John McDonnell appropriately called for proper registers of beneficial ownership for companies and trusts in the Uk and its Crown Dependencies and Overseas Territories today. And I support the call.

But the call is not enough. That's because right now the UK supposedly has a register of beneficial ownership of companies and the result is an absolute farce. Recent evidence reported in Scotland was that there are just four people at Companies House in Cardiff who check the near four million annual declarations submitted by UK companies each year. This, of course, means it is impossible for them to undertake any proper checks at all on these returns. The consequence is obvious: there is in effect no checking at all on the returns made by UK companies, which can be nonsense as a result.

And that means we do not have a Register of Beneficial ownership in the UK; we have a sham that masquerades as such a thing instead. And that is no use to anyone but a government that wants to claim it is doing something about abuse when it is actually doing nothing of the sort. In that case this is not a model to copy.

So, what can be done about this? Two things, I suggest. One is to employ a lot more people to properly regulate companies, both at Companies House and at HMRC. And this need cost the taxpayer nothing: make those using companies pay for the costs of properly regulating them is the way to avoid that. It's really not hard to put up Companies House fees tenfold (to £130 a year) to deliver a vastly more effective service at no cost to the taxpayer at all.

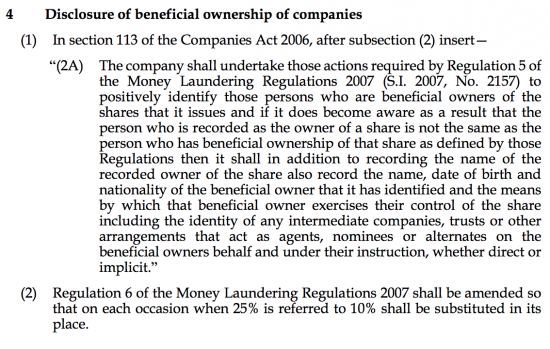

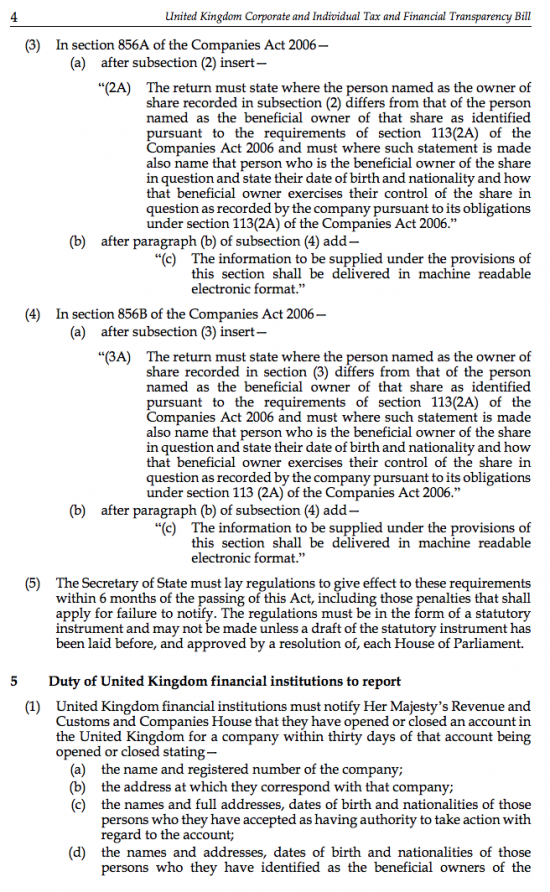

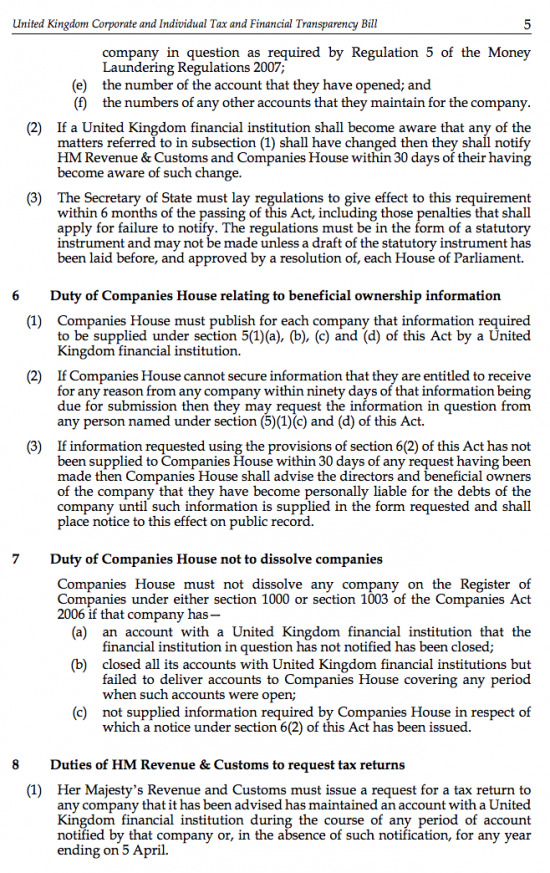

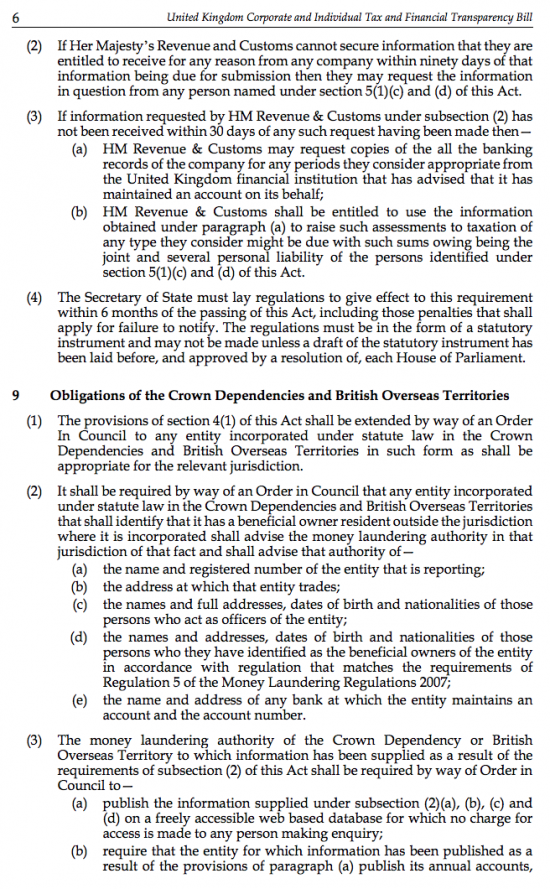

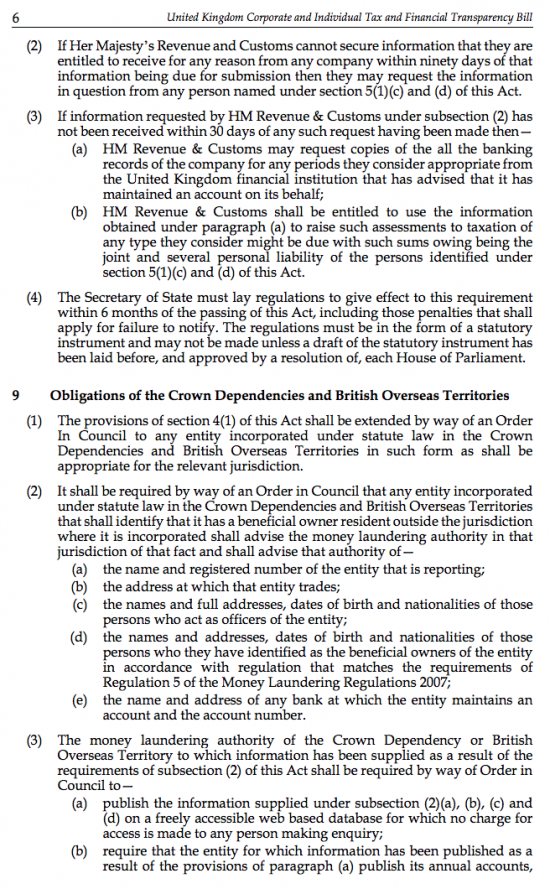

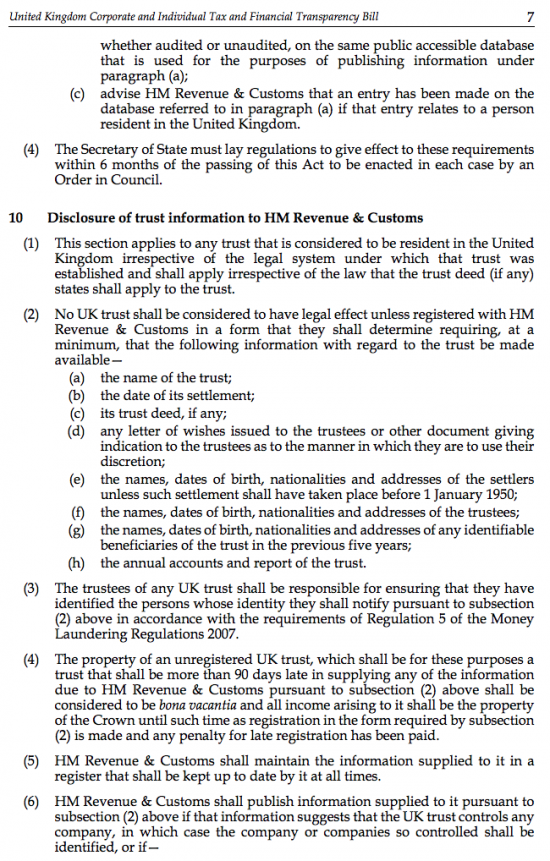

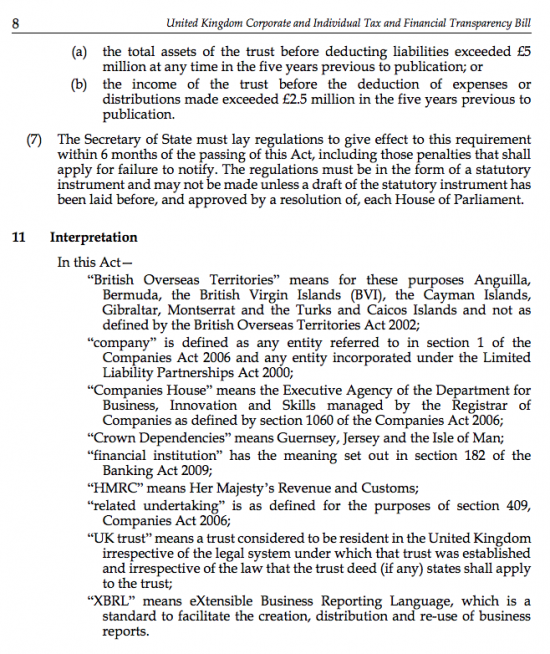

Second, law that I wrote in 2013 needs to be passed. That law is here. Only clause 4 onwards matters. I also reproduce the relevant bits below because I did not write that law for the late Michael Meacher MP for fun: I wrote it because it needed to be law and as I recall it Jacob Rees Mogg talked it out in the Commons.

What that suggested law did was seven things.

First it demanded more rigorous beneficial ownership disclosure in the UK than we have now got.

Second it demanded that banks - who have to prove who the beneficial owners of companies are to open bank accounts for them - must share the data they hold on all companies to whom they supply services to HMRC and Companies House.

Thirdly, it demands that Companies House and HMRC use that data.

Fourth, it says that if the data suggests that a company has a bank account neither Companies House or HMRC are allowed to assume it is not trading and so 'strike it off' the Register of Companies without it having paid all fees owing or having filed its accounts and paid its tax.

Fifth, it says directors who think they can get away without doing what is required of them by law should get a shock by finding they are personally liable for all taxes and fees owing by the companies that they direct if the company does not pay on time.

Sixth, it extends this obligation to trusts.

And seventh, it extended the obligation to our Crown Dependencies and Overseas Territories.

The point is that this drafting got through the parliamentary draftsmen: they accepted that such a Bill, even if written by me, could be tabled in parliament and it was. In other words, it could be UK law.

I suggest that it is time it was tabled again.

And this time it needs to be passed.

I urge those with the power to do this to now present such a Bill and get the support it needs to become law.

And maybe this time Jacob Rees Mogg would be so kind as to not talk it out as a favour to his friends.

____________

These are the relevant clauses:

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Yes please!!

I’ll take two if I may!

But seriously Richard – you have provided the answers – these ideas deserve to be tried out. Your skill as a writer extends to that of even drafting law it seems. You are an admirable fellow. You set a standard to aspire to.

I hope that ‘Rees-Gob’ keeps it shut this time. But if he talks it out again then we need to tell people about it.

As ever I’m afraid this call is statute law as a wish list as per http://www.progressivepulse.org/society/litter-strategy-or-statute-law-as-a-wish-list/

Laws need to have the resources attached – otherwise they are useless. A lot of society’s operations are too complex to consider that it is part of ‘common law’ so will automatically be generally complied with. And there are now also those who consider that they are ‘too complex’ to comply with common law.

I find the new register really confusing. When a company registers properly I still cant really see who owns the shares very easily. It might be me, i shall try again once all Paradise has settled down and I have read all the articles.

The new registers are in very many ways worse than what we had before

I am not so sure that banks are able to check the credentials of anyone opening an account. If you look at some of the scams that have banks who have had accounts opened by fraudsters.

Or do they not care?

possibly not all the banks help the people who are victims of financial fraud.

Is that the same John McDonnell who apparently has a Guernsey pension scheme?

But he hasn’t

He can’t control his pension

So your comment is wholly incorrect