Peter Bofinger is professor of economics at Würzburg University and a former member of the German Council of Economic Experts. He has written an excellent, and accessible, article on Social Europe in which he explains why Keynesian thinking explains the world as it is, and neoclassical economics explains a world that does not exist.

At the core of his argument is this suggestion:

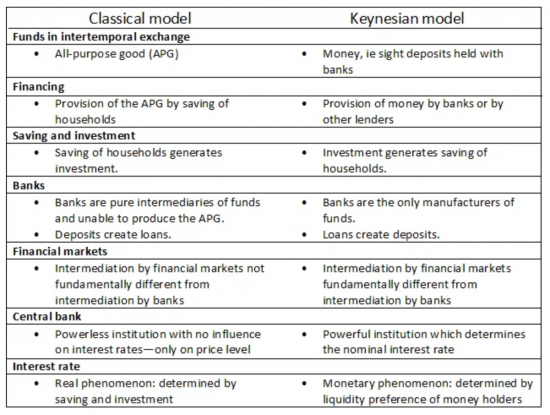

[T]he laws of motion of the classical and the Keynesian world view differ.... In the classical model saving generates investment. In the Keynesian model investment generates saving. In the classical model saving and investment determine the interest rate. In the Keynesian model saving and investment determine aggregate output.

This is not minor. As Keynes himself put it:

I ... argue that the postulates of the classical theory are applicable to a special case only and not to the general case … The characteristics of the special case assumed by the classical theory happen not to be those of the economic society in which we actually live, with the result that its teaching is misleading and disastrous if we attempt to apply it to the facts of experience.

Bofinger summarises his argument in this table:

And then he notes:

But unlike in astronomy, this scientific revolution was successfully defeated by the classical paradigm. The representatives of the old regime carried this off with a brilliant move. They developed the ‘neoclassical synthesis', turning the tables by presenting the Keynesian world view instead as a special case of the classical.

We have all paid the price for this deceit on the part of the neoclassical synthesis. And Bofinger makes it clear that this is no minor issue:

In the classical model there is no money. There is only one all-purpose good which can be used equally as a consumer good, an investment good and as a means of finance (‘funds'). In this model, saving–not consuming the all-purpose good–is the prerequisite for investment. Basically, the classical model is a model for a corn economy: households decide whether to consume the corn or to save it. If it is saved it can be supplied to investors who sow the grains, repaying to the households one period later the credit amount plus interest.

In the Keynesian model the ‘funds' exchanged on the capital market are made up of money–‘funds' are bank deposits. Funds are not created here by a renunciation of consumption but by the banks granting credit.

This is, of course, a claim that is also called to modern monetary theory, but let's ignore that for the moment. Instead concentrate on the suggestion that neoclassical economics presumes that there is no money, because that claim on Bofinger's part is absolutely right: most especially at the macroeconomic level neoclassical economics has no role for money, at all. Indeed, it simply does not exist in its models of general equilibrium. As a result a ruse is required to get it into national income accounting, precisely because in most macroanalysis banks do not add value, which they and those who claim to adhere to this method of thinking would rather not acknowledge.

There are practical implications as well. Neoclassical thinking has an obsession with saving, as result of which billions of pounds are spent each year subsidising those who are already wealthy, and more than 80% of all financial assets are held in tax incentivised accounts, whether that is appropriate or not. This is because that neoclassical thinking does, as Bofinger suggests, promote the idea that this is the basis on which investment takes place.

And yet, we know that is not true. Simple observation of markets shows that it is credit and not saving that funds business. And we also know that credit is no more than a promise that is recorded by a few keystrokes in a computer, and that money is created as a result.

This difference is not then minor: it is fundamental. As Bofinger puts it:

The classical model is therefore not a representation of the long-term laws of economic motion. It is the representation of a fantasy world whose laws of motion have nothing to do with reality. With these opposite laws of motion, a synthesis of the classical and the Keynesian model is as flawed as an attempt to combine the models of Ptolemy and Copernicus. In fact, Tycho Brahe (1546-1601) tried a similar synthesis (the Tychonian system) but, of course, it failed.

We are living with that failure still. And it is why neoclassical economics continues to help destroy us, our economies and our planet. And it has to go.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Many, many, times, Steve Keen has used the Ptolemaic/Copernican paradigm shift to describe this.

Agreed

And all good stories need retelling, often

My brain hurts – I took off my shoes and socks and still could not count beyond 10….

In that case you’re in good company on this forum!

Indeed!

This piece by Peter Bofinger should be mandatory reading for every politician, policy-maker and practising economist and on every university macro course.

It is more than another straw in the mind that some fiscal policy rationality might be beginning to prevail in Germany – because Germany is the biggest obstacle in Europe.

And it gives a deserved hat-tip to MMT.

“And it is why neoclassical economics continues to help destroy us, our economies and our planet”

Really! Are you saying a big state socialist regime like GDR, N Korea, Soviet Union, Venezuela etc didnt (in your words) “destroy economies and the planet”. I would say the human race in its pursuit of a more prosperous life has caused the aforementioned impact. And it is human nature to want a better life isn’t it? Putting basic human nature into a box and then engaging in political point scoring, which is your underlying trait, is quite frankly laughable. Though no don’t you will shout “green new deal from the hilltops”. To which the reply is “so what” as it doesn’t really change a thing other than to make some feel better than themselves and be holier

Oh for heaven’s sake

Those states are hopeless and I want nothing to do with them

Please stop being very, very stupid in your comemnts

Yes, Germany has been a big problem. Surpluses across the Federal, Local and Social Security system amounting to €60 billion a year for several years now. They have been following a classic 18th century Mercantilist policy of exporting all the debt onto others (basically the rest of the Eurozone). High tax has suppressed domestic demand to free up ‘stuff’ for export allowing them to run a bigger trade surplus than China. Great for the bank balances of those that own the exporting companies and, as Adam Smith said it is a ‘beggar thy neighbour’ result for everyone else. Suddenly the tariff war, epidemics, etc have broken that policy and the result is German industrial production fell 8% in the last quarter. Suddenly the big exporters are in real pain and I think, and hope, that the idiotic ‘Schwarze Null’ policy (repaying the entire National Debt) will now quickly bite the dust. Infrastructure spending combined with e.g. a major cut to VAT would help. Perhaps they can finally get serious about getting rid of brown coal electricity production. That makes normal coal look clean.

So many human beings without the ability to understand economic cheating and those that do thinking it’s alright to do so. Such attitudes clearly having both an intellectual and moral dimension with neither being separable from the other.

Unfortunately he finishes on a downbeat: “How can the Keynesian revolution be completed? The chances of achieving this today are not very good, because to do so would devalue the human capital of most macroeconomists.” In other words, vested interests, reputations, jobs, whole careers spent arguing for a world of fantasy, university courses, PhD’s and so on are at stake. Furthermore, those who have reaped the rewards of this Looking Glass nonsense, the financial wizards, the “small-state” politicians, the “free-marketeers”, all of whom have happily enjoyed and profited from a rigged system will fight back.

Agreed