I have a new paper, co-authored with Prof Ronen Palan on the web site of the City University Political Economy Research Centre today. This, at 30 pages, is a chunky price of work encompassing a lot of data for a twenty plus year period (15 historic, the rest projected) which looks at what has really happened with austerity in the UK.

In summary, in the paper we look at:

- UK tax revenues broken down by type for the last 15 years, and forecast for the next five;

- UK government spending analysed in various ways, including by department, by current spending and investment spending and split between delegated department spending (RDEL) and annually managed expenditure (AME);

- Sectoral balances.

As a result of the work we conclude:

- That over spending did not cause the crash;

- That although it looked as if revenue crashed in 2008 with a slow recovery ever since this is not a fair representation of economic reality: as a proportion of GDP revenues have been remarkably flat line (and are expected to be) for two decades although their composition has changed significantly;

- Although in constant prices spending looks to virtually flatline from 2010 to 2020 this also misrepresents reality: as a proportion of GDP government spending has fallen by about 0.8% per annum, almost constantly, and is still forecast to do so, whilst when stated on a per capita basis the story is much more complicated and shows we have already suffered a significant period of austerity that is about to get much worse and that perceptions of that austerity are likely to increase markedly.

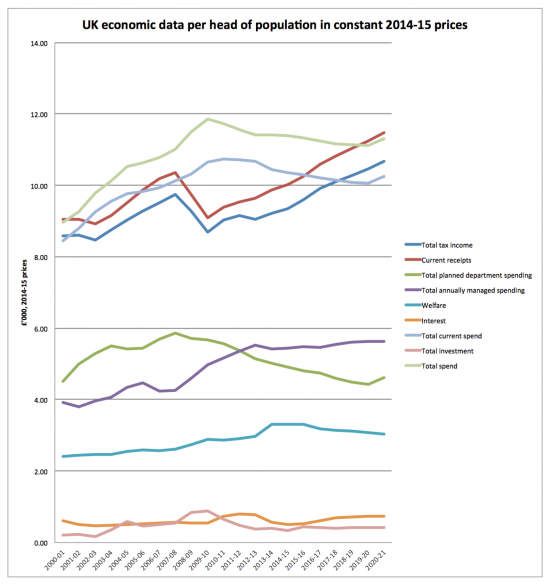

That per capita analysis os as follows

This suggests:

- Current government spending the capital fell very little until 2012 — 13: the impression of austerity in total spending until 2013 was created by cutting investment;

- In contrast, from 2013 onwards has been a steady decline in current spending per head which is only going to reverse in 2020, or thereabouts;

- The composition of that current spending is also changing dramatically: until 2011 — 12 plan department spending (RDEL) on things like health, education, transport, the police, and so on (all of which create a taxpayer feel-good factor) exceeded annual managed expenditure (welfare, debt interest, et cetera). Now these two have reversed and that trend will continue most markedly as planned expenditure is cut by around 25% during the course of this Parliament. There has, then, been a massive distributional change in the way in which government expenditure takes place which many middle income taxpayers will feel is not to their advantage;

- At the same time that this changes occurred the government is forecasting that between 2015 and 2020 national insurance and income tax receipts will rise at a rate significantly above GDP growth (whether stated in real or nominal terms) whereas VAT will only grow consistently with GDP growth and corporation tax receipts will fall against that measure;

- The consequence of this is that there will be many people who feel that they are losing out from the redistribution of government spending towards annual managed expenditure whilst at the same time they will be asked to make a bigger income tax and National Insurance contribution and yet companies will appear to be gaining. The opportunity for significant social stress to arise as a consequence of these changes is obviously very high.

In addition to these facts we have also looked at the probability that George Osborne can actually deliver the restructuring of the UK's balance sheet so that he can eliminate borrowing by the end of this Parliament. We believe that this can only be achieved if:

- There is 6% house price growth to fuel the growth in private sector household borrowing to levels in excess of those witnessed in 2008 as a proportion of GDP;

- If business can be persuaded to borrow to consistently invest over the next few years at rate generally much higher than those witnessed since 1980;

- The overseas sector substantially changes its behaviour so that our balance of trade improved significantly in financial inflows into London reduce.

In our opinion none of these events is likely. The only reason, we think, that the OBR can forecast the possibility of a balanced budget is that they continue to assume, as they did in 2010, that the multipliers applying to government spending vary between 0.3 and 1 whereas the IMF think that they might be as high as 1.7 and Standard & Poor's think they could even exceed two.

The result is that we believe that there is very little chance at all that the promise included in the Fiscal Charter of a balanced budget by 2020 can be achieved. If the errors of forecasting are in fact as big as we expect it is possible that there could still be a deficit of almost £40 billion a year instead of the forecast £10 billion surplus at the end of this parliament.

This means that in combination:

- There will be substantial stress as a result of the reduction in managed expenditure;

- This will be particularly felt by those who might be asked to pay more income tax while such cuts are going on;

- These people's perception of dissatisfaction will grow as it becomes apparent that the likelihood of a balanced budget is diminishing into the future, as has always been the case since 2010 because of the poor choice of multipliers for forecasting purposes;

- Significant political and even social stresses might result;

- The government appears to be attempting to manage a political as well as an economic cycle and both are high risk strategies that appear to include a significant chance that they might go wrong;

- And all of that is before any risk of a further downturn imported as a result of increasing difficulties in the emerging markets is taken into account.

The paper may well develop: comments are welcome.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

You can subscribe to this blog's daily email here.

And if you would like to support this blog you can, here:

Probably, the current government will push the population to breaking point and they will be ignominiously booted out with greater revulsion that Thatcher. Unfortunately, unless something extraordinary happens (and given the current febrile global political landscape, anything “extraordinary” is likely to be very bad), we have to wait five more years before that happens. They can do a lot of damage in five more years.

I imagine they think they are playing a political game and pushing through the unpopular stuff now with the expectation they can win us round again in the second half of their term. Given the lack of awareness they have shown over the impact of their actions, I expect that to backfire spectacularly. Teflon Dave can’t stay spotless for ever.

This will not happen unless the relevant oppositions mobilise and form their own coalitions.

People must see a viable alternative – especially those who do not take part at the moment.

I’m not sure it will change much except to increase the deficit, but it appears that the Government is willing to find vast sums of money to go to war and spend on assorted defence equipment.

Given that the BBC’s sole mission appears to be to rubbish Jeremy Corbyn – along with the rest of the main stream media and with short memories all are also banging the drums for war I feel less optimistic that no matter what mayhem this government creates that Labour would get elected.

Sad days and future for UK.

“Probably, the current government will push the population to breaking point”

I would doubt that, the public seems to have an infinite capacity for absorbing lies and utter garbage about how the economy functions. It’s not their fault, of course, but due to years of myths and fairy tales and the lack of an opposition to educate and challenge ossified perception. This is the result of neo-Liberalism creating a one party state (or even a no-party state see: ‘Undoing the Demos: Neoliberalism’s Stealth Revolution’ by Wendy Brown).

Unfortunately due to these factors, the underlying discontent projects itself onto the vulnerable/poor/weak/immigrants/the other. This happens when the underlying forces are not explained. Labour failed ignominiously on this , so has unwittingly fuelled future extremism and present injustice -nothing short of scandalous, and now we have a virtually impotent Corbyn hobbled by have only about 9% of the party behind him.

By which time there is a good chance Scotland may have opted for independence. There is a lot at stake here as far as the UK as a whole is concerned.

If another financial/economic crisis is looming, the neo-Cons will have nobody to blame but themselves this time. Of course they will try to find every possible scapegoat rather than admit failure, but the public is more likely to see through it when pain and fear starts to outweigh hope for the not so true-blue working class voters.

Leave Osborne and Cameron to get on with it and dig their own graves! My biggest fear is that the wider world will have sunk into more war and despair by the time of the next elections, repeating the 1929-1939 period of economic and social chaos with god knows what crises and atrocities occurring this time.

In the meantime, these alternative economic opinions should be shouted loud and held up as a shining light of what could be achieved with a change of government committed to new economic thinking.

Those are interesting graphs, cheers. There’s a lot of obvious points so far not mentioned.

1- The rise in expenditure as a response to the crash was similar to the drop in tax receipts

2- As an aggregate spending from 2009-now is the highest it has ever been in peace

3- Said spending still exceeds the best ever year for tax receipts ( whither austerity? )

But my favourite observation is what Standard & Poor said about the 2+ multiplier effect of road maintenance and building has literally morphed into a statement about government spending in general.

If I could follow your logic I might comment

But re the last you are just wrong: that has not been said

It seems that Baxter is trying to write in shorthand as if he was sending a twitter message or an SMS text on an old (alpha-numeric) phone. Translated, he is trying to suggest that aggregate demand “(or govt. expenditure? or both?)in the period from 2009 to the present, are as high as they have ever been, and that you are therefore overstating the effects and the extent of austerity measures.

I am not sure that the suggestion is true exactly but it wouldn’t matter if it was as the population is now larger. Put another way, he has made the classic mistake of observing the results of aggregate growth when per-capita growth is the relevant measure.

The ONS chart in the article linked below reveals that per-capita GDP is still lower than it was in 2007.

http://www.economicvoice.com/chart-of-the-week-uk-gdp-per-capita-2/

I state data per head partly for thus reason….

“Leave Osborne and Cameron to get on with it and dig their own graves!” Agreed, but how many of the rest of us are they going to take down with them as well? That’s my worry…

Agreed

What is your source for the political claim that labour overspending caused the financial crash? As far as I can tell no one ever suggested this, or made this argument in order to discredit Labour. Instead it appears to be a classic straw man argument – invented in order to be knocked down. And so the only source of this claim appears to be people arguing against it!

So all that stuff about Labour overspending has been made up has it?

And the claim that Labour should have been in surplus (repairing the roof when the sun shined) has never been said?

Stop talking utter nonsense

No. The claim that Labour overspent was made by many many people there is abundant evidence for this. I am not contesting that, as I think is clear from the words I use.

The claim that labour overspending caused the financial crash appears not to be supported by any evidence that anyone actually made this argument in the first place. Hence my assertion that it is a straw man.

Do you accept that these are two different claims? One is about causation, the other is about being adequately prepared for an external shock. They are clearly two different arguments against labour’s decisions. If you accept these are different, where is the original source for the causation argument? Or do you think the truth is irrelevant of whether anyone actually made the argument in the first place, and arguing against a straw man and presenting it as an historic point of debate by people you oppose is valid in an academic paper?

This is so irrelevant

It only reveals your own paranoia

I cannot waste time on it

The facts you convey in your academic papers are irrelevant?

One of the benefits of internet comments is that errors can be identified quickly and addressed. But if you are not open to these maybe you shouldn’t ask for comments

There is no such error in the paper

You’re just propagating a straw man

James G’s point is that nobody with any sense has argued that Labour overspending caused the financial crisis. People have argued that Labour spending put us in a worse place to counter it when it happened. It’s a clear distinction?

Your paper says ‘the politically motivated suggestions that the economy crashed in 2007-08 due to Labour overspending are not supported by the data.’ This is your core argument #1 and your first conclusion. However, you give no source for these ‘suggestions’ (you do for other historic arguments made by politically motivated people, but not this one which looks odd). But the implication is clear – this was a claim that people made, and an important one. However, you provide no source because none can be found, because it is a straw man. A re-writing of history. No such suggestion was in fact made. This is the error in the report. If I am wrong please quote a source.

It is a claim made all over the place – including by George Osborne and at one time by Danny Alexander

Utter nonsense to suggest otherwise

Don’t try again: I am only interested in debate, not nonsense

Here’s the Ghastly Duncan Smith at the Tory (larger than life Union Jack) Conference:

“But we need to remind ourselves that in May despite the difficulties faced by so many families as a result of Labour’s great recession, the British people asked us to complete the job of sorting out their mess.”

I don’t think any distinction is being made between Labour spending and the GFC James G?

The lies and misrepresentations (with this man as cheer leader) are egregious.

– See more at: http://www.taxresearch.org.uk/Blog/2015/11/22/on-the-keiser-report/comment-page-1/#comment-740703

I’ve been reading the original and feel really shocked by the OBR’s assumptions for 2020. That such errors were found by the IMF in the multipliers that they had been using was bad enough – but how can they in all honesty continue to use the same figures?

I suppose I’m asking do the OBR actually believe themselves, or are they influenced by the fact that their office is just down the corridor from George Osborne’s? It all beggars belief!

I agree: it’s staggering

Use of highly specific figures and formalized language makes them appear as prophets to uninformed laymen. It doesn’t matter economic forecasting is always wrong, anyone who can put together a shiny graph must know what they’re talking about.

Social unrest is unlikely with in excess of ten thousand troops to be deployed on the streets “to help police” (by 2025?….ok, I’ll believe that)

Betcha deployment will rapidly rise if significant “social unrest” (strikes) occur.

Scotland will have its own forces deployment, no doubt the population will take the hint. In any case, collapsing a newly-independent Scotland will be quite easy.

You’re not cynical enough. Two aircraft carriers. Each to have around 40 F35B aircraft. Those 40 aircraft cost more than the carrier. The new-tech pilots headset costs a quarter million EACH.

Now we wander over to the Russians….new attack subs, nuclear fuelled and armed….

Sorry guys, the new defence budget, which magically found many hundreds of millions (big bulge in mattress), takes the screen away from gov policy, and takes the pee out of the population. (many of who actually support not only being nuclear capable, but also use of those same weapons), and exposes the underlying agenda of fast-arriving war.

No doubt that war will be, again, fought in Europe.

Meanwhile, back in the news international nuclear bunker, the population are being fed on a relentless diet of tits and tattle.

As yet I do not see that

But I see the risk

JohnM may have something of a point. The mere headline of this article seems to put things into perspective:

“$69b windfall from war on IS : Europe’s defence industry is set to reap a massive boost after Paris terrorist attacks”

http://www.smh.com.au/business/paris-attacks-war-on-islamic-state-brings-us50-billion-defense-boost-20151125-gl7dkb.html

Given that most of those weapons are of limited use in the immediate Syrian conflict and of no use against urban terrorists, “war on IS” is more likely to be: arms race against Russia.

I think it was Kalecki who first articulated the idea that armaments and war are the preferred alternative for an authoritarian capitalist state when it is mired in stagnation (with excess capacity and high unemployment).

In its own way it also presents an alternative to failed austerity policies – with the spend being unfortunately allocated to the military.

Does anyone know what the multiplier is for rearmament?

I note an analysis of things Russian over on another blog. Looks like both Russia and the USA have good reason the get the guns out:

https://notayesmanseconomics.wordpress.com/2015/11/23/russia-faces-another-round-of-its-economic-crisis/

Further:

http://www.zerohedge.com/news/2015-11-24/russia-escalates-suspends-military-cooperation-turkey-moves-warship-coast-destroy-an

Good morning Richard.

Look what I found:

https://www.youtube.com/watch?v=GPL-IaFpcZA

Very topical!

A master at work

Good Lord-it’s quite shock, now, to hear such great literacy, fluency and clarity in comparison with the dilettantish duffers we’ve got now-why didn’t Hilary inherit this? Clearly it’s not ‘all in the genes.’