My attention has been drawn to the Zero Hedge website where this has been posted:

The conclusion of the piece was:

I was asked to comment on this. I have three comments to make.

First, there is no such thing as fractional reserve banking anymore. Even the Bank of England says that is history. So, the whole basis for this post is wrong.

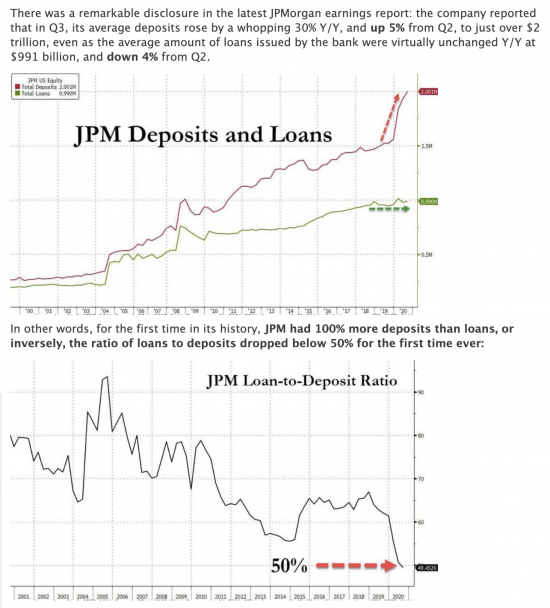

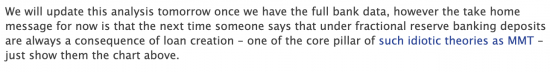

Second, Zero Hedge appear to be unaware that the quantitative easing process has the effect of creating new bank deposits which are then held with a central bank. This is not by accident. This is by design. And those deposits are not made within the commercial banking system by way of commercial banking loan, because this is central-bank money, and not commercial bank money, and the two are not the same.

Third, that central-bank money is created by loan, just like all of the money is created in that way, but the loan arrangement is entirely within government-controlled functions. This is what differentiates it from commercial bank-created money. Commercial banks can only create money by lending to third parties. Government can do it by lending to itself. In the UK that is done by government / Bank of England interaction. In the US, substitute the Fed, but the outcome is the same.

Given these three facts, what Zero Hedge reveals is that it has no comprehension of the way in which the banking sector, or quantitative easing processes, work. It's quite scary that such ignorance still exists.

Perhaps more importantly, it also reveals that it is entirely unaware of the difference between commercial bank-created money and government-created money.

Less surprising is the fact that it has not thought about whether, given that such a difference exists, it is appropriate for deposits held by commercial banks with their central bank should be shown as deposits on their balance sheets, or as something quite different.

I do not wish to be presumptuous here since this is an issue that I am currently working on. However, it seems to me that some fundamental accounting errors are now being made with regard to such issues. That error is partly in government accounting. There central reserve accounts maintained by the commercial banking sector with the central bank are shown as liabilities. However, in practice those commercial banks have no control over the redemption of these deposits, which can only be moved between those banks, but not ever, in effect, be reclaimed by them at their option, meaning that they do not behave like any normal bank liability. In that case, as they are effectively not repayable, are they liabilities at all? And in that case do these accounts need to be differentiated in the accounts of those commercial entities as being something fundamentally different from bank deposits?

I will return to this theme, but suffice to say for now that I think that significant new thinking on this issue was required.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

So you saying – commercial banks are saying, their Bank of England deposits are imputed on the bank’s balances sheet as if they are directly deposited within the comment bank account. If so is that not illegal or just plain naughty? As they are ballooning their own assets of the commercial bank, even though is deposited in the bank of England.

I am not sure what you are asking

Sorry

For the average person there is a huge mystique surrounding the double entry procedures of banks and their relationship to the State (the Bank of England) and given the chaos we are heading into this needs to be cleared away quickly. I have always struggled with the treatment of bad debt – I can see that banks, when making loans (creating money), debit asset accounts and credit loan accounts- a free standing double entry independent of the bank’s cash book and P& L account. If the loan goes bad the reversal logic would appear to be credit asset account, debit loan account; again because the entry affects both sides of the balance sheet equally there is no immediate impact on the P & L account.

I can see that Tier One capital is now there to buttress against the emergence of shedloads of bad debt but how does the bad debt reduce this capital? Since the net equity of the bank has not been reduced by the making of the loan how can it be affected if the debt goes bad? Given the mountain of bounce back loan defaults that may be in the pipeline surely the relationship of non payment to Tier One capital should be clear.

The reversal is not as you claim

The creation is debit loan account, credit current account

The reversal is credit loan account debit P & L account – the debt in the current account would also be bad

There is a P& L entry

Bad debt reduces reserves and so their one capital

I am struggling to understand why Zero Hedge believes a single bank’s deposits rise (at a time when unintended saving is a consequence of COVID-19) tells us much about monetary theory. I did not know there was even anyone left, other than emeritus professors of economics, who not only still placed credence in fractional reserve banking; but would actually admit it publicly.

How the economics profession reacts to that confession by Zero Hedge could be interesting. Order the popcorn?

🙂

Reflecting a little further on this; is there not a timing issue here, between money creation, spending and taxation. If created money is not spent ot taxed, then it is saved. If held by financial institutions we see inflation in financial assets (which followed the Crash and QE). If held by individuals; people not able to spend their income because of COVID-19, will lead to an increase in their bank deposits. So the question I would ask is; does the audit trail of this increase in deposits eventually lead back to a large number of domestic rather than business or financial accounts with increased deposits in their local bank?

Via a lack of demand, yes

But that means business accounts lose out

Zero Hedge are clearly worried about something if they have to resort to rubbishing MMT. They should not be surprised that there is more saving into bank deposits in the present crisis as the economy may or (very likely) get a lot worse and there are rainy days to provide for in future. Also the openings for profitable investment are narrowing (except for a few sectors such supermarkets, PPE firms etc. Buying land or property may also be dicey for several years to come unless investors are prepared for the long haul.

I am making a different point: these deposits are of central bank money, not commercial bank money, and they are different

So the balance sheet categorisation that lumps them together is wrong

Richard,

Is the claim, if I have understood the above correctly, that the growth in commercial bank assets is in effect down to the creation of central bank money that is credited to the accounts of the commercial banks (held at the central bank)?

If the above is correct then is the proposition that you are trying to put forward that the government treats these holdings as a liability but there is no way (at least at present) for the commercial banks to redeem these (in effect converting the central bank money to commercial money) and so its treatment as a liability by government is an error.

If the above two points hold then does the flat-lining of the values of the loans extended, preset both in the above series but also the corresponding series for citi group contained in the zero hedge article, indicate the the commercial banks do not see these deposits as assets (against which they could extend loans) and do not foresee, in the near future at least, any way to realise these as assets?

They are being treated as assets

They are assets

But they are not in the same category as other assets

And are they even deposits? That is the question I am working on….

More to come

Are they assets in the sense that they can be used to service inter-bank liabilities and could, in an emergency, be used to cover losses arising from bad commercial loans?

They cover inter bank liabilities

Covering losses is an accounting issue, and yes as assets, they do

ZH is not really an economy website.

It is a right-wing political site.

You need to et into the “comments” section, which is where the bias can be easily seen. There are so many troll-farm commentators making their opinion know, in many cases different names making the same, letter-for-letter comment, complete with the same spelling mistakes, that it is difficult for me to take anything it says seriously. Oh, and it is GOP to the core, and Trump is elevated to heavenly-heights!!

Have a read of this story (from a more interesting eco-nomy site) https://wolfstreet.com/2020/10/15/whats-behind-the-billions-that-airlines-raised-via-frequent-flier-programs-youre-the-collateral/ Revealing or wot !

Since I have been looking at introducing the new Scottish currency then I have of necessity been investigating things like the commercial bank reserve accounts at the central bank. I think the easiest way to think about all this is simply that the commercial bank is like any normal company, lets say running Sage Accounts like we do. It has (for simplicity) one bank account so while my business has an account at Santander then the commercial bank has its account at the BoE. This is the reserve account. The only genuine money the bank has is what is in the reserve account, just as with my company all the cash is the balance at Santander. Everything we think of as the bank customer deposit and loan accounts sit in the same place as customers and suppliers to a company. They are all just internal entries on the equivalent of our Sage system, and they have no direct connection to the bank’s own account, i.e. the reserve account. It is only when the bank gets a bank receipt or makes a bank payment that the balance in the reserve account will change. For example when a customer asks to move their balance to another bank. Or if a customer deposits notes and coins then they would credit the internal customer account but they are also BoE money so credit the bank’s account as well, so add to the reserve account. The bank does not need to have money in its own reserve account in order to make loans. A new loan just creates bank money, and the only thing they need to watch is how much of their bank created money gets transferred to other banks versus what comes in the return flow. In other words if you grant a lot of loans and all that new money is sent elsewhere then you can run out of cash in your reserve account. So in the converse having a lot of money in your reserve account (i.e. the bank has a lot of cash) does not mean you are going to have to lend it out. That depends on whether there are profitable and creditworthy potential borrowers. However having loads of cash in its reserve account will encourage the bank to look for lending opportunities, though in a depression not many will exist.

I am not sure I agree with all of this, but it us Friday evening….

Zero Hedge are just playing to the crowd who believes everything contrary to what we know.

It’s based on an assumption private banks ‘make money’ when in fact all they do is move it around. Whereas central banks are genuinely replenishing money stocks with new money.

It’s also typically neo-liberal in that there is no intellectual curiosity about the nature or origin of the money – it’s all lumped together and ‘just is’.

[…] Cross-posted from Tax Research UK […]

Hi, I find this subject daunting but in laymans terms (and probably missing your point) is it correct to say that the money from the bonds the BoE buys off commercial banks is held at a BoE account? My confusion is that from how I’ve understood (or not) the commercial bank can’t access this? But it can be used to back up their claims of being viable? But I thought QE had flooded the markets with money.

What am I getting wrong?

Many thanks

This is complicated

In essence you are right

The relationship is not absolutely direct but most of the cash created by QE has needed up bank on central bank reserve accounts with the BoE which are then used to guarantee payments between banks

So, in effect, a bank wanting to reduce its central bank reserve balance can only do so by increasing that of another bank.

This is why to relate these as liabilities of the BoE is wrong

And why it is also wrong to treat the repurchased gilts as liabilities is also wrong.

Ok thanks, that’s given me new avenues to research.

“Less surprising is the fact that it has not thought about whether, given that such a difference exists, it is appropriate for deposits held by commercial banks with their central bank should be shown as deposits on their balance sheets, or as something quite different.”

That is hilariously wrong. Reserves held at the central bank are on the asset side of a commercial bank’s balance sheet. They are not shown as deposits, which are on the liability side.

They are deposits at the BoE …..

Are you really that stupid?

I’m not the one being stupid here. You said that reserve balances at the central bank are deposits on the commercial bank’s balance sheet. They most emphatically are not. They are assets on the commercial bank’s balance sheet. They are deposits on the central bank’s balance sheet.

A deposit account is indeed an asset on a balance sheet

It’s never been anything else in the thousands of balance sheets I have prepared

Maybe you think that central reserve accounts aren’t deposits of cash – but that’s why you got this very wrong

The remarks in your piece are a total muddle. You don’t make it clear which balance sheet you are talking about – the commercial bank or the central bank – rendering them completely unintelligible.

Odd that no one else seems to have a problem

But someone looking very much like a troll does

I agree, Sam. The debits and credits are all over the place.

“Second, Zero Hedge appear to be unaware that the quantitative easing process has the effect of creating new bank deposits which are then held with a central bank. This is not by accident. This is by design. And those deposits are not made within the commercial banking system by way of commercial banking loan, because this is central-bank money, and not commercial bank money, and the two are not the same.”

This is not right. In QE the BoE purchases assets from financial institutions, with the commercial banks acting as intermediary. The bank reserves issued by the BofE, are paid to the commercial bank, which then issues a deposit liability to the financial institution. The bank reserves (liability to the BofE, asset to the commercial bank) back the newly created bank deposit (liability to the commercial bank, asset to the financial institution). It is the bank deposit of the financial institution that is ultimately the newly created money that can be spent in the real economy. The bank reserves “back” the bank deposits and the BofE’s assets “back” the bank reserves (and notes circulating in the hands of the public).

Maybe you should actually find out how the process works

The commercial banks are nit unermediaries, except to the extent that they provide a payment conduit

Your claims are wrong