Overall there is little that I can say to commend the Institute of Fiscal Studies report, out today, on the government's spending options. The report applies conventional analysis to conventional options and concludes that the government has a choice between more tax, more borrowing and less spending in the future without ever considering the option of more money creation when an increased scale of government activity, which the rerport forecasts, will obviously require new net government sector money creation.

There are, however, one or two points worth noting in the report and this table is certainly worth recording:

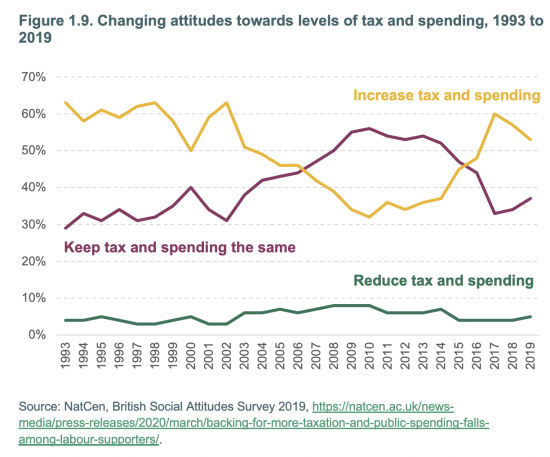

The lack of support for the neoliberal project is staggering, despite all the investment that has been made in it by so much of the political class.

That there has been significant overall support for increased tax and spending since 2015 is hardly surprising. I suspect that such support is increasing again at present. What is apparent is that during periods of Conservative government it almost invariably increases, and usually exceeds support for keeping tax and spending the same, whilst being massively more popular than reducing tax or spending.

I am, of course, encouraged by this.

I am, in fact, more than encouraged. Day after day right-wing astroturfing commentators turn up on this blog to suggest that I am presenting a far-left agenda. In fact, what this government-funded survey shows is that I am putting forward ideas supported by a majority in the UK most of the time. The idea that there is no demand for a bigger estate to meet real social demand is absurd.

But, and I stress it very strongly, that does not mean that people do not want an effective private sector. In fact, I am sure that very many who support the idea of increasing tax and spending would very strongly hope for a more effective private sector, as I do. But what we know is that small government, lax regulation, a tax authority stripped of its resources, and a wholly ineffective company registrar have in combination left the UK without any prospect of an effective, functioning, fair, private sector because we do, instead, have a system where cheats prosper, monopoly thrives, new market entrants have almost no chance of success, tax is not paid and fair competition has ceased to exist.

To believe in fair competition, a fairer society, a strong public / private partnership and real opportunity you have to believe in a functioning state. It would seem that a majority in the UK do that. We are, however, denied it. Why is that?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Self regulation does not really work – we’ve known that for years in the financial sector and also in industry – look at du Pont and their hiding of the toxicity of their non-stick products in the U.S. (I’d recommend watching the film ‘Dark Waters’).

The issue is that big business likes to use its money to effectively get politicians to turn the other way (rampant in the U.S. ) or threaten a loss of GDP or ‘much needed jobs’ to ministers if State regulation is mooted.

It is also possibly rooted in how much debt the companies have with the banks and the banks take a keen interest in your operating costs because they want to ensure that as much company income is generated in order to pay back their loans.

I worked with the CLG and Tenant Services Authority (TSA) in social housing in 2009 looking at a higher tenant involvement standard. The group included people from the Registered Social Landlord (RSL) sector (Housing Associations) who made it clear that their lenders were not in favour of greater accountability to tenants because of the cost.

Housing Associations do get Affordable Housing Grant from the Government but the rates are low and so they get the majority of their loans from the banking sector to pay for development growth.

In 2010 along came the Tories and the TSA was wound up, and the bonfire of the regulations took place under austerity.

But the banks still get paid – and how.

And the bankers view is that debt is good because it enforces spending discipline in debtor organisations which covers everything from wages to investment in services.

And thus we see the stranglehold the bankers wankers have on our society as well as the diminished role of direct State provision.

I think you have answered your own question. Those in authority don’t give a damn about a fairer society. As long as the money is rolling into their own pockets very nicely this is their principal concern, Altruism on the part of the wider public is of no concern for them whatsoever.

as a matter of interest has the IFS ever prepared a critique of MMT ?

if so where ?

I am not sure it has

It clearly does not subscribe to it though

The IFS aren’t even up to presenting a coherent explanation of how they think the UK monetary system actually works. They are far from being a “think” tank just a bunch of Libertarian posers!

[…] have already referred to one public opinion survey on tax-related issues this morning, and then realised that I had not reported another, which was of significance, and which was […]

As ever, there is a poverty of imagination of what the state could achieve.

Strangely we can build HS2 but cannot fix some railway junctions. We are going to have Sizewell C nuclear, but not much in the way of tidal energy.

We will welcome workers from outside the UK on a points based system, but not train nationals to do the work of tomorrow.

We will lock up young men who could have had a chance of a worthwhile life had interventions been made in their earlier years.

Am I alone in thinking that Keir Starmer does now need to rise to the challenge – not just looking competent, but visionary.

I wish he would

I have been discussing that issue today on an edition of the ALex Salmond Show, out on Thursday

And yes that is RT, and I know all the issues

But the message is more important than the medium, I have decided

The IFS is amazing in the total failure of its staff to study the historical evolution of the British monetary system and how the authorities reached the point where it became very apparent the country needed a “Financier of Last Resort” and what the implications of having such an agency meant in times of so called non-crisis (is there ever such a time when regulating the economy to avoid incipient crisis can be abandoned? Think Minsky!) as well as crisis!

Remember the IFS does not do macro and they simply do not think beyond the household analogy

If the government finances are like a household and can print money. Logically households are like the Government so I want to print my own money.

You can try

See how many people accept it

@ Ben Oldfield

Do tell us Ben about your powers to force redemption which gives value to money, a debt/credit flow relationship.

Here’s some data for the Libertarians at the IFS to chew over in regard to inflation causes:-

http://www.paecon.net/PAEReview/issue93/PodkaminerB93.pdf

That issue only arrived last night!