I was aware I was being controversial yesterday when I suggested that the Office for National Statistics was lying about the scale of UK national debt in its bulletin on public sector finances, issued yesterday. I was also aware that I was being provocative. But in the sense that I was suggesting that the ONS were stating something other than the truth - as evidenced by the UK Whole of Government Accounts - I was entirely happy with the claim. After all, if the audited accounts for our government show debt to be other than the ONS claim it to be, because in the audited accounts the bonds owned by the Bank of England under the quantitative easing programme are offset against the total debt to deliver a much lower figure than that which the Office for National Statistics claims exists, then the ONS simply cannot be right.

Someone called Phil Stokoe, who implies he used to work at the ONS, did, however, get very angry in response. His suggestions were (and I quote him to make sure I am being fair):

[The] ONS are publishing a number of different measures for public sector debt, and trying to do so in accordance with internationally accepted statistical methodologies, but these are tempered by other considerations.

I agree they are, but let me be clear: none appear to be right. He continues:

The method for the headline number of debt (Public Sector Net Debt ex) has been basically unchanged for a decade and this was introduced during the global financial crisis.

I agree: the current method was introduced to exclude the debt of nationalised banks and disguise the impact of QE. As he notes:

[I]n 2008 the UK defacto nationalized RBS, Lloyds and Northern Rock, and so these entities were classified into the public sector, that meant their liabilities and their liquid assets entered into net debt — but back then, it was envisaged that these interventions, and the BoE quantitative easing, would be short term affairs — that the banks would be sold back to the private sector (as has happened now with Lloyds) and QE unwound.

But those assumptions did not prove to be good. Many of the nationalised banks failed. 62% of RBS is still state-owned. And QE has not been unwoud. So the conventions adopted were wrong, as it turned out. And so too, then, was the accounting, which needs to be revised, which is the whole point of my claim. Stokoe claims otherwise, saying:

In addition to this, ONS uses a definition of gross debt that includes three types of liabilities — debt securities (bonds and T-Bills), loans, and currency and deposits. These are all clearly liabilities, and widely agreed that these are debt (EU Maastricht debt includes these three instruments, the IMF Government Finance Statistics Manual definition of gross debt encompasses these and other laibilities too).

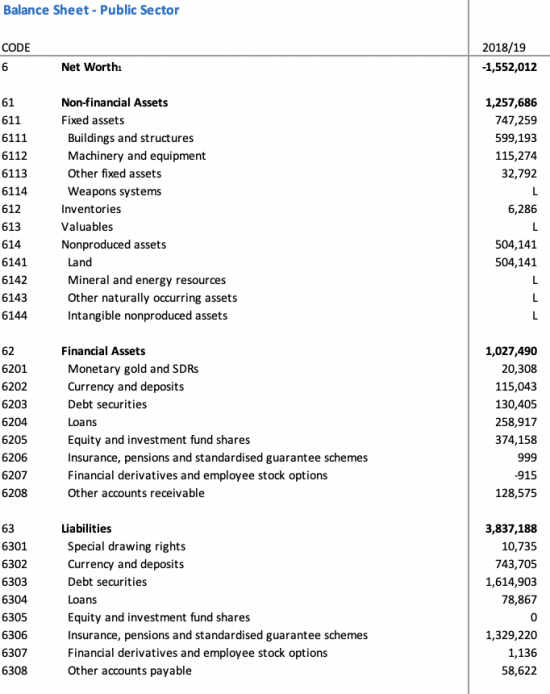

Except that's not what they call national debt, as I make clear below. But before doing so, I noted he provided a link to an ONS spreadsheet which suggests that the UK public sector balance sheet for 2018/19 (which is the last year for which we also have Whole of Government Accounts) looked like this:

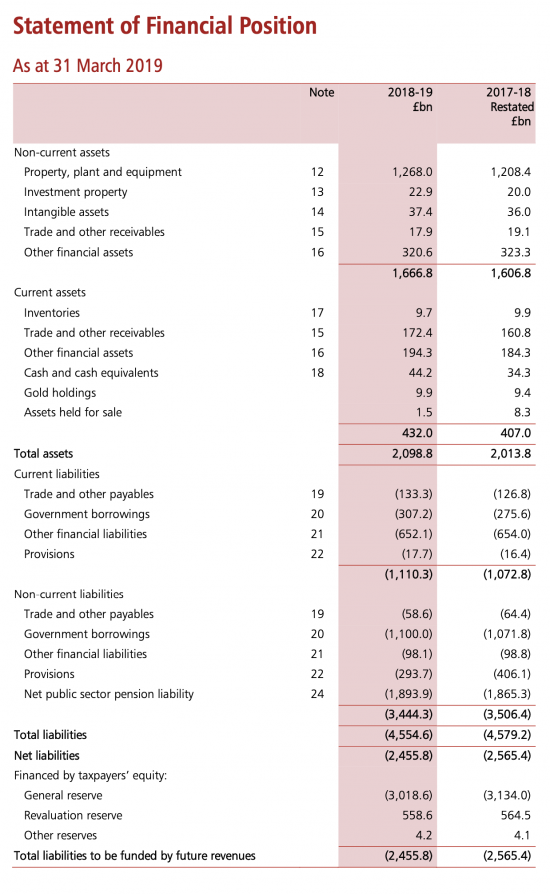

I offer this to contrast with the audited Whole of Government Accounts, that looks like this for the same date:

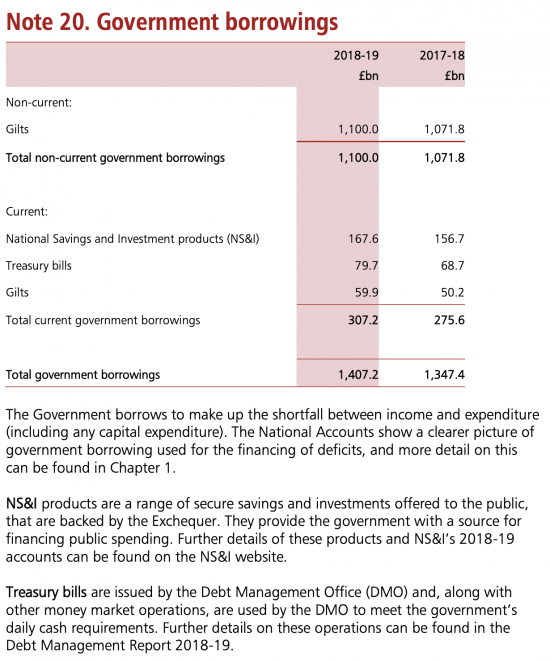

Should we worry that the ONS is, overall, about £900 billion out? I suggest we should be. Only one of these numbers is right, and I'm going to suggest it's the audited ones. And in them the debt, in the form of borrowing, is stated as follows:

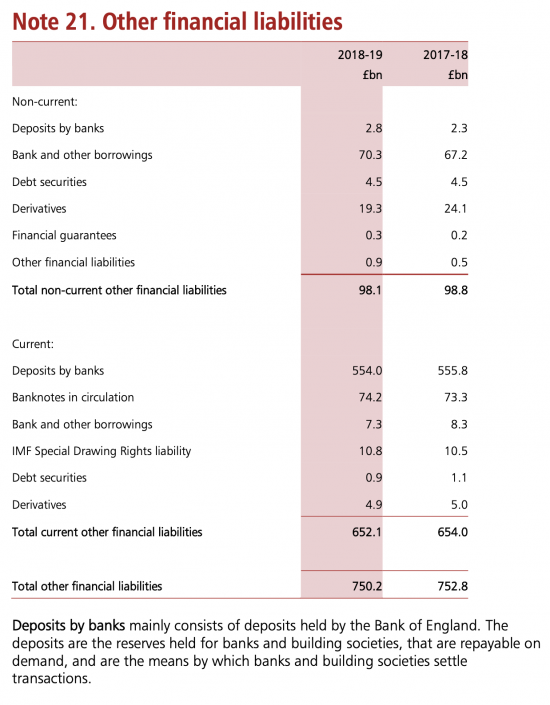

Whilst other financial liabilities are stated to be:

Having noted this, let me go back to the claims from Phil Stokoe. He says:

QE has the practical effect of replacing a government debt security liability with a Bank of England currency and deposit liability. There is still a liability there. Debt is only lower by 735 billion as you claim, if you use a narrow definition of debt, and ignore the Bank of England's own liabilities. As for the 200billion at NS&I, these are clearly liabilities as well, I'm not sure why you'd argue to exclude these.

And he adds:

All of this is complex, all of this depends on the accounting conventions used (ONS is not following IFRS or the public sector equivalent, IPSAS), but statistical standards, in line with the Eurostat manual ESA 10 and the IMF GFSM.

You are objectively wrong to state that ONS are lying, and its not correct to call this false accounting either. You, as much as anyone, now that accountancy is riddled with conventions and differences in treatment which is why the accountancy communities professional in joke is “What is 2+2? What do you want it to be”.

ONS are following a consistent approach, that has been in place for a decade, and its disgraceful for you to question their motives in this way, and you should strongly reconsider this post.

In summary, he demanded that I apologise.

I will not be doing so. There are very good reasons for not doing so.

First of all, debt subject to QE is no longer debt, and accounting standards make that clear. In other words, I have literally nothing to apologise for. His claim, and that of the ONS is wrong.

Second, because a statistical convention agreed in 2008 says otherwise does not make that alternative claim true. I will stick to accounting standards on this occasion as the indicator of what is true and fair.

Third, I can say with absolute confidence that the statistical convention that he refers to is in denial of the truth, as is the ONS as a result. As the March 2019 version of the UK government debt and deficit report for the Office for National Statistics notes:

To claim that the ONS is right when to make it so requires that it deny that a Bank of England subsidiary company is within the government sector is pushing the boundaries of credibility beyond any reasonable limit.

Fourth, to claim that the standard set in 2008 is, in that case, an objective basis for the assessment of the truth is, very politely absurd. Implicit in that claim are a number of assumptions that I think are wrong. The first of those is that there was no politics involved in misrepresenting national statistics at the time when the commencement of QE programmes was deeply controversial and required political cover from national statistics, which has been maintained ever since despite the obvious need for reform. The second is the assumption that such statements are beyond political influence, which is very obviously false when all accounting is politically laden as to meaning. The third is that the statement was ever right, when it has now become apparent that QE programme has not been temporary or likely to be reversed, as was incorrectly assumed (or claimed) in 2008. It is now,m very obviously, permanent and highly unlikely to ever be reversed, changing the whole nature of the issue. And therefore, there is, fourthly, an assumption that the failure to revisit the convention in the light of subsequent behaviour and evidence is not itself a failure on the part of those using this framework, which failure has itself resulted in misrepresentation of the truth. And fifth, there is a failure to recognise that this misrepresentation has been deliberately maintained by vested interests to achieve a political goal even though they must know it is wrong, as the accounts show.

But perhaps as significantly, I simply think the claims about the ONS data that Phil Stokoe makes are wrong. In fact, the ONS agrees with me on that. Phil Stokoe claims I am wrong because debt must include central bank reserves. But that is not in any way what the ONS are saying. They do not say this because it's clear that they do not even understand many of the related issues. For example, they make this quite extraordinary false claim:

But that is not how cash is made available to the government. This year almost all of the government's borrowing requirement will be covered by QE, and as the Bank of England says of QE:

So, the UK government does not, to get cash, sell financial instruments as the ONS claims. Instead, it asks the Bank fo England to create the cash for it. And that is exactly what is happening. If they cannot tell basic narrative truths what else should we believe about their data? My guess is that they have also not read how the Bank of England says money is created. Nor, I suspect, have many who have commented on this issue. But that is an issue I will address in another blog.

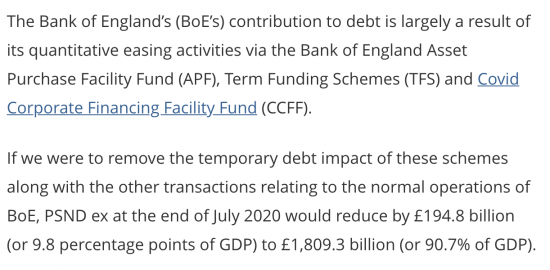

To return to the ONS, what it says is this regarding debt:

Then they add this:

No explanation as to precisely how these sums are calculated, or reconciled, is supplied: indeed, despite publishing a figure that the ONS knew would attract headlines (debt of £2,004 billion) it made no attempt to explain the composition of that number or what it might actually mean, barring these vague estimates. And please do not refer me to spreadsheets headed by code to say they are the explanation: an explanation in code that is only known to ONS insiders is not an explanation, at all.

What is more, the House of Commons Library, still insist that:

In fact, the best data says that NS&A balances are about £177 billion at present. But if that's true (and that's audited accounting information, so I am going to rely on it) then what is very clear is that the £2,004 billion of debt the ONS says exists, less the £194.8 billion they say is attributable to the Bank of England, less the £177 billion attributable to NS&I does not reconcile to their figure of £1,681 billion of gilts outstanding by some £49 billion, the cause for which difference is left unexplained, hanging in the air, giving rise to considerable doubt that any of the numbers they refer to of their own creation actually have much substance to them, and may be subject to either significant degrees of error, or are simply balancing numbers, the composition of which they do not know or are at least not willing to publicise, which in itself is a significant failing on their part.

But whatever the true numbers are what is clear is that Phil Stokoe's claim that national debt includes central bank reserves according to the ONS is wrong. The ONS ignores central bank reserves in publishing this figure, just as it ignores quantitative easing and just as much as it ignores the Bank of England Asset Purchase Facility Fund for purely political reasons, as I have suggested throughout my arguments.

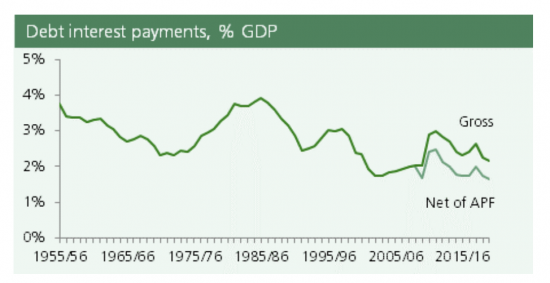

I should add just one further point, though. It is that when the House of Commons Library issued a note on the National Debt, also on Friday, they did recognise that QE had some impact because they noted this:

That is, they recognized that the APF - the Asset purchase Facility - has an impact on debt costs because it cancels debt, and yet the ONS cannot. That I can suggest that the Whole of Government Accounts are right and the ONS is wrong is, then, something which some other parts of government are also capable of recognising.

So, do I have reason to apologise in that case?

Very clearly not. My claim is right: national debt does not include central bank reserves, and the ONS actually agrees.

But what is more, the quantitative easing debt can and should be offset against gross debt owing as stated by the ONS, as happens in the Whole of Government Accounts, but which only does not in the ONS data because of a purely political decision to assume that the Bank of England's purchases of government guilts take place outside government when very clearly they occur right at its heart, with explicit Treasury permission.

And the ONS data does not, in any case, remotely reconcile to audited information and that published on Friday was put into the public domain without any proper explanation that suggested how it was comprised, which itself was negligent on the ONS's part.

Phil Stokoe's demand that I apologise is, then, a demand that I am very happy to ignore.

I won't demand that he apologises. That's not my style.

But I may be raising this issue with the ONS.

And other blogs will follow on the issue of central bank reserves and the national debt.

––––-

Addition on 23/8/20:

Phil Stokoe and I are now in discussion.

He is no longer at the ONS.

I am giving him a right of reply to this post and he intends to write one.

We are also planning to discuss the issueS it addresses, and which I too will be addressing in blogs to come. Whether that will be on or offline is not yet decided.

I will leave him to decide if he wishes to disclose his current position.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog's glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Buy me a coffee!

Buy me a coffee!

Looking forward to Phil Stokoe’s argument why the UK government can’t create money from thin air when the Bank of England says private sector bank’s can! Somehow I think he won’t respond or if he does there won’t be a rational argument!!

And when the BoE says it can

I have included the link

Richard, I don’t agree with a lot of things you say but on this point your analysis is entirely correct. You need to shout this from the rooftops. You need to publish a paper and get proper coverage in the FT etc.

Thank you

I am working on it already

At the moment a lot of gilts are trading way over par. So for ecample a Treaury 4% 2030 is currently priced at £216 per £100 face value. When the BOE says it had £735 billion of gilts is that what they cost in the secondary market or the face value? This is quite important as there may be £2 trillion face value of debt but its market value is around £4 trillion. The BoE could be set to lose a lot if it holds those gilts to redemption.

Traded value

Last time I noted they were sitting on a notional profit of about £60 billion that will never be realised

The profit is not notional and has already been passed back to government from the BoE.

Any losses on bonds held in QE by the BoE would also have to be covered by the BoE, or it’s only shareholder – the government.

The above shows you can’t claim that QE debt is just cancelled. It still carries interest rate and redemption risk, and if the BoE can make money on the assets it holds, you can’t then just claim those assets don’t exist should they lose money or for the purposes of measuring the national debt.

The profit is passed back as the BoE has an agency agreement with the government on this – Which is the principle in all these transactions, which makes the BoE position even harder to justify by the way

“Any losses on bonds held in QE by the BoE would also have to be covered by the BoE, or it’s only shareholder — the government.”

Why given we know that A) in line with MMT understanding the government doesn’t need to issue the bonds in the first place and B) it creates its money without liability to any other agency unlike private sector banks?

In other words if government is giving away money in interest on its bonds why should it be worried about losses on its bond purchases? In for a penny in for a pound!

Precisely

I’m not sure what the point you are making here about agency agreements is.

The point I am making is that any profits or losses from QE bonds owned by the BoE are passed back to government. Meaning the BoE, and subsequently the government can lose money on those QE bonds, so they are not cost free.

This also means that those bonds exist and are not cancelled from the national debt as you claim.

There is an interest cost

That does not mean they cannot be cancelled

Because what you forget is that once owned by the government that’s it: the interest is paid to itself

That is not evidence that the bonds still exist

It is evidence that they have ceased to have economic form

There is an interest cost, but that is only part of the potential profit or loss of bonds held at the BoE. The other part, which turns out to be much more important by far, is the market value of those bonds, which Tim Rideout mentioned above.

You can sort of cancel out the interest payments, though the cost of that newly created money is paid instead as interest on reserves, so you can’t completely cancel it.

But you can never cancel the market value of those bonds as long as they exist as assets. Which they clearly do, as the BoE has been making profits and losses on the increase/decrease in asset value of those bonds, which it has been paying to government or requiring money from government to fund.

So given this, there is definite evidence the bonds still exist and are not cancelled as you are claiming. Which basically everyone in the economics and finance worlds agrees with, exept yourself.

I am sorry- you are ignoring that the so called profit and loss is simply a function of varying interest rates over time

Your claim makes no sense at all

This is basic bond maths. I am not sure why this is so difficult for you. The interest paid on bonds, via their coupons, is mostly irrelevant and has little bearing on the amount of money the BoE makes or loses on it’s QE bonds.

What does make most of the bearing, as Tim Rideout alluded to earlier, is the market value of the bonds owned, which is directly linked to the bond yields.

If bond yields fall, the APF makes money. If bonds yields rise, it loses money. So if interest rates were to start rising, the government would be forced to cover losses experienced by the BoE, much as they have received profits from the BoE when yields fell.

The fact that these bonds cause a profit and loss to appear means that they are not cancelled. And it is a FACT, before you try and claim otherwise. It shows that QE is not free, it has a potential cost, and more importantly, it makes you claim, that these bonds are cancelled because of QE observably and thus completely false.

I know this is basic bind maths

I have said so

But £735 billion of bonds are owned by the government already

And in effect they are not interest bearing as a result

So bond maths does not apply

Please don’t keep wasting my time with basic errors and false claims

I will try and explain this to you one more time – as clearly your understanding of bond maths and QE is very limited.

The interest payments on the bonds are not the issue, and are not the main source of profit and loss on the APF.

The market value of the QE bonds is.

When bond yields fall, the prices go up and the APF makes money, which is returned via the BoE to government.

When bonds yields rise, prices go down and the APF loses money, which government has to cover as the BoE does not have to balance sheet to do so.

We can see this happening year to year on the accounts of the APF and BoE. We know government has made a profit of about £60bn on these moves to date as well.

By the very fact that these bonds still exist, and the interest rate PV01 risk of these bonds still exists as a liability, it means these bonds have NOT been cancelled.

You are just ignoring the evidence to make your point – which is factually and evidentially incorrect.

I am completely aware of all you are saying

And I really do know how fair value accounting works

I also know that it ios dependent on the pretence that PoEAPFF Ltd is a separate entity

It is not

And you don’t realise that and so all you say is nonsense and proves nothing

Well, in the real world, the PF and BoE are separate entities, albeit owned by the government.

Even if they weren’t, it wouldn’t actually make difference.

If Gilts were cancelled as you claimed, they would have been written off the government/BoE/APF balance sheet. By monetizing that debt.

The very fact that they still exist and reside on a balance sheet, no matter who’s, and that they are generating profits and losses through both interest payments AND changes in their market value means that those gilts haven’t been cancelled.

Which means by direct inference, that your claim that Gilts are cancelled by QE and the national debt is lower than published statistics is verifiably false.

They are written off in the Whole of Government Accounts

Thank you for agreeing my argument

They are consolidated out of existence there

Now very politely, that was your last irrelevant comment

Richard,

Those bonds are only “written” off as you call it on the Whole of Government accounts because of the nature of the Asset Purchase Facility Fund, and the look through from the WGA to the BoE accounts consolidation.

In essence, those bonds don’t appear on the BoE balance sheet, so they won’t appear on the Government balance sheet either. What does appear is the loan made to the Asset Purchase Facility Fund to buy those bonds. Which is still a liability on both balance sheets.

Were the PoEAPFF accounts to also be consolidated back into the WGA, then the bonds would once again reappear on the balance sheet.

You might call it a quirk of accounting, but it was done this way specifically by the government in tandem with the BoE to more accurately distinguish between the costs associated with debt issuance and those associated with QE, as well as to ringfence specific amounts of eligible QE purchases.

What this does mean though is that Alex above is correct. The bonds purchased through QE are not cancelled.

No, the loan is not there

It was intra-group so it too is consolidated out

The WGA accounts do consolidate BoEAPFF

And because it does the bonds have to disappear because you can’t owe yourself money in consolidated accounts

So, with respect, you’re talking complete and utter nonsense and have not checked your facts and do not understand consolidation

The WGA actually prove I am entirely right

I am not sure I understand the argument. The trading price of the gilt is presumably a function of the interest rate at issue and current interest rates (or the interaction of, say the redemption yield and rates). The price premium reflects the interest rate the holder receives over the life of the gilt, but at redemption there will be a compensating capital loss for the holder.

Perhaps I misunderstand the point?

At redemption the the equate

The current excess value is simply the NPV of the future interest payments above current anticipated rates

They are redeemed at par, was the point I was trying to establish.

So, the ONS is now part of Boris’ ‘Project Fear’ in attempting to reign in our needs during the pandemic.

It’s the ‘you’ll have to pay it back afterwards’ threat writ large.

As you know, I’m big on the sovereignty side of MMT and what the ONS is doing is contributing to the emasculation of Government to help its citizens and be the sovereign authority for this country.

Their accounts in my view are treasonable and not in the national interest.

I mean – we already have one set of accounts! And yet here we have another version conveniently reflecting a certain set of ‘concerns’! Badged under a respectable façade (like the IFS bullshit) to give it credence.

Stokoe is being played in my view, and that is a shame. I wonder if he and his organisation have been bullied into this Richard? The Tories are good at being bullies and they do have them in abundance.

Phil Stokoe and I are now in discussion

He is no longer at the ONS

I am giving him a right of reply to this post

Good! The ONS needs to be accountable they work for us not private sector bankers! Phil Stokoe can assist in this even though he no longer works for ONS.

A very long time ago I asked the BOE how the QE money would be sterilised.

After they stopped laughing they told me that they would never unwind QE and that *there had never been any intention to*.

[…] on what I consider to be the misstatement of government debt by the Office for National Statisticsin my discussion on what I consider to be the misstatement of government debt by the Office for Nati… has given rise to some, fairly predictable, uninformed comment; some decidedly informed comment and […]