Dave Ramsden is Deputy Governor for Markets & Banking at the Bank of England. Yesterday he gave a speech with the title The Monetary Policy Toolbox in the UK.

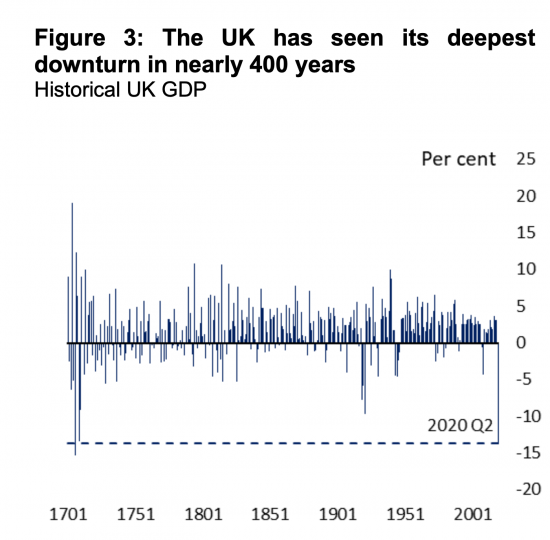

In that speech Ramsden made clear that the crisis we have faced is exceptional in scale:

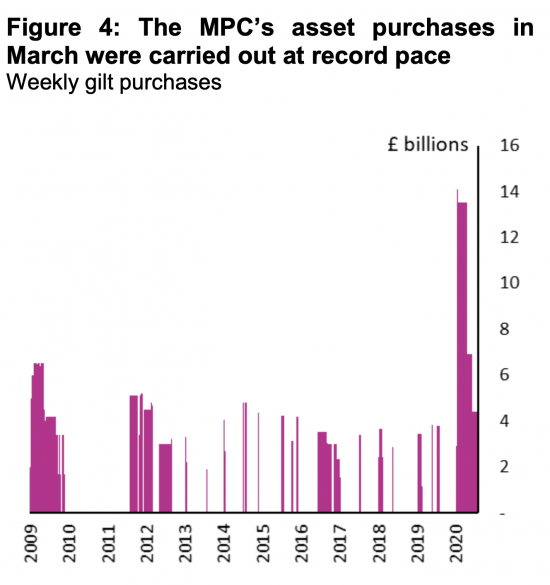

The response has also been exceptional, at least in terms of the scale of quantitative easing (QE) activity undertaken:

Around £250bn of quantitative easing funding has now been injected into the economy: by Christmas this will reach £300 billion. And as Ramsden had it, quantitative easing is by far the most important tool now in the Bank's 'toolbox' given that interest rate policy is, in itself, effectively dead because rates are at the zero bound.

My interest is in what he had to say on the future of QE. As he put it:

In practice the Bank does not buy very short maturity gilts. And to avoid distorting the market it avoids specific gilts where it holds more than 70% of the free float, and attempts to buy evenly across three maturity “buckets”.

He added:

But even with those constraints applied we have considerable headroom after the current programme is completed reflecting a range of considerations. And many of those considerations are within our control — while those constraints are there for good, pragmatic reasons, They are not set in stone and there would certainly be scope to re-evaluate them based on Bank advice if the MPC judged that even more monetary policy headroom was needed.

What does this mean? I suggest four things.

First, that we should expect more QE.

Second, that if necessary that policy could extend to 70% of gilts in issue. That's something like £1,740 billion right now, of which 70% is £1,218. With around £720 billion owned by the Bank right now that leaves around £500 billion of headroom, which is growing by maybe £25 billion a month given current gilt growth rates.

Third, expect this to happen soon. All the rest of the speech seemed to be preparing the ground for that.

Fourth, the 70% artificial limit will disappear at some time. The we will head for a Japanse style situation.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

[…] First of all, we are not borrowing right now. Quantitative easing ss covering the entire cost of the coronavirus crisis, and will very obviously continue to do so, as I have already noted this morning. […]

From this if the BOE ceiling for QE is £500 billion and £300 billion is already earmarked and they are doing this at the rate of £25 billion a month at the moment, this means that in 8 months time (June 2021) they will be “no money left” for Covid or anything else!

The £300 bn is already spent. The £500 bn is on top

And new debt is being issued….

Maybe I am imagining it….. or maybe too absurdly optimistic. Do I detect a relatively open mind about how to conduct policy? A mind that is asking for direction from government?

In short, I don’t see the BoE as the problem… it is the Treasury.

Maybe….

They could increase QE by 5 trillion, but it wouldn’t make a difference if the money doesn’t actually hit the real economy. Christmas is coming, a do or die period for many retailers and other businesses, without some direct stimulus to the population at large, there’s going to be carnage.

I agree entirely

And then next year looms bringing with it trading conditions which will deter many from buying from the UK or bothering to sell to it. How many businesses will that destroy? Calamity upon calamity await us.

There’s room for another £500 billion to make sure that bankers can make their Yacht payments but not a penny for the good people of Manchester so they can make their rent payments!

Boris said yesterday that it will have to be paid back.

He made it loud and clear.

The destruction this ‘paying back’ will cause could be as bad as the pandemic itself.

Agreed