I mentioned yesterday that James Meadway, who is John McDonnell's chief economic adviser, had dismissed modern monetary theory out of hand at the weekend, in the process committing Labour to the austerity agenda which, right now, is pretty much the only known alternative in town.

I was amused, and not surprised, to note that Jonathan Portes waded into the debate on Twitter, saying in response to a tweet that circulated my work to a number of well-known economists:

So, the people (Jonathan Portes and Simon Wren-Lewis) who wrote Labour's fiscal rule that promises balanced current budgets and borrowing only within the constraints of the market (however pro-cyclical that constraint may be, most especially given their vehement dedication to central bank independence), and so guaranteed that Labour will remain committed to the austerity policies that George Osborne and Philip Hammond have been noted for, are also committed to denying that the state may use the very obvious power it has to create money for any purpose bar bailing out banks, as most quantitative easing did.

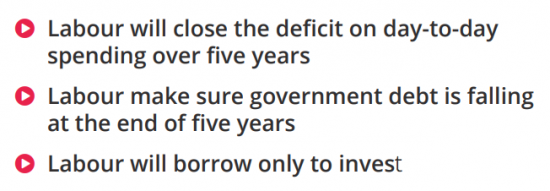

Just to make sure we know what we're talking about this is Labour's Fiscal Credibility Rule, written by Jonathan Portes and Simon Wren-Lewis and adopted by John McDonnell:

Candidly, it's hard to differentiate this from anything produced in the Brown / Balls era. It is pure neoclassical economic thinking. I think that suggestion, much discussed Simon Wren-Lewis on Twitter yesterday, simply to dismiss the suggestion from someone not familiar with economics that it was neoliberal, needs to be explored.

First, to pick a theme from the blog post of Simon's that Jonathan Portes highlighted, the macroeconomics on which this 'rule' is based has its roots in microeconomics. As Simon has accepted, this is in many ways the difference between neoclassical and MMT economic thinking. But the difference is not minor. The microeconomics referred to makes some pretty major, and almost invariably incorrect, assumptions. I am, of course, aware that these are relaxed on occasions, but the fundamentals remain in the macroeconomics based upon it. In particular, there is an assumption that markets can allocate resources efficiently. And that when doing so they eventually use all available resources, even if it takes time for them to correct to external shocks so that resources are used in this way, with full employment being re-established, as the norm. The model, then, assumes government ultimately need not intervene in markets to create this outcome. Unsurprisingly, as a result, the modelling suggests that there is no reason for the government to run a deficit on day-to-day spending because the markets can be relied upon to sort things out. That there is no evidence to support this assumption is apparently beside the point for Jonathan; that's what the model says (even if that's the inevitable outcome of the assumptions made and not the consequence of any observed reality) and so that is what the rule must say as well.

There are also major problems with the macroeconomics based upon these assumptions. In particular, taxation does not play a proper role within it, and nor, come to that, does money. That is because money is simply assumed to transfer value, as does much of tax, but given that we know that is not true of finance, and that taxation plays a much broader role within the economy than this, this macroeconomics is inappropriate as a basis for determining any fiscal rule, for which it can have no answers. Again, then, this model is inappropriate for the task it is being asked to do: it does not address questions of fiscal balance but does instead assume them away, just as this fiscal rule does.

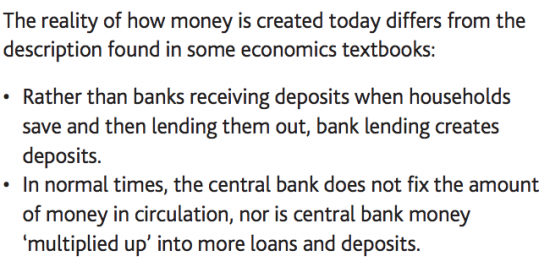

Thereafter the microeconomic assumptions underpinning this macro gets what it says about money wrong. As the Bank of England had to say in 2014:

The reference to 'some' economics textbooks might, appropriately, be read as referring to the vast majority of neoclassical textbooks.

This means it is not true that, as Simon claimed, that the main difference between neoclassical theory and MMT was that the former relies upon monetary policy to control inflation and the latter of lies upon fiscal policy to do so, although that is undoubtedly true, and it so happens that because monetary policy is dead in the water only one of the two can now work. Instead, the real difference is much more fundamental.

Most especially, the differences come at three levels. First, MMT looks at the world from a macro perspective, not a micro one. In other words, it is macroeconomics. That might make it fit for the purpose of managing the macroeconomy.

Second, MMT ascribes appropriate functions to tax and money that actually recognise the way in which they really do play a role in the economy, and which, in the case of money fits with the Bank of England's description, noted above.

And third, MMT does not assume that the market economy automatically uses all resources available within the country, and nor does it assume that the market delivers economic balance at full employment. Given that these assumptions reflect reality, unsurprisingly it suggests a somewhat different approach to macroeconomics to a model based upon inappropriate macroeconomic assumptions. In particular, it presumes that the state might have a role in creating full employment, and might need to spend to achieve that purpose, and what is more it appreciates that in the process all that it is doing is creating the capacity to pay any necessary tax to control inflation, which is a desirable objective of macroeconomic policy, but one that is not nearly as important as delivering sustainable well-being for those who wish to work, and those they wish to support, within a country.

Jonathan Portes might be with James Meadway in rubbishing MMT then. I'm willing to believe that what he says is true in this regard. But what it also means is that he is willing to promote macroeconomics that is based on inappropriate assumptions and models, that cannot say anything useful on fiscal balance because it is assumed that there is nothing to say, and makes balancing the government's books more important than any other economic priority. I'd suggest that's getting most things wrong, from the basics to the assumptions to the objectives to the policy prescriptions. But no doubt Jonathan Portes will handle the criticism by dismissing me as he did his co-author Howard Reed, which I am sure he was chuffed about.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

What amazes me is that just on one simple issue these Labour Neoliberals fail to connect capital spending with current spending. So, for example, capital spending can take place to build additional new hospitals for a growing population but current spending can’t take place to staff them!

That’s a hard one to work out, isn’t it?

I go loopy when I see a preference for “investment” (build a bridge) versus “current spending” (staff that hospital, fund education, research).

I guess it’s easier to spend on a bridge. Just record it in the “accounts” at cost, nobody can be criticised.

Kim,

Bill Mitchell’s article today is about drought aid to farms in Australia, contrasted with a penurious unwillingness to help the unemployed stay alive.

I think the key is assets. The farmers have land assets, which can also be considered industrial plant. Neoliberals will pay anything on behalf of assets: support for farms, or investment in capital equipment.

They’ll pay nothing for people.

To further add to and explain my post here’s an item about Friedrich List’s work and a quote from him. List was a 19th century German economist. By my calculations the UK’s Labour Party is only a mere 185 years behind List in their thinking!

“The creator of the German railways, Friedrich List, spent 12 years in the United States, where he was able to experience the American System of Political Economy. List had to face the same aversion we see today in the mainstream and collective conscience–“How are you going to fund this?” and “Where will the money come from?” In response List wrote a treatise, “On a Railway System in Saxony as the Foundation of a General German Railway System,” which appeared in the year 1833:-

‘People will probably ask me, where will Bavaria get the money to complete such giant works [railways]? I answer, that I have not yet seen any silver or gold in any of the canals or railways. To build them we use only consumer goods, steel, stones, wood, manpower, the power of animals. But is there not a surplus of all this in Bavaria? To the extent that we transform this surplus into canals and railways, which are not yet in existence, we create permanent and enduring value, we create an instrument which doubles the productive power of the entire nation. The money, however, does not leave the country, it only settles accounts.’”

https://www.splicetoday.com/politics-and-media/economic-lessons-from-dead-people

https://en.wikipedia.org/wiki/Friedrich_List

Wonderful!

That middle rule ‘Labour will make sure government debt is falling at the end of 5 years’ is hilarious. What does it even mean, and what are they comparing it to? Nobody knows as they don’t say.

They could mean nominal debt compared to the start of the 5 year period, or nominal debt compared to what it is 4 years in. They could be thinking about how debt hurts us, which is the service cost in days of national income required to generate the interest. But as you keep pointing out, it’s the debt denominated in foreign currency that needs income generated to pay it, but the interest on UK debt isn’t really a burden.

Perhaps Labour are going to go down the neoclassical rabbit hold of the current Conservatives and claim that they are thinking of the debt/GDP ration which is currently falling, but this is to compare two things which are not alike. Debt is a problem that you have in government and it might usefully be compared to government income, but it should not be compared to GDP as by and large that is something that doesn’t belong to the government.

‘What does it mean.? Indeed!

As Schofield pointed out it’s a question of which books are being balanced. I suspect they mean the ‘structural budget’ fudge where the books balance based on a fictional notion of where the spending would be without fiscal transfers as if it were working at full capacity.

This is nonsense and a mealy mouthed playing with words.

Meadway is inconsistent: he admits that MMT describes the system then denigrates it as a basis for policy prescription! SO the framework is right but if you work within the framework it won’t work?

Work that one out!

I do wish the Labour Party “fiscal balance” economic advisors would take the trouble to read the 2006 Scott Fullwiller paper Stephanie Kelton referenced in the Twitter exchange:-

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1722986

Thank you Schofield.

By the way, Richard (and all contributors interested in MMT issues). At the end of Bill Mitchell’s blog post today he expresses an intention to respond to (implicitly) Meadway. He writes:

So we get a version of the problem — the unemployed are lazy — and attack the individual with an elaborate labyrinth of policies that do nothing at all to get the workers into jobs.

The same goes for how we understand Modern Monetary Theory (MMT) and so we get sidetracked into a number of dead-ends because the debate is falsely constructed.

‘On Thursday, I will address the latest comments from British Labour Party advisers about how an application of MMT principles to British fiscal policy would destroy the currency.

That is a perfect example of a false construction.’

Required reading!

Indeed….

I’d suggest that Jonathan Portes’s reply effectively denies that MMT, at base, describes where money comes from.

So where on earth does he think it comes from?

I wish I knew

@ Peter May

You make a good point but I’d add that politicians seem to love the sound of their own voices and to hell with doing much in the way of reasoning before they make their utterances. Thatcher, Cameron, and May have all declared that the UK government has no money of its own but very noticeably you will not find any utterance from them where the workable and coherent model is that explains how the UK creates its currency, its medium of exchange. The same applies to John McDonnell he loves to pontificate but hasn’t got the guts to point to that complete and rational monetary system model he supposedly believes in. As such he’s no better than a disfunctional Tory taking advantage of an under-educated electorate!

I really believe the Labour Party want to have some constraint on spending and also a constraint on the money supply that isn’t taxation. This applies to all major fiat currency Governments around the world and also opposition Parties. No major political party let alone Government endorses the PQE approach. You are saying they are all wrong and you are right?

I am saying there is a constraint – but it is what we can do, and is not financial

In a nutshell!

@ Carol Wilcox

“In a nutshell”

Absolutely! But it’s also about understanding historically and ideologically where that “mental straitjacket” came from and why. Even Karl Marx struggled with this!

Many contributors on this site are sympathetic to the view that the economy is not primarily a money system but fundamentally a thermodynamic one. Money is an important proxy, but it is only a proxy. The thermodynamic system to which everything belongs, and everything is connected is what A.N. Whitehead meant by the phase the ‘universe in the round.’

The universe in the round is a very complex system. We humans deal with that complexity by process of abstraction. Whitehead puts it very well to quote: “The human brain individually does not have the processing power to comprehend the universe in the round. Instead, we sub-divide it into manageable portions, economics, history, chemistry, mathematics and so on. This sub-division is a very practical way to manage human affairs of all sorts. It has proved a tremendous success in all human endeavours. But it is important to keep in mind that (these) sub-divisions, theories are in essence abstractions. Very powerful and useful in the practical conduct of human affairs, but nonetheless abstractions. Within their legitimate, remit it is permissible to treat them as reality. However, this remit is limited and furthermore contains no warning as to its limitations. The temptation, especially in the social sciences is to ignore this truth. We are too prone to treat our theories as concrete reality in circumstances beyond their remit”.

Whitehead famously named this pathology “the fallacy of misplaced concreteness”, brilliantly summing up our modern problem. Abstractions help us but without vigilance, they also imprison us.

Among the great intellectual achievements of the twentieth century three stand supreme, namely The Theory of Relativity, Quantum Mechanics and the Science of Cybernetics. By the Science of Cybernetics, I do not mean the comic book version beloved of our MSM as in “cyber-security.”, cyber-warfare, or cyberspace. I mean the proper science as developed by two giants in this field Stafford Beer, the pioneer of Management Cybernetics and Gordan Pask, the pioneer of Conversation Theory.

Cybernetics is a holistic science. It is a meta-science under whose umbrella all knowledge concerning our universe seeks to be ordered and related. Our universe is one system and cybernetics is devoted to its study. The recognition of the essential unity of all things makes cybernetics a very practical subject. Cybernetics, therefore, is also a theory of design. There can be no practical solution to any problem without also a theoretical one. Cybernetics is thus ideally suited to cutting through the knots of confusion that outmoded concepts present.

According to Marxian analytics in the three class systems of slavery, feudalism and capitalism, exploitation operates as an invariance. The invariance is that, in all three systems and wherever and whenever these systems exist the people who do the work do not appropriate or distribute the surplus, and the people who appropriate and distribute the surplus do not do any of the work. All of Marx’s writings reflect this moral imperative. Marx wove this morality into the very fabric of his economic thinking. For those who don’t share this view, Marxism is unintelligible. For those who disagree with this moral compass, Marxism attracts great hostility.

If we accept the proposition that the economy is a thermodynamic and not the proxy one of money, then we must accept that it is also a mathematical system. What sort of mathematics is required to help us understand its workings? Right away we know we cannot give centre stage to the one based on the serial logical architecture of conventional mathematics. “Knots in string” as Pask said. The computations are simply too vast. IMO it includes consensual and coherence logics. It has a non-serial logical architecture.

Not all exploitative societies (slavery, feudal or capitalist) are identical; their arithmetics may differ, but their algebra is the same. The algebra of Capitalism is the same today as it was in Marx’s time, only the people who don’t do any of the work appropriate and distribute the surplus. Arithmetics are essential, but equally so are algebras. To build a theory we need algebra, arithmetic alone is not enough.

In our economic system, as in all systems relativity applies. Relativity forbids the operation of master clocks. An invariance operates as a master clock. The master clock in Slavery, Feudalism and Capitalism manifests itself as a recursive set of hierarchical structures in which “In this system, we do things this way. Sit down, shut up and do as you are told — or else”. Because master clocks contradict relativity, they are fundamentally unstable. However, social agreement acts as the countervailing stabilising force. A great many people like Capitalism, if that agreement is withdrawn Capitalism as the dominant economic system collapses. The people who like Capitalism must be allowed their space, but equally the people who don’t like should also be accommodated. The tyranny surprisingly doesn’t reside in Capitalism per se; it resides with its imposition as a master clock. The same qualification applies to Richards Green Deal, with which there is much to commend, very little with which to disagree. However, if it is imposed as a master clock, it would become a tyranny. The answer is to change our system of governance from a hierarchical to a Conversational one (as in Conversation Theory).

Labour only needs to make minimal changes to its policies and Manifesto to accommodate this change. No other political party comes close. No need to worry about the presence of duff economic advisors, the new mathematics will sweep them away. It is simply an exercise in design.

Conversation theory?

Links?

https://en.wikipedia.org/wiki/Conversation_theory

and

https://www.researchgate.net/profile/David_L_Abel/publication/275889624_The_Cybernetic_Cut_and_CS_Bridge_From_Scirus_Sci-Topics_Pages/links/5548c80b0cf271a91dc17ece/The-Cybernetic-Cut-and-CS-Bridge-From-Scirus-Sci-Topics-Pages.pdf

The latter article would appear to put forward an argument that runs as follows:-

– for life (animate) to exist there has to be difference

– if there’s difference there has to be choosing

– choosing is an abstract or formalistic process

– scientists (so far) have not been able to show how this choosing process is created from inanimate chemicals

I may have to do some reading

I’m not sure the Master Clock in Einstein’s Relativity operates in the same way in social affairs, except as a descriptive, but limited metaphor. (However, I’m not qualified to judge) Nor can I see how changing our system of governance to a “conversational” one requires Labour to make only minimal changes.

I don’t know what Conversation Theory is, but if it’s like a proposal I’m in favour of – a people’s deliberative democracy where citizens would be chosen by lot to form a “government” – then I think that requires the euthanasia of the political classes and their parties.

@ G Hewitt

“Nor can I see how changing our system of governance to a “conversational” one requires Labour to make only minimal changes.”

I don’t understand this part of John Adam’s post either. Perhaps John you could expand on your reasoning here please, particularly whether you are talking about the party’s consultative processes or adoption of an MMT outlook or both.

There is no Master Clock in Einstein relativistic universe. There are local clocks only. For example, there is one on the ground and there is one in a geostationary satellite, and they have to be synchronized in a systematic way due to differences in timing as a consequence of relativistic time dilation effects. Otherwise, your satnav won’t work properly. There is no master clock even for this simple system.

I agree with that

Just to clarify, I meant I agree that Einstein’s theory prohibits a master clock but I don’t see it’s relevance to social theories. It is said that the brain is the most complex structure in the universe, so although physics, cosmology etc may offer useful insights, I think we need to approach human behaviour, such as economic behaviour, from a different perspective.

While much of Einstein’s Relativity has been verified through observation and experiment, unfortunately the same cannot be said of much of economics. The current orthodoxy seems an evidence free zone. Perhaps it is more of a belief system than a science?

Read Carol Rovelli

I must write a review,,,,

@ John Adams

To change a system of governance to a genuine “conversational” one there first has to be a widespread recognition of the benefit of “Passive Altruism” which Nature constantly works at to hard-wire into life and finds its most advanced condition in most human beings. There is not, however, a very conscious recognition of this being a fundamental necessity for good governance in our societies today not least because of the flawed free market capitalism we use.

“Passive Altruism” is ethical restraint from taking advantage of others’ vulnerability.

From Lynn Stout’s book “Cultivating Conscience: How Good Laws Make Good People.” 2011.

Here is an explanation of its applicability to governance. Notably this explanation refutes Thomas Hobbes’s view of life which has ultimately influenced the flawed form of free market capitalism currently prevalent:-

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3471369/

I like passive altruism

I think that making very forced analogies between MMT, economics and physical theories is quite confusing. And economies are not “isolated thermodynamical systems”. They are not involve Boltzmann statistics, nor driven by entropy (a very misunderstood mathematical term).

And entropy doesn’t always increase…..physicists are still fighting like ferrets trying to explain that letter “S”.

If there were any coherent analogy, please explain Einstein’s General in terms of economics.

Mr Adams,

“The universe in the round is a very complex system. We humans deal with that complexity by process of abstraction.”

You began very well, but if I may ‘cut to the chase’; to me your argument on the power of mathematics ended by committing the fallacy which your opening remarks on Whitehead sought to demolish.

I believe it is fairly safe to say that this Labour leadership is incapable of delivering what the UK needs. It will be some years before any UK party whole heartedly accepts the reality of MMT.

This is sad for me to admit having given so much time and effort to the Labour party over the past year but if they win power then their near inevitable failure to deliver will only further tarnish the progressive brand. Better they allow their thinking to evolve or are replaced by wiser heads than win power as they are IMHO.

All we can do in the meantime is to keep pushing MMT understanding among the public – and for me that means everyone regardless of their background and politics. If Labour’s current bigwigs won’t pick it up and run with it then we should find others who will.

The kindest thing to say about Meadway, Wren-Lewis & their ilk is deluded & unfit to run a chip shop. Europe needs to engineer an energy transformation – & do it within 20 – 25 years. It needs to invest around Euro500 billion per year over that period. I’d be interested to hear from Meadway (Dumb) and Wren-Lewis (Dummer) where those sort of amounts will come from. The UK will in any case need to invest probably north of £10 – £15 billion per year over that period in its own energy transformation. These people are short sighted fools if they think “financial markets” (whatever they are) are going to divvy up that sort of cash over that sort of period. If Europe (& by extension the UK) wants to meet its “Paris commitments” with respect to climate – these are the sort of numbers that HAVE to be spent. Or perhaps they side with President Dump on climate change & the need for an energy transformation?

Hence why I developed People’s QE and Green QE in the first place

@ Mike Parr

“I’d be interested to hear from Meadway (Dumb) and Wren-Lewis (Dummer) where those sort of amounts will come from.”

They’ll never tell you their brains would implode if they had to!

Jeremy Corbyn tried this in a round-about but not very effective way in a Parliamentary Question Time exchange last October with Theresa May. From The Guardian:-

“An exchange on public-sector pay followed, with Corbyn asking for specifics on a pay rise for NHS staff, which May did not provide. Instead there was a mini-lecture on public finances — “the government has no money of its own” — which allowed Corbyn the obvious retort that finding £1bn for the DUP’s support had not proved problematic.”

https://www.theguardian.com/politics/2017/oct/18/pmqs-verdict-corbyns-easy-win-on-the-economy-should-worry-tories

Of course if Corbyn had been really clued up he’d have asked if the Treasury had released a public document explaining how the nation’s money is created and if not on what technical grounds was she therefore justifying her prescriptive statement! Was it not just plucked from a hearsay ragbag?

Here’s a useful article from Randall Wray for the Gang of Three (Wren-Lewis, Medway and Portes) to read that puts government deficits and inflation fighting into perspective. The article is referenced from Stephanie Kelton’s recent Twitter comments:-

http://rooseveltinstitute.org/deficits-do-matter-not-way-you-think/

Thanks

Here are a set of comments by Jo Mitchell, an economist at The University of The West of England:-

“At what point does over-use of a term as an insult render it meaningless? Richard Murphy tested the boundary yesterday when he accused John McDonnell’s economic advisor James Meadway of delivering “deeply neoliberal, and profoundly conventional thinking”. This was a prompted by a negative comment James made about Modern Monetary Theory (MMT).

In response, Richard posted a list of MMT-inspired leading questions which, wisely in my opinion, James declined to answer.”

and

“The two dangers that must be balanced when setting fiscal policy are insufficient demand and private sector unwillingness to finance public deficits.”

https://criticalfinance.org/2018/08/07/labours-economic-policy-is-not-neoliberal/

From these two comments it is very clear that Jo Michel is a lazy and pompous so-and-so who has made no serious effort to understand MMT and refute one of its core arguments that a sovereign government like the UK has no need to finance its spending in the first instance from the private sector. Why else would he be arrogantly saying James Medway shouldn’t be responding to criticism of his fiscal and monetary advice to John McDonnell. Is James Medway God Jo Mitchell?

I will be posting on this tomorrow

I do find the comment deeply arrogant

He also reveals absolutely no knowledge of MMT, which he claims to have read

I think what gets my goat is the Labour Party leadership making a big noise about the importance of democratic debate within the party but we appear to have the Gang of Three (Wren-Lewis, Meadway and Portes) refusing to openly debate the valid and extremely important criticisms you’ve made about the fiscal and monetary policy John McDonnell (and presumably Jeremy Corbyn) have agreed to after consultation with their economic advisers.

I contrast James Meadway’s 2016 article with that of Randy Wray’s 2010 article I previously posted to highlight the areas of contention:-

https://medium.com/@james.meadway/richard-murphy-and-fiscal-credibility-rule-a-reply-156e701fb850

http://rooseveltinstitute.org/deficits-do-matter-not-way-you-think/

Is this the same Jonathan Portes I wonder who reassured everyone before the crash that the Icelandic banks who brought down the country’s economy were ‘good strong banks’? I forget which documentary his comments appeared in.

Really?

I am not sure….

Thank you replying to my post. I will ( with Richards permission) answer all the concerns raised. It may be a day or two, my charity work keeps me busy.9,

I replied to Jo on that link.

Meadway needs to show if you use MMT it makes the £ worthless and back up his claim.

These guys now need to show why they believe this. That will sort out the wheat from the chaff.

Here’s why McDonnell’s economic advisers’ plan for a government to even contemplate implementing a 5 year budget balancing plan is a load of baloney even in Keynesian terms. It’s simply that consumption and savings rate fluctuate and therefore so does demand and a government needs to be able to react to such changes to optimise employment in the economy or indeed to damp down over-heating in the economy. Because it has the power to create and reclaim money a sovereign government is well placed to do that optimisation. Simon Wren-Lewis needs to do more MMT reading!

http://ralphanomics.blogspot.com/2014/07/simon-wren-lewis-versus-mmt.html

You have no reason to despair – we all know that a labour government won’t meet any of the three components of the fiscal credibility test.

So why say it?

Philip,

That’s not good enough. Even by talking about a fiscal credibility rule the Labour Leadership are reinforcing the faulty mainstream economic framing and therefore keeping the public uninformed of reality. It is stupid, cowardly and immoral.

As I say in blogs this morning….

@ Adam Sawyer

Exactly!

Why should the Labour Party kow-tow to capital’s disfunctional monetary system rules?

The party was brought into existence to help labour get a better deal and agreeing to follow capital’s disfunctional rules doesn’t achieve the party’s objective.

No mincing of words or avoiding open debate by the party’s economic advisers is going to change the fact they are slavishly misdirecting the party’s reason for existence!

[…] By Richard Murphy, a chartered accountant and a political economist. He has been described by the Guardian newspaper as an “anti-poverty campaigner and tax expert”. He is Professor of Practice in International Political Economy at City University, London and Director of Tax Research UK. He is a non-executive director of Cambridge Econometrics. He is a member of the Progressive Economy Forum. Originally published at Tax Research UK […]

1. Force a General Election.

2. Win it with a massive majority

3. Party! like its 1945.

4. Carte blanche to dump all shitty orthodoxies and lift the poorest and ALL the burdened. MMT in all but name!

5. Spread the new paradigm across the world and hope that it is done in time to meet the catastrophes underway for all life on Earth (no need to

chop the heads of the superrich – just clip their venal wings a bit). Utopia.

If it does not happen in that order – it will not happen at all.

A failure would mean no election or win and no re-election … a rising of the great unwashed debtors , a disorderly self destruct of the future.

Dystopia.

It is not brain surgery – just rocket science 😉