I spoke at a meeting of the Tax Justice Network in Luxembourg last night on the theme of tax competition.

These were my speaking notes:

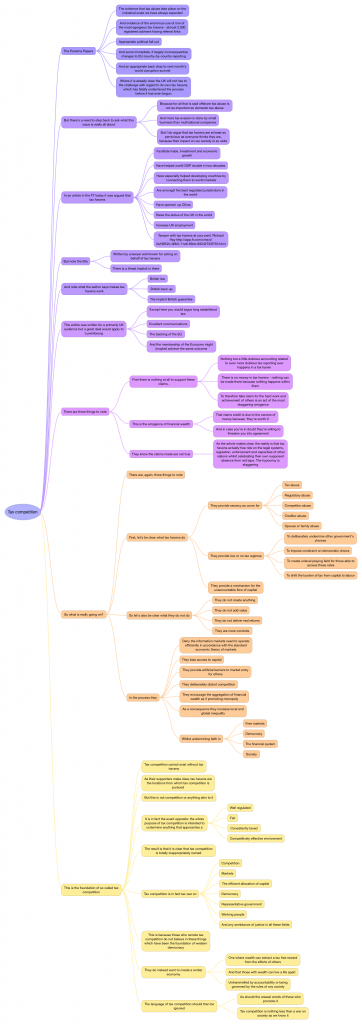

- Tax competition

- The Panama Papers

- The evidence that tax abuse take place on the industrial scale we have always expected

- And evidence of the enormous use of one of the most egregious tax havens - almost 2,000 registered advisers having referral links

- Appropriate political fall out

- And some immediate, if largely inconsequential, changes to EU country-by-country reporting

- And an appropriate back drop to next month's world corruption summit

- Where it is already clear the UK will not rise to the challenge with regard to its own tax havens, which has fatally undermined the process before it has even begun

- But there's a need to step back to ask what this issue is really all about

- Because for all that is said offshore tax abuse is not as important as domestic tax abuse

- And more tax evasion is done by small business than multinational companies

- But I do argue that tax havens are at least as pernicious as everyone thinks they are, because their impact on our society is so wide

- In an article in the FT today it was argued that tax havens

- Facilitate trade, investment and economic growth

- Have helped world GDP double in two decades

- Have especially helped developing countries by connecting them to world markets

- Are amongst the best regulated jurisdictions in the world

- Have opened up China

- Raise the status of the UK in the world

- Increase UK employment

- Tamper with tax havens at your peril, Richard Hayhttp://app.ft.com/cms/s/

3a19652c-00b5-11e6-99cb- 83242733f755.html

- But note the title

- Written by a lawyer well known for acting on behalf oftax havens

- There is a threat implicit in there

- And note what the author says makes tax havens work

- British law

- British back up

- The implicit British guarantee

- This article was written for a primarily UK audience but a great deal would apply to Luxembourg

- Except here you would argue long established law

- Excellent communications

- The backing of the EU

- And the membership of the Eurozone might (maybe) achieve the same outcome

- There are three things to note

- First there is nothing at all to support these claims.

- Nothing but a little dubious accounting related to even more dubious tax reporting ever happens in a tax haven

- There is no money in tax havens - nothing can be made there because nothing happens within them

- To therefore take claim for the hard work and achievement of others is an act of the most staggering arrogance

- This is the arrogance of financial wealth

- That clams credit is due to the owners of money because 'they're worth it'

- And in case you're in doubt they're willing to threaten you into agreement

- They know the claims made are not true

- As the article makes clear, the reality is that taxhavens actually free ride on the legal systems, regulation, enforcement and capacities of other nations whilst celebrating their own supposed absence from red tape. The hypocrisy is staggering

- First there is nothing at all to support these claims.

- So what is really going on?

- There are, again, three things to note

- First, let's be clear what tax havens do

- They provide secrecy as cover for

- Tax abuse

- Regulatory abuse

- Competitor abuse

- Creditor abuse

- Spouse or family abuse

- They provide low or no tax regimes

- To deliberately undermine other government's choices

- To impose constraint on democratic choice

- To create unlevel playing field for those able to access these rates

- To shift the burden of tax from capital to labour

- They provide a mechanism for the unaccountable flow of capital

- They provide secrecy as cover for

- So let's also be clear what they do not do

- They do not create anything

- They do not add value

- They do not deliver real returns

- They are mere conduits

- In the process they

- Deny the information markets need to operate efficiently in accordance with the standard economic theory of markets

- They bias access to capital

- They provide artificial barriers to market entry for others

- They deliberately distort competition

- They encourage the aggregation of financial wealth as if promoting monopoly

- As a consequence they increase local and global inequality

- Whilst undermining faith in

- Free markets

- Democracy

- The financial system

- Society

- This is the foundation of so called tax competition

- Tax competition cannot exist without tax havens

- As their supporters make clear, tax havens are the locations from which tax competition is pursued

- But this is not competition or anything akin to it

- It is in fact the exact opposite: the whole purpose oftax competition is intended to undermine anything that approaches a

- Well regulated

- Fair

- Consistently taxed

- Competitively effective environment

- The result is that it is clear that tax competition is totally inappropriately named

- Tax competition is in fact tax war on

- Competition

- Markets

- The efficient allocation of capital

- Democracy

- Representative government

- Working people

- And any semblance of justice in all these fields

- This is because those who remote tax competition do not believe in these things which have been the foundation of western democracy

- They do instead want to create a rentier economy

- One where wealth can extract a tax free reward from the efforts of others

- And that those with wealth can live a life apart

- Untrammelled by accountability or being governed by the rules of any society

- The language of tax competition should then be ignored

- As should the weasel words of those who promote it

- Tax competition is nothing less than a war on society as we know it

- The Panama Papers

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

What is the total population in the Tax Havens?

Divide this small number by the population of the world ?

You soon see that all countries suffer from Tax Havens

If there is a clear goal, to close the lot by 2020 and elect politicians in wach country on basis of this one nswer, the people in power will soon change.

Just like the journalists have shown recently, there can be co operation amongst 400 of them to publish details about one firm in Panama

The Banks are transporting the money across the world, they need to be faced with closure, if they do not stop

We have to give the world unity on this crime.Live in the solution.

Fantastic Richard. Clear, structured and devastating. Highlights the fact that the current Tory government has a massive conflict of interest – their neoliberal ideology is in direct conflict with what they pay lip service to – in your words they are at war with Democracy, Representative Government and working people. A deeply depressing message but one we need to understand. Thank you for making that easier.

Thank you

The audience seemed to like it

Ihave not seen the press reaction in Luxembourg yet, but they turned up + photographers

Good points: I hope that the talk was effective.

Luxembourg, for those who don’t know the place, isn’t the media sketch of bureaucrats and subsidised cows that we are supposed to think it is. The Grand Duchy used to be a major steel producer and a centre of heavy industry: that all went in the early eighties and the ‘new economy’ of banking, rent-seeking and tax evasion has been suppressing the re-emergence of productive activity and inclusive prosperity for decades.

They’ve done very well out of the EU – employment in neighbouring countries and investment from neighbouring countries matters even more for them than for the UK – but the high averages in their per-capita statistics conceal some uncomfortable truths about economic equality.

In short, it’s a very different country to Britain, so we must be careful drawing parallels: but their financialised tax-dodger economics inhibits prosperity for the many while favouring the few; there, here, and elsewhere – and this is painfully true for ordinary people in the islands we think of as ‘real’ tax havens.

So it’s good to hear that you’re taking the message wherever it’s needed. Who were the audience?

In a wider sense, who do you think is getting the message?

The brave souls of TJN Luxembourg invited me

But a broad political audience – and several of their MPs

From talks I held I think there is real concern about where they go next

Indeed – many thanks for coming to Luxembourg, Richard. More and more people are realising that the current model simply isn’t sustainable and that it’s contributing to poverty and inequality worldwide. We may have been sleepwalking into the status quo, but now it’s high time to wake up and move away from the offshore model and its nefarious impact on the global economy. If we can diversify and wean ourselves off of dirty money, then other places can, too (and for those that may have little alternatives, like some of the smaller crown dependencies, there may still be the option of a universal basic income – but one order of magnitude bigger). The Panama papers may not have revealed anything revolutionary, but they do contribute to the sense of urgency to end secrecy and the massive unfairness it enables.

Thanks Luc

It was great to be with you

Just out of interest do you agree with international competition between companies for exports?………You realise that one companies success may have serious effects in terms of job loss, lower tax income etc in another company in a different country?

Do you also agree with the Sovereign right to put in place Environmental restrictions and laws as they see fit?…..That tomorrow the UK could put in place environmental laws that prevent almost any import of Indian goods (not produced cleanly enough, ethically enough etc) which would cause the same job loss, lower tax and suffering in India?

Why is it OK to cause losses in another Country through company competition and environmental restrictions but not with competition on tax. Surely the first two have just of much chance in causing a failed state?

First, as is glaringly obvious, the reality is few companies have that impact

Second, as Tata proves, ownership can be switched between companies

Third, failed states are not replaceable

Fourth, states are utterly unlike companies in just about every way

Fifth, states almost never do impose such tariffs

But you seem to not understand any of that and present a totally hollow argument as a result

Last line: ” Tax Competition is nothing less than a war on society as we know it.”

That seems to be the ‘poster slogan’ that we must get out there to repeat and repeat, and in turn will draw people to feel they must consider what leads to that conclusion. And will make the tax avoiders and apologists have to try and make a defence instead of burying in the sand, which means debate which means exposure which means change.

It will be interesting to see if the Oxfam US tax avoidance (or tax dodging as they call it) gets any airtime in the US media and political circles, or is just dismissed as yet another piece of “socialist propaganda”.

“Tax dodging by multinational corporations costs the US approximately $111 billion each year and saps an estimated $100 billion every year from poor countries, preventing crucial investments in education, healthcare, infrastructure, and other forms of poverty reduction. US policymakers and a broken international tax system

enable tax dodging by multinational corporations, which contributes to dangerous inequality that is undermining our social fabric and hindering economic growth.”

http://www.oxfamamerica.org/static/media/files/Broken_at_the_Top_FINAL_EMBARGOED_4.12.2016.pdf

A historical perspective of TAX HAVENS would be useful towards a better understanding of the current situation and perhaps help resolve this moral dilemma.

The origin of the tax haven is perhaps owed to the 1720`s South Sea Bubble, which made incorporation rather restrictive in Anglo- Saxon countries. During the latter part of the 19 th century, this may have laid seed to the American states of New Jersey and Delaware to invent the techniques to attract non – resident companies by offering amenable regulatory environments.

Whilst the Americans are the true inventors, all credit must be given to the Brits for their ingenuity of creating the “virtual residence”, allowing companies to incorporate in Britain and paying no tax. This singly must be the instrument which imported the little US sapling and nurtured it to grow into a forest of giant proportions. See the 1929 case of Egyptian Land and Investment Co Ltd v Todd. This was not only important for Britain alone, it was so for the whole of the British Empire.

How could Britain now abandon such an important and lucrative invention. It would be tantamount to disowning George Stephenson, James Watt and Isambard Kingdom Brunel, but to name a few.

But the dilemma is what is the price of morality. Is Caliccles correct in thinking that designed by the populous weak to intimidate the few strong, to keep them from taking what they could by using their strengths.Is Socrates correct in his definition of the virtues of the ideal City, justice, wisdom, courage and moderation.

But the oldest and most perplexing of all questions remains, the question of whether, and how human excellence can be taught. If of course that is what we still expect from those who lead us.

These issues are covered in my book inntax havens with Ronen Palan and Christian Chavagneux

When was it published, before or after the Panama Papers or before or after Treasure Islands by Nicholas Shaxson.

Which issues in particular were covered in your book. Namely that tax havens are a British invention and/or that it is a moral dilemma.

http://www.amazon.co.uk/Tax-Havens-Globalization-Cornell-Studies/dp/0801476127/ref=sr_1_1?ie=UTF8&qid=1460651592&sr=8-1&keywords=ronen+palan

Many of Nick’s ideas were based on the theory in our book

We all work closely together

Ironically, Amazon offers to bundle Tax Havens with Treasure Islands and… The Hidden Wealth of Nations. Gabriel Zucman would no doubt be proud to be in such illustrious company.