HMRC's 2016-17 accounts open with this statement:

In fairness they put most of this increase down to external factors. But I don't. I think this chart has something to do with it:

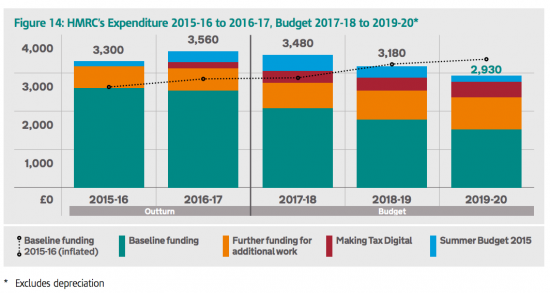

Spending went up by 7.9% in 2016-17. And I think that had a lot to do with that extra yield.

It's going to fall by 2.2% this year, by 8.6% in 2018-18 and by another 7.9% in 2019-20, by when they budget will be 17.7% less than at present. I am not, of course, saying that the tax yield will be 17.7% smaller as a result but to give just a couple of examples, I think we can safely assume these two stats will not hold up:

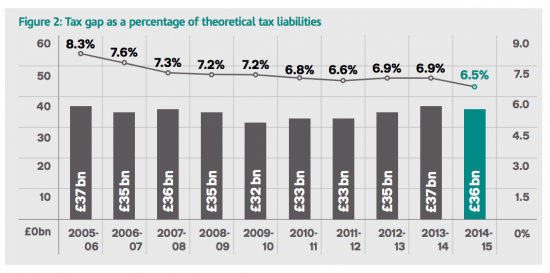

Whilst this trend, which has always been based on decidedly dubious data, will show a marked reversal:

And the real question is, why would we in any event, for the sake of £630 million, want to prejudice the future of tax collection in this country at considerably greater cost to us all? It seems to me that HMRC are planning to fail and there's no logical explanation as to why they should want to do that. Unless that is, continual shrinking of the state via the perpetuation of austerity is still the real political game the Tories are pursuing, which I suggest it is.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The financiers don’t need us any more, being usefully deregulated, so life support for us is being withdrawn. All part of a process which started with Thatcher ending apprencticeships and the development of Mode 4 immigration. The parasites seem now to have decided they are evolved beyond where they need the local host. To the death it is then. I’m good with that 🙂

Perhaps government want to out-source revenue data collection to a company like PWC. They’ve already sold unpaid tax to private collecters. Those would be my first thoughts.

I am certain that this is correct, despite the obvious conflicts of interest.

This will happen in subtle ways, with outsourced IT and ‘staff on secondment’ and ‘external Business Change consultants’.

All of these things will be far, far more expensive than operating HMRC with HMRC staff: and that, too, is a real funding cut.