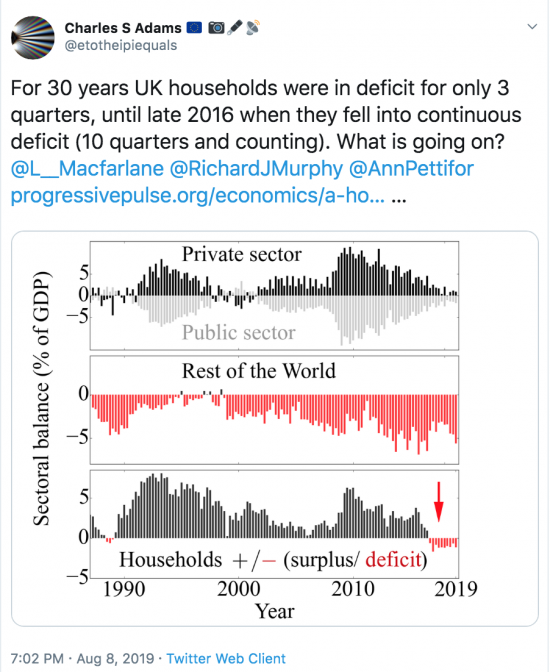

Charles Adams, who is a regular commentator here, an occasional blogger at Progressive Pulse and a professor of physics at Durham University posted this comment on Twitter last night:

Charles raises an excellent question. Like many such questions in social science you could spend a fortune trying to answer it or I could speculate now. I don't have a fortune to spend so I am going for the second option.

Charles raises an excellent question. Like many such questions in social science you could spend a fortune trying to answer it or I could speculate now. I don't have a fortune to spend so I am going for the second option.

I would suggest that the answer is simple: it is growing inequality that is creating this situation, plus a structural change in the way that wealth is held.

Now let me be clear, households is all households so in principle this should not be the case, since the ranking should be indifferent to wealth. But if the wealthy hold more of their assets through companies and pension funds invest ever more widely outside the UK, whilst the links between asset owners and their assets becomes ever harder to trace because of nominee holdings, then the likelihood that there will have been a shift of apparent asset holding out of the so-called household sector and into other categories is high. The result is that the net insolvency of a great many UK households becomes much more apparent.

I stress, I have no proof of this. It is just an idea. But I think it's a plausible one.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

In his film ‘Inequality for All’ former U.S. Secretary for Labour Robert Reich produces a graph illustrating in the U.S at least that the growth in credit is roughly equal to the decline in wages and earnings in the cash economy so I have no problems with your thoughts on this at all.

May I also share with you this link concerning poverty to Prof. Paul Spicker’s blog which you Richard might find interesting in particular:

http://blog.spicker.uk/the-poverty-of-nations-a-relational-perspective/

Thanks.

@PSR

Aw man, I’m disappointed. I guess I’ll have to wait for the trolls to appear ;p

Sorry – you’ve lost me Johan G.

Looking at it through the MMT lens of sectoral balances it seems obvious.

Rising household indebtedness and continuous household deficits are largely synonymous with private sector deficits. What has been the trajectory of business deficit/indebtedness over the same time period?

I’ve been led to believe that at the highest level of abstraction private sector deficits are simply the inevitable result of insufficient government sector deficits (or actual government surpluses) regardless the nitty gritty detail. Reductions in the national debt are exactly the same thing as reductions in private sector savings BECAUSE THEY ARE EXACTLY THE SAME THING!!!!

The ultimate causes are complex and I don’t fully understand them but I’m fairly certain they revolve around the balance of power in our society. Over the last 40 years power has shifted away from domestic UK productive forces towards the financial sector and globalised productive forces.

Intellectually power has shifted away from Keynesian economics to monetarist/neoliberal/neoclassical economics.

I don’t think that power shift is an inevitable force of nature – it is a societal choice that has been deliberately (and mostly cynically) engineered by the powerful cliques who benefit most from the resulting reordering of society.

Their goal is increased control of increasing amounts of wealth.

Less control of less wealth by those outside those favoured cliques is surely the inevitable corollary of those cliques’ success in gaining more control over more of the same available wealth.

Austerity, macroeconomically unnecessary government surpluses/reduced-defecits, private sector deficits and increasing indebtedness of the many to the few are just the largest elements of the broad and multifaceted strategy used to achieve that goal.

For me at least MMT makes this elite strategy unmistakeably clear to see. It drastically undercuts all attempts of the power-elite to use divisive rhetoric to dupe me. I assume that’s why MMT is resisted so heavily in the mainstream media and academia – it poses an existential threat to the current world order.

I hate to keep saying it but, in my opinion, in this greater context Brexit is merely an insignificant but very distracting spectacle to draw attention from this more fundamental battle for control of our society.

Personally I believe either brexiting or remaining will work out fine if we successfully push back against these powerful cliques. However if we fail to turn the tide then we’re doomed regardless whether we brexit or remain.

I hope that the seemingly permanently divided-and-ruled majority in the UK can eventually be united behind a modern vision for the future based on parabolic technological advancements fairly shared (fairly not equally) among the population and real action to avert/ameliorate climate change if we only could all come to understood that we can do it if we just agree to do so.

Fear, hate and real resources are our only real obstacles.

Of course I mostly expect we continue to allow ourselves to be divided and ruled like the frightened fools most of us are most of the time. Thus I fear we’ll continue to walk blindly but willingly into oblivion.

If we let the existing power-elite continue down their current route I honestly believe climate catastrophy combined with the literal deliberate neutering or extermination of the bulk of the human population and broad mass extinctions await us within a handful of generations at most.

As soon as these powerful cliques can lay their hands on sufficiently capable AI powered automatons to do their bidding the rest of us become entirely surplus to requirements. We’ll be useless but expensive and dangerous competitors for an elite who completely and irrevocably control all productive forces.

We have to shift the centre of power to a more socially inclusive and humane place. We have to regain control of our economy so we can manage our advancing technology to support our whole population and the rest of the planet’s ecosystems too.

I really fear that our failure to do so risks an apocalypse worse than anything imagined in art or previously witnessed in human history.

This will sort itself out when ‘households’ realise that the received wisdom that inflation will reduce debt no longer applies. That is to say for the foreseeable we aren’t going to see enough inflation to bail us out quickly enough.

In that case household’ debtors will have two choices: They keep on cutting their lifestyle spending or they start in serious style to default on their debts and/or stop waving the credit card at every outrageous demand from a pillaging and exploitative private sector which is killing the sheep it has been fleecing for so long. Or thirdly, as I come to think of it, they spend their pensions now if they are amongst the minority who have the luxury of pension expectations. If I had them I’d spend them because I wouldn’t trust anyone in the financial industry to honour any agreement they will sign up to today. Not entirely because of their bad faith (though there’s a lot of that), but because they have no way to prevent a financial market collapse however clever they think they are.

Trickle down isn’t going to happen, Guys and Gals; Ya dig ? The ‘squeezed middle’ is about to join the squashed bottom. Poor people don’t have a credit rating. Soon this will become the norm amongst the middle income strata. When they realise what a load of bollox it is. It’s certainly worked well for a good while, but its days are numbered. The poor have realised what the wealthiest have long known: if you can’t pay back that’s tough on the lender.

The middle classes have still to learn this. They are clinging to an ancient tradition of ‘honour’ which the wealthy abandoned aeons ago.

In my view ALL classes seem to have bought the lie that debt is wealth.

How many times are we asked if we are a ‘home owner’ when in fact the bank or building society actually owns the property until we do indeed finish paying for it?

Debt has been normalised in my view in modern society.

Sorry, Mr Pilgrim, a mortgage can make economic sense in that the debt is paid back over the lifetime of its use. As a retiree, having paid off my mortgage and therefore not subject to the usurious rents that pertain to where I live, I can survive. Short term debt for holidays etc. makes no sense as the product is consumed before the debt is repaid.

Debt is wealth in that some government debt is matched by individual savings as the money is not spent and therefore not returned to the government in tax although this principle has been usurped by the dodgers who believe tax is theft. I accept that too much saving is as bad as it takes purchasing power and therefore job opportunities out of the economy but we all need that reserve of money that helps us manage those peaks and troughs.

I agree that debt has been normalised but, like in all things, there is good and bad. Good when it finances a new business, but bad when it is abused by those who, through financial irresponsibility, rack up liabilities they have no hope or intention of repaying and leave the cost to those who lent in good faith..

As a child of the fifties I learned to save up for things. A Moneybox programme on BBC Radio 4 today neatly explores the dichotomy of attitudes between a mother and son. Well worth a listen.

I have used debt

For a mortgage

And for businesses

What worries me is that it is used to promote consumption

In addressed the issue at length in ‘The Courageous State’

@Pilgrim Slight Return and Paul Mayor

“Debt has been normalised in my view in modern society.”

One way of ‘normalising’ it was to call it ‘credit’ 🙂

Re mortgages….They are a great idea, really very clever and mutually beneficial to lender and borrower alike allowing people to have a secure home and to pay for it while living in it. Where the system has gone awry, I think is that the time-honoured building society model was scrapped and allowed vast amounts of money into a feeding frenzy housing market which then led to outrageous levels of house price inflation, and inflation disproportionate to the general level of inflation.

It was entirely mad for years and it will take a long time for this madness to be assimilated into anything resembling sensible value for money….it may indeed never become sane again until somebody devises an alternative model. Far too much of our money is tied up in property with fantasy price tags attached.

If the house was worth the name when it was bought it will be worth the same when it is sold (assuming it’s been reasonably maintained) if it has doubled in price that tells us more about the value of the currency than it tells us about the house.

We’re all in Red Queen land, running as fast as we can to get nowhere. Only the money lenders win.

Still…..why worry. When the benefits of trickle-down kick-in it’ll all sort itself out won’t it …….???

Re mortgages:

This is one of those cases of not what you do but how you do it.

I think it’s fair to say that creating money to pay for something isn’t in and of itself automatically problematic. That holds whether it is the government spending money into existence or the banks lending money into existence.

The problem with how we currently do mortgages is that lots of money is created to pay for homes when there are significant long-term bottlenecks in the supply of homes.

1) too tight planning permission restrictions and slow/expensive/inequitable planning process

2) public sector restricted from building social housing

3) insufficient hi-tech sustainable construction capacity

4) oligopolistic pricing of construction materials and products

5) land banking by big corporations and large individual landowners

Until we intelligently and fairly resolve those problems no amount of newly created money for home purchases can possibly be the right amount of money from a broader social/environmental perspective.

Same would be the case if government tried to outbid the private sector for resources that are already at maximum supply with current technology and economic organisation. You’ll just get inflation in the relevant prices.

So government has to modify our laws and regulations in order to empower both private and public sectors to deliver sufficient sustainable housing fit for our society in the 21st century and the future.

Individual home owners and developers cannot resolve the situation by themselves – it’s beyond their control.

Ultimately the UK probably needs root and branch land reform to properly tackle this issue. That’s difficult to achieve while being fair to all members of society. Trouble is too few people are currently taking this issue seriously enough.

I think it is exactly as you suggest, and the interrelation isn’t difficult to surmise

1. For an increasingly large percentage of households, income from wages no longer cover all necessary expenditure. As a result people are using debt (repaid with interest with future labour) to make up the shortfall. This has allowed major structural economic problems surrounding inequality to be kicked into the long grass.

2. Amongst the most affluent there is a growing realisation that a storm is coming, in public discourse they may glibly dismiss massive growth in food bank use, and the impact of the increasing casualisation of labour, but privately they are worried. Very worried. Whatever reckoning is coming, they have concluded that the best way they can prepare is to keep their assets mobile, and at arm’s length.

At 3:25 of this excellent 5 minute Steve Keen MMTish video, the money factories are raised.

Clearly if the government does not inject enough money into the system, the private sector will increase the money supply with personal and business debt.

https://www.youtube.com/watch?time_continue=1&v=287Cu5me0Og

The highly respected conservative business economist David Rosenberg has realized like Ray Dalio, that debt growth is unsustainable https://www.theglobeandmail.com/business/commentary/article-the-most-acute-potemkin-rally-in-history-rolls-on/#comments Unfortunately his online commenters have not seen Keen or read this blog 🙂

Like Dalio he sees we need a debt Jubilee – ​https://www.bnnbloomberg.ca/video/get-u-s-dollar-exposure-to-prepare-for-coming-economic-pain-david-rosenberg~1708327

Just to be clear – I was reflecting on how mortgages are interpreted by society – not denigrating them per se as I have one myself – well, for a few more years at least. So thanks, but no thanks for the lectures.

If we are honest, your/our mortgaged properties are used as homes but also as security to raise more loans even though you have not finished paying for the house. This financial use of housing means that the house/dwelling side almost becomes incidental in the face of lower wages and easy credit – the latter as Richard points out is all to often being used to fuel consumption.

In other words the asset use of housing seems to be more important than the shelter it provides. It all seems rather messed up to me. Housing is a good and an asset – but the latter – as a gateway to further indebtedness – is deeply troubling. In a society that measures itself by how it spends its money, rather than where the money comes from, is it any wonder things are as they are?

This remains my point.

And what do we know about assets and their pricing structures? When you produce a good, normally the more you produce, the price will go down. There is no evidence of that in the asset price world which only seem/tend to correct when bubbles burst after rises. You could build loads of houses but would the prices really come down as builders and estate agents all have their noses in the trough, seeking to cream their bit of the future debt bounty to follow?

Honestly, our housing system is seriously fucked up because it is used as a debt cash cow.