I have been looking at data on employment and taxation in the UK. Because HMRC publish tax data very late I have been forced to look at the tax year 2014/15 and have used employment data published by the Office for National Statistics for March 2015 for comparison.

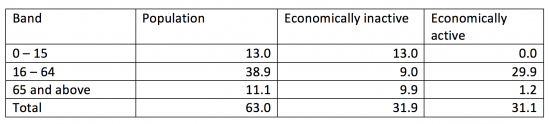

The following is data from these sources for March 2015 split by age bands on economically active and inactive people (the number for 0-15 is current, but does not impact the analysis that follows). The bands are those used for official statistics and reflect a past era of employment and pensions, but are all that is available:

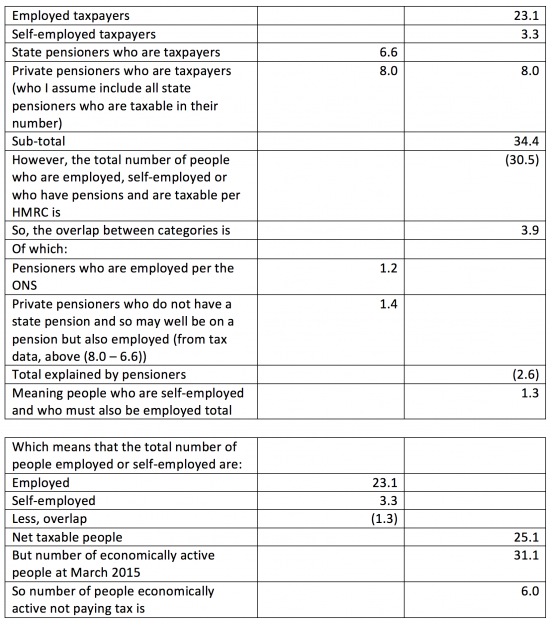

The following tax data is from HMRC for 2014/15 when combined with ONS labour force data for March 2015:

This immediately gives rise to some quite surprising conclusions, even allowing for the obvious margins for error that must exist in any such data and its extrapolation.

The first is that 19.3% of all people who are at work in the UK don't pay tax.

That can be analysed in a little more depth. The ONS said there are 4.5 million self-employed people in March 2015: the data therefore suggests 1.2 million of them did not pay tax. This means that 26.7% of the self-employed did not pay tax in 2014/15 whilst 17.2% of employees did not.

Some, of course some will say this is a good thing. I beg to differ. As the statistics make clear, in a great many ways these people don't count. They disappear from view. Working these numbers out takes some effort.

More importantly, saying this is good news ignores the simple fact that this means that many of the people in question are almost certainly living in conditions of considerable hardship.

And this is what is really significant about this data: near enough one in six UK employees and more than one in four of the UK's self-employed people do not pay tax because they don't earn a figure that is itself only, near enough, just 75% of the UK minimum wage.

If you want to know what is wrong with the UK economy this is the answer. We have a government that is apparently happy with large numbers of people living on far too little.

This country needs a pay rise.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

They don’t pay VAT or Council Tax?

The table makes it clear I am talking income tax

Hello Richard i am one of those who think that paying tax is a badge of citizenship trather than a burden but BBC is running an article that sugmgests tax burden is increasing. The Tax Payers Alliance is of course pushing this point hard! What is your take on this?

Tax burden is not a term I recognise. Tax is the price we pay for living in a civilised society.

And the amount we pay is a function of three things. First is spending. Second is borrowing. And third, the residual, is tax.

Spending is going up.

The aim has been to reduce borrowing – and that’s worked.

The result is tax goes up.

That’s the price we pay for the services we get.

The question for the TPA is what do they want? People dying? Children educated? Fires not fought? And so on? Or do they want more borrowing? Because unless they want to cut services (and the reality is they do: they don’t believe in the NHS, for example) or want borrowing to rise then tax is the price we pay

Most people are already horrified by the shortage of resources for public services – where overall waste is as low as human beings can deliver (and they’re not perfect for exactly that reason) – and so tax is excellent value for money

The TPA want to destroy public services. That’s their agenda. The BBC should say so

So in your view the waste in public services is as low as reasonably possible. You’ve never seen defence procurement then, or wondered at the effectiveness of the winter fuel allowance versus the counterfactual of just putting £4 a week on SRP, PC and the linked applicable amounts, or been baffled by the transfer of the EU parliament to Strasbourg once a month.

What courage when maligning the name of a great potato

Yes I have seen that

The EU will prove to have been a bargain

Means testing the winter fuel allowance is more costly than paying it

And defence procurement is always wrong because systems are designed in the hood

Next?

Tax burden is least felt by the multinationals whilst they often enjoy monopolistic (competition killing) positions in the economy along with benefits from either leveraging expanding AI or global cost efficiencies. A libertarians dream – do TPA work for MNCs?

How can anyone call this ‘a long war’ when our successive governments have supported (subsidised) this growing ‘elephant in the room’ with their sluggish, inept or bereft responses.

@ Richard

I wonder how long it will take for the BBC (or any other main stream media) to produce an article countering the views of the TPA.

Also, the following video (see link below)with Michael Hudson is an interesting talk on economics. I would doubt if I every read something similar to this in the mainstream media.

https://www.youtube.com/watch?v=cQmrg8cIjdQ

p.s. really enjoyed you book Joy of Tax – do you think you will ever make an appearance on Question Time or Any Questions?

I vey much doubt the BBC will ask me

Although they have sniffed about doing so a couple of times

@ Richard

Such a shame that the BBC doesn’t have you on these programmes – it would balance out the panels a little and give you an opportunity to broadcast your message to a wider audience. Would also love to see people like Danny Dorling, Martin McKee, John Hills, Ha Joon Chan, Margaret McCartney, Anne Pettifor.

Agreed

It would be fantastic to see you on one of these programmes …if they would actually let you speak and not interrupt you every time you try to make a point. I don’t watch these shows any more because I get SO angry at the waffle they allow, and the good points which they routinely stifle.

I pretty much share that view

A fine piece of deduction Richard – and a slightly surprising conclusion.

I didn’t earn enough to pay tax last year, but to be fair I was taking short term jobs and a lot

of time off. Because I own am fortunate enough to own my home it didn’t bite, but I no longer run a car.

My sympathy is with childless singles on the so-called living wage. In the south of England it would seem to me impossible for such a person to rent a one bedroom flat, pay the bills, eat and bear the cost of traveling to work (by that I mean flat tyres on the bike etc.)

I hesitate to correct a professor, Richard, but OECD data indicates that only 1.32m people in the UK are involuntary part-timers who would prefer a full-time job, which strongly suggests that the vast majority of part-timers are happy working the hours they do. See:

https://stats.oecd.org/Index.aspx?DataSetCode=INVPT_D

Certainly, this was my experience in the care sector. Even when we advertised f/t posts, we got applicants asking to work only some of the hours available. Some of these people were in genuine hardship, but most had a partner with a work pension and/or a state pension, so it made sense for them to work part-time, rather than their partner, to minimise income tax in the household.

There is ample dra to the contrary. I would refer you to the work of Danny Blanchflower

But, Richard, Danny Blanchflower claims that 15% of part-time workers want a full-time job, which is not dissimilar to the OECD figures.

See: https://blogs.spectator.co.uk/2015/12/jobs-miracle-or-low-pay-disaster-andrew-lilico-and-david-blanchflower-debate/

This fits with my experience in the care sector. We worked on the basis that only 10-15% of part-timers could be persuaded to fill full-time posts.

So?

I’m not now sure what you’re arguing?

Fill me in on what I have said you want me to clarify

is there any way to break down the economically inactive, 16-64 9.0 (I assume that’s millions?)

25% of those of working age being economically inactive seems to be a convenient catch all that probably hides a less rosy picture than students, the disabled and housewives,

during the Thatcher/Major years many people just slipped off the edge of the radar, I wouldn’t be surprised if it is happening again,

much of the harshness of the benefits system of recent years is probably aimed at discouraging claimants and thereby giving the illusion of low unemployment,

don’t you find the unemployment figure suspiciously low in the current economic climate?

I have no more data

I think unemployment is artificially low

Michael Hudson in David’s link above has rather a good line on budget deficits. Paraphrasing for the British context, he says that Governments cannot be governments if they don’t create money and spend into the economy.

If governments are adamant that they don’t want to do that, they should stand down and then we would be able to have direct government by the City, who are the only other people to create money.

Michael is good at getting to the heart of things

But of course one reason that 19.3% of working people don’t pay income tax is because the Coalition hiked the personal allowance considerably. A move which I seem to recall you opposed.

Presumably you think that the 19.3% would be better off if the PA was reduced and they were dragged into income tax?

I would have them pay tax, yes

I’d make sure they were no worse off

But that they they count

And crucially, the evidence is clear that people who pay income tax vote