I have just posted this thread on inflation on Twitter. It will feature in 'Money for nothing and my Tweets for free' in due course:

Current debate about inflation isn't really about whether it's likely: it isn't. Instead it's about whose vision of the future is going to win. Is it going to be the right-wing demand for small government that the inflation fetishists promote, or the one we need? A thread....

Remember that the inflation that we are talking about is that with regard to consumer prices, which is often related to wages. It does not relate to asset inflation on things like shares, or house prices, which can behave quite differently, as the last decade's shown.

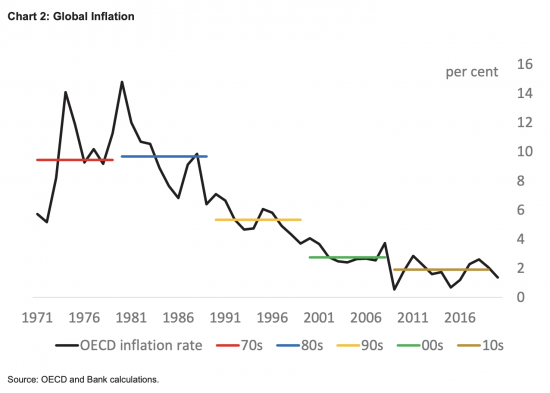

Since the 1990s central banks have been given the target of keeping inflation low. 2% has been the goal. But in practice as this diagram shows, the trend was already strongly downward before central banks were given this goal. Achieving it was not a problem as a result.

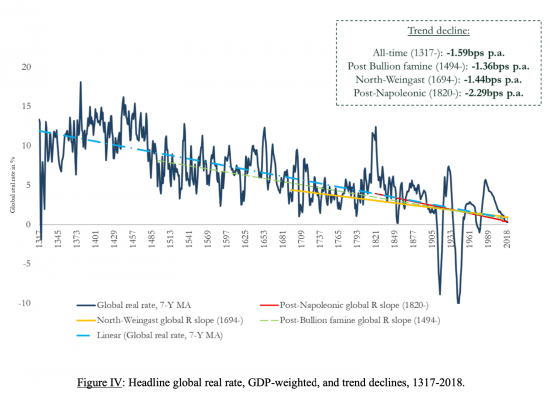

It's also important to note interest rate trends. These have been steadily downward over hundreds of years. There's no reason to think that central bank control of interest rates has had anything to do with this over the last couple of decades.

There are good reasons to think inflation and interest rates move in line with each other. If inflation is high interest rates need to be higher to pay real rates of return. The fact that the two move together is then unsurprising. But also reassuring, because they do.

It is also reassuring that the trend in the data is so persistent. The past does not predict the future, of course. But before I go any further in this thread it is important to say that the onus is on those who say this trend is going to be broken to say why that is the case.

I am not saying that inflation or interest rate rises are impossible in the future but I am suggesting that those who suggesting these are anything but very temporary phenomenon have to explain why the trends of many decades are going to reversed now and for what reason.

Only two reasons are being given. One is that there is going to be excess demand after coronavirus. The other is that there will be a shortage of supply of goods and services in the economy to meet that demand. My argument in this thread is that neither is likely.

The first of these ideas says that if demand for a product rises and the supply does not then its price is going to increase. Economists would say this is so basic that no one could really argue with it. So let me do so.

First, this assumes that there are no alternative products available. The reality is that there usually are. Few things are so essential now that this is not the case. Secondly, this assumes we will not wait for what we want. We often will, and that smooths demand.

What is necessary then for inflation to happen is that not just one product must suffer excess demand, but all must. Given that the diversity of products available usually makes supply shortages of this sort unlikely this has to imply something else is happening.

There are two options that can create this scenario. One is a general breakdown in supply. The other is a general increase in purchasing power. Of course, if they coincide that adds to the risk. That's the ‘something else' those predicting inflation think is going to happen.

That something else that is happening is that it is assumed that wages, or spending power, or both are going to rise meaning there will be too much money pursuing too few goods, and so inflation follows. Any shortage in the supply of goods and services would exacerbate this.

Linked to this is the assumption that after the economy reopens there may be some supply disruptions. Part might be enforced e.g. an absence of foreign holidays. Some will be because businesses making what we want have failed. Others will arise because of slow slow restarts.

It may be easier to deal with this part of the issue than wages in the first instance. I would entirely agree that there will be supply disruptions after we get over coronavirus. It's impossible for it to be otherwise. Nothing works smoothly after such a massive close down.

But is it really plausible that we are going to suffer long term supply disruption after coronavirus? I think not. In fact, what the disruption has shown is just how resilient many of those parts of the economy supplying goods are, despite disruption.

And given government support much of the missing social economy will also bounce back very quickly, I suspect, when the opportunity is given. We may holiday at home and not abroad. We may even want to, to see friends again. But overall, we will be able to get what we want.

Brexit, of course, does not help in this scenario. But it is very largely a one-off shock. For inflation purposes the impact will probably be short lived and unlikely to last more than 12 months. Such things happen. But they are not indications of underlying inflation problems.

The assumption that we face long term supply constraints does not stack then. If either Brexit of coronavirus cause an inflation blip it will not last, and we need not worry about it in that case. So neither is the ‘something else' that must be motivating inflation fears.

The ‘something else' must, as a consequence relate to either a general increase in wages or a general increases in buying power in the economy not related to wages, but which might have the same effect of creating an overall increase in demand. Both options need to be considered.

Serious wage increases are incredibly unlikely at present. When nurses are offered a 1% pay rise and other public employees none at all because there is no private sector wage inflation anyone suggesting wages will be the cause of inflation is seriously misreading the evidence.

Anyone making that claim is also ignoring the state of UK unemployment. The government claims that this might reach a peak of in excess of 2 million people, but that claim is not a proper reflection of the truth.

Almost 5 million people are furloughed at present, and realistically some of them may not return to work when the crisis is over.

In addition, more than 2 million self employed people are receiving support because their businesses have suffered as a result of coronavirus.

It's also been widely reported that millions of people have not qualified for employment help during this crisis. The precise number is, of course, not known.

Add all these up though and more than 10 million people are in vulnerable employment situations right now. Many of them will be looking for work when the opportunity arises once the coronavirus recovery gets underway. Many will be looking for the security of a regular wage again.

Put all those factors together and one in three people in the UK work force are highly likely to be looking for some change in their work, including a job change right now. And that makes serious wages increases very unlikely.

When there is a mass of willing and able labour looking for work - as is going to be the case in the UK over the coming years as people seek security after this crisis - the likelihood of wage inflation is very low.

To summarise then, supply issues that might push up inflation look to be pretty unlikely right now. And so too do wage increases that might push up inflation look very unlikely. So what else might create that inflation?

There is one other cause that I mentioned earlier in this thread. This is a general increase in buying power not related to wages, but which might have the same effect of creating an overall increase in demand. This is what the inflation fetishists are really worried about.

Despite the fact that supply is likely to meet most demand without disruption and despite the fact that wages are not going to increase much those obsessed by inflation think that demand is going to rise in the economy. And that is, they think, all down to government stimulus.

It is indisputable that the UK government has injected record amounts into the UK economy over the last year. Around £400 billion has been spent. More has also been made available by government backed loan schemes which are not a cost as yet.

It's also true that in some countries, like the USA, this stimulus continues. Biden is continuing to pump dollars into the economy in a way the UK government has now announced it wishes to stop doing by the autumn of this year.

The question is whether this stimulus will create buying power that might create general levels of price increase even though there are unlikely to be any major supply shortages. The answer is that this is incredibly unlikely, but why this is the case needs to be explained.

First, let's be clear that deficits were necessary. Without them vast numbers of people could not have stopped working. That was necessary to prevent the spread of coronavirus. Without that happening many more people would have died. The NHS would have failed, without a doubt.

Second, since more than 80% of the UK's businesses, and a higher promotion of employers, received government support it is fair to assume that a significant number of businesses would have failed during the lockdowns that were necessary to save life and the NHS but for this help.

Third, exceptional costs were incurred to tackle the crisis itself.

And fourth, whilst it's unpopular to say so, we still don't know that we have won this battle as yet. England might have a roadmap out of lockdown, but many countries are now going back into it. It is far from clear that this crisis is over as yet.

So, the spend was essential. And so too was the quantitative easing that funded it. I've already explained this in other threads, so I won't do so again here. See this thread instead.

I have also explained how the money that was required to fund these deficits was created. That explanation is in this thread, amongst others.

The point is, that what quantitative easing did was create new money. This is indisputable. That's what the Bank of England says it does. That's not news then. Or a shock. It's a statement of fact.

But what is not a fact is that this leads to inflation, as some economists claim. They quote the quantity theory of money. This is a piece of economics that says if there is more money chasing the same quantity of goods prices go up. This is why they say we face inflation now.

They note that quantitative easing (QE) creates money without any more work being done and without any extra tax being due so they argue that this must lead to inflation. But they are wrong, for a number of reasons.

The most important reason is that they assume the government creates all money when making their claim. It is true that the government is important when money creation is being considered but it most certainly does not create all money. That's because banks also create money.

Banks create money by lending. That is how all money is created. So, when lending increases the money supply goes up. The corollary is that when loans are repaid then the money supply goes down. There are few other rules in economics as basic as that.

What happened in the last year are four things. First, people stopped borrowing. Consumers spent less (more than 20% less, on average) so of course their borrowing went down. The result was simple. The money supply was reduced as a result.

Second, people saved more. Given that the government protected many people's income that was inevitable if spending went down. And savings reduce the money supply. That's because loan repayment is saving in economic terms, and because savings take money out of the economy.

Third, government guaranteed lending to support business did not make good this shortfall. It kept business afloat, for sure, but the money created was not enough to tackle the money creation shortfall.

And, fourth, the government's own deficits massively boosted savings. This is an issue I have already addressed in another thread, but it's worth repeating because this issue is so little understood.

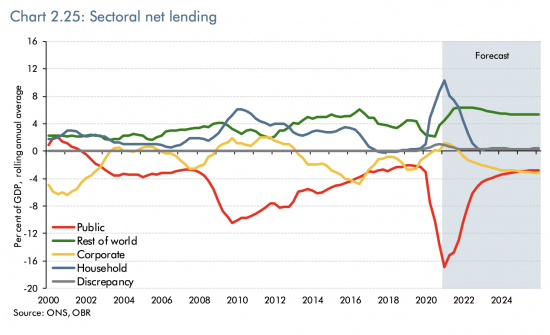

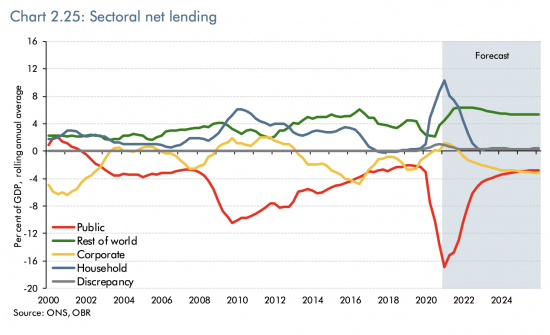

When the government runs a deficit it, in effect, borrows. It's a simple accounting fact that someone must save as a result. This is explained in economics by something called the sectoral balances. This is the government chart of these in March this year:

The top and bottom halves of this chart are always equal. Savings equals borrowings is a fact. So, as is apparent, the government deficit has to create private savings. And it did. QE just added a twist. In effect the new money QE created went straight into private savings.

Now, not everyone was fortunate enough to see the benefit of that. In fact, many households are deeper in debt now than a year ago. Many more just got by. But the best off just got richer. That's what QE does.

This bias to the already wealthy within QE was not by chance. The Bank of England says that one of the aims of QE is to increase the value of financial assets, believing that this will increase spending. They achieved asset value increases. The spending increase I will get to.

For all the reasons noted, there's s a glut of savings now. But that is because of the crisis. And it's because government created money has had to replace privately created in the economy. QE might have increased money supply, but the savings it's created has reduced it again.

In that case the claim that inflation is about to break out is hard to justify. So far the quantity theory of money is not a sufficient explanation for that. But, the inflation fetishists do not give up there. They still have another argument up their sleeve.

That argument is that this mountain of savings (much of which is held in money form) is all about to be spent. This is where, they say, inflation is going to come from without there being any increase in wages.

Andy Haldane, the chief economist at the Bank of England promotes this view. He thinks the economy is a ‘coiled spring', waiting to burst. It will, he says, do so once Covid is over. Everyone, he thinks, is going on a spending spree of a scale never seen before.

The government and Office for Budget Responsibility also share this view. That chart on the sectoral balances reveals this. I share it again here.

The green line is overseas saving in the UK. The red line is the government's deficit. The yellow line is business saving / borrowing and the blue line the same thing for households. The but that I am really interested in is the shaded section: the projections.

The government is forecasting that businesses already overburdened with debt because of Covid are going to borrow at near record amounts to fund investment and I can say with near certainty that they won't be, because banks will not be lending, and that ends that suggestion then.

The government projection for households is also wrong. By 2022 we are all supposedly going to have given up saving. But after 2008 it took until 2016 for this to happen, and the shock this time has been much more serious. There is simply no way this is going to happen.

The reality is that it is much more likely that after initial holidays, days out and meals out with friends that people are actually going to be pretty cautious. That's precisely because there has been, and is, so much uncertainty, and because people know wages aren't rising.

The exception may be amongst the very wealthy. They, after all, have more of the gains To spend than anyone else. So they might splurge a bit. They'll relate to the advertising mantra ‘that they're worth it'. But there's something quite unusual that we also know about the wealthy.

The wealthy are wealthy precisely because they do not spend all of their savings. That's not rocket science, but it's also true. In other words, they will simply not spend enough to create the massive surge in spending the inflation fetishists think is going to happen.

The reality is now apparent. Supplies will be sufficient to meet what demand there is. Wages are not going to go up. People will save still because they are worried about their jobs. And the wealthy simply can't spend enough to create inflation.

I seriously doubt that anything much can create the persistent likelihood of inflation now. In that case one finally question has to be asked, and that is will interest rates be increased? Around the world markets think that likely. But again I have to disagree.

Part of the reason why markets think interest rates will rise is because they think inflation will, and as I have noted these two are related. If I am right on inflation interest rates will not increase either.

Even if we do get a short term increase in inflation e.g. because of Brexit, I do not see rates rising. The reality is that inflation has been well below target for a long time now. That means that the Bank of England can tolerate temporary upward blips without increasing rates.

There has to be a persistent threat for that increase to happen. And again, the lack of any real chance that business will borrow or households spend to the extent that the Office for Budget Responsibility suggests also suggests that there is no real threat of that happening.

In that case I cannot see any realistic chance of any significant increase in interest rates either. I could be wrong: all economic forecasting has to be caveated with the condition that ‘it all depends on how events work out', but I just don't see it right now.

The reality is that the inflation fetishists are making their claims not because they believe in them but because they are living in fear of something quite different, and that is that the size of the state might grow after Covid.

The state is what the inflation fetishists really hate. And what they know is that society wants a bigger state right now. So they are using a false claim about inflation to try to prevent it happening. And they could win. As excuses go this is a winner, in their opinion.

But it's only a winner if we believe them, and there is no reason to do that. There are no real grounds to fear inflation. But there is every reason to believe that we need more spending on many aspects for what the state alone can supply.

The battle over inflation risk is not really about whether it's likely. It's about whose vision of the future is going to win. Is it going to be the right-wing demand for small government that the inflation fetishists promote or the one that we need? That's why this is important.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Danny Blanchflower was on Alex Salmon yesterday, saying, I think, much the same.

He said that when he was on the monetary committee, some of the others statements seemed to be more theology than economics.

Some economics seems to be like or even astrology!

Danny and I don’t always agree

Btu we do, often

Especially on economics as theology

A good piece.

If we look back in history most periods of inflation in the UK are associated with war…. is that what the inflation fetishists are forecasting? I don’t think so.

No, the only relevant history is the 70s and 80s when prices rose 5 times between 1970 and 1985. So, I think the onus on the inflation fetishists is to draw parallel to that period – and there are few. That inflationary burst was driven by oil prices going from $3 to $30 a barrel between 1970 and 1985 (courtesy of OPEC’s monopoly) at a time where production was heavily dependent on energy input. (Switching away from OPEC oil and improving energy efficiency was a multi-decade process but has been achieved). What is the equivalent today? I don’t see one.

Of course, some inflation fetishists look to Weimar, Zimbabwe and Venezuala – but that is absurd. Inflation in these situations is a result of a complete political and social breakdown, not by a bit of deficit financing in order to get the economy running at full potential.

Finally, what would be so terrible about a bit of inflation? Keeping people languishing without work is far worse.

Thanks

And I agree with your conclusion

Me too!

If inflation were as deadly as it is portrayed, we would not do anything for risking it – making, buying, selling – the lot.

It’s bullshit.

Inflation obsession only helps those who have already accrued money.

For those of us who have yet to accrue wealth or in the process of it – it’s of no use whatsoever I wager.

Inflation obsession also seems to be capable of halting social mobility for the majority.

Thank you for another thought-provoking post — though I have to say I admire anyone with the patience to follow it as tweets, even as text the staccato paragraphing gets a bit disruptive to the logical flow.

May I pick up one point, really for my own education? About the relationship between interest rates and inflation.

Until I discovered this blog, my simplistic non-economist understanding was that the Bank of England tried to engineer interest rates to be similar to inflation. On the basis that inflation is likely to be slowed if spending is slowed, the Bank gains some leverage if tweaking interest rates upward means people are a bit more likely to save and thus spend less (or less likely to borrow to fund spending). And conversely more spending and a consequent boost to the economy might be encouraged by a downward nudge in rates.

Your 50-year graph suggests that once the dust settles inflation is likely to wiggle around a value of around 1.5%. But you predict interest rates won’t rise from their current value of around 0.1%, which is too far below inflation for small adjustments to have much effect. So do you think the Bank will be content to lose that useful lever over the economy? Or is the influence of interest rate changes on spending and the economy a myth, just like the idea taxation has to balance government spending?

The theory of interest rates is as you suggest, but few think that this theory holds at low rates – and that means the prevailing rates now seen

Re base rates, the BoE base rate is indicative. Most actual rates are somewhat higher because the BoE rate is effectively the risk free one. So real rates except on government bonds are higher than that rate already. The rate trend is already and still downward so my prediction is that very low rates will remain the norm.

“They note that quantitative easing (QE) creates money without any more work being done and without any extra tax being due so they argue that this must lead to inflation. But they are wrong, for a number of reasons.” <<< Why don't you come to Argentina and experiment yourself the relationship of money printing and Inflation

Because I am writing about the UK

I highly doubt that economists never considered the possibility of alternative goods or deferred consumption when theorising the relationship between supply, demand and prices.

These mitigating factors don’t refute the fundamental dynamic at all. In some important cases, they are not even relevant: take oil for example. We can’t just pivot away from oil to alternative energy sources overnight, let alone defer consumption for a few months while we wait for prices to drop. Yet oil is a major input into global supply chains; its rising price contributes to rising prices everywhere.

You may not have noticed, but the price of oil is now soaring, along with many other commodities (steal, copper, lumber, etc.) We have seen financial inflation for years, now the signs are here that it’s spilling into the real economy. This article does little to convince me otherwise.

First of all, we are not nearly as dependent in oil as we were

Second, oil is important but it is not most of the economy, and it is declining

Third, of course such shocks happen. They also will thorough the index in 12 months. They do not require corrective economic policy. They do require decarbonisation

You really are still missing the point I fear

“Soaring” oil prices? Soaring so high that they are still at half the price of a decade ago?

🙂

One inflation fetishist here.

So of course, there’ll be inflation.

Lockdowns caused a massive hole in production. There’s no doubt about it. And it was obvious, the money is and will be printed. The role of this money is to create a virtual reality of production, that isn’t happening. A patient is losing blood so we are pumping transfusions and we hope, that in 2-3 years, the patient will be able to live without more transfusions.

And it’s likely to happen. The UK will get better in a couple of years. And on the surface, it won’t be that a big difference. You could have a huge economic crisis, or you don’t have it, but you end up with massive public debt.

So now, Rishi Sunak is raising taxes. And he will probably raise them even more. And if Labour will take over Conservatives, I doubt they will lower taxes.

This means, you work the same amount of time, you create the same amount of value, but you can buy fewer things because you are slowly paying off the crisis that “didn’t happen”. Virtually, it wasn’t inflation. Parking is still 1 pound and a lunch 10 quid. But instead of living with £5000 per month, you live with £4500. Which is in some way similar to 10% inflation.

And it will take decades of higher taxes to pay for all this. When it’s decades, it’s a whole career, a lifetime, it’s a huge part of personal income lost. Maybe it’s not inflation in the definition (but still, 10% of the value you create every year is lost). But it is as unpleasant, as much draining and just as bad.

If it was me in the role of a central banker, I would probably print money in such a scenario too. But as an individual, getting rid of fiat and putting everything into deflationary assets seems like a wise decision no matter how much people like you tell me, there’s no inflation coming.

There is no debt to pay off

You are making up a claim that is not true

I have written extensively on why that is the case

Please learn some economic basics before commenting here as if you know what you are talking about when very clearly you do not

So when the government finances to overcome the crisis, they have three options. Printing, debt & taxes. Taxes aren’t an option during the crisis, because less is created and consumed, so less can be taxed. So you can borrow and print. The UK (and others too) is doing both.

Every debt has a counterparty. You have to pay it off. And they’ll do it by increasing taxes. If everything is the same, except the state is paying off debt by increasing taxes, so people have less money, what is it then? Something like inflation!

Printing money is in fact debt too. It has been explained here https://www.lynalden.com/money-printing/ in great detail.

(for learning economic basics: besides having MSc in Economics, I am an avid learner of the topic for almost two decades; however, my position is not building on things like Keynesianism, or so-called modern monetary theory, which is, at least, promoting unethical behaviour, and also bad practice)

The national debt has never been paid off

And the national debt hardly increased during the pandemic. Money did.

And the only debt involved is from the government to the commercial banking system, providing it with the liquidity it needs

You are, quite simply, wrong

Sure, explain away immoral behavior as necessary. Why do the economics gurus of our day try so hard to point at indices or other pricing measurements to show the people how inflation fears are silly and inflation threats don’t exist?

Richard and these gurus refuse to acknowledge one reality. Monetary expansion IS inflation. The truth is that all things equal, inflation(of the money supply) diminishes purchasing power of money. The demand side of the equation determines WHEN* the inflation is reflected in something like consumer prices or common asset classes. It is a separate issue to question if today’s inflation will drive prices up in a noticeable way.

Moral hazard is built right into our system when a government that requires people to use specific currency with legal tender laws and a tax code which requires payments be made in that currency, also endorses the debasement of said currency.

Keynes framed this mindset perfectly with his famous statement, ‘In the long run, we’re all dead.” Notice the vacuum where empathy for the younger generations inheriting the world should be. Oh right, we need all this printing to fix climate change!

A healthy economy that is advancing and progressing toward enhanced prosperity for all does not look like an annual 2% CPI. Technology advancements and efficiency gains from innovation cause prices to go down over time.

Sound money will emerge from the ashes of these central banking experiments, and probably sooner than most people think.

I confess I am not sure why I am posting such utter nonsense

Except to show it exists

And how I’ll informed the inflation fetishists are as to how the economy really works

Agreed. Rent extraction from the economy is so embedded and so horribly efficient that CPI inflation is very unlikely – as a rule, the working population don’t have significant disposable income (asset inflation however is through the roof, and the two are inextricably linked).

Those that are pretending to be fearful of imminent consumer led inflation are doing so to protect their rent extraction assets. They are liars benefitting from the current structure.

We need an inequality levelling up, and fast.

> The national debt has never been paid off

Irrelevant. It hasn’t been paid off, but it is being paid off every year. Now, we pay the debt made years ago. 2% of GDP just to cover the interest.

> And the national debt hardly increased during the pandemic. Money did.

Yes, but as you cannot consume money, you can print them and release them when markets are not producing as a replacement for production. And in such a scenario, it’s not inflationary. Yet. But as they aren’t consumables, this money will continue its circulation.

When the production will go up again, the Bank of England has to either get them back or they will cause inflation. What are the ways to get them back? Taxation (realistic scenario), raising interest rates (almost impossible), money reform (like in Czechoslovakia in 1953 – impossible).

Or maybe, they could push institutions not to circulate money (higher fractional reserves in banks, etc.), but I doubt it’s likely. Unfortunately, Keynesianism has infected Conservatives too and anti-crisis measures are not popular anymore.

You are playing semantics on the first issue. The national debt has never been paid off. The next interest cost is 0%

And you show your ignorance on money by thinking there is fractional reserve banking. The BoE does not agree. You have a lot to learn

Don’t call again

“ Don’t call again”

Said to Jiri Knesl who is Professor of Finance at the University of Oxford

What you really mean is….“ anyone can call If you agree with me anyone else please don’t, particularly if you have more knowledge than me (and there are many) because I don’t want be exposed. I prefer to engage with those who pander to my ego as opposed to genuinely discuss and challenge what I say”…

Just as you are a troll, I suspect the person using that name is a troll, and for very good reason

What would have happened without the so called extra money the Government created for furlough, business loans etc that people worry about.

Firstly a substantial number of people would have been made unemployed. The money they previously earned through employment would have “disappeared”. Where to? Demand for goods including essentials like food, housing and utilities would shrink and the money people would have paid for those would contract so those businesses receive less money. Where has that gone?

Government “borrowing” has therefore kept the productive side of the economy going such as manufacturing, food retail and to be fair some things like home furnishings, renovations,rental incomes, crucially loan repayments and the pockets of Government chums for uncontested contracts. Demand didn’t fall simply the ability to service that demand disappeared so there was no immediate risk of inflation. Had this not happened prices could have collapsed even though the money supply in their view would not have been reduced. The inflation hawks do not seem to be cognisant of this possibility. What realistically has happened is that private borrowing has collapsed and lending from banks and pseudo banks such as suppliers of car loans has shrunk dramatically. If this is correct then the money supply has not changed significantly by the so called money printing. It has simply replaced the money from other sources. If private debt has shrunk and in effect that money removed from the system the increase in Government debt to replace it is not and will not be inflationary.

Nice post, sets out a very logical argument.

I also see our multiple personality disorder sufferer has been haunting the comments once again : ).

You certainly act as a trigger for the condition for one misfortunate individual. But it is interesting how all the “different” personalities obsess about your posts though. I’m sure the Lancet may be interested in this as a case study.

This reminded me of an old article from a few years back. The NZ central bank has a history of revolutionary thinking ,here is a good example from the 1930s.

“In 1935, the new Labour Finance Minister, Walter Nash, wanted to use the RBNZ to help stimulate aggregate demand, increase employment, and get the economy going again. According to NEF (2013), the primary goal of the RBNZ was to undertake “credit creation for the real economy”.

The central bank was to primarily use its money creating powers in two different ways. Firstly, it would guarantee the prices of agricultural produce, where “shortfalls between market and guaranteed prices met by its (RBNZ) advances”. Secondly, Nash instructed the RBNZ to make £5million of loans available for the construction of social housing — aimed at providing low cost homes to poorer households.

NEF (2013) further suggests that the RBNZ also created credit to help finance a number of other public work projects. From 1936-1939, the RBNZ created roughly NZ £30 million (equivalent to around 5-7% of New Zealand’s GDP). According to NEF (2012) over this 4-year time frame, real GDP grew by 30%.”

https://positivemoney.org/2016/04/canada-nz-a-history-of-qe-for-people-part-8/

Why do they want to see inflation? So that they can put up interest rates.

Of the two types of gods of money – actually humans in wizards hats who hold the power to create money out of nothing – the government and the bankers, only one benefits from high interest rates.

The banker wizards can retain even more.

The government wizard doesn’t mind, it can always create more to pay any interest rate. But it doesn’t, it uses it as an excuse to keep the public services small – so that private enterprise can feed on that need.

So that’s why inflation has to happen. By hook or mostly crook , it will. That is why the narrative is being fixed as it is.

Even in classic economics there is more than demand/supply that can affect prices for the consumers.

Monopoly and Cartels.

(Which is also how a lot of shortages and price increases happen in some countries which resist the old robber barons, as well as using ‘sanctions’ to effect artificial shortage.

They are beyond control in this neocon/neolib post Thatcher/Blair country in every aspect of our spending life. The watchdogs – Auditor & MSM equally monopolies, controlled no doubt by the same people. Controlled Regulators and politicians just toothless minions.

Yes they can magic up inflation just as easily as money. Fuel prices are going up steadily…

Please put me right if I have it wrong.