I have been looking at the last filed accounts for BHS Limited - the operating company of the BHS group that is now in administration. They are available, free, here.

The accounts cover a period when the company was under the control of Sir Philip Green as they end in August 2014. The accounts were signed on 6 March 2015. The company was sold a month later.

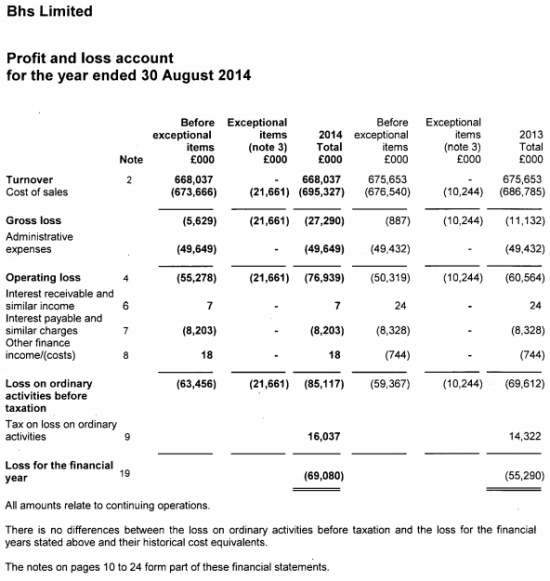

The profit and loss account was not pretty. It looked like this:

That's a hefty loss.

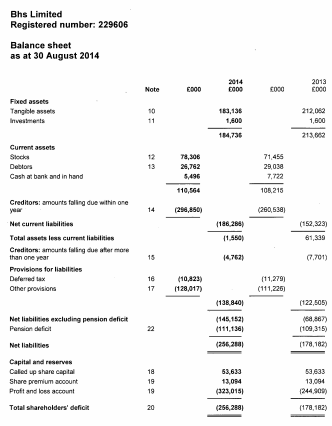

The balance sheet was as unattractive:

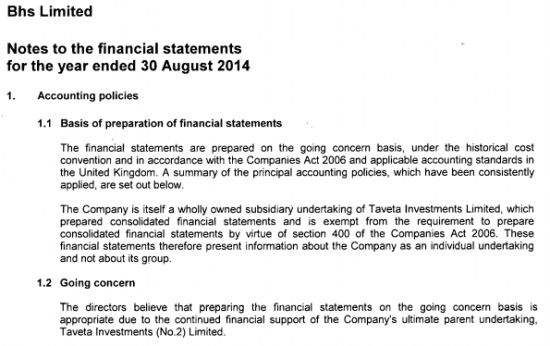

The key point here is the bottom line: the company had liabilities in excess of assets of more than £250 million. It had also had an excess of liabilities the previous year, as was also the case in 2012. This meant that there was an obvious doubt expressed in the accounts as to whether the company was a going concern i.e. whether it could still pay everyone to whom it owed money. This was addressed as follows:

The key paragraph here is 1.2. It says that the company is solvent because of funding to be supplied to it by its parent company.

You can be quite sure that the auditors, who were PWC, will have required that support to be quite robustly documented and that they will have tested the reasonableness of the claim made. So they will, for example (I hope) have tested the ability of the parent company to support BHS Limited with the cash it needed and will have ensured that this support should persist at least until the next audit report was likely to be due.

This, then, gives rise to some very serious questions. First, the duty of the auditors is to the shareholders in general, and not the current ones in particular. In that case did they know a sale was pending? It seems very likely that they did. And did they ensure that the support of Taveta was transferrable on sale in that case? If not then the basis of preparation for the accounts was meaningless.

And what did the letter of support say? And how much did it cover? For how long? And how were the new owners to benefit? If PWC had not ensured that they did then there are serious questions to answer on their work, so I can only presume that the new owners did benefit from the assurances given. But in that case for how much is Taveta, and so Sir Philip Green, liable?

These seem to me to be reasonable questions.

And PWC know the answers.

It should be files open face up on the table time for them.

In which case getting PWC before select committees now seems to be to be a good use of parliamentary time. If these account gave a true and fair view then they need to explain how.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Quite a cap between pension deficit at August 2014 of £111 million & reports this week of £571 million?

I understand different assumptions used when not on-going but, nevertheless.

More questions to be answered

The accounts appear to show that the Directors were selling stock at less than the cost price in y/e 2014; and that is befor stock write downs.

Given the size of the admin and other charges a substantial loss would inevitably follow. BHS would not be a going concern on this basis, how can you buy at one price and sell at a lower one?

Suppliers would be dependent upon the parent guarantees for payment, did they continue to supply goods and services in full knowledge of this dependency?

The balance sheet stocks would have been inherited by the new buyer in the light of the fact that they were historically being sold on at less than the cost price.

Wow!!!

That was my first reaction but CoS does include store costs

So goods were sold at a positive margin

Still cost of sales were greater than sales ( a certain trading loss must follow), difficult to assess the mark up and stock turn with store costs included but it would appear that on these figures turnover would have to nearly double to breal even.

Turnover fell dramatically from about 2004

As the money was taken out, the reinvestment was not made and the pension deficit rose

A case of wrongful trading?

“the company is solvent because of funding to be supplied to it by its parent company.”

And yet they payed 42 million to Arcadia for administrative expenses? What does it mean? (honest layman question here)

An excellent question

Is ‘administration expenses’ another euphemism ‘let’s deliberately trash this business’?

No

It’s insurance

And bank charges

And admin costs

Quite a gap between pension deficit at August 2014 of £111 million & reports this week of £571 million?

I understand different assumptions used when not on-going but, nevertheless.

Another good question

Perhaps I’m missing something but what happens to the tax credit?

Per Note 9. we have a tax credit of £17.7m however this is not reflected in the net deferred tax asset in Note 16, which only shows fixed asset timing differences and the pension deficit. It would be unusual to recognise a deferred tax asset on the amount given the company’s profile but you would expect a note in the accounts of any unrecognised deferred tax in respect of losses, there is a note but only covering £631k (Gross £3.1m) with no change from the prior year.

Is it reasonable to assume then that the loss was surrendered by way of group relief, even though this is not reflected in the tax reconciliation at Note 9?

This is a legal use of the loss but what may be of interest is how the loss was generated/accounted for. The management charge paid to Arcadia Group has already been pointed out however looking at Note 14. “Creditors due within 1 year”, there is also a liability due to group undertakings of £184m, which we are told is interest free, unsecured and repayable on demand. Given this footnote it’s unlikely that this is a loan, it could be accumulated and unpaid management charges from Arcadia however having the amount accruing year on year as a debt due within 12 months seems unlikely. It could be reasonable therefore to hypothesis that this amount relates to the purchase of stock or more likely rental of premises from connected parties, potentially the property investment company set up in Jersey and owned by bhs, per note 11. The accounts make much of a provision for onerous rents (also not recognised or disclosed in the deferred tax note as a future tax benefit – although surely it’s not deductible in the current year) however I fail to see another creditor amount which could obviously be rent due either in the current or prior year which could be deemed as onerous and certainly no other creditor amount has been reduced by £20m (the onerous rent write off). I therefore lean towards the idea that the £184m connected party creditor is made up (largely) of rental costs.

What I would be interested to know is how robust PWC’s audit of the transfer pricing is here, where we have £42m of “management charges” for a business essentially making year on year losses and also incurring rental charges, probably from connected companies described as onerous in the accounts. Especially where the rental incomes may not even arise in the UK and yet appear to generate a trading loss which is surrendered elsewhere in the UK group (although this is not clearly shown in the accounts).

Possibly I’m missing something but then the way statutory reports are set out does leave the reader guessing to fill in the gaps.

I am sure rpthis was group relieved

But legally a cash flow is not needed to prove it

Very annoying

And I agree re transfer oricing

If group relief wasn’t paid for there would not be a credit in the income statement for accounts purposes. You only account for a current tax credit where group relief is paid for. So BHS is owed cash (or has received cash) from other group companies as a credit has been recognised.

Since 2005 (after it paid out £400m in dividends previously) net assets of BHS went from £150m to a negative (£145m) in 2014. Not including the pension deficit.

However, the consolidated parent group went from a negative (£818m) (after it paid out 1.3bn dividens previously) to a positive £351m in 2014. (Again not including pension deficit)

Now it is clear, that the parent company charged admin and management charges to BHS, so it is probable that BHS supported the parent or other group campanies, rather than the other way around. There is no way of establishing if the charges by related group companies were over-priced or adequate, or extremely good value. For example a £41m management charge by one of the group’s companies is charged to BHS in 2014 and 2013. If that was not there BHS would have made a smaller loss.

In summary, while the net assets of the group improved in the time period by £1,169m to 2014, the BHS subsidiary worsened by £295m.

That would not have happened without the high management charges. So the question should be, what were the management (and other) charges for, were they reasonable, or were they just a mechanism to bleed BHS dry for the benefit of other companies within the group.

At an extreme, could they be viewed as a mechanism to transfer funds from a loss-making, insolvent subsidiary which then has less money to pay its other creditors.

I am sure the administrator will ask similar questions. But also a good one for the auditors.

Well spotted

PWC?

Oh no – here we go again…………………seems like deja vu to me.

PWC:

Pro-actively

Weaning

Catastrophe

A lot of apologists for these kind of business practices always try and justify it by saying “it’s legal”. I’m not so sure it is, although I’m no expert on accounting it seems like there was a massive fraud or at least a deception. In any case, whether it is legal or not it is both immoral and unethical.

I for one think as well as the various select committees looking into it, the prosecuting authorities should look into it.

I would however caution against holding breath.

If you can pay for the right lawyers, accountants and attract enough external investment then the “rules of the game” no longer apply (if there ever were any in financial capitalism other than make a profit at everyone else’s expense).

There is a strange metaphysical merry go round going on, some time ago I referred to it as like watching a group of old men playing musical chairs and pass the parcel at the same time. They all know someone is going to lose, they all think they can win and they all love the thrill of the chase.

Q. What value does this game add to society as a whole?

A. Absolutely nothing in fact it has a hugely negative value as it sucks the wealth from the already “have nots” even further to the “haves”.

And yet we (the citizens of the supposed democratic nations) allow it to happen in front of our very eyes because we’ve been told to believe for so many years that there is no alternative, because capitalism and free markets are the least worst option.

Surely it is now time for the better option to be developed and positively encouraged to grow? I’m not sure how many more examples are needed that this is a failing system that has outlived its useful purpose and needs to be retired and replaced with one that meets the needs of all people in society, not just a very small few.

http://www.thecanary.co/2016/04/26/bhs-crisis-exposes-capitalism-bleeding-us-dry/

Hasn’t Green played the usual asset stripping trick of absorbing all the landed property into the holding company which then demands the rent? If so are the sales accounted for and legal? (Sorry, may be a stupid question from someone who only has a 50 year old ‘O’ level in Accounts and Commerce.)

This looks to be likely