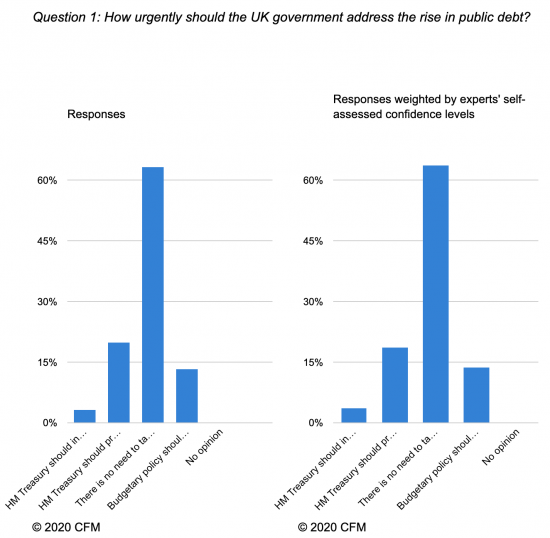

Simon Wren-Lewis drew my attention to a survey by the Centre for Macroeconomics at the Centre for Economic Policy Research, published on 28 May. This asked a panel of senior macroeconomists two questions. The charts, below, summarise what they are.

The summary that the Centre published said:

Public debt has risen to unprecedented peacetime levels, due to policies put in to place to address the economic fallout from COVID-19. Nevertheless, the CfM panel was nearly unanimous that the Treasury should not take any action to decrease the deficit in the upcoming budget. The panel was split on when it would be wise to publically announce long-run plans to address the deficit and the debt. At that point, the majority of the panel supports a mix of financing options, with tax increases receiving strong support and not a single panellist supporting public spending cuts.

And as an explanation of their approach, they also said

The May 2020 CfM survey surveyed its panel of top UK economists on the urgency of addressing UK public debt and the ways to do so.

The findings were:

To elaborate, the four possible answers were:

- HM Treasury should increase taxes or cut spending in the upcoming budget

- HM Treasury should present a long-term plan to reduce the deficit as soon as possible, but not introduce measures to do so in the upcoming budget

- There is no need to take or announce any budgetary actions to reduce the deficit or the public debt until the end of the pandemic

- Budgetary policy should not be used to address public deficits and debts in the foreseeable future

It is very encouraging that the weight of opinion is on delay and current inaction. I would have chosen option 4, by the way at this stage, arguing that overall this was the right choice and that focussing on debt is the wrong concern.

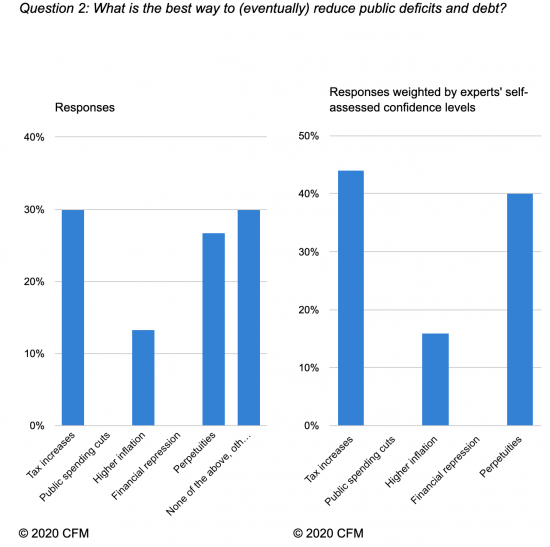

The second question addressed this issue:

Almost all who said 'none of the above' answered that growth was the right answer.

I am sorry to see that tax increases were so popular: that cannot be the route to tax justice. Higher inflation was an entirely fair response. But the focus on perpetual debt - never to be repaid, and issued at current low rates was also encouraging. It would have been my choice, overall.

The survey responses are worth reading. but the good news is that there is widespread rejection of the 'we have to do something now' argument.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Interesting…. perhaps even mildly encouraging that the consensus is to allow the deficit to balloon for now. More encouraging is the unanimity on no spending cuts.

As for the other options I think there is a case for a mixture of all. Yes, tax rises may be required eventually…. indeed, targeted tax rises might make sense sooner. A bit of inflation would help and more long/perpetual borrowing is part of the mix.

Intrigued that nobody wanted financial repression. Is it that the word “repression” has such negative connotations? How was (is) it defined? Seems to me that it is already part of what we have when gilt yields are so close to zero and inflation is still running (for now) at a positive number and is still targeting 2%.

Clive, what sort of targeted tax rises do you have in mind?

I fear a spectacular supply-side shock – especially in socially-distanced services sector. Output will fall and prices will rise.

I don’t know the correct policy response but it will have to be very clever and multi-dimensional. A V-shaped recovery seems extremely unlikely.