You couldn't make it up:

Look at the top right hand corner.

And ask who is responsible for the BVI's role in the world.

Then ask the government to do something about it using the power we have to legislate for these places if we so wish.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

The royal family are exempt from IHT, should tell you all you need to know. Its almost certain the entire political class don’t and have never paid it but through the years have subjected (those subject to it) to one of the highest rates in the world, perhaps 1 reason inequality is rife?

Not all the royal family are exempt

And your claim that no politician pays tax is absurd

Please keep within the boundaries of reality here

Anpbuse happens but let’s not exagerate – that helps no one

eerm shouldnt ‘NO’ member of the royal family be exempt though? Unless of course the tax is repealed? Unless that happens it is a great injustice? I was just theorizing probably the reason why bipartisan support for IHT subject to minor changes while the actual rate is close to the highest in the world is they wont pay it.

Sorry – despite havinbg made three TV documentaries on their affairs I think there are bigger issues to address

I’ve had a go but can’t be bothered to do more

But cant you do both? After all the queen is certainly worth more than many named in the ‘panama papers’ and worth more than Cameron’s Father was. By all means go all out against the tax havens but don’t just leave the queen untouched . Most Other countries don’t have tax havens, but they also have considerably lower estate taxes or dont (Australia, Canada, New Zealand). Its not an accident the tax code in this country is among the longest and taxes also far, far from the lowest. So if there was no longer any ‘overseas’ dependencies/loopholes would you move to cut taxes for all but the very, very richest or would you still raise them?

I think you need to read my book Ther Joy of Tax

I have not got time to repeat it here

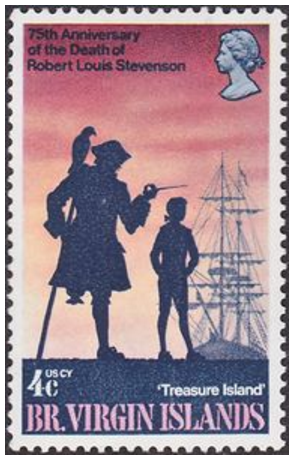

I do like the juxtaposition of the Queens head with my old friend Jack Sparrow the one legged pirate on the stamp though. A very appropriate pairing if ever I saw one!

It certainly is still a “treasure island” for ill gotten gains, the crown may have started off the trend but it has certainly caught on amongst many of her hangers on and loyal supporters over the years.

Perhaps the Queen should set the right example and denounce her involvement with such “dirty deeds” (oh I forgot pigs don’t fly!)

Hi Richard,

I like the stamp you selected as an example, ‘Treasure Island’ LOL

I remember Mrs T rattling on about the City and ‘hidden earnings’ back in the 80’s,

It would appear that a big chunk of the financial services Britain provides are aimed at hiding earnings,

Isn’t it an awkward paradox that if Britain did reform it’s ways and dismantled it’s huge offshore network of tax avoidance Britain would also nobble a fair chunk of it’s economy seeing as we’ve become so overly dependent on financial services?

Question

Is it possible that accountants could be sued for negligence by not advising their clients to route their clients earnings through offshore companies?

Some claim so

I disagree

I never was

Any accountant would have the “affirmative defence” that any contract Clause requiring them to recommend tax havens was “illegal, contrary to public policy or unconscionable”.

I think you mean LongJohn Silver.

” If anyone’s seen more wickedness than her, it must be the devil himself” (Silver, talking about his parrot Capn Flint).