As the Guardian has noted this morning:

Tax increases will be needed across the board for Britain's highest and lowest earners to bring down record levels of government debt amassed during the coronavirus crisis, leading economists have warned.

Sending a message to the chancellor, Rishi Sunak, as he explores possible options for raising taxes at the autumn budget, experts from four of the country's leading economic thinktanks said any significant tax changes should not be introduced until a sustainable recovery has taken hold.

I noted that this hearing was on yesterday. At one point I intended to watch, but events got in the way. But I did notice something from the notice of the hearing. This noted that the speakers were:

So we have one person from a far-right think tank that will not disclose its funding and three other speakers, all of whom have worked for the Institute for Fiscal Studies, which is a microeconomic think tank that says it does not do macroeconomics. And yet the issue that they were discussing was macroeconomics. I am not disputing that each of the three currently or formerly at the IFS might know about tax at a micro level, but macro knowledge appeared to be almost entirely absent from the transcript of the hearing, which I have read.

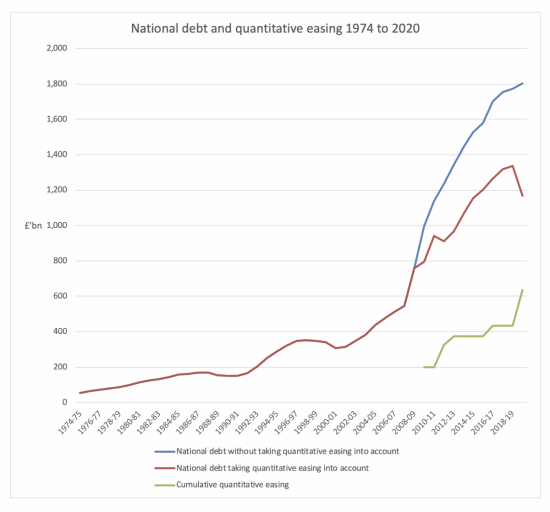

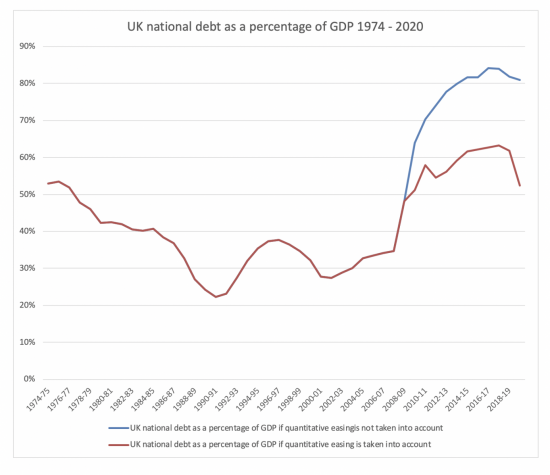

Perhaps the most telling evidence of that is that there was no questioning within the hearing on the scale of the so-called national debt. It is claimed to be £2 trillion, but net of quantitative easing it is not:

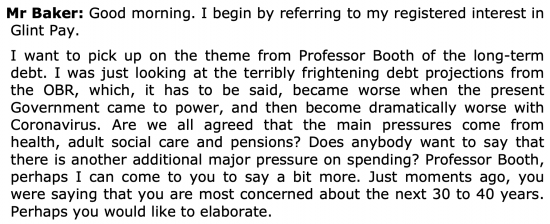

That data is to March 2020. The percentage data looks like this:

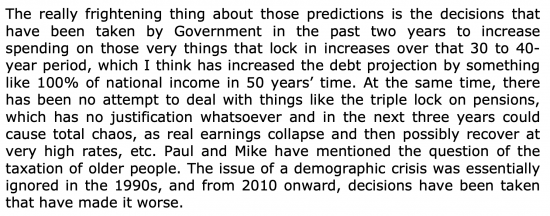

That data is, again, to March 2020, and we know that the top line has now risen to 100%, aided (no end) by the fall in GDP, but that the real debt figure is well below the headline figure was not discussed. Indeed, the impact of quantitative easing was not mentioned once in the hearing. This was a discussion of tax to repay debt where no one present seemed to know that tax does not have this role. Instead, we got exchanges like this between the far-right Steve Baker MP and the far-right Philip Booth from the so-called Institute for Economic Affairs:

Booth replied:

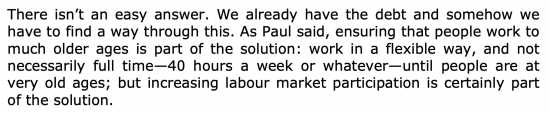

This was not challenged by the meeting. Nor was this comment from Booth:

How is coronavirus to be paid for then? By making people work until they drop, apparently.

But then, the whole discussion was deeply regressive. Gemma Telow for the Insitute of Government when asked to discuss tax increases said this:

So, the focus was on being regressive. It was a commonplace theme. All that was agreed was the deferring the increase in regressive taxes was desirable for the time being. Overall, the tone was deeply depressing, ill-informed as to the role of function of tax in the economy where Philip Booth was allowed to make wild claims without any correction being offered, and (to be blunt) very small-minded in the sense of being intensely micro, and so peripheral.

At the conclusion of the hearing each was asked by MP Harriet Baldwin to summarise their recommendations. This is what they had to say:

So what have we got? I summarise as:

- Some sensible reform to council tax, barring Booth's suggestion;

- Some tinkering with road fuel duties ;

- An assault on the self-employed, who I should remind people on average earn much less than employees, with considerably less security and support from the state;

- Significant increases in VAT;

- No changes to corporation tax, at all;

- An increase in income tax on the lowest paid but no mention of higher rates;

- No wealth tax reform barring, maybe, on capital gains tax;

- No mention of tax relief reform, generally;

- And nothing on measures that might address climate issues.

In summary, the leading think tanks think that we need tax increases, and that the least well off in our country should be paying more tax to pay the price for coronavirus which has already been paid using quantitative easing, which does not need to be unwound. Meanwhile, capital gets an easy ride and the wealthy aren't to be impacted almost at all. It was a deeply depressing event.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

I think you might want to review your definition of ‘far right’, it you want any credibility!

According to you, anyone to the right of the Lib Dems is ‘far right’!

I have reviewed my definition

It is right

Philip Booth is anti-communist and anti-socialist. I am not entirely sure who he thinks is communist or socialist, but it seems to extend to Roosevelt. And therefore extends to anyone who supports those ideals today, which includes the Green New Deal.

This is re-identification of the centre ground (where I have always felt myself to be centre left, and where the Tory Ian Gilmour was once centre left) as the far left

What a load think-wank.

It’s amazing – it’s like being in a some form of ‘death-cult’ Richard!!?

It’s the pinnacle of the success of ignorance.

Help!

Incredible.

Never has so little been offered to the many by so few.

“a far-right think tank that will not disclose its funding”

Perhaps they are being funded by a Trust that wishes to remain anonymous? Didn’t you afford anonymity to one of your financial supporters for the same reason?

In the last decade or more I have not disclosed about £25,000 of income, although I made clear it was a Quaker related trust, because the sole relatively aged, female trustee did not want the aggression from right-wing sources that might follow

I explained the income source then, how much it was and why it could not be fully disclosed

The IEA refuse any disclosure of any sort

There is no comparison – unless you are the sort of person who would hassle a trustee

Perhaps the IEA wouldn’t want to subject its financial supporters to the aggression from far-left supporters that might follow?

If this is an acceptable stance by you, why can you not afford the IEA the same rights? Unless you are the sort of person who would hassle a donor?

In the same circumstance, I have no doubt IEA would have a case

But that is not the case that they make so your claim is completely false

Like much the IEA say

“ did not want the aggression from right-wing sources that might follow”

What complete nonsense..your a hypocrite end of story

Your persistent comments here (most of them deleted for good reason) do prove my point, very precisely

Upon further reflection, these 4 come across like the Four Horseman of the Apocalypse.

It’s like consulting 4 funeral directors on how to treat a medical problem.

Covid-19 is going to be used to finish off the job that Cameron & Osbourne started.

This is quite simply disaster capitalism isn’t it?

But the biggest problem is the British people, too many of whom I think will let them get away with it.

Agreed

I think you hit that on the nail the country is being run by “funeral directors” – ill-conceived Brexit (The EU isn’t going to stand for the Tories massively subsidising British businesses whatever form this takes), massive increase in poverty and public services failing to cope after ten years of austerity including a pandemic arriving, and now the threat of a break-up of the union.

It is clear that the government think that pensioners are easy cash cows to milk and want to add to inter-generational tensions. Already the TV licence fee has been re-imposed (with imprisonment threatened for non-payment). Talk of abandoning the triple lock for pension increases to the lowest option is clearly on the cards.. It will only be a matter of time before winter fuel payments are scrapped along with bus passes. I expect Mr Steven Baker will think the extra 10p a week that the over 80s get is an exorbitant expense and will help the national debt reduction by saving this vast sum!

I suspect you are being far too optimistic

The UK Parliament is a joke! Almost no MP’s competent enough to discuss macroeconomics being even too dumb to recognise two very obvious lessons from British history A) the UK state bought “the market” into existence requiring the private sector to provision and equip its army and navy and B) the first thing British imperialists did after conquering a country was impose a head tax to make the inhabitants work for the conquering government and private colonialist businesses.

“That data is, again, to March 2020, and we know that the top line [Debt/GDP%] has now risen to 100%, aided (no end) by the fall in GDP, but that the real debt figure is well below the headline figure was not discussed.”

In other words, we should notice how the Debt/GDP% is a function of both the numerator and denominator. Allow me to be cynical (heaven forfend!).

I suspect we are being set up for a return to Reinhart and Rogoff (this is Johnson-Cummings politics; the fact the Reinhart-Rogoff thesis has long been utterly exploded doesn’t matter, this is the world of effective populist politics: Twitter repetition – the last Tweet is the only truth that matters.

The British Government will play the impact of the fall in GDP on the Debt percentage as the real calamity; this is faux ‘science’. They will use the sharp rise in the Debt/GDP% to justify either tax increases (but not of the wealthy – because the easy, cheap increases are in PAYE and VAT, and there is far less effective outrage doing that than taxing the 1% – for taxing the 1% is very easily manipulated by their lawyers, accountants, and their PR consultants (the best money can buy, and money buys a lot). The 1%’s PR consultants are known to we mere mortals as the British media (who own them, body and soul), supported by bleating far-right think-tank lobbyists; so the Government will probably resort to austerity, the easiest option with the least complaint, because it is only the poor who complain – who cares; this is a Conservative Government, they understand only faction, they simply define their faction as “the nation”? They will make the poor and disabled pay again, and again, and again; because the poor and disabled are powerless, few Conservative MPs represent them (save intolerant Brexiteer ‘red wall’ constituencies), or will stand up for them, and no think-tanks, no lobbyists, and no money supports the poor and disabled; the public really needs to think about how they are being maipulated by the simple combination of money + technology + PR. The British public is being stiched up yet again; but that, above all is because they are, above all being unbelievably gullible. They should know better by now.

“They should know better by now.”

Clearly many voters are like children and to avoid harming themselves require caregivers who care. But where are these caregivers who are meant to act as caregivers? Our political representatives are like children themselves, children who get given a silver spoon as soon as they enter Britain’s well-rewarded Parliamentary system, the true “entryism!”

Yet more despair! How can you write an article as Larry Elliott has just done without spelling out the implications of the options he lists?

https://www.theguardian.com/business/2020/sep/01/rishi-sunaks-tax-options-are-hemmed-in-by-the-tory-manifesto

I don’t know….words will be had

Perhaps this one-pager explanation of MMT may help the penny truly drop particularly this extract:-

“As MMT explains, since reserves must be exchanged when purchasing government bonds, the reserves must be supplied first before bonds can be purchased. It demonstrates how the Fed provides the needed reserves even as it upholds the prohibition against “lending” to the Treasury by never buying the bonds directly. None of this is optional for the Fed.”

http://www.levyinstitute.org/publications/are-we-all-mmters-now-not-so-fast

I fear few will get that…

I wonder if it is time for Richard to become a bit more ‘mouthy’ – or perhaps a Richard Mk II who can get on the media with some ‘man of the people’ comments.

Comments that can then be supported by good evidence.

PSR – has your time come? I like ‘thinkwank’…

As an aside, I think there are some excellent people on this blog who have very particular insight in their areas of knowledge. It would be good to bring these people together in perhaps another blog or some Youtube videos.

This is what Progressive Pulse was meant to do

I would encourage people to write for Progressive Pulse, which I publish

Please do

May I say, I think one of the worst products of current politics is the exploitation of faction and division, especially achieved most effectively by the Convservatives. The Conservative Party do factionalism “best” in Britain, because they win general elections, more often and for for no good reason, save the cynical exploitation of profound and repellent personal prejudices; they try to move convential political standards of public reasonableness inexorably toward intolerance and beyond the margins of general acceptability, in order to square the circle of intolerance.

I do not think answering this tactic in kind is a wise decision for anyone, who has any standards at all. The requirement surely is to be wiser and smarter. I do not deny that this is far more difficult, when you are up against people who are ruthlessly and cynically intolerant of opposition, and – when the chips are down – will, surely, stop at nothing. I have no inclination to join them in a race to see who can win by throwing themselves furthest and deepest into the foulest sewer.

Thanks Richard – I will take a look at Progressive Pulse.

@John S Warren – I was thinking more of making seemingly outrageous comments as a way of getting noticed. You can be funny, interesting and engaging – so less Brian Blessed and a bit more Rob Brydon / Rhod Gilbert.

I think the BBC apologised for having e.g. Stanley Johnson on so regularly over Brexit, but they made the point that very few people were willing to to be interviewed. Clearly there were plenty of people who had clear and coherent views, but they were not known to the BBC.

I’ve just done an hour with the Express….

Be careful what you wish for!

‘an hour with the Express’ !!?!! It is exhausting enough just flicking through their leader page online.

Well done – and in my view it doesn’t matter if they don’t like you – it could get picked up by other ‘quality’ news outlets

Indeed

Where is the vision? When talking over business plans, one of the most useful questions is: “Where do you want to be in 20 years?” . Silence is the normal response, followed by management babble. What is being offered by the majority of commentators (you excluded, take a bow) is horribly short term and fails to address any of the key structural problems of the post Covid world.

Agreed

I particularly like this declaration of “priors” by Harriett Baldwin (Con): “tax is money taken off the individual by the state in order to spend it on public goods, under threat of imprisonment”. Well, I think she meant to say “Tax is theft”.

What an anodyne set of questions, all very cozy, and really we all agree on the nature of the problem and the solutions. End of. Now on to Andy Haldane’s cozy chat about how he hasn’t dropped any clangers in his 6 years as a member of the MPC, that there has been a v-shaped recovery so far, though the past is no guide to the future, that much has been done and more will be done as and when required.

“Say ‘good night’, Dick.” “Good night Dick.”

🙂

” current behaviour of traders is to try to get their goods reclassified as zero rated for VAT instead of standard rated” – what nonsense. The boundaries between zero rating and standard rating are set in law and attempts to reclassify goods as zero rated have been dealt with by HMRC and previously C and E to the point of exhaustion via Tribunals in the past – there is no scope to change the liability of products that are currently standard rated unless someone invents some new version of the famous Jaffa cakes case. I remember when I worked in C and E I had one case of a fruit bar that the trader had zero rated but in fact should have been standard rated but such border line cases are few and far between – and can work both ways.

I think we both kn ow what that reveals….

Replying to John S Warren

‘I do not think answering this tactic in kind is a wise decision for anyone, who has any standards at all. The requirement surely is to be wiser and smarter. I do not deny that this is far more difficult, when you are up against people who are ruthlessly and cynically intolerant of opposition, and — when the chips are down — will, surely, stop at nothing. I have no inclination to join them in a race to see who can win by throwing themselves furthest and deepest into the foulest sewer.’

I fully agree with Mr Warren’s comment. However, anyone who tries to offer a viable alternative (in any manner whatsoever) to the status quo will be cast down, spat upon and trampled to dust by those who dwell in the sewer and the mainstream media, which is in the pay of those who control and uphold the prevailing narrative. I cite the treatment of Jeremy Corbyn as just one example. In my opinion the constant demonisation, slurs, outright lies and misinformation that was printed about him looked like a (successful) campaign to deny him a legitimate platform from which to implement policies that would have reversed some of the damage done to the most vulnerable in our society. The attacks weren’t about him per se, they were about a (successful) attempt to eradicate any whiff of socialism entering the political discourse. That his policies were labelled ‘hard left’ was a joke. Then I am of an age to remember what the ‘hard left’ looked like back in the day.

Perhaps, in moving foward we need to move away from descriptors such as ‘left’, ‘centre’, or ‘right’ and towards ‘social justice, equality, fairness and inclusiveness’. Perhaps politicians are not the right sort of vehicle by which such messages could be delivered?

Of course, the ‘great’ British public seem only too happy to ‘go with the flow’ and not bother themselves too much about what is really going on until it hits them square in the face. By that time, when too many are nursing their sores, I fear we will be too far down the rabbit hole to do anything about it. Indeed, I don’t think we will even know how. The ‘establishment’ are already moving into the domain of social media to close down alternative sources of information that challenge that which is put out in the mainstream. We are, I think, moving into a kind of dystopia that Orwell described well.

The future belongs to all of us (for varying amounts of time) but, in the main, it belongs to the young. They are our hope and their own salvation. Perhaps then, messages to be conveyed need to be delivered by those who resonate with the young? They are out there. Can they be harnessed in sufficient numbers and be enthused enough to challenge the status quo? I hope so.

Hi, I work in care and my parents have very kindly bought me a flat I could never afford on my wage. If council tax was proportionate to the property it might be beyond my means. Would it not cause more social segregation along economic lines. Is a tax proportionate to the amount of property/land you own more effective at wealth distribution and so social cohesion?

Thanks

The intention is that this would increase council tax on high-value property and reduce it on lower-value property, which most flats are, relatively speaking