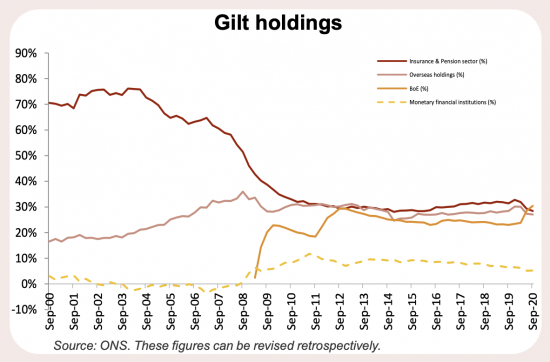

The Debt Management Office of the UK government has issued new data showing the changing profile of the ownership of UK government debt:

In 2004 around 75% of Uk government debt was owned by insurance and pension companies. The rest was almost entirely owned by overseas interests, Banks held almost none, and nor did the government.

Now the Bank of England is the biggest owner:

The trend will continue. By the end of 2021 the Bank of England is set to own £895 billion of UK debt.

For those who say that there has been no such thing as direct monetary funding, or that the government cannot fund itself, or that there is no magic money tree, the evidence to the contrary is very clear.

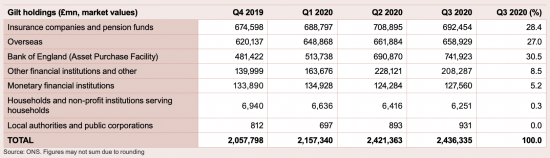

But, and I make this point with good reason, there are three things to note. First, this data is based on market value. At 31 December 2020 the nominal value of gilts was as follows:

The difference between gross and net values is the value of the gilts held by the Debt Management Office itself - which adds to the net government holding.

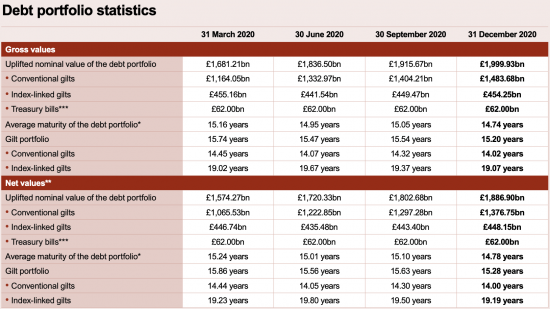

Second, market value is very different:

There is currently a premium of £740 billion within gilt stocks. Over the next 17 years that will unwind.

Third, note that we know the yield, and so that premium, is falling now.

But, the question is, does that make it any harder for the government to do QE, and so fund its own activities? The simple answer is no. In that case I suspect that £100 billion of QE will be the annual norm for 2022 onwards.

Direct monetary funding of government is here to stay, in my opinion.

Importantly, that does not deny others the right to save in gilts. Just recall that their total value has increased considerably since 2005. The government can both fund itself and be the borrower of last resort. Stability can be offered despite this situation. And that is what matters.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

First, I am not sure that BoE holdings of gilts should really be included in these charts as it is merely “lending from the left pocket to the right pocket” and obscures other trends……. but it is all there to preserve the fiction that the BoE is “just another investor”.

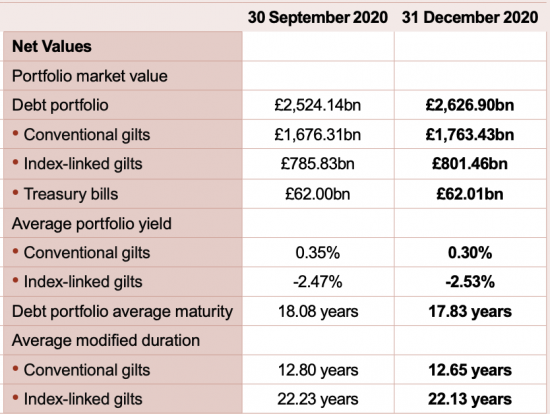

The thing that really stands out to me is the average yield on Inflation linked securities – -2.5%. (with an average duration of 22 years). That means that £1 invested today will, in 30 years time, only buy you what 50p gets you today.

This creates so many problems (asset bubbles, pension fund deficits etc.) and this means that when asked “are you worried by the level of government borrowing” I reply “YES – it is too low….. the government should be borrowing more”.

Very good…..

As a matter of illumination, I think you might usefully tease out the logical steps in your connection between negative yield and government borrowing.

First, such a large negative real yield (inflation adjusted return) on long term government bonds is a signal that all is not well. What’s wrong with this? Well, in a world where so much needs doing, savers are happy to see their money eaten away by inflation rather than do anything else with it…. and policy makers are content to let this happen. It is saying (for example) that a healthier, better educated population will not be more productive. This, surely, cannot be right.

At a simple level, it is either a lack of supply, a surfeit of demand or both. If government issues more bonds (not swallowed up by the BoE) then they will have to offer a slightly better deal to gilt buyers – ie. a higher yield. If investors had better options to invest in then they would shun gilts and the government would have to offer a better deal merely to sell the planned amount of bonds.

The “market” has failed to provide an alternative – because it can’t seriously operate in such a long term way in the sectors where investment is needed. The government has failed by abdicating its responsibility to invest on the false grounds that “we can’t afford it”…….whereas the negative real yields are telling us that we can’t afford NOT to invest.

Thank you for that prompt and clear explanation. The problem is, however that while it is a standard trope of economics to point to ‘productive’ investment (and I am not challenging that obvious advantages or wisdom), there is another factor: safe assets. Most investors will spread investment according to some form or risk assessment; and most investors will look for a proportion of their investment to be in a safe home. The safest home is Government bonds; the private sector fails the measure of ‘safe asset’ before it has begun (based on everyone’s world-weary experience – I need hardly embellish the argument). This applies ‘a fortiori’ to pensioners, or funds holding the savings of pensioners. We may glibly refer to this as the ‘paradox of thrift’, but there is more to it. May I point to the ECB (Golic and Perotti – ‘Working Paper Series; No 2035, 2017’), where they acknowledge “the recognition of a fundamental demand for safety, distinct from liquidity and money demand. This novel insight has the potential to induce a major theoretical reassessment in macro and banking theory.” (p.2)

Having read this blog for some time and some other sources, I’m under the impression that creating money as debt via QE or otherwise, rather than simply creating it on the current account, represents a “promise to destroy” the newly created money – do I have this right?

There is no promise attached – and money can be destroyed in either case

I understand that in practice the money can be destroyed in other ways and that there’s nothing to stop money created by the issue of bonds being replaced on an ongoing basis. And I understand that that’s what happens in practice. What I mean is that by creating money as debt with a fixed maturity, is an effective promise to destroy it in psychological terms not built into the idea of a fixed-term bond, and is this perhaps a function of how they have traditionally been viewed? Could totally be barking up the wrong tree.

Factually you are right

But the narrative the structure you describe creates permits another, false, narrative to be told, and it is

Stability matters – but not to those who thrive on destruction – like the vulture funds and those who are betting using credit default swaps and waiting for a pay out based on some one else’s misfortune.