As the FT notes this morning, an IMF report authored by Jannick Damgaard, Thomas Elkjaer, and Niels Johannesen of Copehngane University has suggested that:

A large proportion of the world's stock of foreign direct investment is “phantom” capital, designed to minimise companies' tax liabilities rather than financing productive activity, according to research.

As they note:

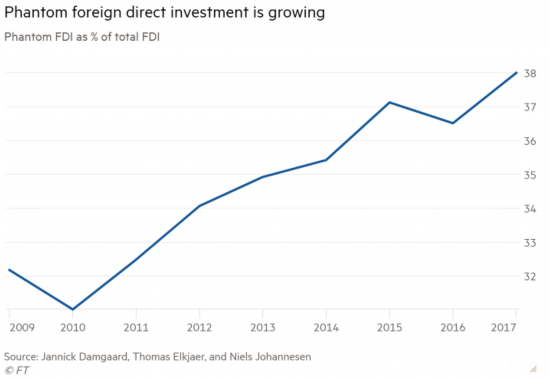

Nearly 40 per cent of worldwide FDI – worth a total of $15tn – “passes through empty corporate shells” with “no real business activities”.

The trend is growing:

Why is this when all the pressure is on companies to pay tax in the right place?

I think there are three reasons. One is pressure from the deal advisors - the Big 4 accountants and big lawyers - who have simply not believed the trend in pressure on corporations.

Second is cost: doing this is actually fairly cheap compared to the billions that a deal costs in a great many cases. So companies are hedging their bets and saying that if necessary they can not sue these structures if that's what's right in the future.

And third, they really did not believe that things like country-by-country reporting, which expose profit misallocation would really happen, or ever become public, which I now think will happen in the not too distant future. So they thought they could get away with this. They're wrong: it's being found out.

I'd actually describe this as the death throes of old-style globalisation. I may be wrong, but I think the pressures to change are now becoming unstoppable and that this trend will change.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

This seems credible to me, and the most hopefully view I’ve read in Finance this whole year. Much needed in these dark times, thank you Richard!

Let us hope so.

A fourth reason for the pressure on companies to pay (the right) tax in the right place?

4) Powerful people would chose to NOT pay ANY tax ANYWHERE unless they were forced to – so pay me my due then go and rob everyone else.

Properly brought up jewish people like me call this the ‘kvetch principle’. Proper Jews never forget it. To kvetch is to distrust ANYONE who has any power over you – and in the modern globalist wold, there’s none more powerful than the 0.001% who control capital and its use. There is only one nano-second when you or I or anyone else has a modicum of power (or a pretence to it) – and it’s the second when you are giving someone your money.

To kvetch is to live. Without kvetching life is meaningless. Live well and prosper.