I thought that this infographic from the OECD on inheritance tax was worth sharing:

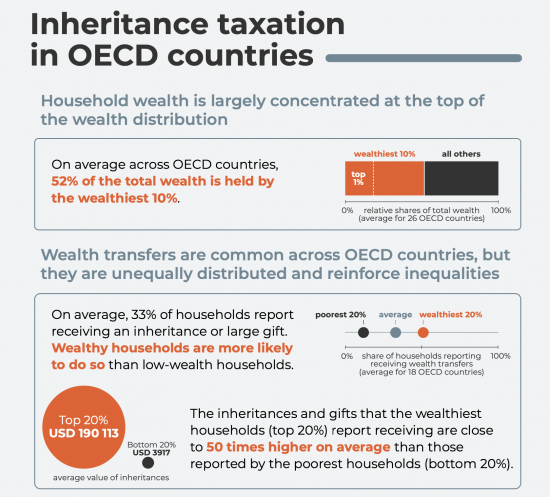

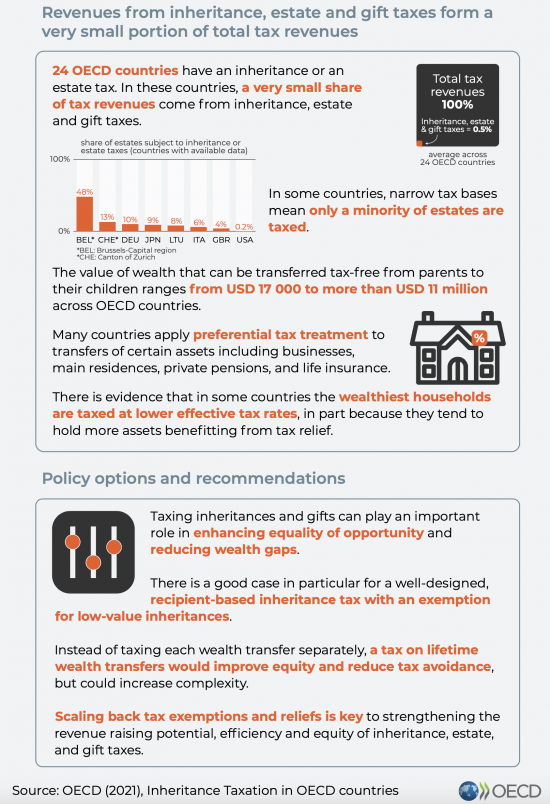

The message? Inheritance taxes are not working and that we can do a lot better when it comes to taxing wealth to promote greater equality within society - which is an advantage in itself.

If only UK political parties would take such issues on.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Having grown up reading lot of science fiction, much of that writing pointed to a world dominated by ‘money-power’.

It’s almost as if the sci-fi was right.

I’m not surprised myself.

My view is that people need to be concerned about this. Wealth ‘spill overs’ into politics, Government, democracy etc., are not good news. We have a system that benefits wealth now – and it can only get worse as the wealthy want their money to work for them (maintain its value over time).

The work I am doing on spillover includes the political dimension

I think that really important

I’m glad to hear it and look forward to hearing about any progress.

Agreed.

A while back I considered the lack of disincentive that parking and other such fines have for the wealthy and what could be done about it.

I wondered if a tax token could work, i.e. fines levied as a proportion of ones token value. Say every one was asked to pay 10 tokens in tax per year. So if I earned 100K and my effective tax was 36% then my token value would be £3600 and if I earned 1 million a year with an effective tax rate of 46% then my token value is £46000. Lets say the parking fine is 0.0333 tokens, in the first case I would pay ±£120 and in the second case I would pay ±£1533. Disincentive created. Obviously, one has to account for the marginalised earners that pay lower tax, one wouldn’t want to encourage indiscriminate parking because it is almost free of consequence either.

The above examples indicate that they are based on income but perhaps it should be based on some function of income and wealth.

What if inheritance tax was similarly taxed in terms of token units. Clearly wealth inheriting from wealth expands (cements) inequality so the token idea promotes equality.

I can think of other taxes that can be done in the same way, dividend tax, council tax, stamp duty, carbon tax, frequent flyer tax.

Obviously, tax avoidance needs to be looked at and a funded authority to implement the token system is needed etc..

It will in all probability not happen but it is food for thought.