The Mail had this headline yesterday:

Britain's £100bn lockdown bonus: Bank of England economist Andy Haldane says Britons have saved bundles of cash during the pandemic... and now it's time to spend to rescue the economy

What the Mail fails to understand is that because households in the UK have saved, as have companies, then the government had had to borrow.

The government is the borrower of last resort. When the country refuses to spend - for whatever reason - then it has to make up the slack, and be the recipient of those deposits. That is its inevitable role as the currency producer.

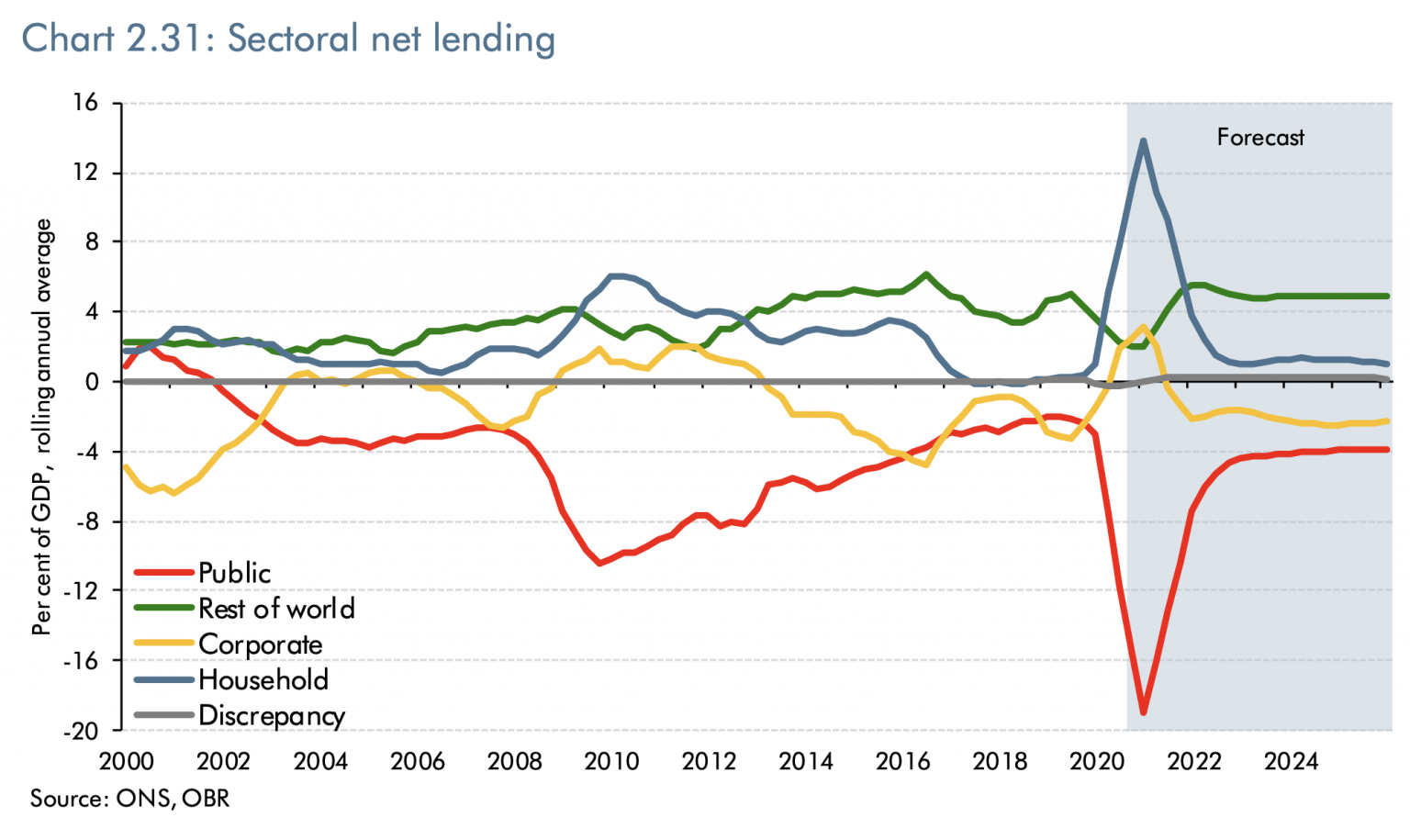

This is clear from the sectoral balances, to which I referred yesterday:

The peaks and troughs of 2020 do not arise by chance. Businesses, the overseas sector and households (especially) saved in 2020. And so the government had literally no choice but borrow.

So what the Mail was really celebrating yesterday was the impact of a government deficit. It just did not realise it.

And what it hopes is that consumer spending will drive that deficit away. I can't see that happening. But that's what it is really saying. It just does not realise it.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

If only the Daily Mail simply did NOT exist is a better question in my view.

I wouldn’t even put in my loo.

PSR, not putting in a loo is taking restraint in household spending a bit too far in my opinion. But thanks for the laugh on a morning of gloom

You might have to!

“According to the Confederation of Paper Industries, 1.3 million tonnes of tissue is used in the UK every year, with 1.1 million of it being imported into the UK.”

https://www.wired.co.uk/article/brexit-toilet-paper-shortage

Toilet paper shortages, anyone?

On which subject, I have to apologise for my recent comment wherein I suggested imports/exports via roro wouldn’t be happening but we’d still have the container ships coming and going. It appears I may well have been wrong as due to continuing problems at the major ports, Felixstowe where the govt’s chums have dumped loads of containers of PE gear in particular, there’s now concern the UK will be relegated to feeder status, which means in practice those container ships will no longer be calling here on any regular basis. Dearie me…

So Brexit is an even bigger load of *hit than I thought then Helen. Well done Brexiters. Thanks to you we might all end up wiping our bottoms with our hands………..actually PSR, maybe you will be getting the DM, if only to wipe your **** on it.

About the only thing i’ts fit for really, especially as its been one of the major promotors of Brexit down the years.

Imports are already running into serious problems. We try and source everything in the UK but that is simply impossible. We are too small to import directly on our own behalf (thank goodness) but the component we have most need of from overseas has been in short supply for over four weeks now. Last week there was none to be had anywhere. The importer we deal with has had their latest shipments delayed once a week for the last 4 weeks. Nobody could say definitively where their containers were. In Felixstowe, at sea, in the home port? they had been told that one shipment was on a vessel that had skipped Felixstowe because of the delays in unloading and had gone on to Amsterdam. They were also informed that it “might” call in on the way back. The Port is apparently practicing for the new import regulations which is adding further delays. I hate to think what is likely to happen when we actually get to Brexit. I am currently increasing the stocks of dried goods etc for the potential siege.

‘If only the Daily Mail simply did NOT exist is a better question in my view’.

Absolutely. Let’s silent any of the press whose views differ with our own. In fact, why stop with the press ? Let’s close any schools that don’t teach our orthodoxy on things like MMT. Then let’s lock up anybody who doesn’t agree with us on anything. In that way, there will be no need to waste our time with dissenters of any sort.

What a rag tag collection of people whose primary obsession appears to be constantly dictating to others how they should think and act.

Terrible

Oh look, a prime example of a right whinge grievance warrior. People express their justified disdain for a newspaper with a proven history of lying, racism, anti-semitism, homophobia and misogyny, which is essentially a right wing propaganda rag, like most of the British press in fact.

And that apparently is a tyrannical act of oppression of dissenting opinion. And then you go on to make the ludicrous assertion that those who support MMT want to shut down schools! Which schools teaching non MMT economics would those be then John?

Can’t you deal with arguments that don’t fit your right wing view of the world? Feel yourself being oppressed by the nasty liberal-lefties? Ah, diddums. Poor old righty, eh? You only live in a country where most of the press is right wing, we usually get right wing governments, we still have the tax and spend orthodoxy dominating (what passes for) debate on economics, and all you can say is that Richard and his supporters are trying to oppress you.

Sometimes I just have to let an idiot through…..

A spending boom! Oh good show – now we can raise VAT, which will cut the deficit even further.

And then we’ll get the Governor of the Bank of England using the predicted “spending boom” to predict rising inflation expectations to justify the increased taxes.

You forgot the BoE raising interest rates so bankers can make more money on their loans but all in the jolly good cause of defeating inflationary pressures. Rings through noses!

Going out on a limb here….but I find the Daily Mail to be useful – why? because it gives you an idea of where public opinion might be. it can help in understanding where people get their ideas and some of what drives them.

And for those who would or would not use it to wipe their bottoms on…….please note that the pictures are a bit slippy…….especially on a tablet…just sayin.

Cleaning your excretory orifices with newspaper should be avoided.

While the inks used are normally non-toxic, presenting more ‘delicate’ parts of your body to materials they are not used to; can cause allergic reactions.

Which may be an explanation as to why the mail is generally a pain in the rrrrr’s.

A little question – How much of these ‘savings’ are tax deferrals?

I note for instance I could have deferred self assessment tax from July 2020 to Jan 2021, this amounts to about 4% of my income. Is 31 Jan 2021 going to be a day of reckoning for some people?

Only a little, I suggest

But some will be