages have hardly increased. Or we could decide to have an economy that meets need, rather than self-imposed financial constraints, which is what we have fone for four decades.

With no plan for employment, or as Beveridge put it, the outlay to create demand, what is clear is that we cannot meet the hopes of people for the work that they want at the pay that they want. We could do that, and then have what can genuinely be considered to be full employment. But we have to change our understanding of economics considerably to do so. What chance if there of that? None, unless we get people to talk about it.

And, by the way, please don't argue that this is to suggest an unsustainable economy: the greatest wasted non-renewable resource is people who want to work and cannot do so: their effort is gone forever when not used, and much of the work needing to be done is low carbon impact. I see no conflict in having the goal of full employment.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

“Now we have a system of economics that treats unemployment as the residual in the equation used to ensure inflation does not happen so that the wealthy do not see the value of their cash deposits fall.”

That may be the economists’s formal explanation. I think in reality we have an ideological neoliberal system that is designed to persuade the world that it can privatise money; indeed persuade the world that it has already successfully privatised it.

I’m all for a new definition of full employment. NAIRU is complete discredited. Another casualty of the 2008 financial crisis.

Many elements of MMT are captured by Beveridge (and Keynes). It is rather sad that 40 years of neo-liberal, ideological nonsense have reduced so many brains to blancmange. A look back at what these clear and pragmatic thinkers had to say is instructive.

It seems to me that we are still trapped in a narrative that describes the 70s as a terrible time and that therefore (a) all economic management techniques employed in the 50s and 60s must have been wrong (b) it was all the fault of Trade Unions and (c) any attempt to return to greater state involvement in economic management will automatically end in disaster

First, I thought the 70s were (bar the fashion) great… but I was younger then! Second, the oil shock, Cold War and the end of the Gold Standard and the resulting turmoil never get a mention. Third, it takes two sides to have an industrial dispute – the 70s was characterised by poor management and low investment, not just workers wanting more. Fourth, COVID and Climate Change suggests that WITHOUT State involvement things will end in disaster.

“Labour” is not a commodity, it is real people. Precarious, low paid employment is dreadful and any government that does not have a policy to deal with this is not worthy of power. (Yes, Labour Party – I am talking to you!)

Interestingly, my rather conservative neighbours get this – they all have children and grand-children many of whom are trapped in unsatisfactory employment and they see that the current state of affairs is unfair.

The answers are relatively simple….. but only if you engage your brain!!

Agreed

The private sector’s fear is that public spending to reach full employment will crowd out private enterprise and force them to compete. Hence NAIRU which uses poverty to restrain labour power for better terms and conditions instead.

But it’s a political question not a financial one. Bevan in 1946 was specific that he intended to crowd out the private sector in healthcare. He said bringing hospitals and staff into public service drove out “the innumerable harpies who battened on the sick who are are slowly being eliminated.” That wasn’t so the private sector had to compete, it was so that they couldn’t.

As for the number of people unemployed at any one time, it doesn’t matter so much if the period of unemployment is short – ie ‘between jobs’ or possibly re-training (the kind of churn we might expect as green jobs are created for example) rather than unable to find work long term. And of course if benefits are adequate and not designed to create destitution.

But setting a figure on ‘full employment’ leads us not only to NAIRU but also to the removal of any political expectation that something must be done about it. At its worst it enables policies like the replacement of an anti-poverty strategy (a government responsibility) with weasel words about ‘social mobility’ (the individual’s responsibility).

Keynes said that except in wartime it was unlikely that there would be no slack at all in the economy so ‘crowding out’ wouldn’t be anticipated in peace time. I am not sure he would have anticipated the extent of Bevan’s drive to create services actually designed to protect all people from the profit motive (as opposed to policies like council housing which only protected a certain section of the population).

But without a desire for full employment associated with a rate how can any policy be achieved?

You claim to be an economics Professor. If that is the case then I am a bit shocked at the content of this article and very worried for any students you may have.

If you think Beveridge is a good starting point and NAIRU models are the lens at which unemployment is viewed through in modern economics, then you are at least 20 years out of date.

Any real economist or teacher of it would know this, which suggests you are ignorant of the subject you claim to be an expert in.

I am a political economist – looking at the ideas that structure the relationships of power in the economy

Maybe it’s you who needs to understand what is really happening

And as I note, this comment came out of a discussion with Danny Blanchflower. Are you saying he’s not a real economist too? Try it….

I would leave out the economist part of any description of what you do. Your knowledge of economics, having read a few more of your posts now, is severely lacking. You seem to simply make things up as you go along, and more often than not end up contradicting yourself.

Just using this article above as an example, you talk about full employment and what that means, but then refer to old non-current models, leaving out how the economics profession (including those in central banks and government) actually measure and model unemployment.

By doing so you are creating a totally false narrative. The reality is very different from what you portray. Though I think a lot of why you do so is through ignorance and a lack of understanding of the subject of economics. You simply do not know any better because you aren’t really an economist and have had no training or experience in the field. You are a small practice tax accountant turned campaigner and blogger. Not an economist.

The models in question have been at the core of modern economics and a staple of textbooks for a decade, but I highly doubt you could even name what I am talking about.

Danny Blanchflower might have been an economist once but for a very long time now his very left-wing politics has left his pronunciations less than credible. He has positioned himself very much on the fringe of debate and his name does not carry the gravitas it once might have.

So, you ignore my suggestion

And provide a second comment using a new identity, still seeking to be entirely anonymous

You give no hint of your qualification

And question what Danny and I are saying even though he has 33,000 google citations https://scholar.google.com/citations?user=erAFQIgAAAAJ&hl=en&inst=18254509834311452328

If there’s someone talking utter drivel here – following the Tim Worstall line (maybe you are Tim Worstall, you certainly read like him) – then it’s you

“The models in question have been at the core of modern economics and a staple of textbooks for a decade.”

Unfortunately, that is not a recommendation. I do not think “Erim” (or whomsoever the scribbler is), realises just how deep the problem has become for the intellectual reputation of the whole discipline of economics (since it was subject to hegemonic neoliberal takeover), given its performacne by any conventional or standard measure of scientific predictions (‘forecasts’ in the intellectual fudge of economics, a term that rather gives the game away), or for the whole subject as a credible social science; or as any form of science at all. Economics has been found out by its obvious failure to deliver usable predictions at all, time without number; and falls over in a heap whenever there is a crisis, which it neither sees coming or is capable of finding solutions (beyond short-term fixes that set the theory on its head). Economics is frankly becoming something of an embarrassment.

Economics possesses no adequate empirical methodology (it has virtually no capacity to undertake experiment – a ‘sine qua non’ for science: which is why it is better termed ‘political economy’; and its modest efforts in mathematics have merely turned it into an idle, abstract exercise in mental gymanstics, with no purchase on reality at all. At the same time academic economist’s understanding of behaviour is notoriously thin, and has been for decades. Behavioural Economists like Thaler are trying hard to turn the tanker, but not wholly with success, but in order to make something of real human behaviour in economics, and rescue it from the kind of banalities of primitive behaviourism that economists have been peddling for decades.

In addition, “Erim” undertakes in his comment a wholly personal, anonymous, evidence-free attack (merely pointing to economic theory is not a defence, but a form of circularity), that would be quite unforgivable if its source is an economist. An attack in which no specific evidence whatsoever is provided that makes any case at all, beyond mere, bald assertion.

If “Erim” you are an economist, then economics is in an even worse mess than I have so far suggested.

When I was studying Economics it was described succinctly as an intuitive subject and as such those with a modicum of intelligence could derive and contribute to the advancement of the subject. Unfortunately Economics was highjacked by those who sought to impose rigorous mathematics and so come up with a scientific formulation of how the world and the economy functioned. This obsession with a mathematical proof has lead many into the trap of thinking that because something can be proved mathematically it is reality. This is clearly not the case. Economists can grasp some idea as to mechanism but proving a mathematical certainty is impossible.

“…[Blanchflower’s] very left-wing politics has left his pronunciations less than credible. ….”

Only right wing pronunciations are credible in some circles it seems…….. Oh, well.

🙂