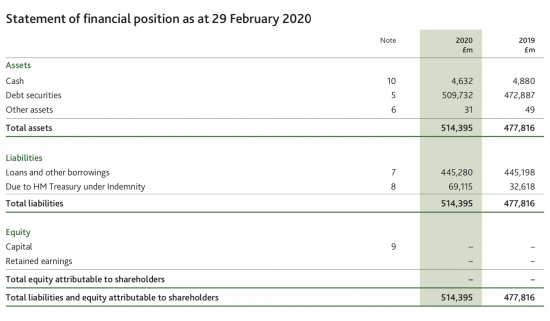

I thought I should draw attention to a curious little feature of the annual accounts of Bank of England Asset Purchase Facility Fund Limited, just published. This is the balance sheet:

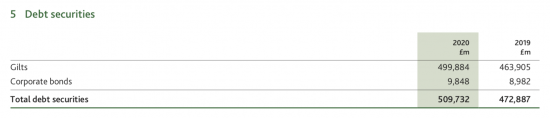

Note 5 shows this:

So, the company was lent £445 billion by the Bank of England to buy bonds.

It spent £10 billion on corporate bonds and has lost a little as a result.

It spent £435 billion on government bonds and they're now worth £500 billion (near enough).

What this means is that the Bank of England has made £65 billion by buying the government's own debts and holding them as rates have fallen. And as the balance sheet shows, all that money is due back to the Treasury.

Bizarrely, quantitative easing has been profoundly profitable for HM Treasury. Whoever knew that owing your own debt could be such a good thing to do?

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Hah!

There’s mud in your eye, all you orthodox jessies out there!

That is why the only viable test of a theory is found by observation and empirical testing. Models are always second-string, second-best, second-rate. I know, I used simple modelling in business; I used models because usually it was all you could do; you make the best of what you have, and what is possible to help planning; and adjust massively for contingent error. The problem is that neoliberal economists think models represent the real world very accurately. Economics is as bad as that.

Incidentally, I see the FT has just pointed out that UK debt is now over 100% of GDP for first time since 1963. Now how will that be received? The household has just run out of money? Austerity anyone? If you think I am joking just remember that your Cabinet includes such proven dunces as Johnson, Patel, Hancock, Gove and Raab; with Dominic Cummings hovering like the Apocalypse in the background.

I have sent a letter to the FT disputing the claim

Unlikely to get in though……

Billing this as a “curious feature” is fine….. but take care, any talk of P+L potentially gives ammunition to those who oppose your ideas.

All gilts mature at par, mark-to-market gains (due to declining yields) will be slowly “given back”. What is true is that paying interest to yourself (UKT to BoE) is more “profitable” than paying interest to anyone else (UKT to Private Sector). When you are creating the money yourself at no interest cost the “profit” equals interest (not?) paid.

Similarly, credit spread widening leads to falls in corporate bond prices that, ASSUMING NO DEFAULTS, will be reversed as they, too, mature at par. Standby for an almighty row when a bond owned by the BoE defaults!!

Having said all that, could the decline of the Corporate bond portfolio simply be maturing bonds?? Not sure that the Balance Sheet alone tells the full story.

In many ways it does these things:

a) Shows how screwed up accounting is

b) Shows how much QE has increased private wealth

c) Shows that the benefits have not been delivered as a result

“Similarly, credit spread widening leads to falls in corporate bond prices that, ASSUMING NO DEFAULTS, will be reversed as they, too, mature at par. Standby for an almighty row when a bond owned by the BoE defaults!!”

I would be grateful if this could be teased out little more. I understand that they mature at par, but I lost my way here with the rest (prices are rising through QE? A specific example might help here). Also what is the precise effect of defaults please?

Really interesting discussion.

It is not about QE as such. I think he is saying that a bond of say £100 issued at par (that is, the lender paid the company £100 to get a note with a face value of £100) at 1% interest might be worth more than £100 and trade at a premium to its par value when interest rates are only 0.5%, but might be worth less than £100 if the buyer is worried about the creditworthiness of the debtor (together with other sentiments that might affect the market price, such as views on inflation, or the performance of the business or the business sector of the debtor, the time of year, the weather, the phase of the moon etc.) so you might be able to buy that bond for say £90 – or even £50 or less if it is very distressed. *IF* there are no defaults, you’ll get your £1 per year of interest during the term of the note until its maturity, and then your £100 back at maturity. Shortly before maturity, it should be worth nearly £100.

If the company defaults, the noteholder might not get their £100 back at all. But, as the administration of Lehman Brothers shows, even the unsecured creditors might eventually get back 100 pence in the pound.

Thanks, I think I had most of that, but I appreciate the gallant effort. The QE point I made was merely a reference to the effect of QE on the current market. I didn’t think this was principally about corporate bonds, which I took to be something of a red herring. It lost me, somewhat.

Richard Murphy covered why money was being made by gilts holders when QE was first introduced read Appendix 2 in the following then you’ll understand:-

http://www.financeforthefuture.com/GreenQuEasing.pdf

I should update and republish it…

This bombshell needs a small correction here – “the company was lent £445 million”.

Done

Thanks

Allow me to restate:

I (owned by myself) spent £435 billion buying my bonds (also owned by myself) and they’re now worth £500 billion

I (the Bank of England) made £65 billion by buying my own debt and holding them as rates have fallen. And as the balance sheet shows, all that money is due back to Me

I hope that’s all nice & clear 🙂

🙂

Once the smoke (BofE) and the mirrors (Treasury) are done away with, all that’s really needed is some bloke with a keyboard and the authority going Click! That’s a few billion into the economy and then Click! Some people paid their taxes so that’s a few billion gone out again. The obfuscation is just theatre to disguise what’s actually going on. A lot of what we count as money’s like emails now.

Is there any reason why Bank of England Asset Purchase Facility Fund Limited should not realise some of that £65 billion gain by selling some of its gilt holdings into the market? Not all at once, as that might push the price down, but there is clearly an appetite for private investors to buy them.

They won’t

And as Clive Parry notes the gain is an accounting aberration – they hold these to redemption

I don’t follow. I expect the gilts were issued at par, and eventually they will be redeemed at par. No doubt the current above-par valuation reflects a combination of the interest they carry and the creditworthiness of the creditor, but why won’t they be sold? Would the government prefer to leave them in place, and issue new gilts carrying a lower rate of interest instead?

They could – and that is an interesting idea

Perpetuals would be best – get rid of the problem for good

I’m sure everyone knew I meant “creditworthiness of the debtor” (not creditor!).

Perpetuals doesn’t quite get rid of the problem, as you have to keep paying the interest. If the rate is sufficiently low, you might not care too much, and if the rate falls far enough you can always repay them and issue new ones.

By way of example, the UK’s last undated war bonds and other undated gilts (including the consols issued in 1927 to replace the gilts issued in 1888 that replaced the ones issued in 1835 to pay off the slave owners) effectively remained in issue for centuries before the debts were finally repaid in 2015 (funded presumably by issuing further gilts carrying lower rates of interest, like earlier refinancings, albeit dated now). I expect some investors bought high-rate perpetuals at a premium, expecting to receive coupons for years, but were unexpectedly repaid at par.

Quite a nice explanation here: https://medium.com/@matthewbrealey/the-myth-of-the-uks-debt-to-slave-owners-being-finally-repaid-in-2015-df82cba09c6c And more here: https://www.taxjustice.net/2020/06/09/slavery-compensation-uk-questions/ (although I doubt anyone who received gilts in 1833 was still holding the instruments that replaced them when they were finally repaid 180 years later, and tracing ownership would be almost impossible as by that stage they had been consolidated with various other issuances into fungible bonds, and then sold and resold in different parcels).

Oh, sorry, we are talking at cross purposes. You meant the dated gilts held by the bank’s subsidiary could be replaced by perpetuals, so the government ends up paying interest to itself forever and never has to repay the principal. Essentially capitalising the debt and making it go away.

I assumed those gilts would be left in place, and new gilts could be issued to the market to satisfy investor appetite. (Although, again, if the gilts held by the subsidiary are valued at a premium to par, and investors want to buy, why shouldn’t it sell some of them?)

You now have what I meant

Oh, what to believe?

Didn’t Theresa tell us not so long ago that there was no ‘magic money tree’ ?…….

Hi Richard, do you know of a good book on Government Securities please, or one that has a chapter on them? I would like to know more about how they work but there doesn’t seem to be anything on Amazon, and sites like Investopedia are pretty sketchy.

Just placed my order for The Deficit Myth.

I’ve also downloaded the BoE Accounts.

I don’t….sorry

Richard,As the app that Boris said would be the greatest in the world do you think that Serco should be made to pay back a large part of the cost,I doubt it as Soames would not like it,below is a link about the app.

https://www.theguardian.com/business/2020/jun/17/serco-boss-defends-its-work-on-setting-up-nhs-test-and-trace-sys

I can’t believe that you don’t understand that this is just a temporary mtm situation and that £65m will be reversed as the gilts mature at par. Will you then be highlighting the £65m that the government has lost on QE from today?

Or is it the case that you do understand, but you hope you readers don’t, as otherwise there isn’t actually anything worthy of comment? “Huge increase in demand for Gilts from BoE results in temporary increase in price” isn’t really much of a story, is it?

If the gilts are redeemed at par

They could be replaced by perpetual: they could be sold back into the market, in effect, to be replaced by perpetaul bonds

I admit, I would find that an intriguing option

I entirely accept it may well not happen

But in that case you have another paradox: and that is that International Financial Reporting Standard accounting produces meaningless accounts

I can’t lose with either argument

You’ve repeatedly claimed that the Gilts purchased under QE will never be sold back to the market, so what has changed?

Regardless, if the BoE tries to sell £450bn of Gilts back into the market, what do you think will happen to yields?

So it looks like you’ll be wrong either way!!

The accounts reflect the value at the current price, nothing more. It seems you are against mark-to-market accounting when it suits you and in favour of it when it suits you!

Perpetuals were not acceptable

Now may be they are

What will happen if £735bn is swapped through the market: you imply you know. Why not tell us?

And on accounting – I think market to market almost invariably wrong

Have you heard of supply and demand?

You’ve managed to observe that massive QE buying of government bonds has caused a large fall in the yields of government bonds, and a corresponding increase in their price, but can’t work out what would happen if this was reversed, and suddenly there was an excess supply of government bonds in the market?

I thought you were meant to be an economist, albeit one with no formal qualifications?

And you didn’t noticed that I talked about bond sustitution?

I really do not think you have a clue what you are talking about…..

I struggle to see the point in people commenting here to score a point. A lareg number of people who visit here, it seems to me have varying levels of knowledge; from the professional (including bond traders), to ordinary citizens trying to understand the complex modern monetary economics that in the end affects them or their family lives. They come here to learn.

Trying to score a point does not help; nor does it add to the knowledge of that wider community of reader if terms like ‘mtm’ are thrown in without bothering to explain that it refers to ‘mark-to-market’, a technical term in fair value accounts for investment institutions (I assume that is the reference, and not to Mary Tyler Moore TV – for those with a long memory); because such swaggering indifference to the wider audience leads to such comments as this being required to be made – otherwise there isn’t actually anything worthy of comment.

I give people a go

When they prove to be pains in the proverbial they cease to get that chance

Is this not insider trading

No

The government makes the product and the market

Richard,

As clearly can be seen above, you claimed “They could be replaced by perpetual: they could be sold back into the market, in effect, to be replaced by perpetual bonds”

Can you explain how selling these bonds back to the market does not result in a significant increase in supply, with obvious consequence for prices / yields.

‘Replacing by perpetuals” how? Yes, they could issue perpetuals when the other bonds mature, but (as explained already), the other bonds will mature AT PAR, so the £65bn profit will have been reversed at that time.

A point I have acknowledged

And how to change that? The government would offer itself a swap. Anyone else could take it too. Really not hard…

Now, go away, or I will help you do so