The government's announcement on audit and accounting reform, out this morning, refer to the significance of climate reporting. As they note:

The Government agrees with the Brydon Review recommendation and proposes to introduce a statutory requirement on public interest entities to publish an annual Resilience Statement, consolidating and building on the existing going concern and viability statements.

Included in this, they argue, is a requirement to consider climate change issues, saying:

[T]he Government would welcome views on whether the Resilience Statement as a whole, including the long-term section, should specifically address the impact of climate change on the company's business model and financial planning.

They do, however, immediately close down debate on this issue by saying:

In this respect, views are invited on whether the Resilience Statement could provide a means for companies in futureto provide disclosures consistent with the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD), in whole or part.

So the actual choices on offer are:

- TCFD, or nothing.

- Audit the TCFD data, or not.

This is wholly inadequate. The Task Force on Climate-related Financial Disclosures are not fit for purpose when it comes to financial reporting. That is because as a result of the work I have been doing on sustainable cost accounting I have become pretty familiar with this thing:

The greenhouse gas protocol splits greenhouse gas emissions into three categories. Thankfully, they're pretty easy to define:

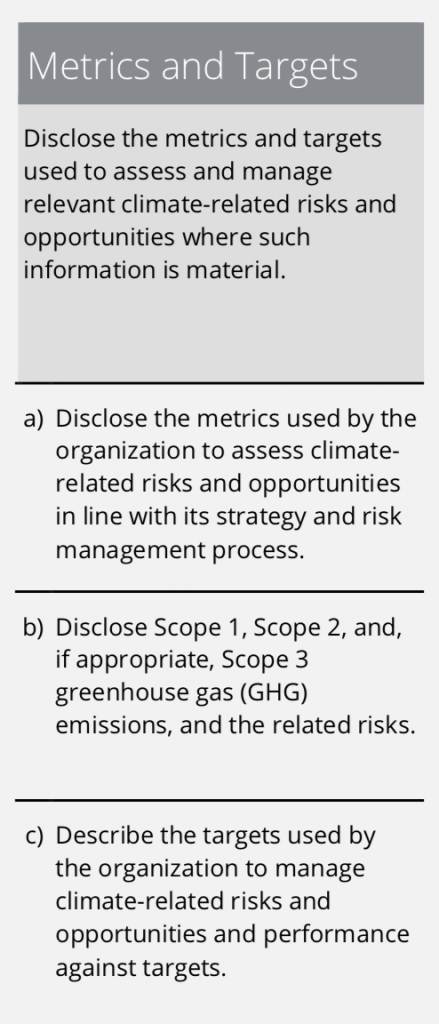

I've reproduced the Protocol's own description just to make clear that they really do think there's not much to this. Except that there is. And that's because right now business has decided for reasons all of its own that only Scope 1 and 2 emissions are of importance. Mark Carney's Task Force on Climate-related Financial Disclosures summarises its reporting requirements pretty succinctly as follows:

Note that category (b). It says that Scope 3 need only be disclosed ‘if appropriate'. And what defines 'appropriate'? Nip up to the top of the column and you will find it is when management think that it is 'where such information is material'.

And as it turns out, almost no one does seem to think Scope 3 is material. So we end up with the absurd situation where airports claim they are carbon-neutral because they ignore the emissions from the planes that fly from them and coal mines can make the same claim because they say someone else burns the coal that they mine, and they claim that's got nothing to do with them when glaringly obviously that's untrue.

My points then are very simple ones.

First, any accounting standard for greenhouse gas emissions that does not require Scope 3 disclosure is incomplete. In fact, it's not a standard worth calling by that name because it ignores a crucial issue.

And second, anyone who claims they are carbon-neutral and ignores their Scope 3 emissions is making a claim that is simply not true.

But now the government is saying that financial support should be linked to this wholly inappropriate standard. And that's wrong.

Thankfully there is a better option. That is sustainable cost accounting. That will work. And that's what financial support has to be linked to because it makes Scope 3 disclosure mandatory.

The government's proposals do not do that. And for that reason they fail to address the issue of climate change and accounting, whatever other failings there might be in the Task Force on Climate-related Financial Disclosures.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Reading your posts on SCA over the last couple of days various people have pointed out that it wouldn’t work. They do miss a couple of points though.

1. How exactly are you supposed to measure scope 3 emissions?

2. Why should a company be liable it doesn’t directly create?

3. If you include scope 3 emissions, you would be double counting a lot of emissions. For example, using the one from today’s video, Gatwick airport would be responsible for the emissions of the planes that fly from it but so would the airlines companies at the same time. Meaning that to stay carbon solvent companies would have to account for more carbon than is actually net produced. Why are you including scope 3?

Scope 3 emission measurement is a well-established practice. I suggest industry practice is followed.

The whole point of accounting for climate change is to account for externalities. The company does create them, but putting products into the market. The idea that a company is liable for the consequences of the products it makes is well established.

Yoy wholly miss the point in your point 3. SCA does not account for carbon. It accounts for the cost of eliminating carbon from the company, which is something quite different. There is no double-counting in that case.

“Scope 3 emission measurement is a well-established practice. I suggest industry practice is followed.”

No it isn’t. There is no standard, no well-established best practice method and those that do exist are very subjective estimate based ones.

It also raises the question why you think that end users of a product should be immune from the consequences of their choices and not have to pay for the emissions they create but the companies that create products have to be responsible for all emissions created.

“The idea that a company is liable for the consequences of the products it makes is well established.”

A company should be liable for the emissions it creates directly. The indirect emissions should be the liability of the user of the product. Most emissions are based on amount of use, and there is no way a company can control or measure this.

Is Apple liable for the emissions you create writing your blog, for example? I doubt you could measure your own Scope 1 or 2 emissions, let alone your scope 3. It’s not trivial.

“Yoy wholly miss the point in your point 3. SCA does not account for carbon. It accounts for the cost of eliminating carbon from the company, which is something quite different. There is no double-counting in that case.”

Changing the terminology doesn’t change the point I was making. What you have said is totally fatuous.

If Gatwick is responsible for the cost of eliminating carbon from the planes that fly from it, and the airlines are also responsible for the cost of eliminating the cost of carbon from the planes that fly from Gatwick, then you are double counting the cost of eliminating that carbon.

Which makes no sense at all. We only need to account for the cos of eliminating carbon once.

I have to ask you to go and look at what I said, again

That is exactly what asCA does

It only accounts fir the cost of eliminating carbon from the particular company doing the accounting – including eliminating from its product portfolio Caron emitting products

Tell me how else we are going to be net zero carbon if companies are not required to do that?

Your reply to me is a lot of words which don’t actually answer any of the points I have made.

“That is exactly what asCA does”

As I understand it, SCA takes the cost of eliminating all Scope 1,2 and 3 emissions and places them on the balance sheet of a company. It then bans offsetting. Then if those costs make the company “carbon insolvent” it must be wound up.

That’s it in a nutshell. No real detail is given how this would work in practice. Or of the effects it would have on companies, prices, jobs, the economy or anything else. There are a lot of obvious problems with it, as I and others are pointing out.

“It only accounts fir the cost of eliminating carbon from the particular company doing the accounting — including eliminating from its product portfolio Caron emitting products”

So are you now telling me that Scope 3 emissions are not included? Or if they are, multiple companies will be paying the cost of eliminating the same emissions, as in the case of Gatwick?

The answer is very clear. If you include Scope 3, you will be double counting.

“Tell me how else we are going to be net zero carbon if companies are not required to do that?”

Things seem to be heading the right direction without your input and without your SCA.

Why is it only companies, and only large ones, that are going to be forced to account for their emissions?

Why shouldn’t smaller companies and individuals be accountable for the C02 they generate?

Of course Scope 3 is included

I said so

But that is not double counting because SCA only considers the cost to the reporting entity. It never counts carbon and it never costs carbon. It counts the entities cots of eliminating carbon and that is not the same thing

And I have answered the small company question already

Let’s just say the UK adopts all your proposals in entirety..but no other Country did?..wouldn’t we just instantly impoverish ourselves and become the laughing stock of the global economy?

No, we’d be the people who got our act together in time to deal with the new world we have to live in

Your question assumes that we can continue to burn the planet as we are doing

Very obviously we cannot

“Of course Scope 3 is included”

Glad we’ve got that settled. But it means you are double counting.

“But that is not double counting because SCA only considers the cost to the reporting entity.”

This requires extraordinary levels of doublethink to say at the same time you are counting scope 3 emissions but not double counting.

Let’s use the Gatwick example again.

The airline’s scope 2 emissions involve those created in operating the plane.

Gatwick’s scope 3 emissions involve those created in….the airline operating the plane.

There is going to be a huge amount of overlap, if not exactly the same. Which means that if you count scope 3, you will be double counting some emissions. This makes no sense, as it means either companies will be charged too much or you are not aiming for net zero, but net negative.

“It never counts carbon and it never costs carbon. It counts the entities cots of eliminating carbon and that is not the same thing”

How do you propose to count the cost of eliminating carbon without counting the amount of carbon and the cost or removing it, directly or indirectly? Guess? Make things up? It’s a serious question which you haven’t covered at all, other than saying you can’t offset and you can’ rely on future technologies…so how are people supposed to do it then? Especially without using the amount and cost of carbon they produce?

Gatwick’s cost is the cost of deciding to not let planes that emit carbon land, unless government licenced to do so

It does not have to count the carbon the plane emits, per see

It has to require that it does not emit by landing at Gatwick

And yes, that is a decision Gatwick will have to face

Denying that is your problem, but not mine. I ma facing the reality of the decisions to be made

The cost is lost revenue

It may be that Gatwick cannot survive

But that may be the truth

It’s really not hard

Gosh Malcom – you’re such a card!

“It also raises the question why you think that end users of a product should be immune from the consequences of their choices and not have to pay for the emissions they create but the companies that create products have to be responsible for all emissions created.”

If anything betrays your mindset then its this statement!! What planet are you on?

So – a company will be pro-actively marketing products to consumers (advertising, discounting, promoting, encouraging etc) that are known to pollute but you think that the end user is the polluter? Despite being encouraged to buy and use it by someone who knows their product or service pollutes!!

When companies want to make money and returns from polluting products on the basis of making and marketing polluting products? Do you work in the cigarette industry at all – just asking!?

This is buck passing – it really is. It’s also known as bollocks.

You know Malcolm what the answer is mate and its not make products or services so polluting in the first place. End of.

Personally, I’m not sure that zero carbon is possible as quickly as it needs to be – but we have to start to winding it down NOW.

.

That is essentially what Richard is advocating. The accounting industry needs to stop responding emotionally to this stuff and get on board – otherwise there might not be any bloody clients left in not too distant future.