Many years ago I took some interest in the affairs of Sir Philip Green. The failure of BHS has led me to do so again. There are a number of important issues that its accounts suggest, but let's stick to tax right now.

BHS was acquired by the Green family in May 2000 and has since 2004 been owned by the Arcadia Group, ultimately owned by a company called Taveta Investments Limited for the benefit of Lady Green and her family. She is tax resident in Monaco.

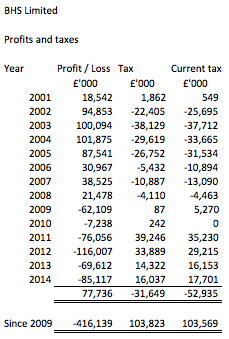

This is the trading history of the group, in summary, drawn from its accounts:

So, a question: should the group have been able to enjoy £103 million of tax subsidies for its losses because other companies in the Arcadia Group were presumably able to offset these against liabilities owing?

Is there good reason why the state should support continually loss making companies in this way?

Is a time limit on the number of years during which losses will be supported appropriate?

Would this sum have been better used helping clear the pension deficit?

I think these are appropriate questions to ask.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

She is tax resident in Monaco.

And the Jersey Evening Post were crowing last weekend that Taveta is based in Jersey… a nice piece of irony, given that 60 jobs are now at risk in St Helier in BHS’s second-best performing store.

In the book “After the Great Complacence” which charted the 2008 crash, the writers observed in their conclusions that the banksters were mostly just “working the angles” (this is not to absolve them from responsibility). Green “works the angles” and UK governments of various stripes have allowed him & his ilk to do so for far far too long. In a related areas the takeover of large swathes of UK industry over the past 30 years, is another example of Uk financiers “working the angles”, whilst the Uk body politic is either too idle, too stupid or too ideological (it interefers with markets) to do something. My guess is that Green will tell ’em to keep their knighthood & he will kepp is £400mill.

Your post yesterday on this subject got me wound up and I started to think about causes. I would place the onset of neoliberal policies in 1976. Neolib policies are justified using a bogus philosophical moral argument based on a misreading of 17th/18th century tracts (Kant and Locke), a concept of property based on a very peculiar reading of Christian ethics and spin that appears to promote freedom of choice. The pseudo-scientific nature of the claims of a neoliberal paradigm found favour in several university faculties and has been promoted since via PPE courses (MPs, SpAds and Civil Servants).

The questions you ask Richard are good ones and I would argue they direct attention toward considering the thinking of those in positions of power. Part of my first degree included psychology and I was struck by the undeniable evidence of how systems can change and corrupt the moral values of those engaged in them. Milgram, Zimbardo and Elliot showed how an immoral system changes the psychology of otherwise moral individuals. More recently Falk and Szech demonstrated how markets can operate in a similar way. (Science Vol 340, P707, 2013)

I suggest that the hegemony produced by the uniformity of training for our politicians and administrators is a major cause of amoral decisions. Add to that the reinforcement of attitudes provided by developmental years spent in a very narrow and elite social circle and it is no surprise that the response to systemic failures is denial or silence. To admit error would be to challenge the very foundations of the neolibs’ world. To admit error would entail making changes that would hurt one’s chums and patrons. Better to shut your eyes, put your fingers in your ears and hum loudly.

http://plato.stanford.edu/entries/moral-character/

http://plato.stanford.edu/entries/concept-evil/

http://www.janeelliott.com/

City University is trying to break the hegemony

You are not alone.

Bill- a very perspicacious analysis. The year 1976 is decisive in the evolution of neo-liberalism, the irony being that it was Labour under Callaghan and Healey that took monetarism on board four years before Thatcher came to power.

See Bill Mitchell’s blog on this which offers preliminary chapters of his forthcoming book on the ‘Failure of the left.’ See: http://bilbo.economicoutlook.net/blog/?p=33419

To quote Bill:

‘he assertion by British Labour Prime Minster James Callaghan on September 28, 1976 that Britain had to end its ‘Keynesian’ inclinations and pursue widespread market deregulation and fiscal austerity has been taken to reflect a situation where the British government had no other alternative. His words have echoed down through the years and constituted one of the major turning points in ‘Left’ history. Successive, so-called progressive governments and politicians have repeated the words in one way or another. The impact has been that they have increasingly imbibed the neo-liberal Kool-Aid and have, seemingly forgotten that their were options at the time that the British government rejected, which would have significantly altered the course of history. ‘

We’ve now got a distance on this which allows us to see the pattern of the last 40 years fairly clearly. We’re probably in the endgame phase, which will be messy and protracted and very hard on the vulnerable.

In Healey’s defence he made much of the fact that there was quite a bit of panic at the time so the ‘new thinking’ provided by neo-lib theory would have looked attractive to anyone in such a situation.

A decision was made – so what?

What is more worrying is that there is now overwhelming evidence that the economics of the last 30-40 years has been a complete disaster and despite this, there are far too many people stuck in a rut to know any better and choose a different path.

As a significant number of our MPs etc profess to be christians- why do they lose sight of any basic morality?

Why does professing to be a christian have any bearing oin basic morality?

On your first question how does this tie into your support of unitary taxation (ie taxing the overall economic entity not constituent parts)?

On your last question, if more money was paid in tax by BHS and the wider group (because losses should not be offset) how would the Group have extra money to reduce its pension deficit? Surely you have this the wrong way around? Or are you saying that the Government on receipt of this extra tax should have paid down the deficit?

I think that a fair question

Whilst we have not got it the existing system has to be made to work

Which means my question is for now more relevant

Thank you.

Haven’t we got a proxy for it though in the UK being group relief, which was used by the Arcadia Group in exactly the way it was intended by Parliament?

If you wanted the law to be different to what it is why wouldn’t you want it to go straight to a Unitary Tax which is what you have always advocated – and then your question above on not allowing offset would be redundant?

Any thoughts on the pension point, ie how can less money as a result of paying more tax equate to having more money to put into the pension?

I am not sure what you are driving at now

So your position appears to be: we haven’t currently got unitary tax system so, as we haven’t, the current system needs to be made to work as though it is at the other end of the spectrum to a unitary tax system (and thereby tax constituent parts individually). That way we can get to the position that BHS should have paid more tax even though that is precisely the system that lets Apple, Google etc arrange their affairs in a way you don’t like.

Also, I’m still not sure how BHS paying more tax enable them to have more money to pay down a pension deficit but then again I’m not at your level of understanding so perhaps one of us can be forgiven.

I snse you are not seeking to engage in debate so I will not bother either

Richard, sounds like BHS are not paying their fair share of tax by using a loophole in tax legislation to use losses of another UK company (classic tax evasion like those super capital allowances). Appears the driver to this tax evasion is to deprive poor pensioners their hard earned cash. Government should change law to make losses less flexible – out of date system! I blame PwC #JoyofTax #Unlegal